Introduction

Investors,

Before we jump in, I wanted to bring attention to a quick note:

I have turned on paid subscriptions for anyone would like to support my work.

This is not mandatory, and currently doesn’t unlock any premium content, however it shows support to the publication, and myself after 3 great years of writing on Substack.

If you’re a long time reader, know that the Sunday newsletter will always be free, and any pay-walling in the future will be for additional content outside of my normal rotation.

Indices

It feels like I say this every week, but what a week it has been. Earnings, *more* tariff news, further development of the energy trade and crypto booming.

Lets jump in and take a look at the indexes ive been tracking:

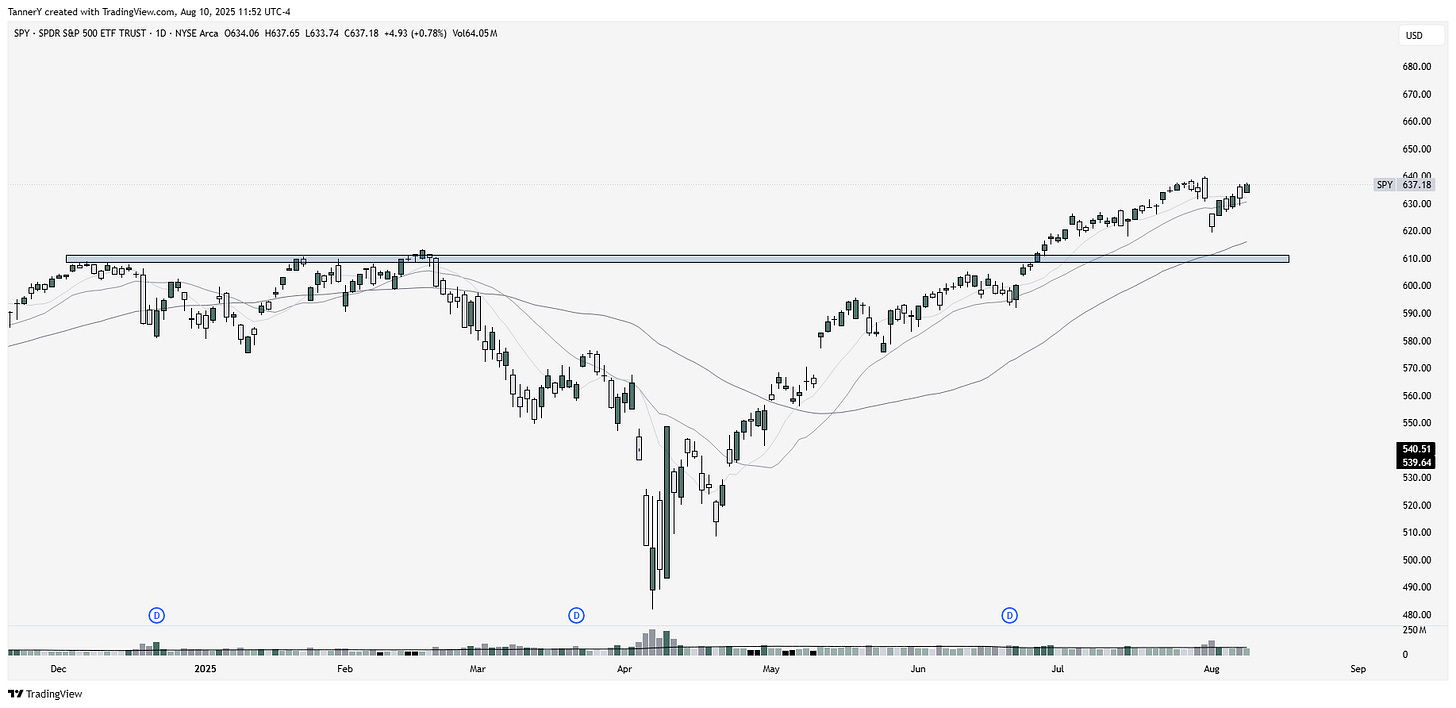

SPY 0.00%↑ up first of course. Not much has changed since my last post here. We reclaimed the 20sma, and are pushing back to highs. Tech focused index QQQ has reclaimed highs, indicating that tech equities are leading the charge, not financials, energy, industrials ect. This checks out, as there is clearly a lot of speculation this earnings season around the premier AI players.

Taking a look at the rest of the sectors, Its apparent that there is still some work that needs to be done. Many of them are under their 10/20sma, signifying some underlying weakness. That being said, the majority of the top holdings are tech or closely related, so even if the smaller components do not cooperate in the short term, it shouldn’t spell danger.

For those unclear on my thought process this year:

Trump shakes the tree, expect volatility, with a generally strong uptrend as he does not like to see a down market

Three key themes: Deportation, Space, Energy (electric utilities)

Dips are opportunities, and everyone should be taken advantage of

AI is here to stay

Find entries in what you want, don’t wait for “perfect” setups, you wont get them on the best names.

This thought process has kept me in a position of heavily outperforming the market, as well as mentally level header through the turbulence.

Lets take a look below at the opportunities moving forward.

Upcoming Opportunities

Its become very apparent that this market is rewarding strong EPS growth and guidance raises. By now we are three years out from the AI revolution beginning, and it is becoming clear which companies are putting it to good use, and which ones are just using it for headlines and earnings call appeasement.

Below is a list of the top performers this earnings season:

NBIS RDDT ALAB CLS BWXT APP ANET SHOP KTOS SOUN WWW PSIX MOD

I have not had a chance to go through every report in the list above, however the ones I did go through, PSIX, APP, MOD, and KTOS are all repeated names from this newsletter, and their performance was more expected than the rest.

In fact, APP is probably the one to keep the closest eye on, as it had absolute blowout earnings, reporting truly absurd growth in both the top and bottom lines. Spectacular, I am long.

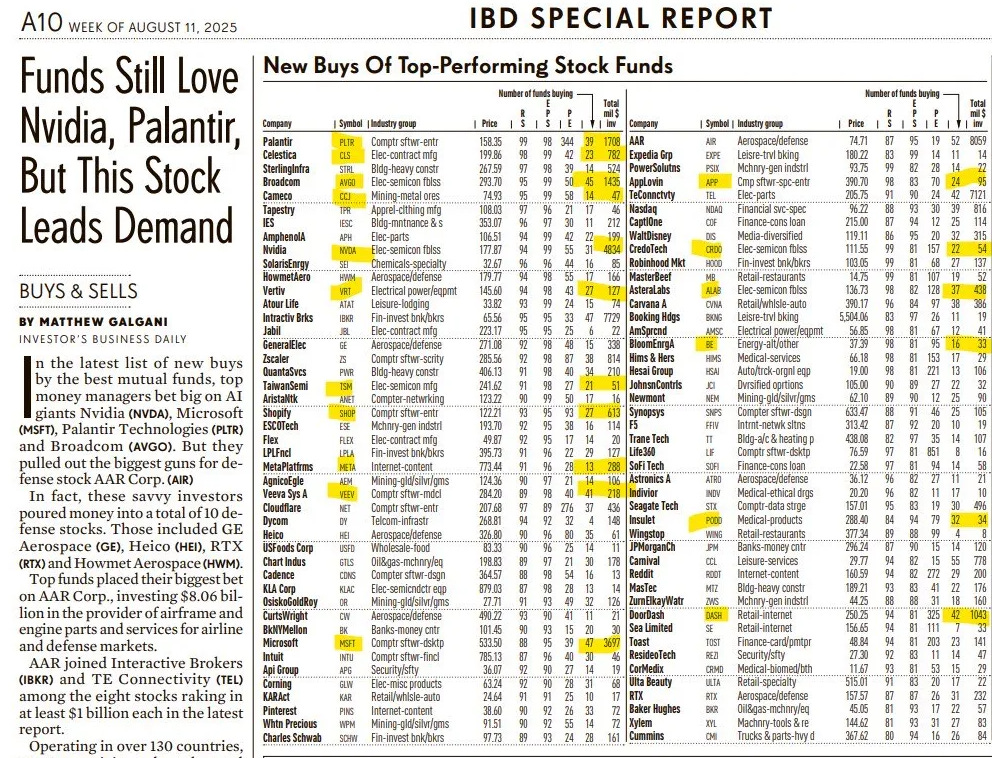

Looking forward, I will continue to pay attention to the reports of companies I track, as well as look for any new opportunities that are popping off my radar. In addition to earnings season trades, I will also be paying attention to this list here:

This is a list of all the biggest buys from funds this last quarter. While this list isnt gospel, it is a really strong glimpse into what type of thing is being bought up by institutions. There is of course a bit of lag to this, as the data is not released live, but again, big institutions don’t generally trade stocks, so its fair to assume that if one is getting lit up, its for a good long run, not a week long pump.

I wanted to bring some attention to OKLO and SMR quickly. These 2 names are trading over 10 billion in market cap, with no products or sales, and at least a 2 year runway before they are up and operational. As ive stated before, these are the most speculative of the group, and I am the least attached to them. If the government does not provide funding soon, I will likely offload these positions and then just trade them as they garner momentum, not as a piece of the core nuclear thesis, as I have been.

Well that’s all for this week folks. Expect a new podcast episode this upcoming week, and maybe a fun piece of trading advice in a long form writeup. Again, if you enjoy this work and feel it warrants a donation, feel free to do so.