Introduction

Investors,

Before we jump in, I wanted to bring attention to a quick note:

I have turned on paid subscriptions for anyone would like to support my work.

This is not mandatory, and is essentially a donation at this stage, however it shows support to the publication, and myself after 3 great years of writing on Substack.

If you’re a long time reader, know that the Sunday newsletter will always be free, and any pay-walling in the future will be for additional content outside of my normal rotation.

Indices

Welcome back to another week in the market. Last weeks short session was quite a ride, gapping down, pushing to highs, and ultimately finishing at the top of the range from the past few weeks. This type of action is good as large caps digest the recent gains, but man does it make it tough to trade around in a primarily tech based portfolio.

I know personally this last week has been the toughest of the bunch, with my portfolio sliding off highs quite substantially as I struggle to position in new names, and my power portfolio takes on water with the theme cooling off amidst concerns of being left high and dry by POTUS. While I do still think funding is coming for the electricity power demand group, timing is everything. Over the spring and winter we saw so many deals roll across the desk with major players taking stakes in electricity providers to secure power for their datacenters, that a POTUS funding package during the summer would have been par for the course. This has not yet come, and I think that’s causing some cold feet in the rank and file.

SPY 0.00%↑ look above: Note the consistency of the basing and breakouts along this uptrend. As long as that continues, and we don’t see any disconnect from the linear trend, I think its very possible that this continues for quite some time, especially if new sectors emerge to carry the torch for the index.

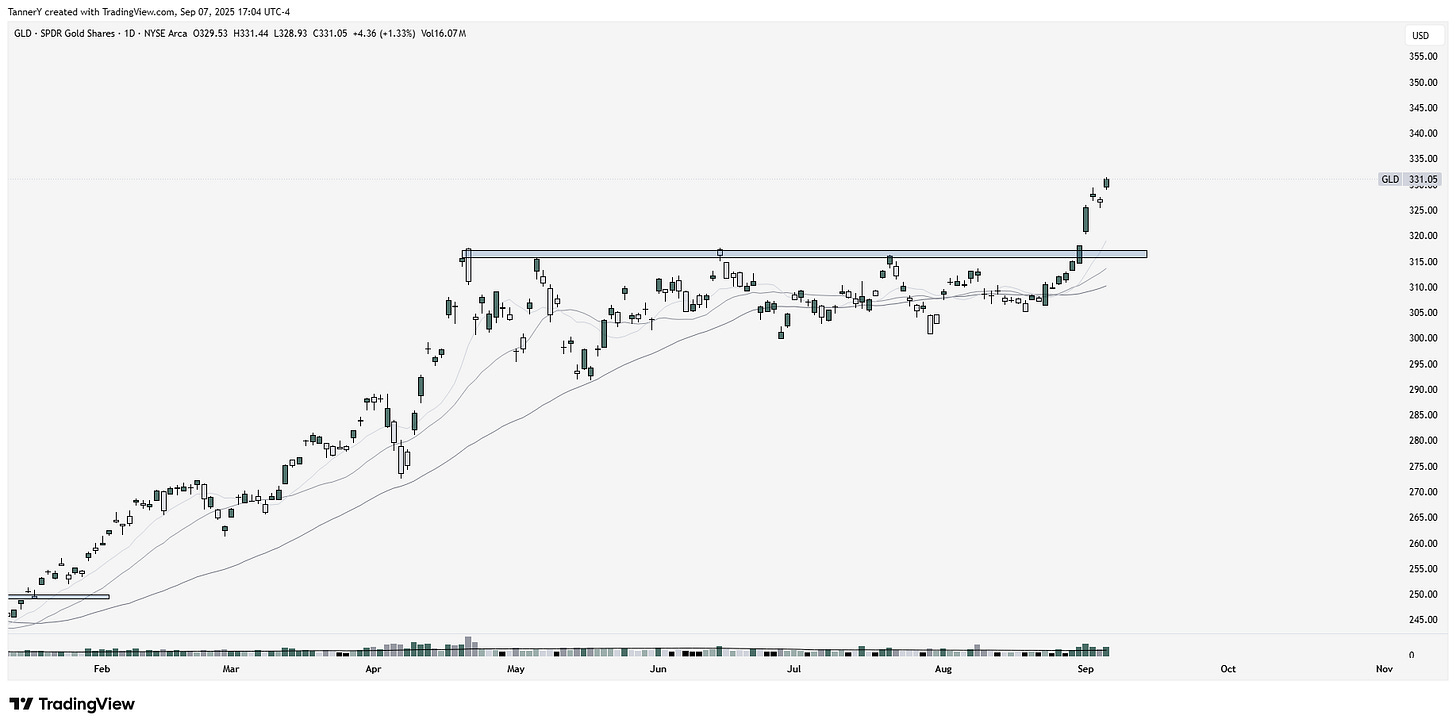

Published GLD 0.00%↑ last week, what a breakout! Definitely one of my favorite vehicles to trade, especially with a little bit of leverage and calendar strategy.

