Hello and welcome in to the latest volume of “The Weekly Selection”, where I go through the market, my opinions, helpful information, as well as anything I may find in my research that I deem valuable to all of you.

2023

This article in particular holds a higher level in significance as it marks the first of 2024. Before I get in and get to the usual material, Id like to take a look back over the year and discuss the growth of the newsletter, as well as a few market metrics.

In 2023, the newsletter grew over 150% from 139-358 subscribers

Average viewership was over 400 per article, peaking at 720

Total views were over 20,000 for the year

None of this would be possible without everyone who subscribes, and I appreciate everyone who has helped along the way. If you’re not yet subscribed, you can do so below:

Newsletter portfolio performance

For those who are unaware, the weekly selection is designed to be purchased at market open on Monday, and sold at Fridays close. This gives a very realistic approach to trading for busy individuals, where I strip away precise entries, and just look for stocks in uptrends or at pivotal turning points.

Average week/week gain: 1.69%

Total Gain: 101.3%

Best Week: 17.43%

Worst Week: -6.89%

Best Pick: 39.11% (AFRM)

SPY 0.00%↑ performance was 25%, so we beat the market pretty handily, even after netting out taxes for short term gains.

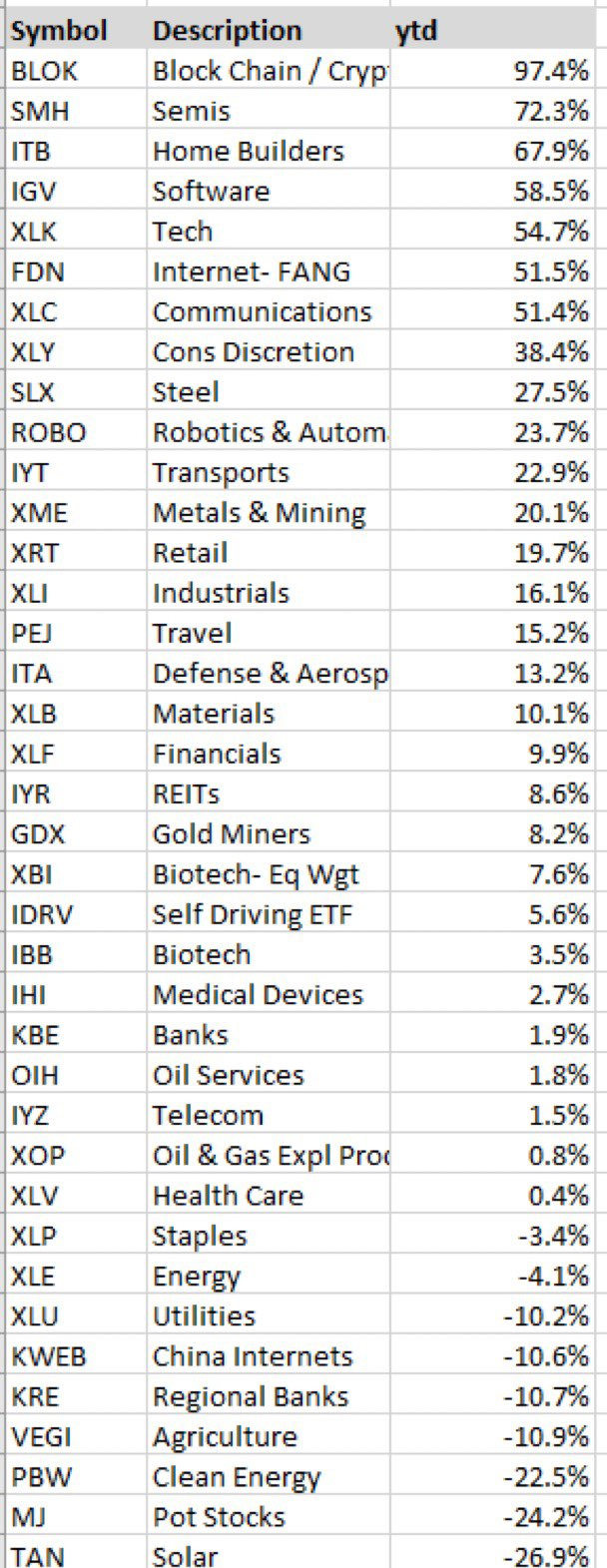

I also beat every top performing industry (gross), seen below:

2024

Lets move into this upcoming year, and generally how I see it.

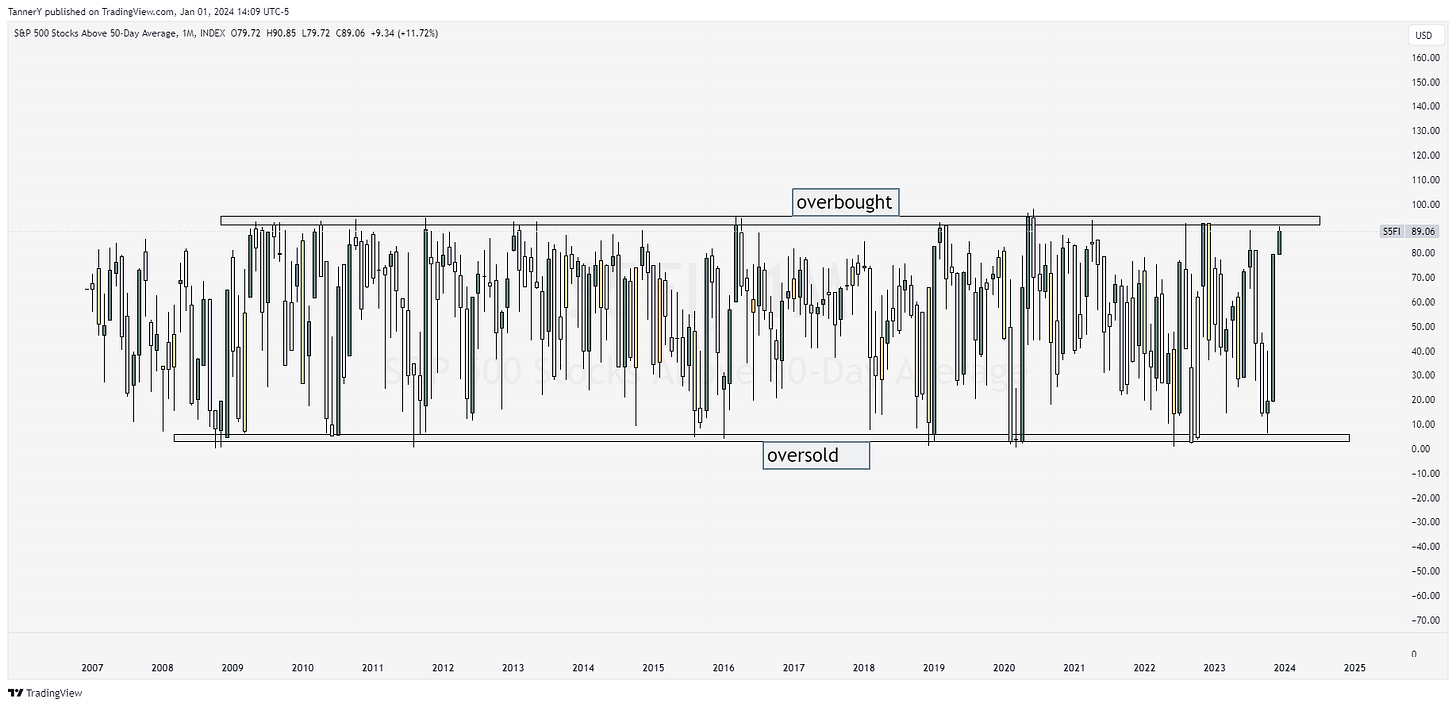

First up is the S5FI, a gauge that shows stocks in the SP500 that are above their 50d sma. This gauge is a decent health gauge, as it offers a look that you cant really visualize flipping through individual charts. As you can see, we are headed into the new year pretty overheated, approaching the overbought zone ive labeled.

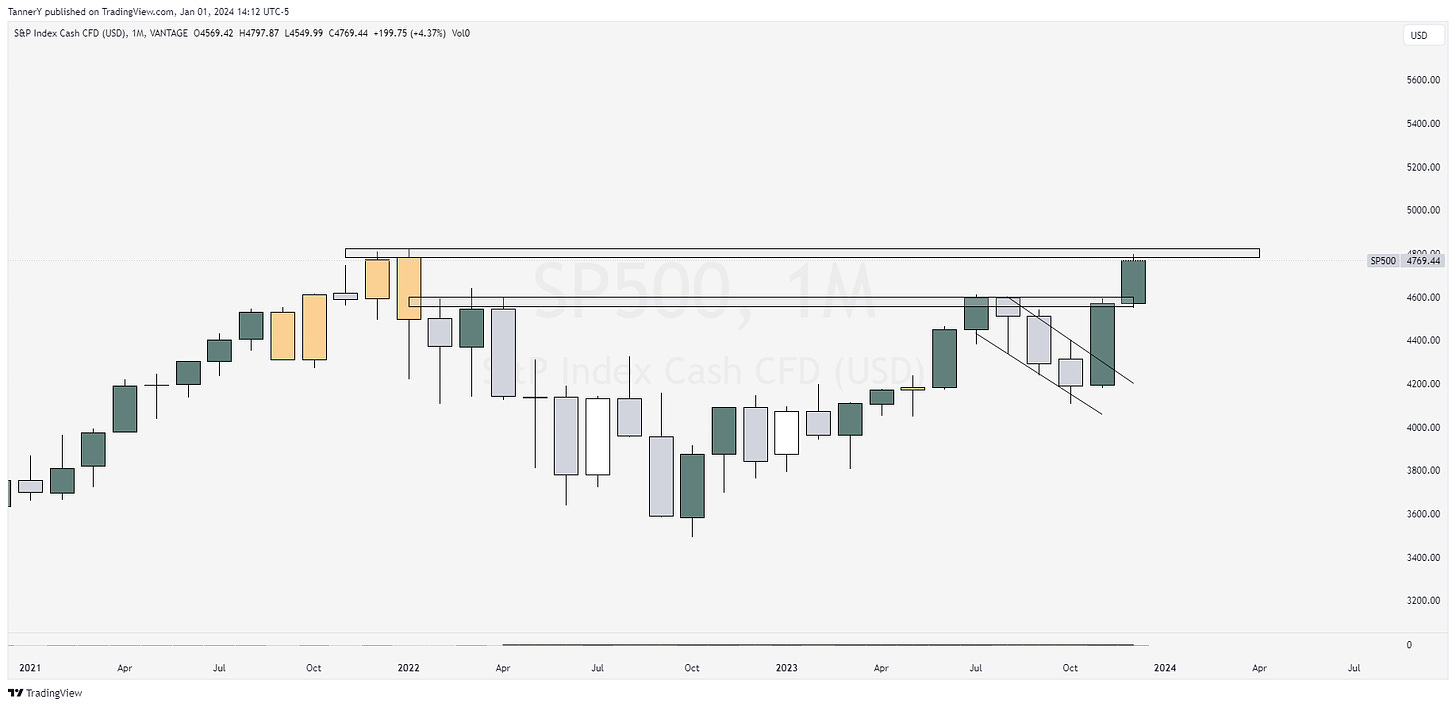

SPY 0.00%↑ monthly doesn’t look terrible, approaching all time highs with some velocity after a fall pullback.

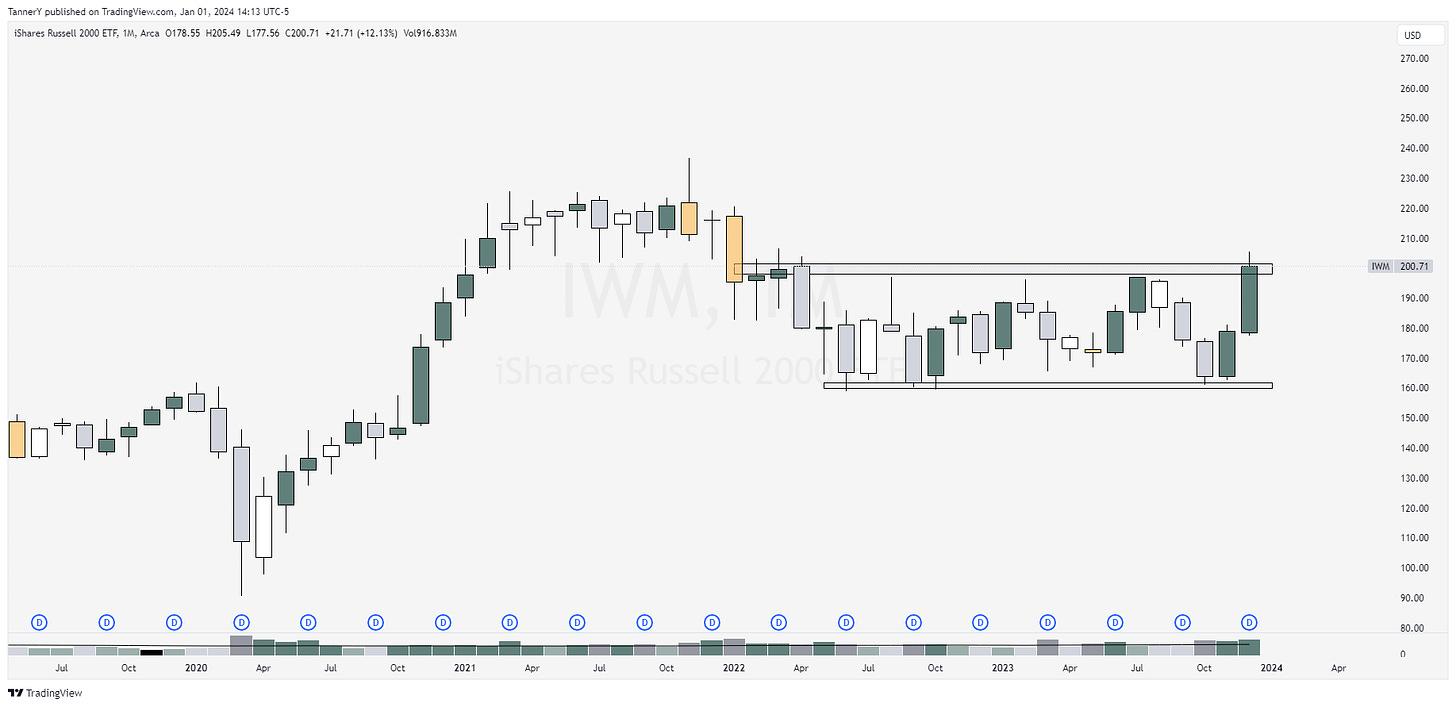

IWM 0.00%↑ monthly offering a much different look, showing signs of strength into the end of the year, but ultimately not making much progress.

My thoughts

2023 was the year of the mega caps. Until the latter portion of the year, Magnificent 7 gains were carrying the market, with some standout groups like crypto and homebuilders. in 2024, I would like to see rotation into some of the oversold small/mid caps that really didn’t get much action this past year.

I would also have to assume that bonds (TLT) performs well, as I see the fed getting a better grasp on inflation with the last years worth of hikes.

I will continue to trade, day in and day out, regardless of how the market performed.

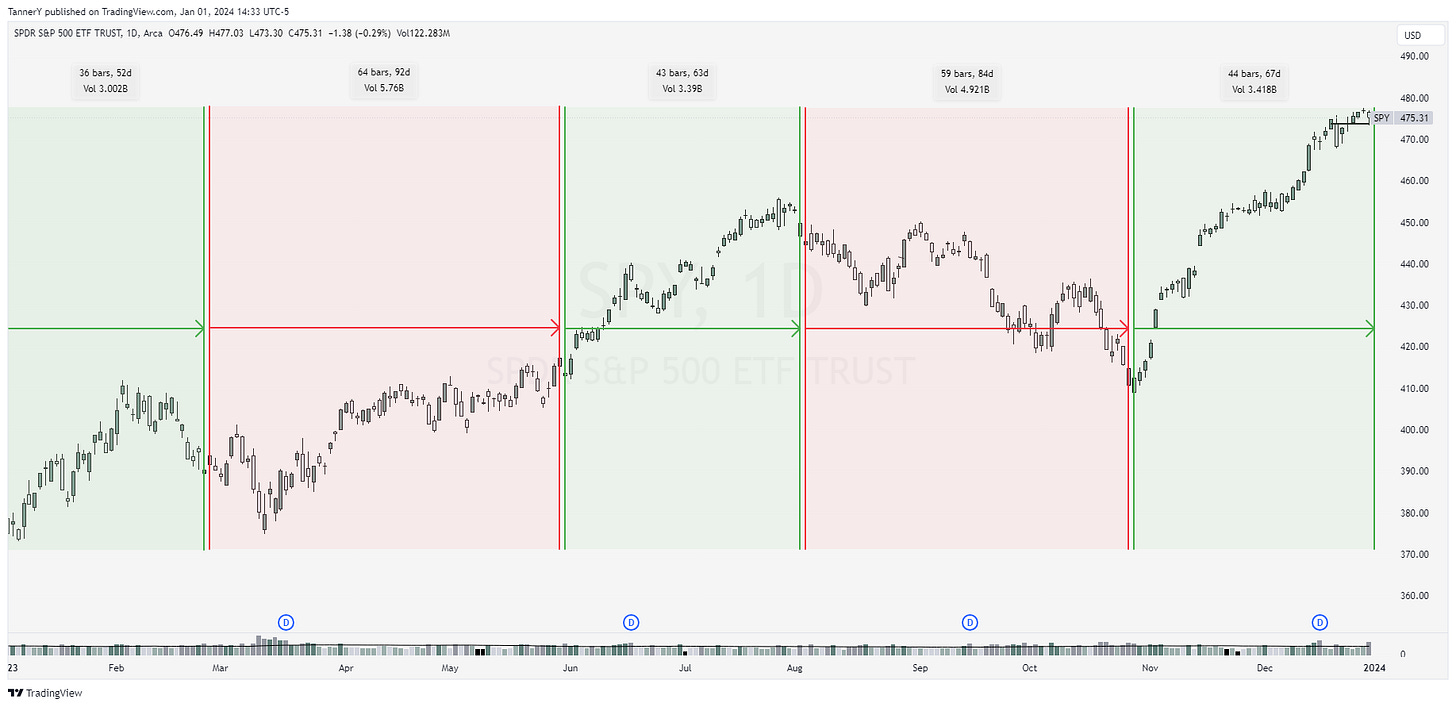

This graphic represents what I saw as tradeable runs through 2023. Looking back, I did not take advantage of 1 or 3 enough (greens), and overworked through the second red zone. Going forward into 2024, I will be more diligent about efficiently recognizing what type of market we are in, and use this to be more confident in my decision making. For my strategy, I need really clean and obvious Risk/Reward parameters, which the 2nd green zone offered, but didn’t get in the 1st or 3rd.

I think if you struggled in 2023, you’re not alone. At the beginning of the year the fear was insurmountable, and we really only started to make something out of it around April when AI hype began.

Charts, Tip, Past Performance

Seeing as I didn’t post last week, and I am using this as more of a year in review + year ahead, I’m going to forgo the usual pieces of this newsletter.

That’s All!

If you enjoyed, don’t forget to leave a like and subscription to support my content.

If you’re interested in more of my content, my YouTube channel is HERE

My twitter is HERE

Subscribe to see more: