(Yellow Cake) Uranium

002: Mid Week Update

Introduction

Welcome in to another mid week update from SEBS.

For anyone new here, these are the core themes of my positioning and thoughts on the current geopolitical landscape:

The United States needs more power production

Decoupling from the necessity of China is a must

The AI bull market is still in its infancy

This administration will do anything they can to continue “growth”

So far this week has been a bit turbulent in the news, but linear in price action. SPY rips to highs amidst FOMC, Xi/Trump meetings, earnings season, and a minefield of economic data of varying importance.

When I know going into a week there’s going to be a lot of volatility, I tend to plan research as opposed to execution on new trades. This week, I focused on Uranium, as a few notes have become increasing clear:

Trump is not rolling back his solar/wind hatred in light of the power problem

Nuclear is becoming the clear choice of the administration

We need a lot more uranium, and the domestic supply chains to support it.

The options are extremely narrow, making the selections for the portfolio easier

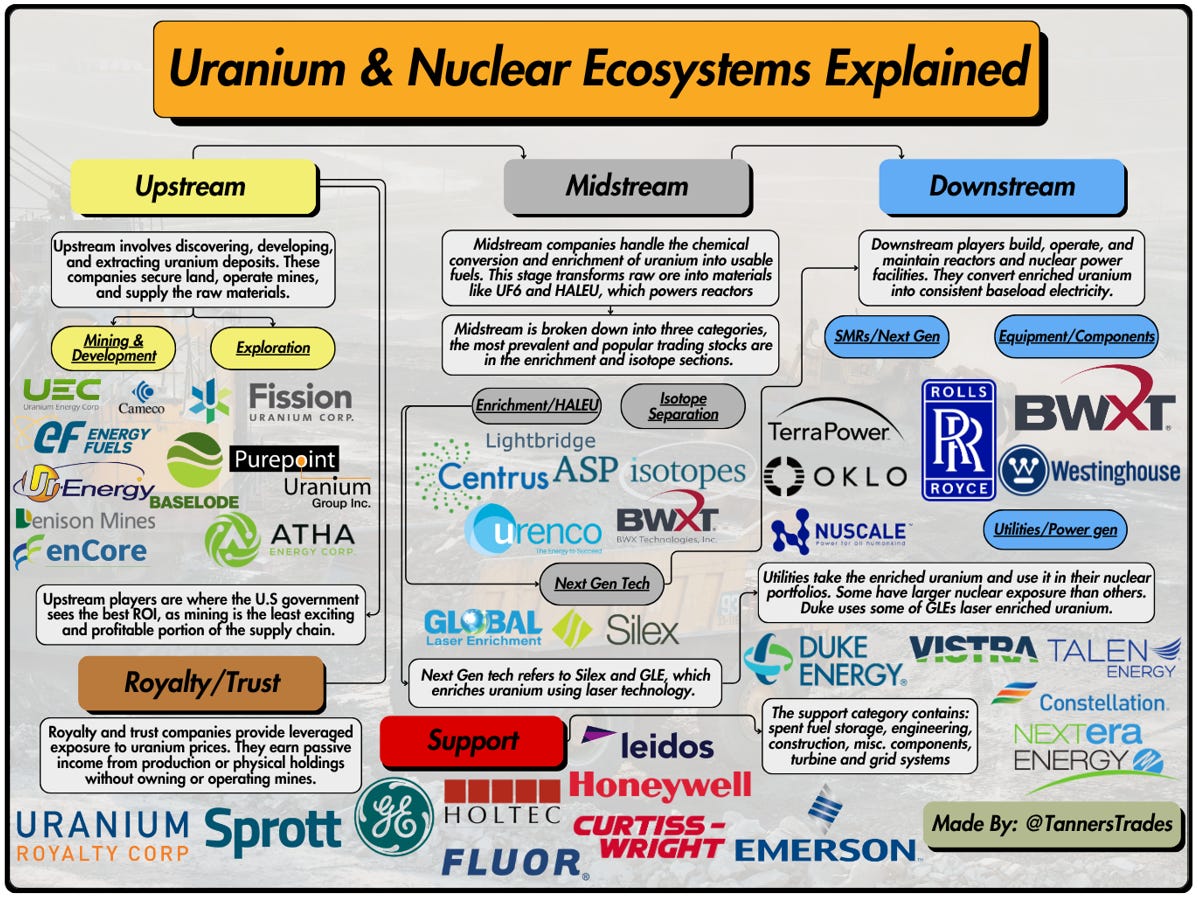

As we can observe, the graphic is split up into 5 key sections: Upstream, Midstream, Downstream, Support, and Royalty.

In my coverage this week, I will discuss my favorite stocks within the groups, as well as cover additional names I am watching outside the uranium ecosystem.

For full access to the research, subscribe or sign up for a trial below:

Keep reading with a 7-day free trial

Subscribe to SEBS to keep reading this post and get 7 days of free access to the full post archives.