INTRODUCTION:

Hey everyone,

As the feds hawkish stance continues to fester in the ever worsening economy, it remains in our best interest to stay nimble as we trade, DCA, swing, and invest in the semblances of value we may find.

With the latest FOMC and a staggering 75bps rate hike behind us, we can now look to the markets for some volatility that may have been hampered leading up to such events. For those who are unfamiliar and too afraid to ask, the FOMC is the Federal Open Market Committee, chaired by Jerome Powell. They meet 8x per year to discuss the health and financial standing of the country and make interest rate and other guidance driven decisions based on their analysis. In addition, the 75 ‘bps’ stands for basis points, which is just a jargon word for %, where 100bps = 1%.

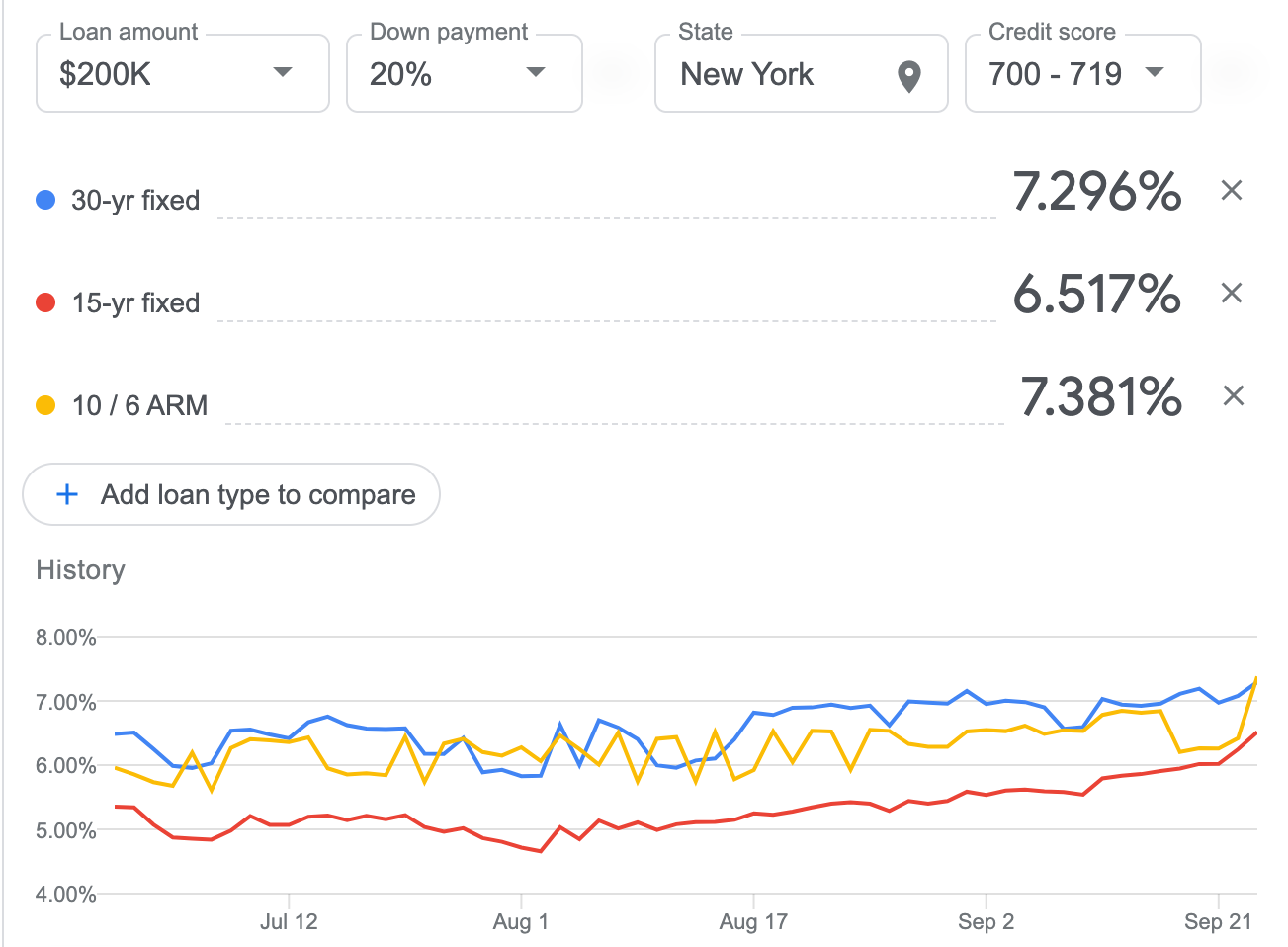

Taking a look at some broader market impacts of this rise in rates, we see mortgage rates, especially 10 year adjustables hit fresh local highs. What this means is that the purchasing power of an individual now is about half of what it was for someone in the bottom of 2020, when rates were closer to 2.3-5%. This, coupled with inflated home prices has begun to rapidly deteriorate the integrity of the housing market. The deterioration can be seen in a large decrease in purchases over ask, listings and purchasing by institutions such as BLK 0.00%↑ and $BRK.A.

See below for a graphic depicting an average individual in New York:

Broad market macro econ is cool and all, but let’s now move to a more micro approach. Last week, the weekly selection pointed towards chop into FOMC and then a large directional move afterwards. Sure enough, that’s what we got. Individual stocks performed abysmally, with many of my selections breaking trend to the downside and annihilating gains that i’ve been building for weeks. This is the market that we are, and will continue to have to deal with for the foreseeable future.

PAST PERFORMANCE:

I must admit, I’m not currently at my pc with my stock tracker and excel, so for this week you’re just going to have to take my word for it that we got absolutely bamboozled and I will never financially recover from this (satire).

Below is the SPY 0.00%↑ daily chart. as you can see, we have bounced off of the previous 2022 low around $363. The speed and momentum at which we approached this level leads me to believe that a relief bounce is near. If we slip below this area, $320 is in order, but it seems unlikely after such a swift move down the last few weeks.

My focus this week will be on looking for longs. These setups may not be immediately actionable, but if they paint the picture id like them to, i’ll look to add at which point I will alert on my twitter, which can be found HERE (@TannersTrades).

WEEKLY QUOTE:

“Over the course of my lifetime, the most valuable things i’ve learned were the results of mistakes i’ve reflected on to help form principles to avoid making the same mistakes again”

-Ray Dalio, Bridgewater Investments

CHARTS:

I don’t see anything in the market I like as much as fall themed beverages topped with donuts, but the following stocks will have to do! Let’s get into it.

Up first: DDOG 0.00%↑ . approaching a long term base with a pretty brutal looking flag setup. I’d like to see downside continuation on this, looking for this week or next weeks 75p contracts. From there I think the R/R is good for a long equity position.

AMD 0.00%↑ . is notorious for holding the 73.9 level. Last week, we slipped it. Id expect some downside targets to be the gap below. An actionable trade I may look for are the november 60p contracts for a long dated swing.

NIO 0.00%↑ : producing a good looking flag on the weekly chart, I am long shares and targeting the gap above.

AVGO 0.00%↑ . is a strong company with a poor looking chart. Id like to see the 421 area retested before adding long.

ENVX 0.00%↑ , my good pal from the last few selections is looking to either roll over into this gap, or bounce. The chain on enovix is pretty strong, and its optionable if thats what you’d like to take.

STEM 0.00%↑: needs to hold this base here or it will return back to its hole in the ground.

PLMR 0.00%↑: Pullback, or continuation to breakout?

ENPH 0.00%↑ holding on for dear life. under this zone this should rapidly fill the gaps below. nov 250p looks good.

Thanks all for this week guys.

I appreciate you sticking around, and if you did, please subscribe at the button below.

-Tanner