Investors,

Welcome back to another iteration of ‘The Weekly Selection’, where I cover my thoughts on the market, what’s upcoming and some other little nuggets for your enjoyment.

Check out the latest Podcast at the link below, as well as some other socials:

Indices

SPY 0.00%↑ continued its rally last week, adding another 5% from Monday open. After retesting the 2021 ATH earlier this month, a rally seemed probable and many of the individuals I respect in this space agreed. Sure enough, we now find ourselves 14% off the lows. Whether or not this continues is to be seen, with a menagerie of factors contributing to the direction from here.

I’ve noticed more individuals applying gauges, indicators, and efforts to measure the past to predict the future recently, and I think there’s a clear misconception here worth noting.

If the gauges you are using are attempting to make a prediction based on “lowest reading ever in xx days/months/years” its important to go back in history and actually see the back-tested data and whether or not there was correlation. I find a tremendous amount of technical traders to fall into this trap, making note of specific SMA tests, reclaims, and crosses as a means to adjudicate their thesis when no actual data exists.

A good example of this is the 50SMA on SPY. Since the beginning of this rally in 2023, we’ve had very minimal respect of this SMA. However, claims that a “reclaim” will be pivotal for price are thrown around expeditiously. Instead, I find it better to be carrying out level work through this downturn as it has more merit on price.

Enough rant, here’s the chart:

Note the 2021 retest, and 50sma with 0 respect for the last year.

GLD 0.00%↑ Gold has acted as out uncertainty trade for a couple years now, with acceleration recently as investors question whether or not this administration has a handle on the foreign relationship situation. Over the last couple weeks, the uncertainty has ramped as long term impacts set and price in.

I almost never draw an up trending line like this, but I think it does a good job to show some acceleration in price, tied to this unease. It was a strong trend to begin with, and now we have broken even higher.

XLP 0.00%↑ staples have also held up well in this tape, furthering the thesis that uncertainty is in out midst. Names like COST 0.00%↑ have remained RS to the market, putting in a double bottom where SPY made a significantly lower low.

Upcoming Themes

The nice thing about a market like this is we get a really pure look into what is *actually* doing well. Names like PLTR COST CRWD TMDX HOOD, although diverse have had premium price action in comparison the market.

Noting their relationships to the newsfeed and identifying why we may be seeing these trends will allow future positioning to be much easier in the top names. Have a look below at some of these names, some of which I may own.

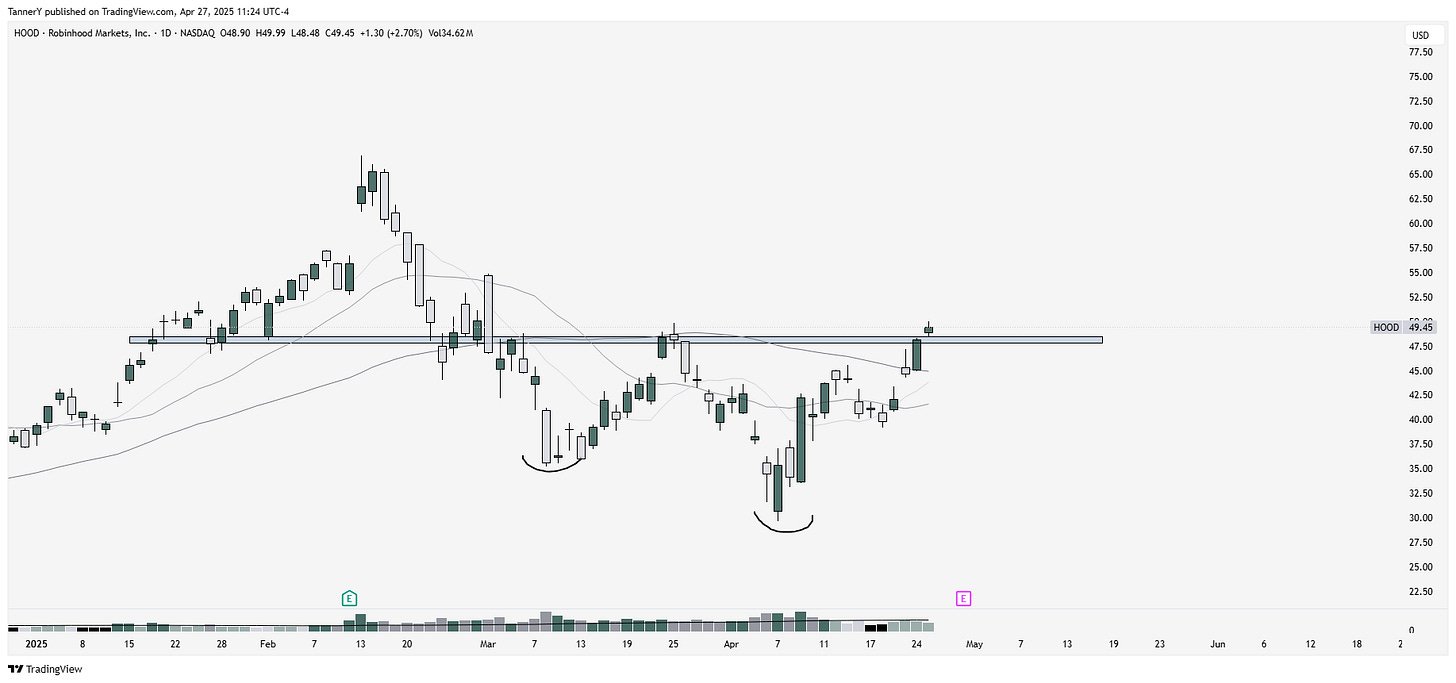

HOOD 0.00%↑ first here. Many believe this company to be the future of banking/investing as the younger generations grow up trying to manage their own money before going to an advisory firm. I think this is a plausible thesis, and its holding up well versus the market.

CRWD 0.00%↑ one of the strongest in the market right now, nestling up towards its all time highs. Hilarious to think after the outage last year people thought the business would struggle moving forward. From industry professionals I speak to, CRWD has the best product, and an outage is not capable of forcing users to switch to lesser respected products.

PLTR 0.00%↑ extremely notable as well. In fact, this name made a near perfect reflection to COST 0.00%↑ last April, seen HERE.

GEV 0.00%↑ in electric utilities looks phenomenal, clearly leading the group with VST 0.00%↑ second.

EAT 0.00%↑ has earnings soon but still looks tremendous.

So there you have it. Cyber, Electricity, Gold, Food, and AI data analytics. Its not always clear what will lead, but we have to see the notables and do with them what we can.

Thats all for this week! Peep the rest of my socials below: