Introduction

Investors,

Welcome back to another iteration of my weekly market analysis newsletter: The Weekly Selection.

Since my last article, the newsletter has nearly doubled in subscribers thanks to the *free* trading guide I put out last week. If you missed it, it can be found HERE.

For those of you who are new here, let me break down the purpose here. Not only do I post educational materials and analysis of various financial markets, but every week I compile the best of the week behind and ahead. Not only that, but all the stocks I like on my ideas list are tracked from market open Monday - Friday, with the purpose of teaching catching a portion of the move instead of getting married to buying bottoms and selling tops.

Without further adieu, lets get into my analysis of the broad market.

Indexes

SPY 0.00%↑: The S&P500 finally eclipsed the 2021 all time high. This comes in the wake of a tech & AI fueled run in stocks like NVDA 0.00%↑, AMD 0.00%↑, and MSFT 0.00%↑.

IWM 0.00%↑ is always a fun one to look at. currently pulling back on the weekly chart, but has tons of potential as small/mid caps setup beautifully for a move. Participation from these would support a healthier market, as improving breadth is important for any market move.

XLV 0.00%↑, the longer the base, the higher in space! I still like this theme for 2024. We will see how it plays out as indexes breach all time highs.

Weekly Parabolic Trend Analysis

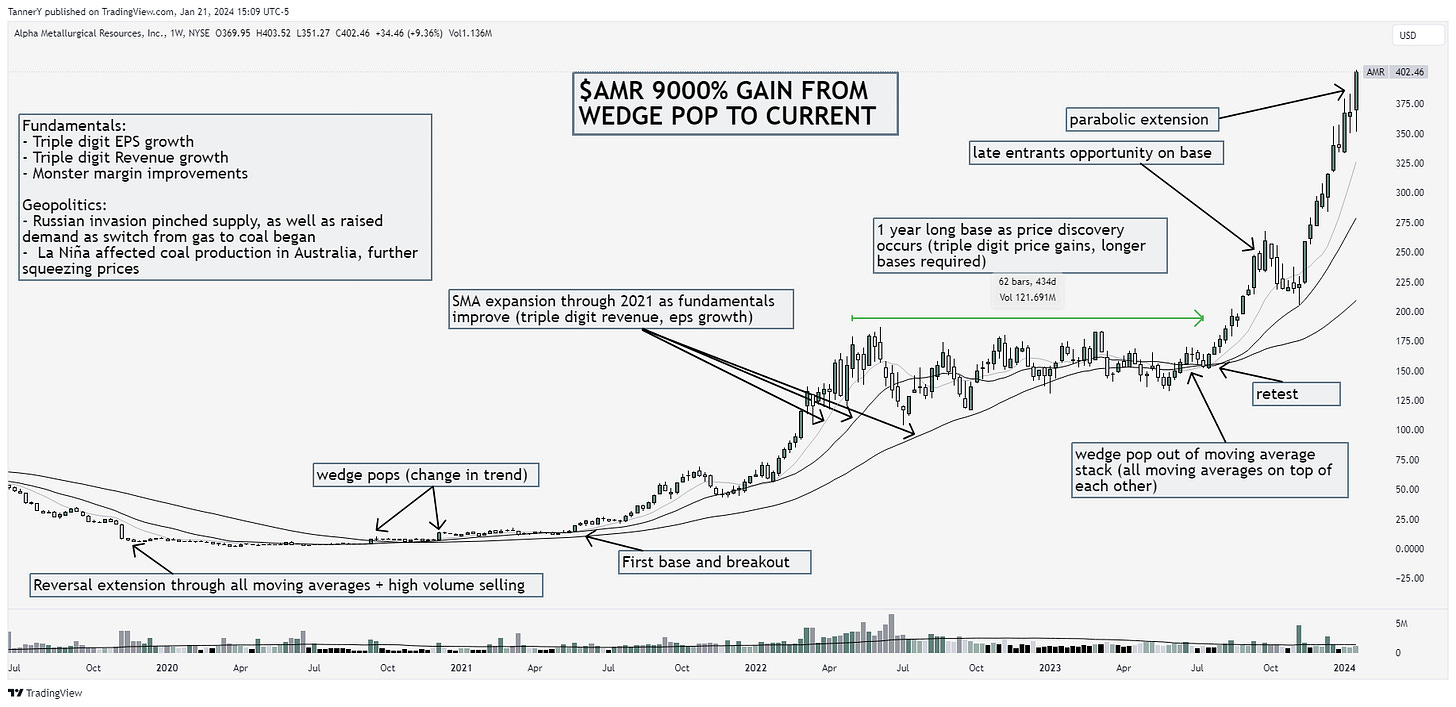

This weeks trend analysis comes from a recent gainer, $AMR. AMR produces and sells Coal on the east coast of the US. from 2022-current, they have seen a staggering 9000% price increase. Check out the chart annotations to see how!

If you enjoy this type of content, be sure to subscribe and leave a comment for more of these analytical charts

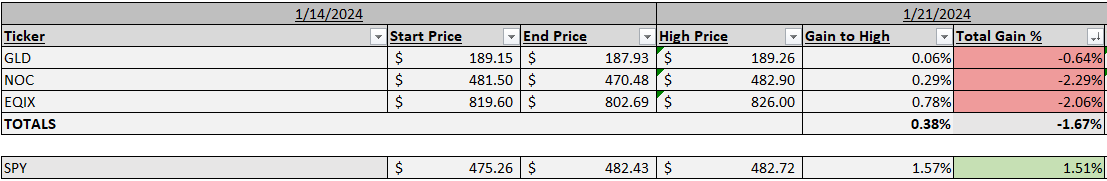

Past Performance

Honestly, I missed the ball last week. I was looking into sectors like aerospace and commodities to perform in case indexes held up at all time highs. I was wrong, and it showed.

After a great start to the year, I underestimated the power left in big tech. This week is also looking promising, we shall see.

Charts

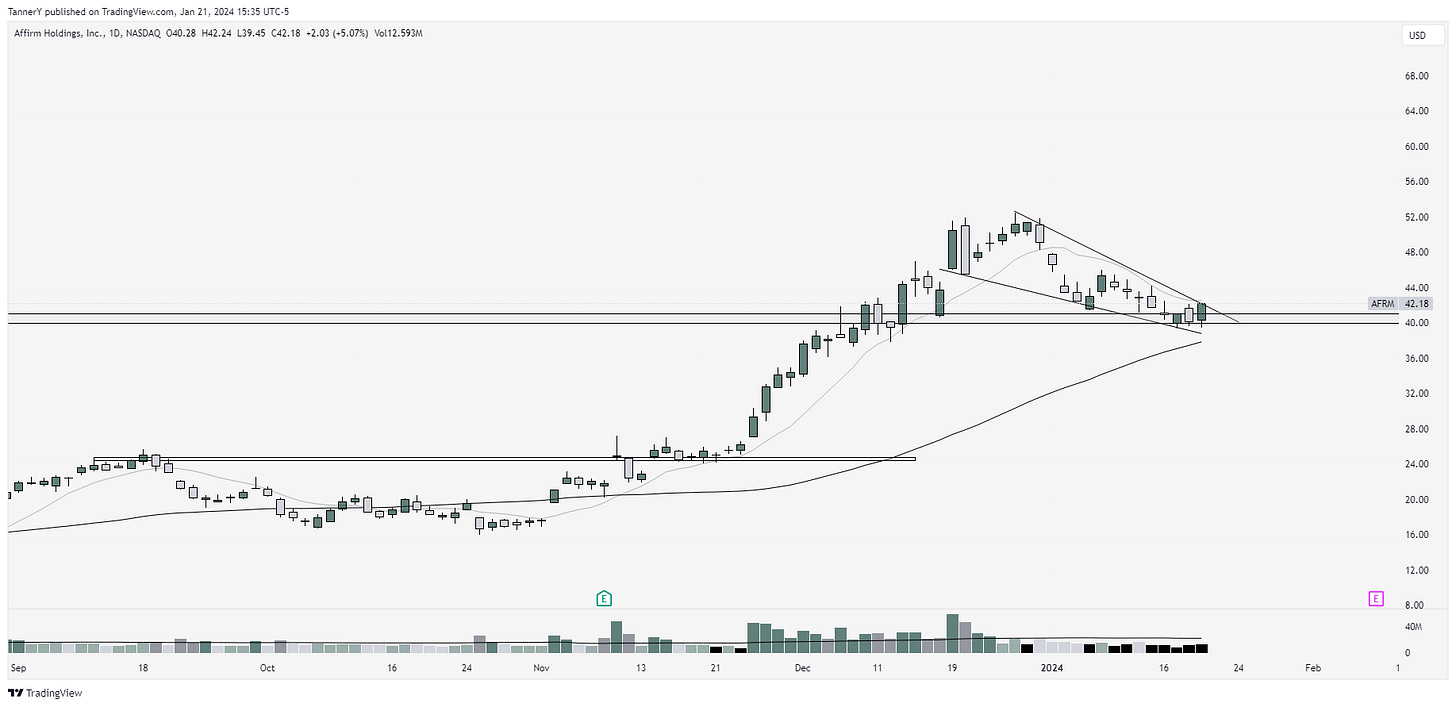

AFRM 0.00%↑ is the reigning champion for top performing stock in the weekly selection in one week. It is now tightening up, above the 50sma and tucked below the 10. I think if small/midcaps rotate in, we could see a nice break.

This week, and into this year, I see MDB 0.00%↑ performing well. This weekly setup is quite pure, and the business is AI related, which despite criticism has performed well into 2024.

Cant deny this $MNDY setup. tucked below a nice pivot, with long term support below. Underperforming its group this year as well.

BRZE 0.00%↑ setup is pretty clean. above pivot, flagging again, MAs close.

Whether or not you’re a believer in this market being a bubble, one thing is for certain, there are a lot of great looking setups from a technical standpoint, and the valuations of leaders are inflated, but nowhere near what they were in 2001 or even late 2021.

Cant wait to see how it shakes out!

That’s all for this week!

IF YOU ENJOYED:

Like this post