Investors,

Welcome back to another iteration of ‘The Weekly Selection’, where I cover my thoughts on the market, what’s upcoming and some other little nuggets for your enjoyment.

Check out the latest Podcast at the link below, as well as some other socials:

Indices and News

Coming into this week the market was poised for a large gap down into Monday following erratic Trump trade strategy. I will reiterate again, this was laid out in his initial plans, and for those who are still confused on what “The art of the deal” is, let me lay it out for you:

Step 1: Aim High

Trump always initiates the deal with a monstrous ask or proposal as a means to establish that big goals lead to big results. He believes limiting oneself to what is realistic will always hamper the maximum outcomes.

Step 2: Remain Likeable While Standing Tall

Since most cannot comprehend step one, Trumps strategy is often met with criticism. He usually quickly pivots to easily appease the base, hampering claims of bombast while still keeping his goals in tact.

Step 3: Control the Narrative, Fight When Necessary

Trump utilizes the media to his advantage to spin all particulars of the deal into positives for various parties.

He never backs down from the fight if it protects the deal. Picking his battles on the fronts he sees as most important even if it means decreasing the initial size of the proposition. This detracts criticism while still betting bigger than going after small fish to begin with.

Step 4: Stay Flexible

Trump always leaves the door open for input, its why he always aims high, knowing it will attract the most attention and input from all parties. Some even providing ideas he may not have thought of.

Additionally he surrounds himself with the best team he can muster. In this current administration we see a fleet of powerful and loyal names, allowing him to easily fall back on council if he needs to make swift changes to strategy.

Step 5: Never Admit Defeat

Possibly his most controversial part of the deal. Even when all things seem to be going down in flames, Trump projects strength. He spins setbacks as victories in one regard or another, with the goal becoming protecting self image to try again. Regardless of how this makes him look in the near term, it keeps his name in the media and accepted to try again but at least some portion of the base.

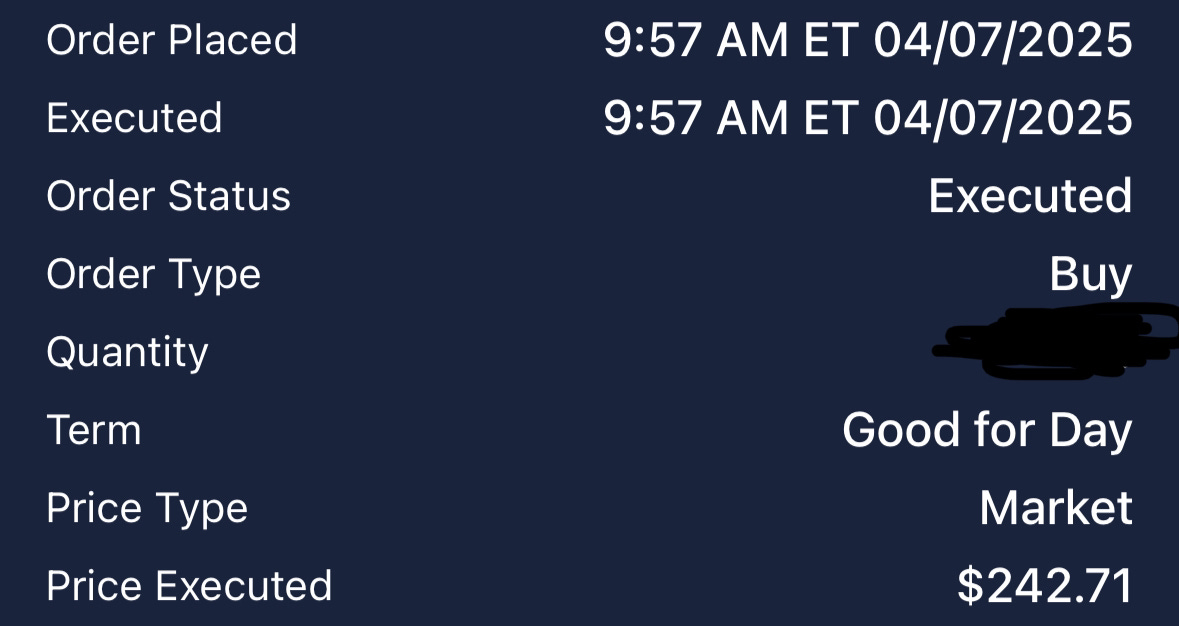

We are currently seeing this play out on the global scale with Trumps ambitious tariff plan. In my opinion Step 1 is what hurt the market the most, as many were unprepared for the sheer size of the proposition, myself included. However, as we know every reaction in the market is an overreaction, and that opened the door for opportunity on Monday morning, which I was able to take advantage of in my retirement account, adding VTI.

Taking a look at the bigger picture below, we can see the volatility in real time. This week were heading in with some reel back on Trumps ambitious plan, which is right in line with his history of deal making.

Like clockwork, we retest the 2021 all time high. For what its worth, a retest like this is a worthy buying opportunity regardless of the news or macro factors, in my opinion. This buy-zone was outlined in last weeks write up.

Gold continues to perform through uncertainty, no further commentary needed there for the frequent readers.

the RSP, or equal weight index is slightly below 2021 highs, highlighting the fact that the rest of the SP500 outside the mag 7 is struggling more than the major players.

Upcoming Opportunity

Looking forward to this next week, as I think setups are starting to appear and the relative strength groups are revealing themselves. Cybersecurity names are holding up exceptionally close to ATH, with CYBR 0.00%↑ CRWD 0.00%↑ FTNT 0.00%↑ looking the most actionable.

Names like RKLB 0.00%↑ ASTS 0.00%↑ SATL 0.00%↑ all ate up the previous few weeks volatility, and are more poised than most to continue higher assuming the broad market participates.

Many are of the opinion that this level of volatility is not something to touch, regardless of what your end goals are. While I generally agree for new market participants, right now is when we will get the most important feedback on what groups the market is actually favoring.

In an uptrend, it can become difficult to pinpoint the true leadership groups/themes, however in a downtrend they stick out like sore thumbs.

Those that swim against the current when its rough tend to make it to calm waters faster than those merely going with the flow.

Clarity in trade negotiations is becoming clear, and with that we will start to see the direction the market is leaning. While I am still of the opinion that buying value through these large swings is worthwhile, it is important to note that as technicians I must also pay close attention to what price is telling me. If names I am in are acting poorly and volume is supportive of the downside then I must accept this and recalculate buyzones.

Thank you for reading.

Check out my other articles here:

Check out the latest articles at the link below, as well as some other socials: