Introduction

Investors, home-buyers and speculators,

Since the Covid-19 pandemic began, the American home buying market has seen a substantial rise in median home prices, as well as ascending mortgage rates to go with those homes. This has left many individual investors, families and real estate firms at a bit of a crossroads when it comes to purchasing their next/first property.

In this weeks article, I will be discussing the current mortgage market, and the wild ride we’ve taken since the Covid-19 pandemic to get here. I hope to clear up some basics of purchasing power, and its effect on lendee’s in these market swings, as well as apply my knowledge as a lending analyst for the few years I spent employed at my local bank.

Timeline

Lets first begin back in 2019, before Covid was on the radar of investors. Here are the stats:

Median home price: $329,000

Average mortgage rate: 3.94%

When Covid first hit, A lull was seen in buying and construction, as well as a rapidly plummeting mortgage rate. Below are the 2020 stats:

Median home price: $336,950

Average mortgage rate: 3.10%

In 2021, we saw continual decline of rates, but increased purchasing of homes. This was mostly due to these sweet rate deals, but also because of the social and culture changes in the workplace. Work from home was taking over, giving employees the opportunity to continue making their big city salaries, far away in the countryside and suburbs. The stats can be seen below:

Median home price: $396,800

Average mortgage rate: 2.96%

This astounding rise in prices was essentially the end of “cheap money”. While mortgage rates were down, this large rise in median home prices took out the possibility of “getting a deal”. 2022 was no better, with their stats below.

Median home price: $432,275

Average mortgage rate: 5.40%

All this data begs many questions. Most notably, what does all this mean? Why is the money spent then less valuable than it is now? Do changes in mortgage rates really matter that much?

Lets discuss.

Rate analysis

first up, rates. I’ve taken the time to make a calculator to take into consideration home price and mortgage, combining to show total cost of a mortgage held to maturity (30 years for this example).

In 2019, before the pandemic, a median home at an average mortgage would look like this:

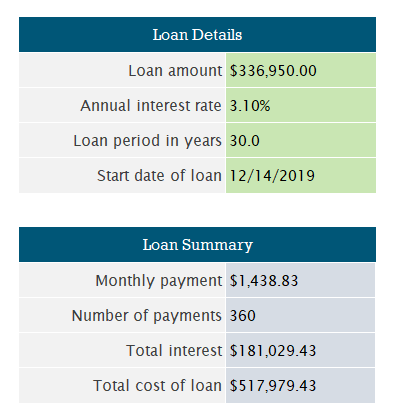

A total cost of $561,361.43. We will use this as a baseline. In 2020, this figure changed slightly, which ultimately spurred the frenzy. All else staying constant, notably savings is a factor we are focusing on. Below is the same calculator for an average home purchased in 2020:

Individuals paid on average roughly $8,000 more for the home, but in the long run save roughly $43,000. This catapulted the market into a frenzy, with many institutions hopping on board to sweep up homes to add to their portfolios. Not only were all types of investors getting an appreciating asset in the home, they were getting them for a 7.84% discount!

Unfortunately for late buyers, this would quickly change in 2021. Stats below

Now individuals were starting to feel the burden of inflated home prices. Costs in total rise 15% y/y. 2022 is where things really get juicy, and remember, average savings value changes are negligible, so people do not have much money to afford the costs of the homes they’re buying. Below are the stats:

45% increase in total cost of the average mortgage year over year! what a move. People are still buying homes at these prices, expecting to refinance down the road but have stilled payed a wild 32% over 2019 median for JUST THE HOME. Remember, since the 1950s, home prices have appreciated a little over 1% per year. This egregious overspending for homes now does not mathematically make sense and the time it will take for these homes to reach prices like this again will be substantial, even with a refi.

If not now, when?

From my experience at the bank, and personal analysis of the market at hand, there is considerable cash sitting on the sidelines through this latest downturn in the rollercoaster that is the last year. Dips in homes and vehicle prices are getting bought up, suggesting longer than expected federal reserve tampering. For new home buyers, or those looking to move, it is crucial to run similar calculations before making a purchase decision. It is so easy in todays world with such great access to news to get caught up in the noise and make a poor choice.

Personally, I think an ideal buy scenario would be to follow the price of the homes more so than the rates themselves and watch for a settlement. It is likely that prices will fall before rates, and locking in at a falling price and refinancing a couple years out from then could wind up being a decent deal.

Concluding notes

Mortgage rates will continue to fluctuate over time. Traditionally, rates have an inverse effect with home prices. As rates increase, home prices come down. Over the last year we have seen something truly wild, with both home prices and rates going up simultaneously. This has proven to be a terrible time to buy historically. There is hope however with CD and high interest savings rates crossing well above the 5% threshold. Individuals who are weary of prices and purchasing are now beginning to park their money there to wait out the potentially long cycle to a ‘normal’ market while still collecting a solid yield and fight inflation burn.

That’s all for this one folks. If you enjoyed my writing, please drop a sub and a like to support me. Until the next one,

bye bye!

-Tanner Yarton

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by anyone.