As for sector updates, I’m really waiting on XLI to make its move that I think will come as AI application comes to manufacturing. In addition to this, I think the canary in the coal mine is oil and gas. Keeping an eye there to make sure that that theme doesn’t break out too soon.

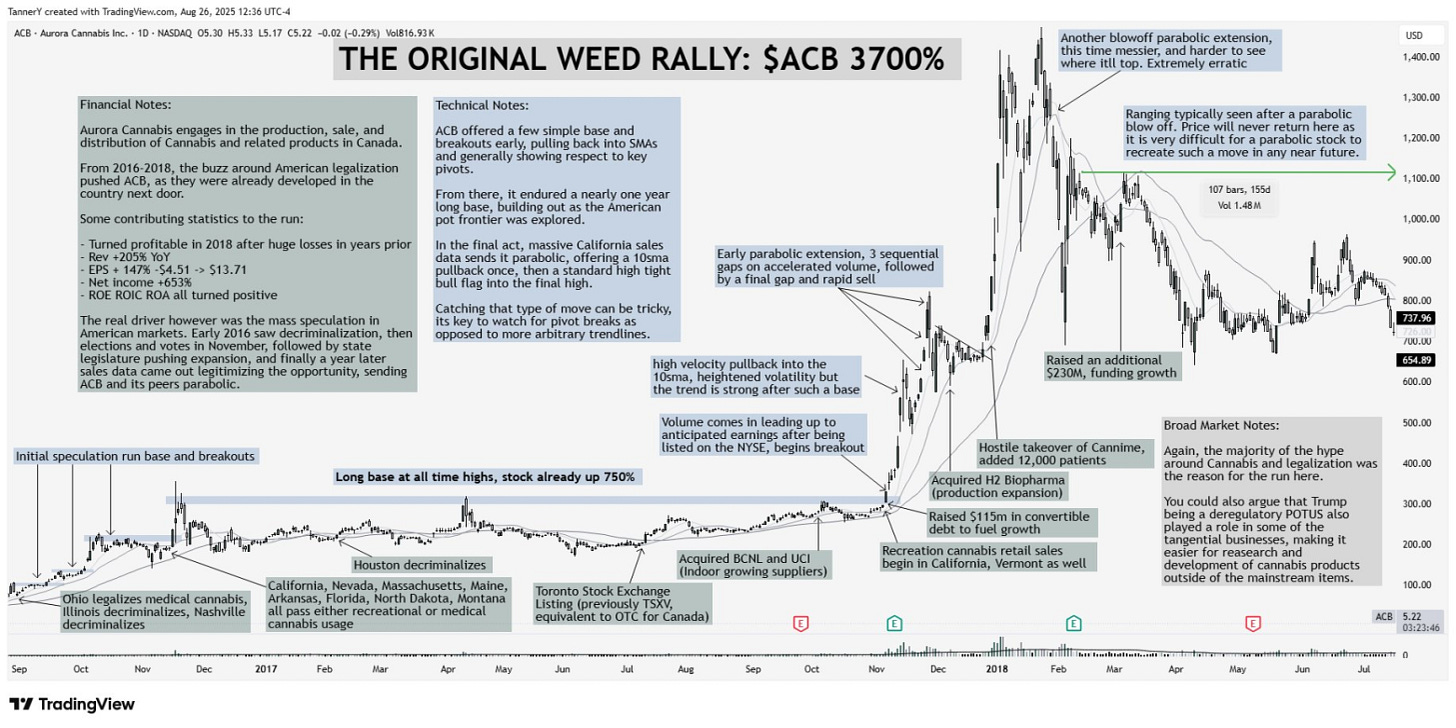

Parabolic Trend Analysis

This weeks analysis is on ACB 0.00%↑, what many consider to be one of the greatest runs of all time, as well as the first time weed stocks really ran hard for any period of time.

For those who pay a lot of attention to the news, weed legislation has come back into the conversation recently, with Trump flipping the script on expectations and looking to reschedule marijuana. Names to watch are ACB 0.00%↑TLRY 0.00%↑ MSOS 0.00%↑

*If you enjoy these writeups, consider subscribing, as they take a considerable amount of time to complete.*

Upcoming Opportunity

The immediate leadership names I see these last few weeks are NAIL 0.00%↑ (homebuilders), Gold (GLD), CLS 0.00%↑ and CLS 0.00%↑.

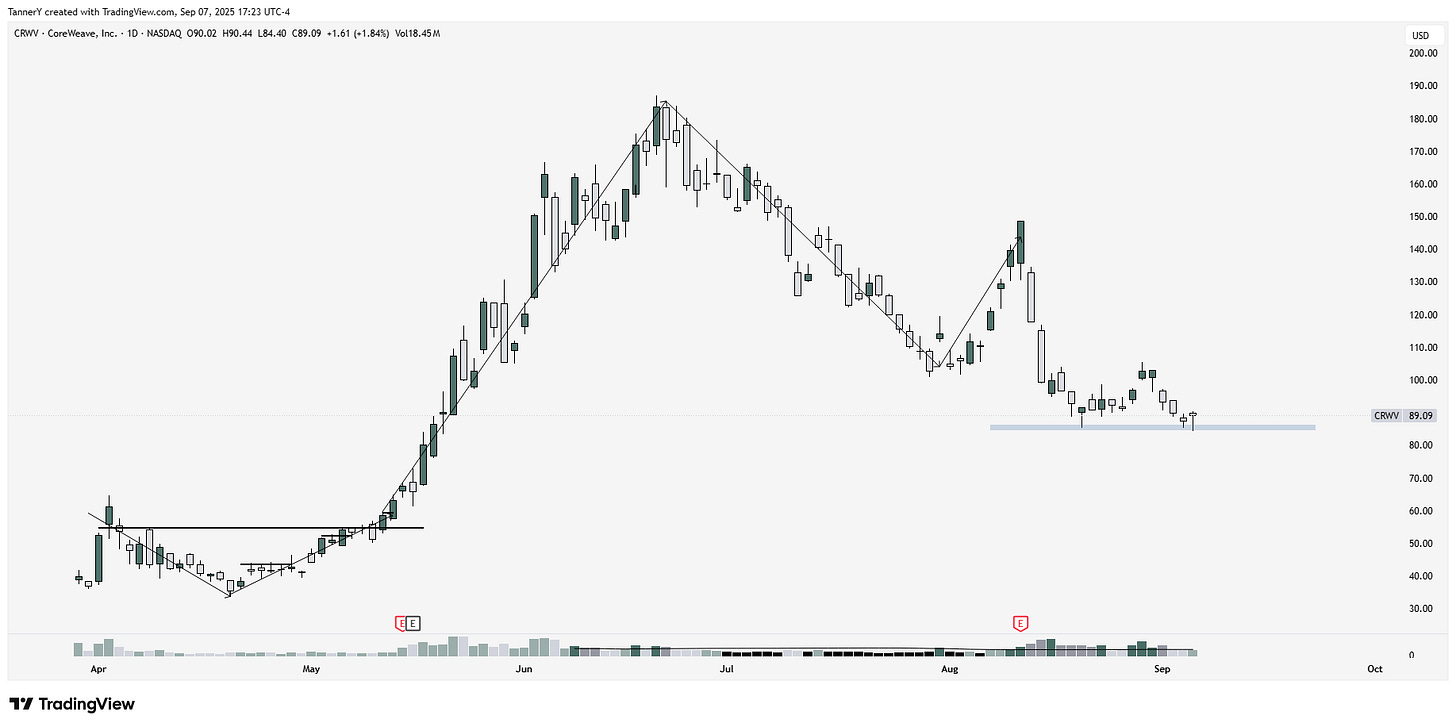

IPOs are getting smoked: CRWV 0.00%↑ CRCL 0.00%↑ FIG 0.00%↑ FLY 0.00%↑ HNGE 0.00%↑

CRWV 0.00%↑ above, I think this name closes the year above $100, double bottom put in here around $86, decent potential.

Of the notable leaders since April, CLS 0.00%↑ is holding the best. HOOD PLTR GEV are all lagging in some capacity.

APP 0.00%↑ has been underappreciated on most channels for some time. This is a common name on this publication, and I think its for good reason. Strong grower, pushing highs now after being added to the SP500. Should get some volatility this week.

PSIX 0.00%↑ is a lesser known name in the electrical equipment space, flagging out nicely and looking to curl upwards soon after blowout earnings. Despite being sold off, this is still one of my favorite looks.

RDDT 0.00%↑ starting its hook higher, strong name, no reason not to try this one for me personally.

They of course made it difficult for RKLB 0.00%↑ to breakout. In seriousness, RKLB not going earlier this week was a major blow to the portfolio, sliding more than 10% in a single session, blowing past my stop loss from weeks prior.

That’s all I have for you this week!

If you enjoyed: CHECK OUT ANOTHER ARTICLE