Introduction

Investors,

After 3 years on Substack:

I have turned on paid subscriptions for anyone would like to support my work.

This is not mandatory, and is essentially a donation at this stage. If you’re a long time reader, know that the Sunday newsletter will always be free, and any pay-walling in the future will be for additional content outside of my normal rotation.

Indices

I am coming to you live today with yet another slew of broken record commentaries, with a couple new takes sprinkled in for conversations sake.

First, we must review what happened last week:

Markets traded higher as we approach rate cuts (Wednesday of this week).

Many new IPOs went live for major tech businesses, such as Klarna, Gemini, Figure, and Via Transportation

Utilities and Communications sectors both led the market in gains, while Tech cooled off.

ORCL 0.00%↑ reports blowout earnings guidance, Larry Ellison becomes wealthiest man alive (briefly)

In all reality, this is great action. We saw some rotation out of tech and into the sister sectors, as well as some overall strength improvements, with stocks above their 50sma surging from 53% to 63%.

Quick look at SPY 0.00%↑ above. Very clean, linear price action out of the April lows, with minimal trickery around the SMAs… smooth sailing.

Parabolic Trend Analysis

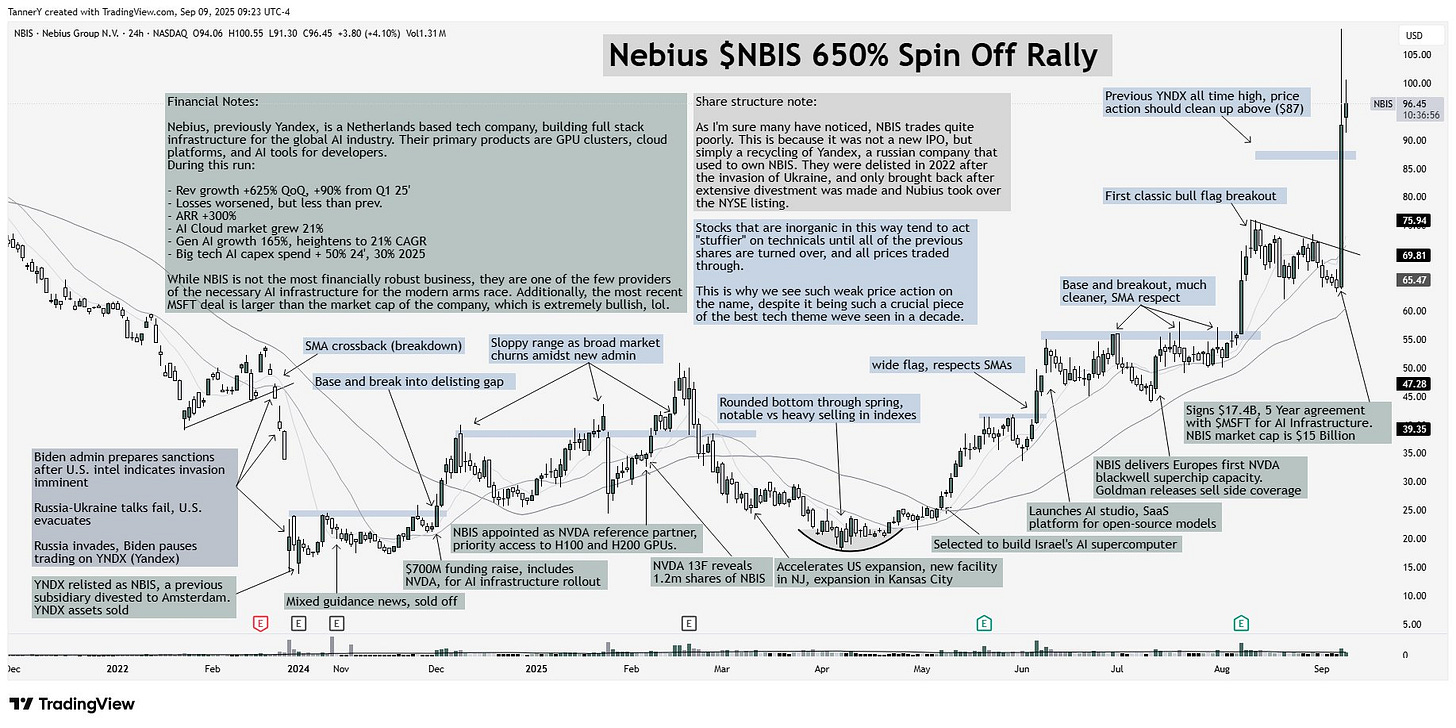

I completed 3 parabolic analysis this week on my twitter, which can be found here. I covered ORCL 0.00%↑ , NBIS 0.00%↑ and OPEN 0.00%↑. They are worth looking at for the full breakdowns in the captions.

*If you enjoy these writeups, consider subscribing, as they take a considerable amount of time to complete.*

Upcoming Opportunity

Some curveballs this week in the opportunity department, as well as old friends: Biotechs, manufacturing, space, nuclear, software tech, value???, and more.

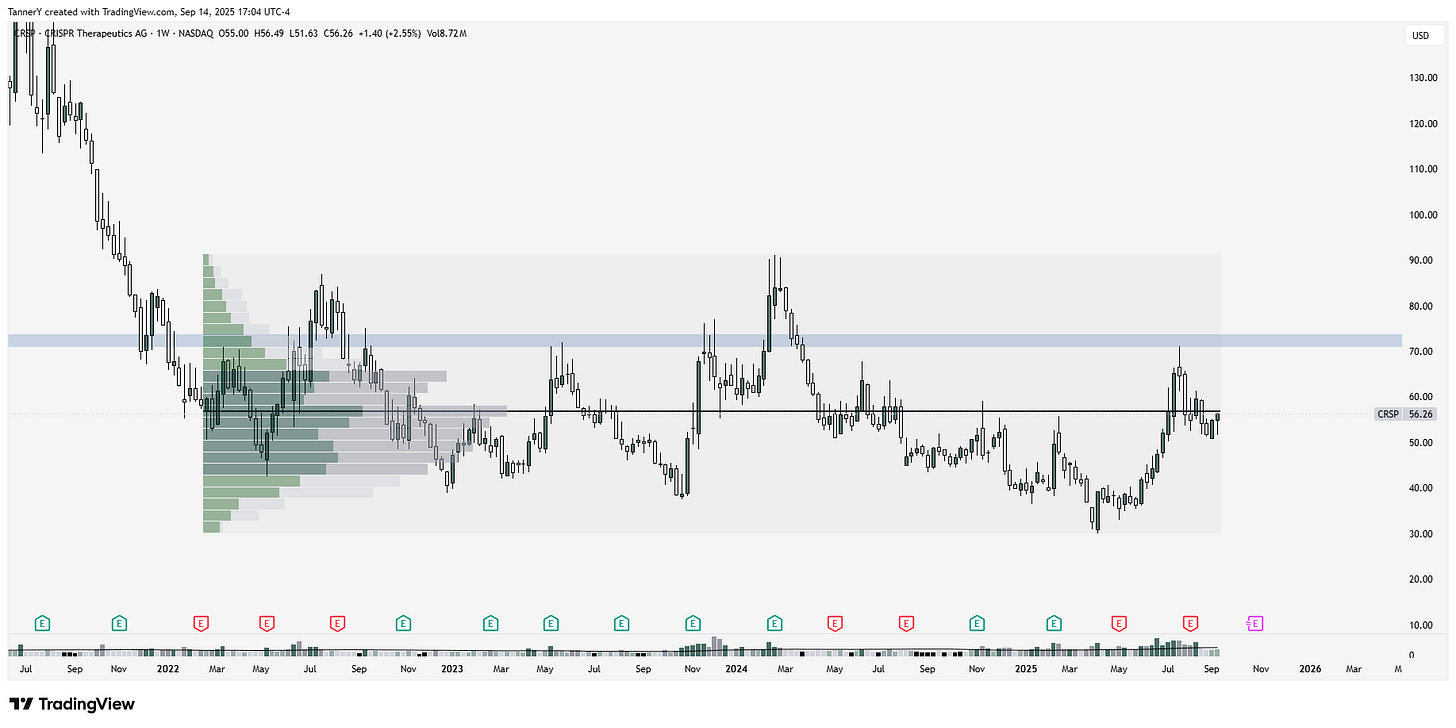

CRSP 0.00%↑ appears ripe for a nice tide shift in its current action. It has been flat for over 3 years, and has historically benefitted from a relaxed rate environment as well as deregulated industry. as it stands, none of its peers are notable, but in an adjacent indsutry, TEM 0.00%↑ is breaking out to all time highs and is notably active.

