Introduction

Investors, traders, enthusiasts,

Welcome back to the 70th volume of "The Weekly Selection," a source for insightful perspectives on the stock market, educational content, trading/investing tips, and upcoming trade ideas. As we venture into a new year, my anticipation for what’s to come is second to none.

In this edition, I'll delve into my thoughts on the stock market's current landscape, both technically and fundamentally. In addition to this, I like to share educational material to uplift market newbies financial understanding, and present trade ideas for the upcoming week for those who are regulars around here.

Indexes

Lets get into the index analysis

$SPX up first. Last week we saw a drawdown in most indexes, which was expecting coming off of such a heated run and large number of strength gauges reading as overbought or topped out. I believe there to be unfinished business on the upside, and pullbacks are healthy. Looking for opportunities even down into 4560 SPX.

IWM 0.00%↑ still in its range. We’ve seen a lot of rotation into small/midcaps lately, but coming off a massive selloff into the fall, it couldn’t drive the index out of this nearly 2 year range.

XLV 0.00%↑ healthcare with a strong breakout. In last weeks articles I mentioned 2 themes I was looking forward to in 2024, healthcare was one of them. I think this massive range break will be powerful for not only the big players such as LLY 0.00%↑ and UNH 0.00%↑, but also smaller names like my favorite TMDX 0.00%↑.

Weekly Trend Analysis

In 2024, I’m changing the structure of the newsletter slightly. Instead of offering “tips of the week”, I will be switching it for an annotated chart with commentary from years past. The tip of the week will be in the YouTube video instead to spread the content out.

What better stock to start with besides TSLA 0.00%↑. This run was unbelievable to many, and offers trend analysis lessons on parabolic moves that are not commonplace. This trade will be studied for years to come.

Did you enjoy this new portion of the newsletter?

Past Performance

The Annual Report was last week, where I did not include stocks for 2024. Past performance will return next week (after this weeks stocks play out)

Charts

First up is INSW 0.00%↑. I mentioned this on my twitter last week: HERE, and I think with energy performing week, and INSW being the group leader for tankers, utilizing this $48 pivot could be a fine entry on a true parabolic runner.

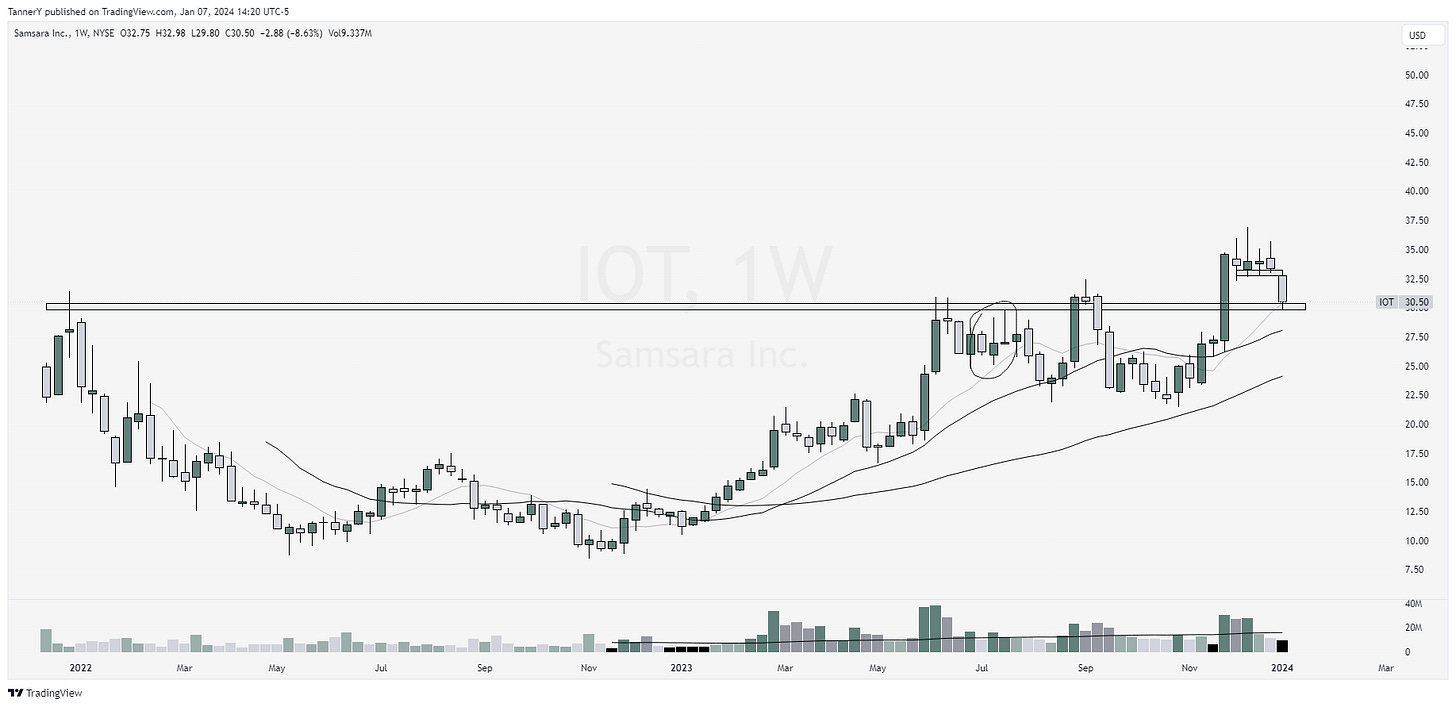

IOT 0.00%↑ trades down to its 10sma on the weekly. After a monster quarter and breakout to all time highs, I expected this to run, and hard. After not making that happen, It now offers a good R/R entry at a key level and moving average.

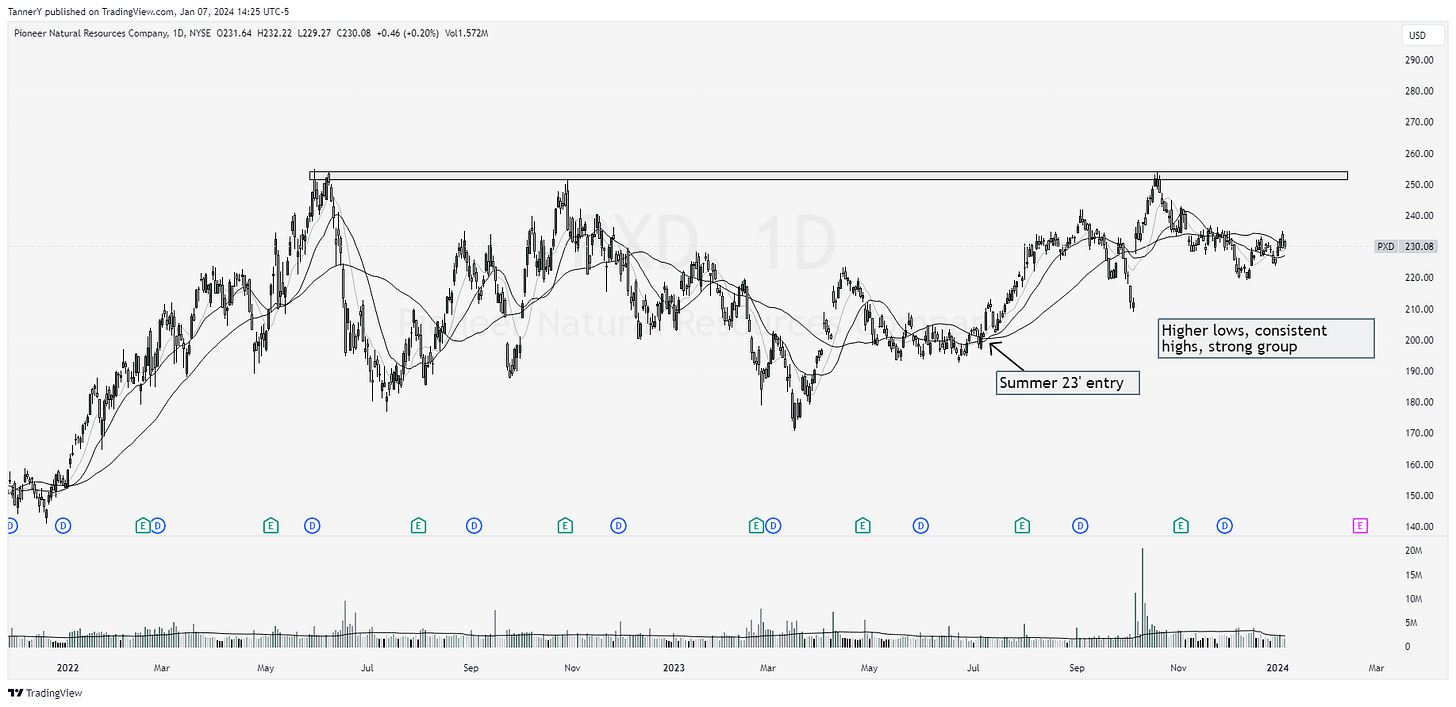

XLE 0.00%↑ energy has been strong to start the year. Earlier in 2023, I traded PXD 0.00%↑ and now I see a similar looking entry. The risk/reward is strong.

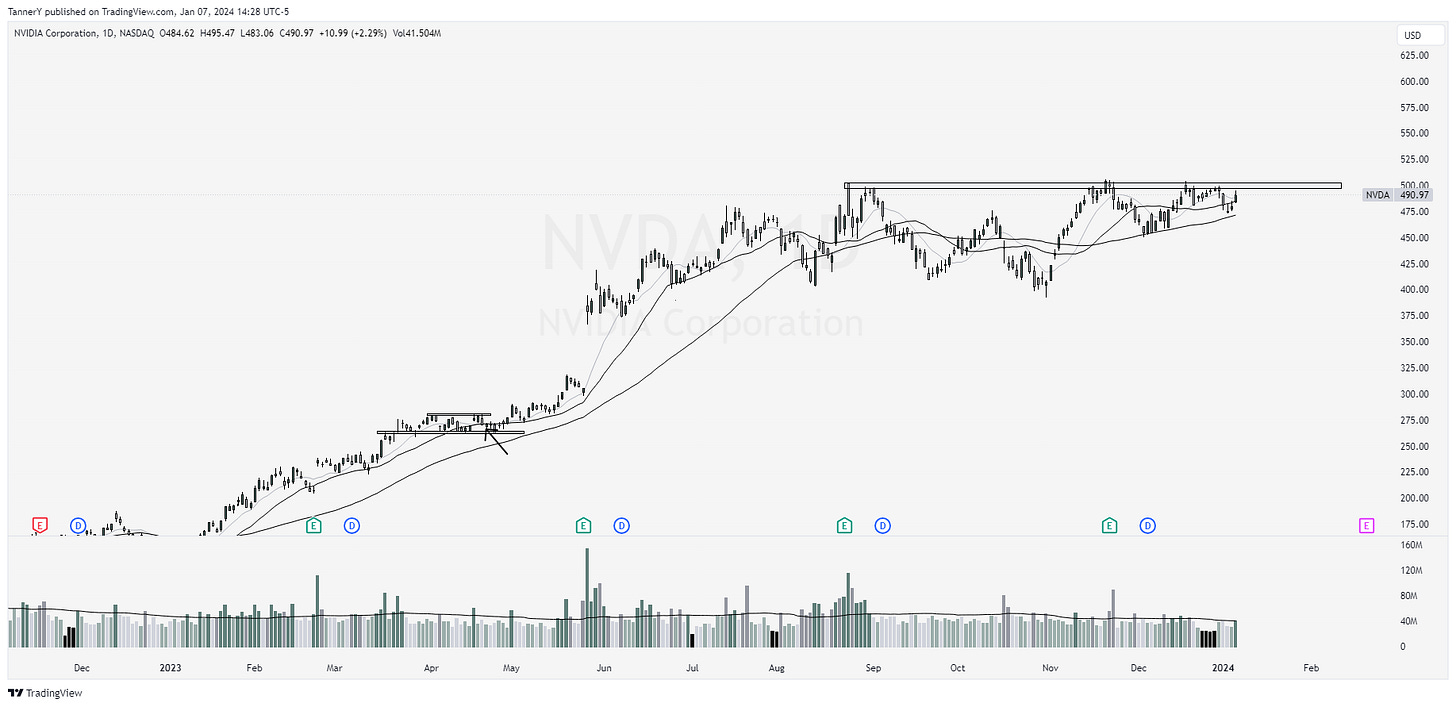

$NVDA, despite a drawback in SPY 0.00%↑ continued to perform. the $500 area seems to be the golden ticket for continuation.

That’s all for this week!

IF YOU ENJOYED:

Like this post

good stuff tanner

First