INTRODUCTION

Hello Everyone,

This week is shorter than most, as we observe Labor Day to honor those who work. Ironically enough, One of the primary reasons we invest is so we don’t have to work quite as long, but I’ll take the three day weekends when I can get them.

last week was a bumpy ride, but we saw pretty expected overall direction, continuing our downtrend off the latest relief rally. For some context, the average bear cycle since 1940 has had an average of three relief rallies of 10% or greater. Since we theoretically began this trend at the beginning of the year, we’ve now seen three rallies that fit this mold, suggesting a potentially large move to the downside is afoot to bring full capitulation. Short term swing traders/investors are afraid of such action, however; a colossal downside move would certainly allow us to trade with less fear of random economic catalysts destroying our positions.

A note about this upcoming week. We may be slightly oversold/in need of relief on SPY 0.00%↑. The Selection will be more geared toward upside for this reason. Expect names that held flat/up last week to perform exceptionally if this is the case.

PREVIOUS PERFORMANCE

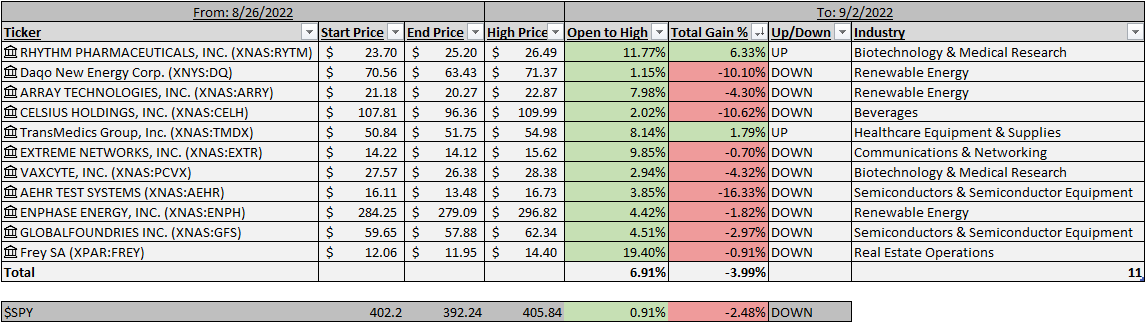

The performance for last weeks selection stocks is as follows:

As you can see, it was a pretty rough week. However, if you’ll turn your attention to the ‘Open to High’ Column, you’ll notice we had some strong trading opportunities despite week open→ close data. In last weeks selection I noted I would not be bringing back the weekly portfolio in which I buy stocks at the beginning of the week and sell them at the end, for this exact reason. Until we can determine a long term uptrend in price, I am only trading, not usually swinging.

CHARTS

Alright, I wont hold out any longer. Here are the charts and ideas for this week!

If you enjoy, please subscribe for *free* at the button below. If you don’t enjoy, subscribe anyway.

ARRY 0.00%↑ : strong look for continuation. Maintaining a base despite strong market downturn.

TSLA 0.00%↑ : The indicated box is both a gap to fill and a previously used area of support/resistance, in the event we continue the downward trend, I will be using this as a potential add zone.

CCJ 0.00%↑ : Strong action as of late for this Uranium name. I would assume its in response to the extension of a few foreign powerplant contracts. I will be looking to enter around this supply zone if we can hold

CPRX 0.00%↑: Relative strength name here. I like it if we can hold this bottom support, anything below and we will be gap hunting, long way to fall.

AMD 0.00%↑ : approaching one of my favorite buy zones, AMD is looking good down around $73.9.

PLMR 0.00%↑: A favorite from last week, I will begin to offload shares around these targets. Great Strength.

SHLS 0.00%↑ : A 4 hour look for SHLS, Any validation of this flag to the upside would certainly be worth taking.

SPY 0.00%↑: not a take I've seen a lot yet, but I am under the impression that we may be overheated on SPY. The chart above indicates what I would assume is a demand zone.

TNP 0.00%↑: Strong sideways action, a powerful breakout is in order.

TRMD 0.00%↑: Offering some strong sideways action, also on watch for a breakout.

Nice inside Day for ARLP 0.00%↑

NTNX 0.00%↑ with a pretty looking flag. Earnings gap.

PDD 0.00%↑ Daily: Looking crazy strong with a bullish outside day and a gap to fill above.

No top trend to speak of, but BTU 0.00%↑ weekly + a bullish outside daily on friday suggests some continuation. Strong watch this week.

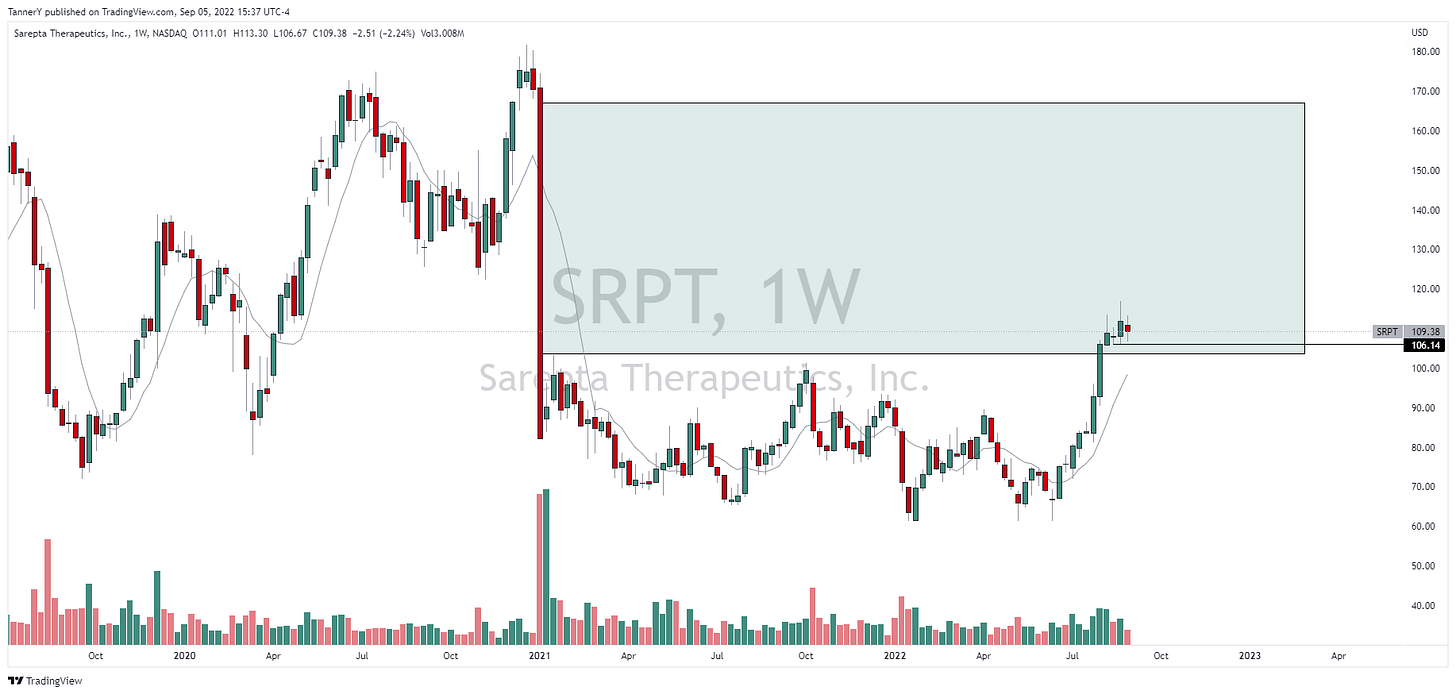

SRPT 0.00%↑ with an inside week within a large gap.

CLH 0.00%↑: Inside week @ previous all time highs.

Alright guys, That is all!

If you enjoyed, please subscribe below.

If you’d like to see some of my trades, be sure to check out my twitter: @TannersTrades

Thanks for the support as always,

Tanner