Introduction

Investors,

Welcome back to another iteration of ‘The Weekly Selection’, where I cover my thoughts on the market, what’s upcoming and some other little nuggets for your enjoyment.

Check out the latest Podcast at the link below, as well as some other socials:

The Past Couple Weeks…

As you all may have noticed, I have not been active for the last couple weeks. I recently made the decision to move from New York down to Charlotte, North Carolina in an effort to advance my career, network and enjoy the benefits of reduced taxes in my younger years.

Content will resume in full immediately, lets dive in to the past couple weeks:

Right on par with previous expectations, the market continues to be a mass bidding machine, shrugging off more tariff news like its nothing. Four months ago, the commentary were getting now caused a 30% slide, now it only has the impact of a few measly percentage points.

Remember, what this market has endured for the last few years has had no impact on price, as we surge to all time highs. This has been crucial in my performance as I continue to buy dips and long quality themes and stocks.

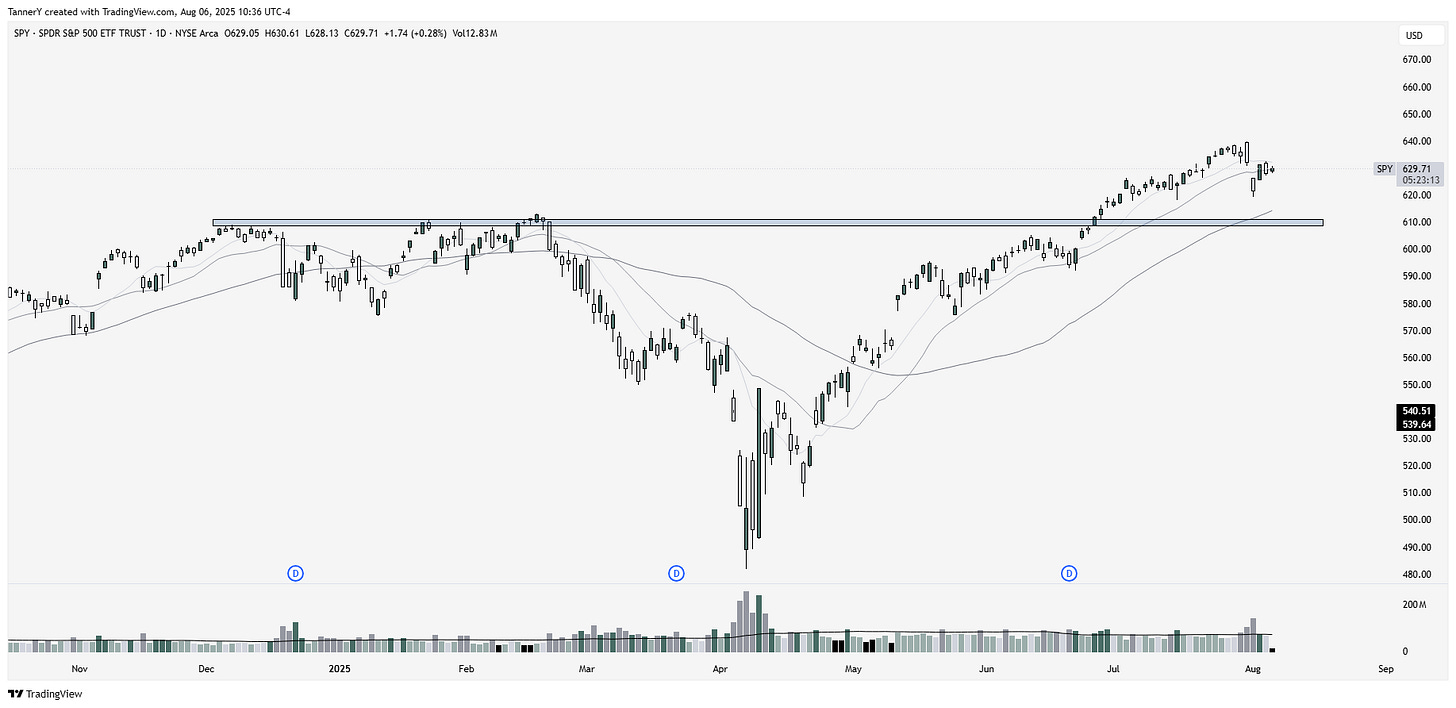

SPY 0.00%↑ as we can see, SPY has reclaimed the 20sma after briefly undercutting last Friday. After such a heated run, and earnings season upon us, volatility is to be expected.

GLD 0.00%↑ remains one of the top looks in the market, consolidating for over 4 months right under the all time highs. This has the makings of another leg soon.

Indexes are up anywhere between 20-40% from April lows, marking a historic recovery. Opportunities are plentiful, but actionable setups are fewer and far between. It has been a market in which buying pullbacks has benefitted greatly, and I expect this to continue as long as this frozen rope run does.

Lets get into some of the opportunities and themes I am watching below:

On Watch…

Favorite Themes: Nuclear, Deportation, AI (datacenters), Space, Defense

We’ve seen tremendous performance out of the core themes I annotated in the year ahead back in January, I expect this to continue in the back half of the year.

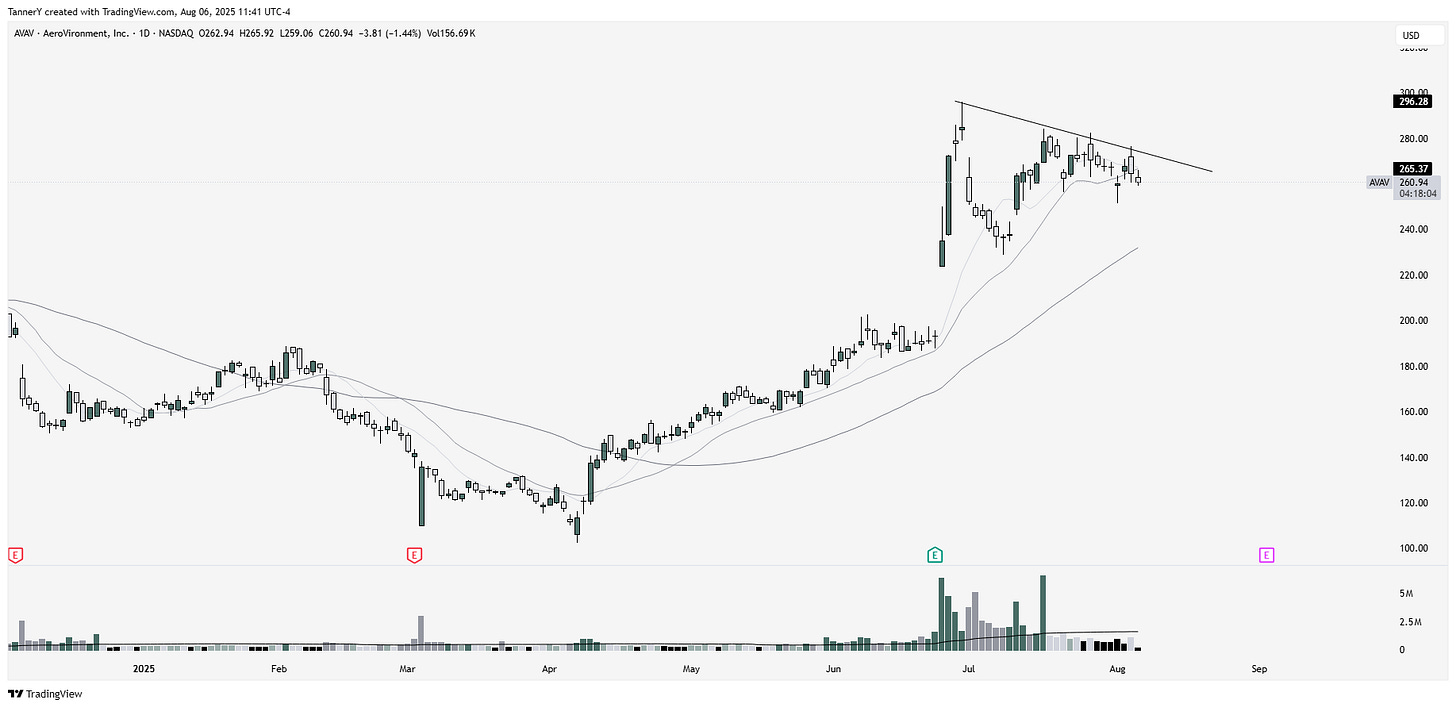

Defense names such as Anduril have sparked interest in drone stocks and related groups, hopefully we get an IPO there in the back half of the year.

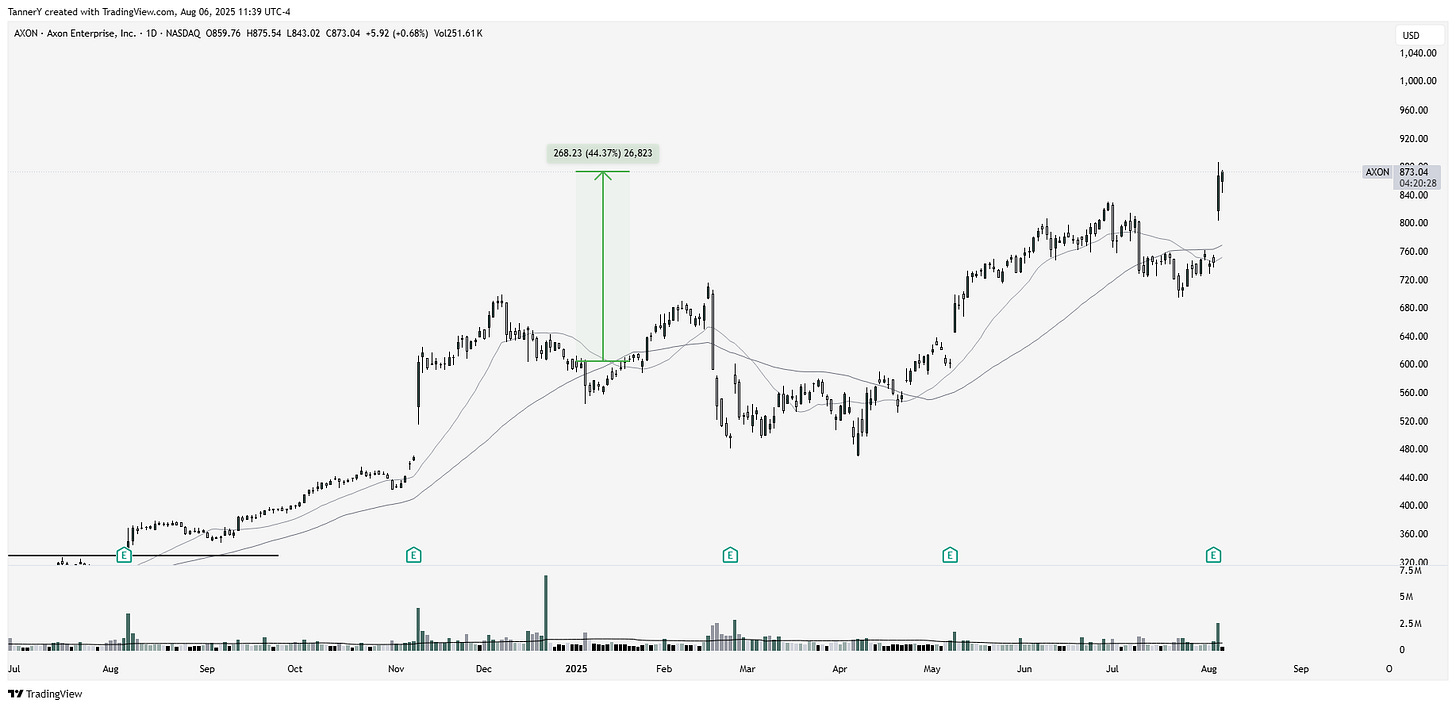

Deportation stocks like AXON 0.00%↑ are blowing out earnings left and right, as the spending on the border and security grows.

AXON 0.00%↑ up first from the deportation theme: AXON BYRN GEO primaries. Strong report a couple days ago, likely to continue to be one of the strongest names in the market.

RKLB 0.00%↑ best in class for the space theme. Others include RDW ASTS LUNR SATL. Still own RKLB.

AVAV 0.00%↑ is the top drone name behind Anduril. Until they IPO this is where I am watching. Strong fundamental too, other names with worse fundies but better technicals are ONDS JOBY ACHR.

HOOD 0.00%↑ best in class name, much better than SOFI 0.00%↑ in my opinion. Setting up after earnings here. Behind PLTR the strongest stock in the market.

In the nuclear/power gen world, OKLO 0.00%↑ is the strongest of the bunch, despite not having a product for sale. Others in nuclear: VST 0.00%↑ GEV 0.00%↑ SMR 0.00%↑ $RYCEY.

ALAB 0.00%↑ is my pick of the semis names. Semis were the pioneers for AI, and I think they’ve settled for long enough, with NVDA now making all time highs. Others in the group and related: NVDA 0.00%↑ ASML 0.00%↑ SMCI 0.00%↑ .

That’s All I’ve got for you this week. Be sure to look out for a podcast on Friday, and more writeups next week. Subscribe and share if you enjoyed!