Introduction

Fellow Investors,

Welcome back to another volume of; The Weekly Selection, where I breakdown the market and its intricacies, as well as share some of my favorite looking stocks for the next couple weeks.

Last week we saw some strong action in the main index, SPY 0.00%↑, bolstering a 1.08% return despite dipping into the week befores’ low on Monday and Tuesday. The week was chock-full of fed speakers, most of whom gave generally dovish comments. In context, dovish comments from the fed are suggestive of easing on their policies and confirmation that what they are doing is working. Hawkish comments, which were much more apparent throughout the fall are much more suggestive of continued heightened policy and interest rates.

Below is the chart for the broad market index, SPY 0.00%↑:

As it can be observed with the annotations, the broad market is looking pretty good. After a brief flash up a couple weeks ago on light volume, this retest of the moving averages and now pop above gives a glimpse at a tradeable run in the near future. I was risk-on this week, and will continue to do so with about 55% exposure.

Quote of the week

“As the Danish philosopher Søren Kierkegaard noted, life can only be understood backwards—but it must be lived forwards.”

- Benjamin Graham, father of value investing

This quote stood out to me as it relates well to the price action we’ve seen lately. Tons of speculation of past crashes playing out again, and plenty of ‘seasonal’ run theses from the bulls. While hindsight is 20/20, and the past is the best indicator we have, ultimately paying close attention to price and maintaining a nimble stance through this choppy market is the only way we are truly going to live forward and make it out of this cycle with our shirts.

Past Performance

A quick note about past performance: Every week I post stock ideas on this newsletter. I track them from market open price on Monday to Friday close. When I was in my earlier days of learning the markets, I always found it frustrating when individuals would give out ideas and then post unrealistic buy and sell points. To curb this, I created the weekly selection which truly tracks 1 week stock performance on my favorites. Not only does this take out the guesswork of buying, but it also gives a realistic idea of how this port performs vs the market.

Below are the stats from last week. Crushed it

META 0.00%↑ was the winner, 7.78% from weeks open to close. CRWD 0.00%↑ and XM 0.00%↑ were notable as well. Average performance was 3.89%, beating SPY 0.00%↑ by 260% (SPY 1.08%).

Charts

Alright lets get into the week ahead. Tech seems to be the best looking, with 50ish stocks I check up on a weekly basis looking more bullish than bearish.

MNDY 0.00%↑ is up first. I had this one on my list last week, and it maintained its moving averages and got a nice pop up into the existing supply zone. A break through here would open the chart up to its early 2022 decline action, which is quite thin.

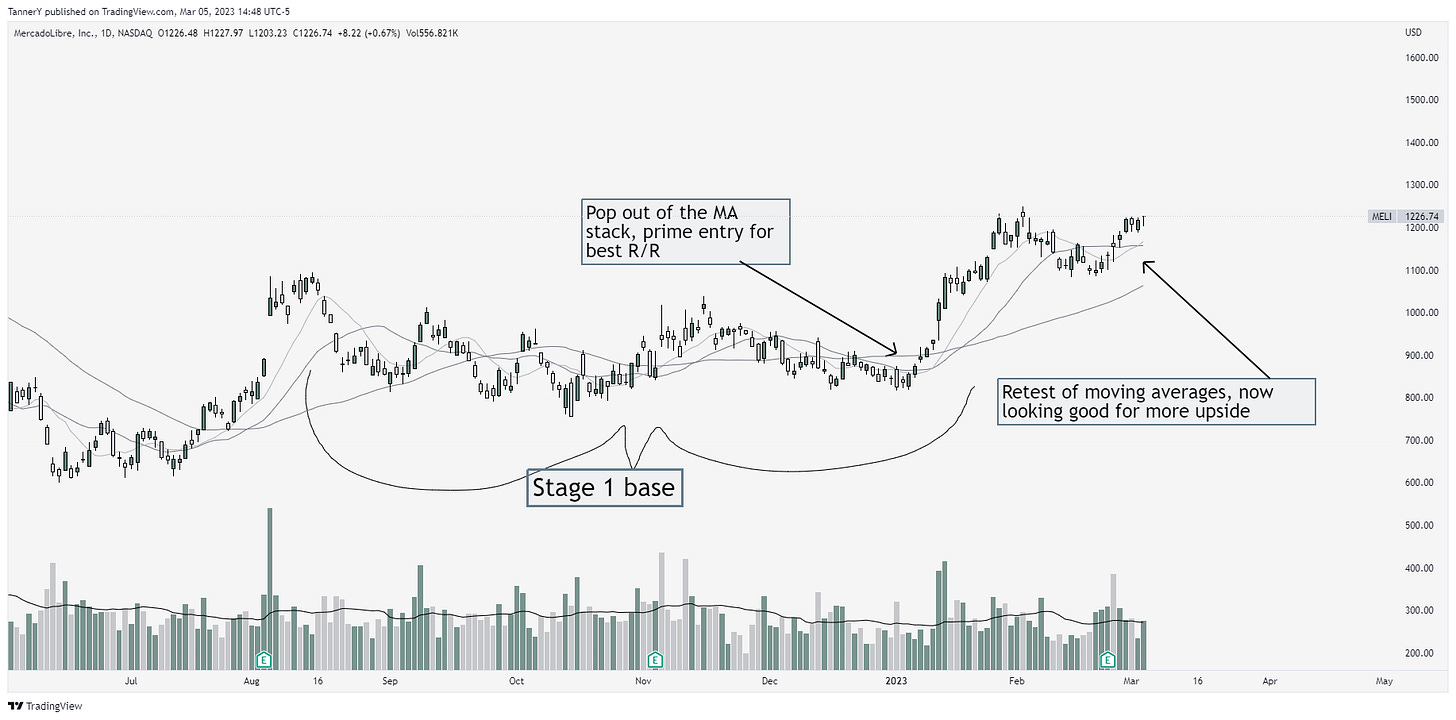

MELI 0.00%↑ is one that ive watched carefully over the last few months, and never got involved with. I like what I'm seeing on this daily, and added some annotations to get the point across.

CROX 0.00%↑ has been a monster this year. Consistent growth in both EPS and Sales, despite extremely poor overarching macroeconomics. After their last report, I took a position and would like to see this either continue soon or build back into the 50sma

ANET 0.00%↑, not only is Arista Networks a fundamentally sound business, with over 30% EPS, FCF, Rev and Asset growth, it also is quite sound technically. I hold this in my long term portfolio, but sometimes double dip on it to capitalize on the setups provided.

AI 0.00%↑, a bit of a loose cannon on the list this week, AI 0.00%↑ has been getting alot of attention lately with the new products from ChatGPT and other similar offerings. While AI 0.00%↑ has been unprofitable, and mostly lackluster since its IPO, I think its worth noting especially with the potential here on a week long swing.

Thats all for this week. Stay nimble and remember to keep up to date with my page as I often release educational and other finance related content throughout the week. My latest article, Mortgage Mania, can be found here: Mortgage Mania: An analysis of the American housing market

Have a good one, and subscribe if you enjoyed!

Tanner