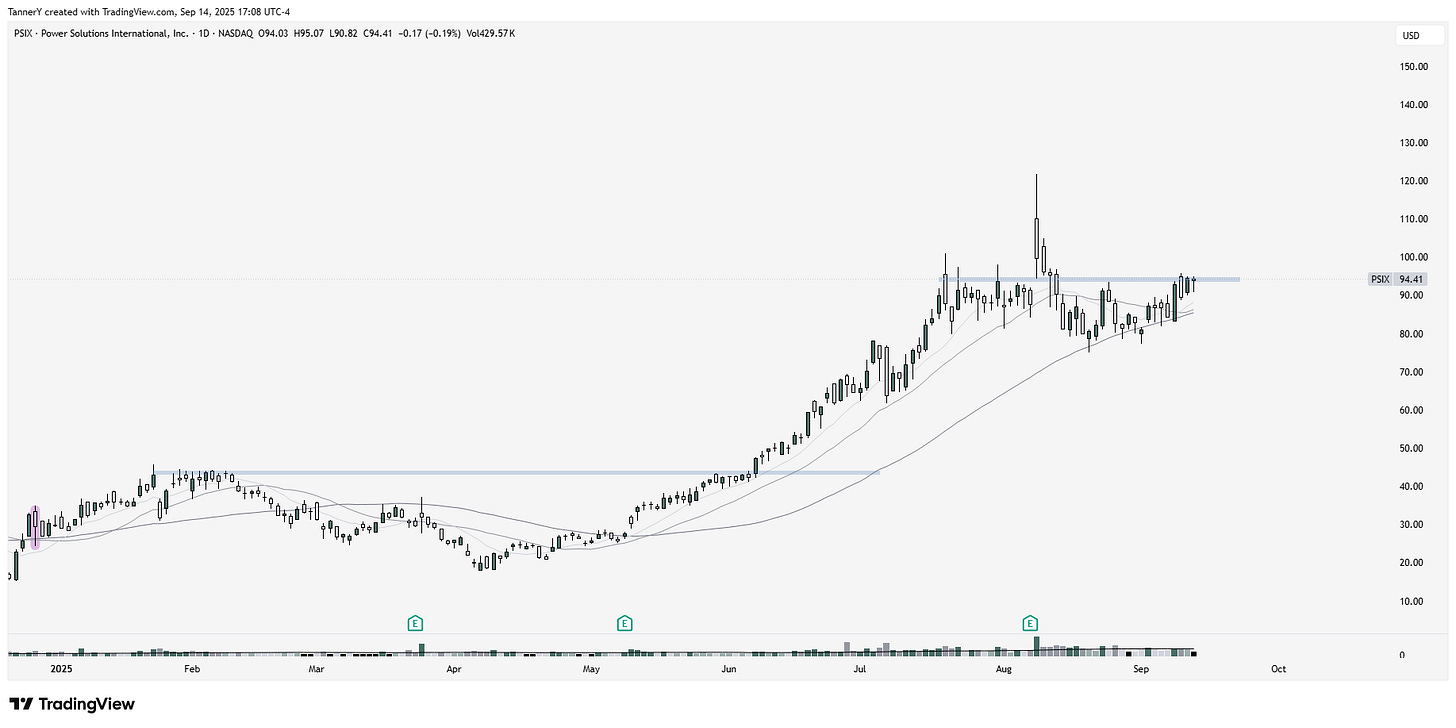

PSIX 0.00%↑ from power systems group, and tangent to datacenters is looking ripe for a move higher after a superb quarterly report in early august. Peers and other notable watches are VRT 0.00%↑ MOD 0.00%↑ TGEN 0.00%↑.

ADBE 0.00%↑ in software tech has been getting a lot of eyes recently, as after this quarter many of their financial metrics are the lowest they’ve ever been, as AI fears mount. Other software names I am focusing on: CDNS 0.00%↑ ORCL 0.00%↑ APP 0.00%↑ NOW 0.00%↑.

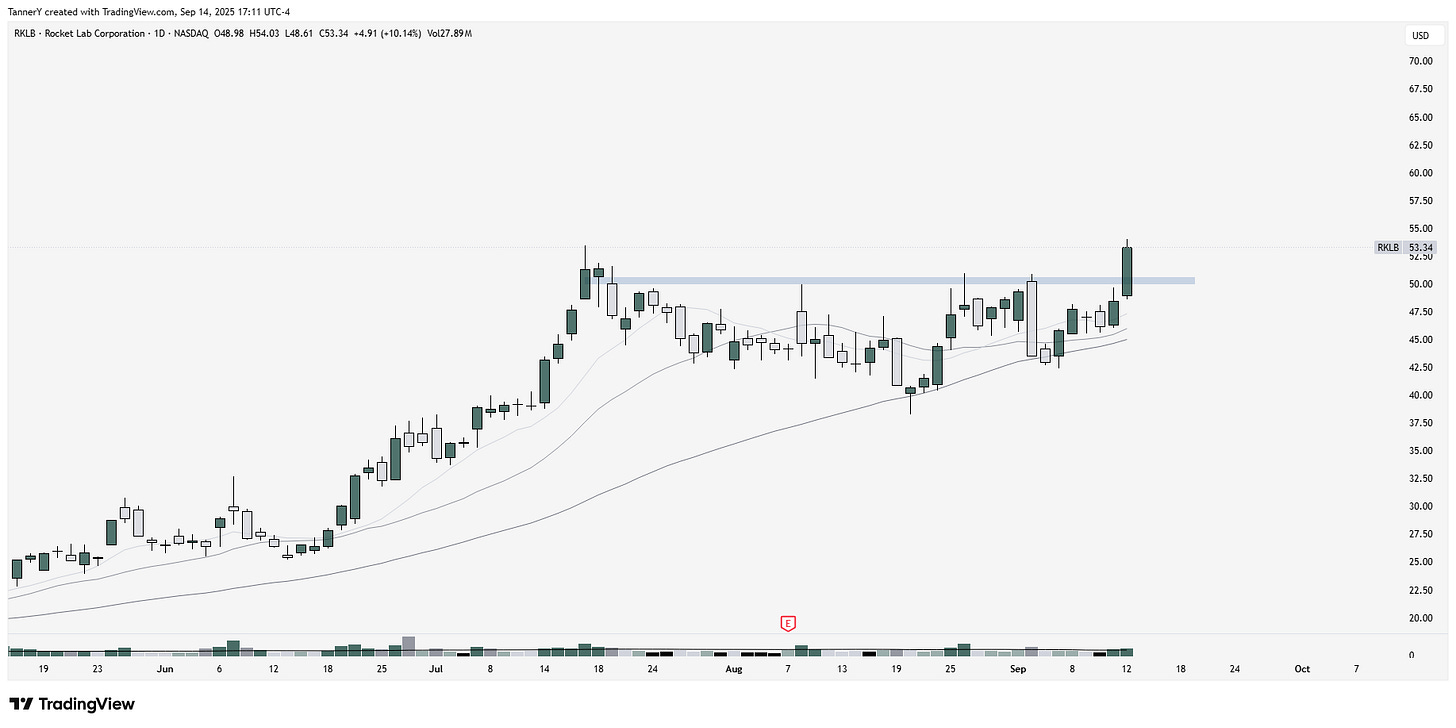

In the space industry, RKLB 0.00%↑ is proving to be quite the… force (ba-dum-tssss). Its peers ASTS SATL and RDW are all performing terribly, which i think speaks volumes to the excitement around RKLB neutron launch.

No charts needed as I think we’ve seen them enough here, but nuclear future tech stocks like OKLO and SMR are setting up, and generation names like VST CEG GEV are all working on a next leg. I am still long these names, and believe in the thesis.

In the datacenters group, CRWV 0.00%↑ is best in class, or rather has the potential to be the best. Note the double bottom around $86 giving us a line in the sand. That, coupled with the potential higher low over the next couple weeks, could make for a great entry. The main peer NBIS 0.00%↑ gapping to highs, looking to continue as well.

That’s all I have for you this week!

Remember to subscribe to support the work, and check out other work below: