INTRODUCTION:

Hey everyone,

I hope everyone enjoyed the short week. This week we observe 9/11, honoring those who died in the tragic burning of the Twin Towers 21 years ago. From a price action perspective, we nailed it. Great bounce off the mentioned $386-$390 price area. There were a few fed speakers as well, and to escape without too much volatility is quite solid.

SPY 0.00%↑ Note from last week:

With the close like we had on Friday, it leans the case to the bullish side for this upcoming week. $4000 $SPX was a large level to cross, and to end so strongly above it indicates we will at least see $4100 and maybe above. One thing to note, we have CPI this week, and monthly Options expiry, so be tentative to hold past daily extension.

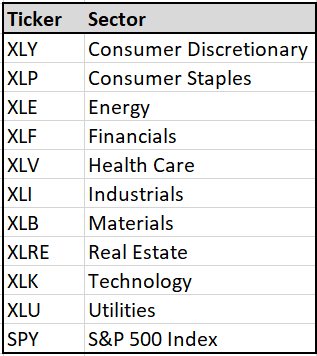

Before we get into anything for this week, I’d also like to make a quick note on the different sectors, Their tickers and why its important to see the whole board before starting a week. As I’m sure many of you know, big tech is what we trade most often in TCR. The stocks are most liquid, offer strong volatility and are always optionable. In perma-bull conditions, traders really have to look no further. However, in less than ideal downtrend conditions like we are experiencing now, its advantageous to look to other sectors to try and find some strength.

It comes as no surprise that my selections this time around come chalk full of random tickers and markets, and that’s by design. through this chop I’ve been able to generate winners consistently by approaching the up trending sectors before going back to what’s comfortable and fighting the trend.

Below is a list of sectors and their tickers:

LAST WEEKS PERFORMANCE:

Without further adieu, grab a fruit cup, get your dog on your lap and lets get into the charts. Enjoy :)

CHARTS:

SHLS 0.00%↑: Strong daily look here for SHLS. Operating in the solar sector which currently contains some of the markets best performers, id like to see continuation.

EE 0.00%↑: Currently printing a bullish outside week -> inside week on $EE. Strong pattern.

DINO 0.00%↑ Seeing the same thing here on $DINO. Bullish outside week -> Inside week.

LTHM 0.00%↑: Coming out of the before mentioned pattern. Would like to see this metals continuation into this fall.

STEM 0.00%↑ with the bullish outside week + a trend break on the daily.

MNTK 0.00%↑: Still a favorite, would like to see this either cup and handle or h out of the consolidation.

SI 0.00%↑ with the bullish outside week. Break of this trend should run.

ENVX 0.00%↑ strong daily hold over the gap.

Strong weekly look for PCVX 0.00%↑

SMR 0.00%↑ inside week in a large fla

ARRY 0.00%↑ struggling to hold this flag break, ideal entries around here.

PFHC 0.00%↑ looking strong off this ipo zone.

ENPH 0.00%↑ strong out of this base

Some good names this week! Might be a bit choppy, but that’s to be expected through this weird economic time.

Be sure to follow me for my intraday trades @TannerTrades on twitter.

If you enjoyed, please subscribe for free:

Have a great Sunday!