Investors,

Welcome back to another iteration of ‘The Weekly Selection’, where I cover my thoughts on the market, what’s upcoming and some other little nuggets for your enjoyment.

Check out the latest Podcast at the link below, as well as some other socials:

Indices

As I run my scans for the week, check indexes, observe breadth and carry out my usual search for news and upcoming events, I find few reasons to be bearish. SPY and other indexes look tremendous, trading above all key SMAs, tucked right below all time highs, and having gone sideways for nearly 4 weeks.

For those who remember, at the April lows I posted this tweet:

Since then, S&P500 stocks above their 50dsma has gone from 11% to 70%, indicating a turnaround in broad strength. While using these gauges are not a perfect science, buying equities when all of them are flashing signs of extreme deterioration has been quite profitable. Personally, I utilized this instance to load up on my favorite themes and stocks whos technical and fundamental positions made them attractive buys.

There was no bull flag or standard setup, just capitulation, broad market flashing the same bottom signs mentioned in the post, and tremendous value on high quality stocks. VST was one that ill quickly touch on for thought process:

VST on April 7th:

Price: $92

Blended P/E: 14.13

Historical Average: 25.03 (43% discount)

Broad market gauges all flashing all time lows

Extreme fear around Trump tariff plans

Domestic energy production unimpacted by tariffs and demand stable

SPY capitulating with sequential gaps and huge volume

Ok so if we take a look at these extremely rudimentary factors about valuation and market environment, VST 0.00%↑ offered a ridiculous value buy on April 7th. Since then, the position is up 72% and grinding higher. I’ve gotten a lot of questions about my less technical style of buys, and this is it. For the chart, take a look below at the technical reasoning:

Ok- back to the work.

GLD 0.00%↑ Gold looks great still headed into next week. Volume is beginning to taper off as spot goes sideways, looking for a punch up with volume to indicate the next leg beginning.

$BTC Bitcoin with an undercut and rally look at the all time highs. Wouldn’t mind this or a longer consolidation.

Looking Ahead

This upcoming week, like many of the last, looks ripe with opportunity. To me, the strength we saw out of HIMS 0.00%↑ and PLTR 0.00%↑ are defining characteristics of a bull market. Those two names have been running extremely hot recently, and both found themselves at an inflection point on Friday, poised to roll over below the 20sma and trend down. However, both made bounces with strength and volume, continuing their monster runs.

APP 0.00%↑ Applovin is my favorite name for next week. Previously a liquid leadership name now looking to reclaim a historic pivot from pre earnings earlier this year. Maybe another few days tight, but I could see this going.

I already own this name, but wouldn’t mind getting oversized in it should it setup a proper cup and handle under highs. With Sam Altman leaving the company it opens the door for them to carry out deals that would have previously been a conflict of interest for him. I’d imagine many of these deals were already in the works before he left, and now that he’s gone the news can flow.

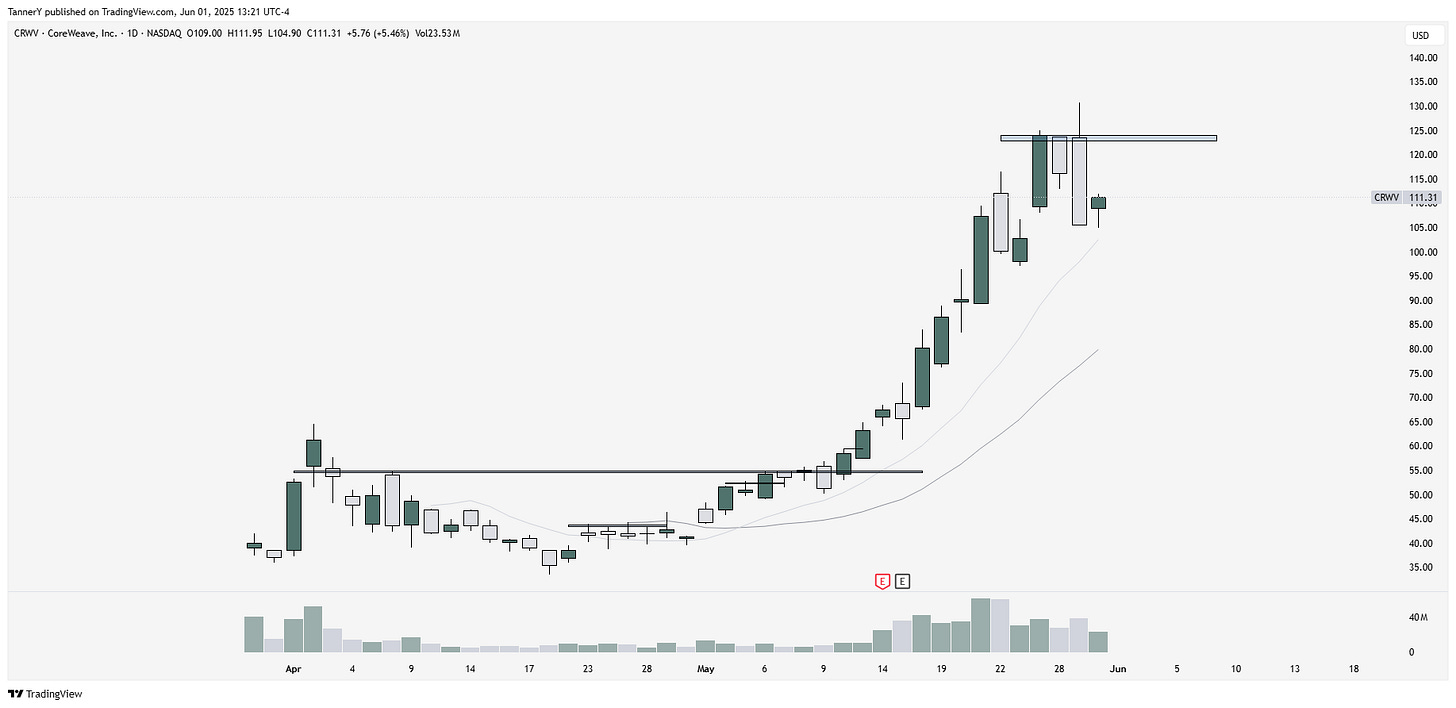

CRWV 0.00%↑ CoreWeave one of the strongest in the market right now. IPO base and breakout very similar to PLTR Spac IPO. Tightest ADR day on Friday since April as well, with relatively average volume for the run. That type of look on a strong uptrend doesn’t come often, and I’ll be watching closely.

RKLB 0.00%↑ snaps back into its 10sma on light volume compared to the prior few days of its uptrend. I already am positioned here, but always looking to accumulate more on a strong uptrend in a good r/r spot like this.

ALAB 0.00%↑ is one I havnt’t traded much but I do like this pivot retest. Big stick of volume as well. Might need another couple days.

I don’t like the solar trade per se, but the leader is here in NXT if it is to go. Great setup.

That’s all for today!

Enjoy the rest of my socials here and be sure to share this post if you enjoyed: