Investors,

Welcome back to another iteration of ‘The Weekly Selection’, where I cover my thoughts on the market, what’s upcoming and some other little nuggets for your enjoyment.

Before we begin, I’d like to note the importance of next weeks newsletter. Its a big one, and it will be packed full of announcements and information. I highly suggest tuning in.

SOCIALS

Subscribe to the newsletter!

Indices

As we head into the close of the year, markets remain strong. Sentiment on the street and media side has certainly shifted, but until a fundamental shift in the market, or a macroeconomic pivot occurs, I have not seen a reason to fret, or stop my market action plan.

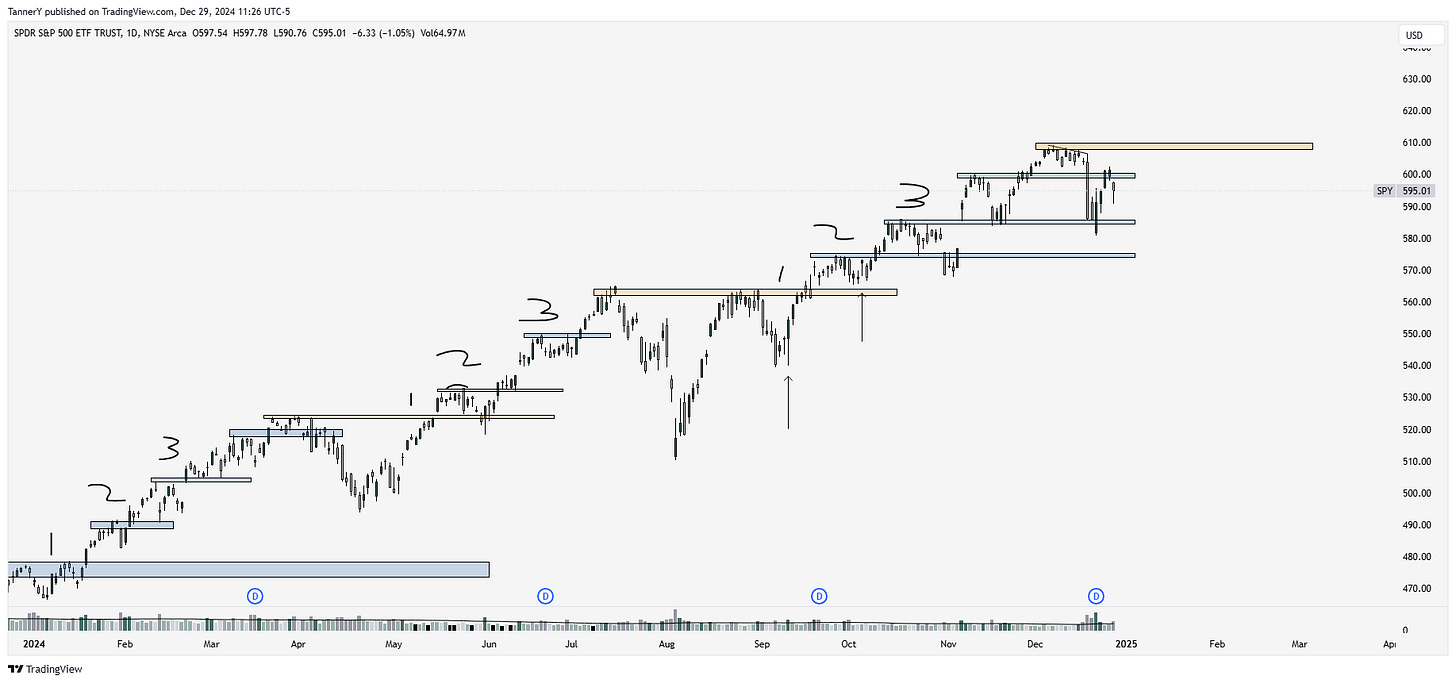

SPY 0.00%↑ Looking solid, between pivot two and three of this most recent run. If we look back to the beginning of this year, the action remains within the linear path of the uptrend.

RSP 0.00%↑ has certainly taken a larger beating than most, however just one month ago the equal weight index was outperforming heavily, suggestion a rotating market, which again, is healthy until proven otherwise.

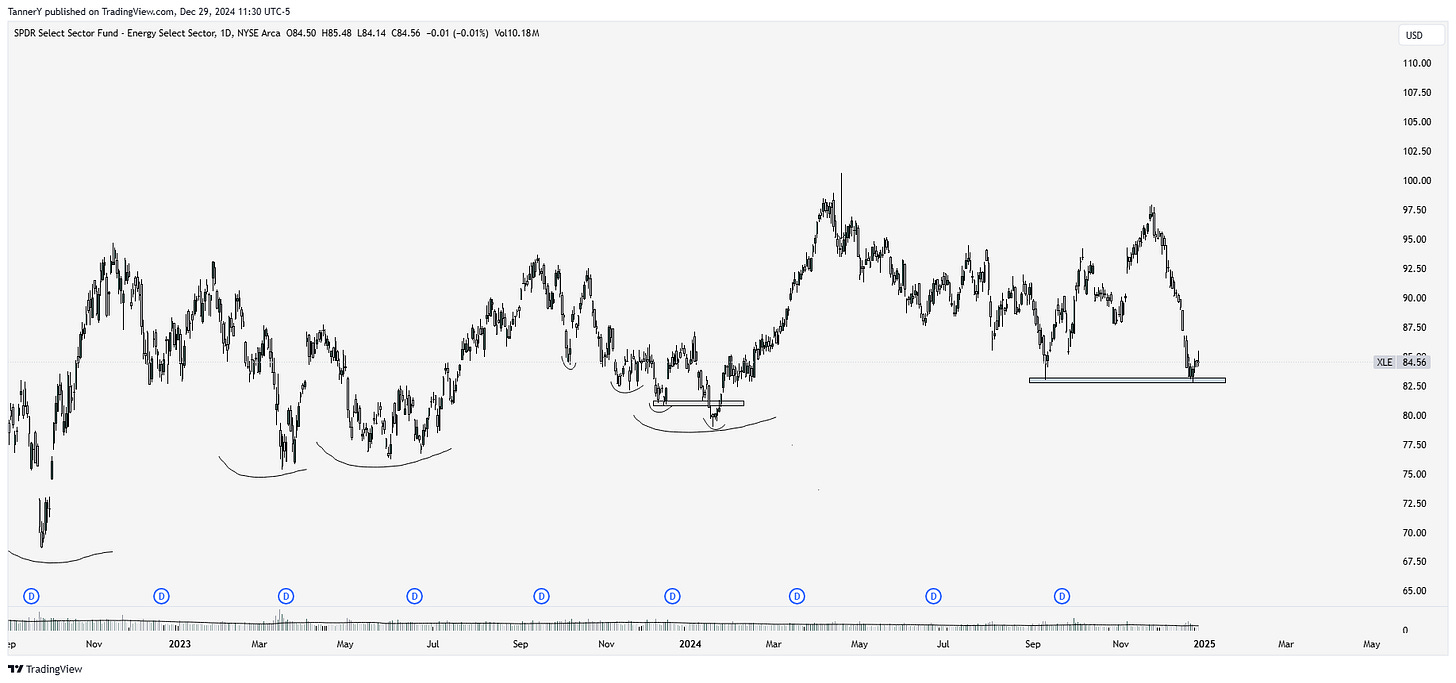

XLE 0.00%↑ energy getting sold off much heavier than everything else, and I think an uptick in these names seems probable around the double bottom price. From a macro perspective, this trade has not materialized yet, as I do not foresee any additional headwinds that could drive prices, and this theme.

Parabolic Trend Analysis

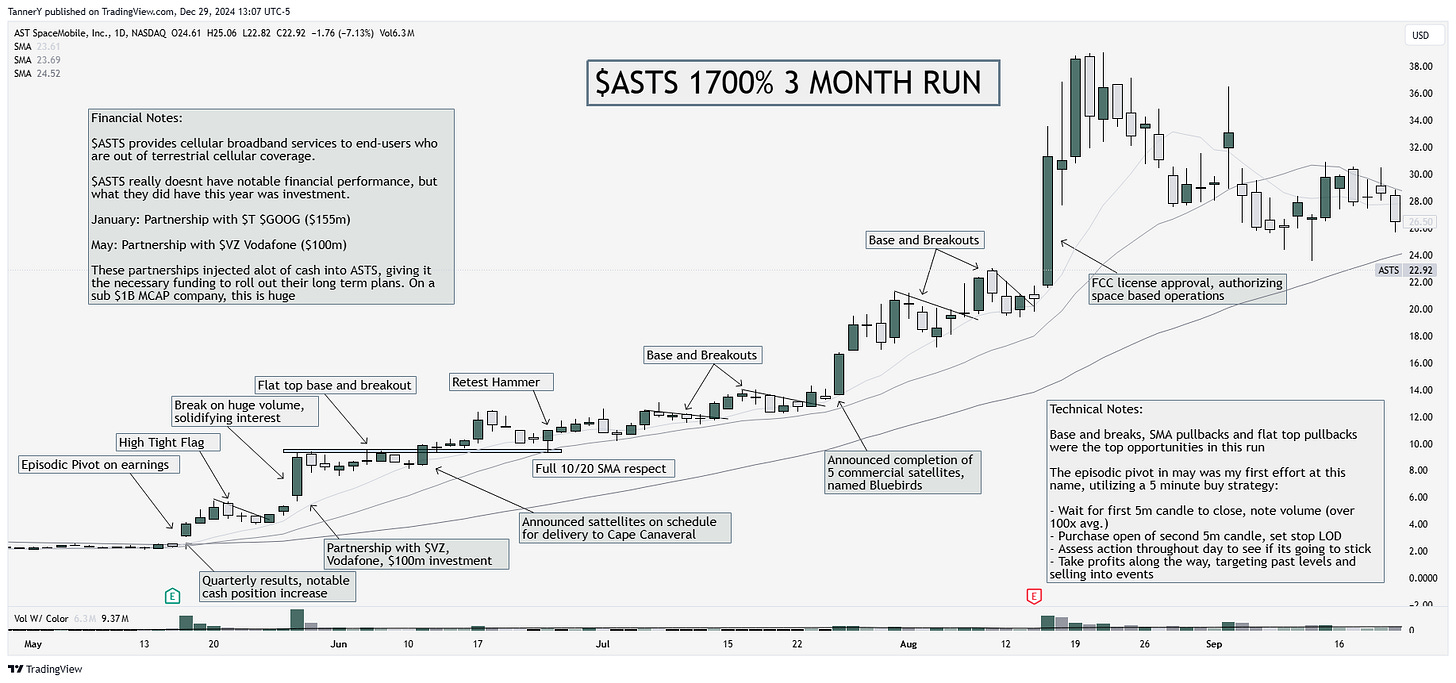

ASTS 0.00%↑ Really doesn’t have much financial success to back its run, but where it lacks on the income statement it makes up in the balance sheet. In the last year, ASTS 0.00%↑ has received over $350 million in funding, from major players in communications, including Google, Vodafone, and AT&T. with a market cap of $500 million in may, these key injections were equivalent to over 70% of the value of the company in convertible debt and cash investments.

In my study of these parabolic movers, the ones that get stimulus from the government, or large exterior investment move the furthest, the fastest. I always assume when a business gets more than 20% of its market cap in investment, especially from key players the stock is going to be significantly impacted.

*This portion of the newsletter takes considerable time in researching the stocks and why they ran. If you enjoyed, consider liking this post and sharing with a friend.*

Upcoming Themes

As we head into 2025, I think there is a new theme emerging outside of the usual suspects for the last few months. Energy, and specifically in equipment and exploration stocks is that idea. After a fruitful 2021 and 22 for the group, 23 and 24 have been dormant. With that said, many of the names are starting to pick up steam, and there could be a rotation if the broad market wants to cool further as valuations get stretched.

Lets dive in:

OIL AND GAS E&P: EQT 0.00%↑ AR 0.00%↑ EXE 0.00%↑

AR 0.00%↑ noted here, top performer in the group, EQT very similar look.

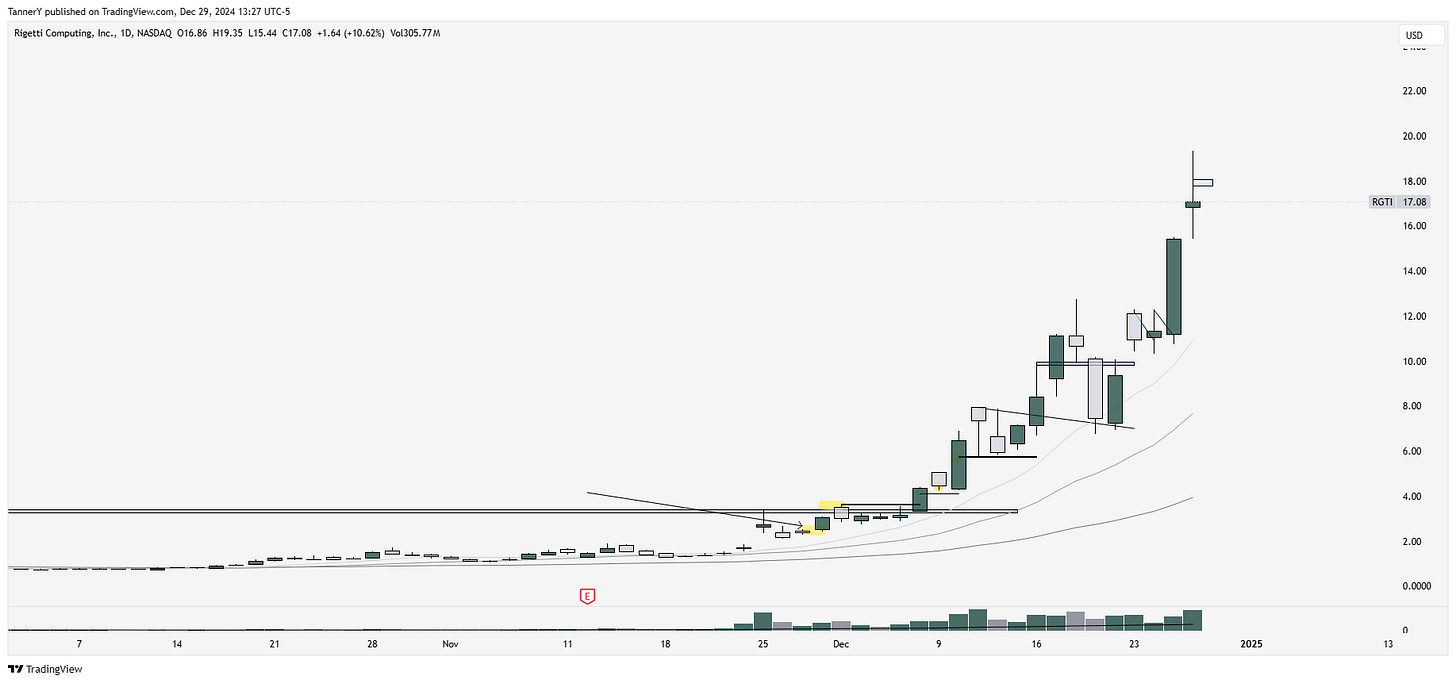

QUANTUM: QUBT 0.00%↑ IONQ 0.00%↑ QBTS 0.00%↑ RGTI 0.00%↑

RGTI 0.00%↑ displayed here, as we can see the run has gone parabolic, and now putting in a doji, generally indicative of an exhaustion top. We will see.

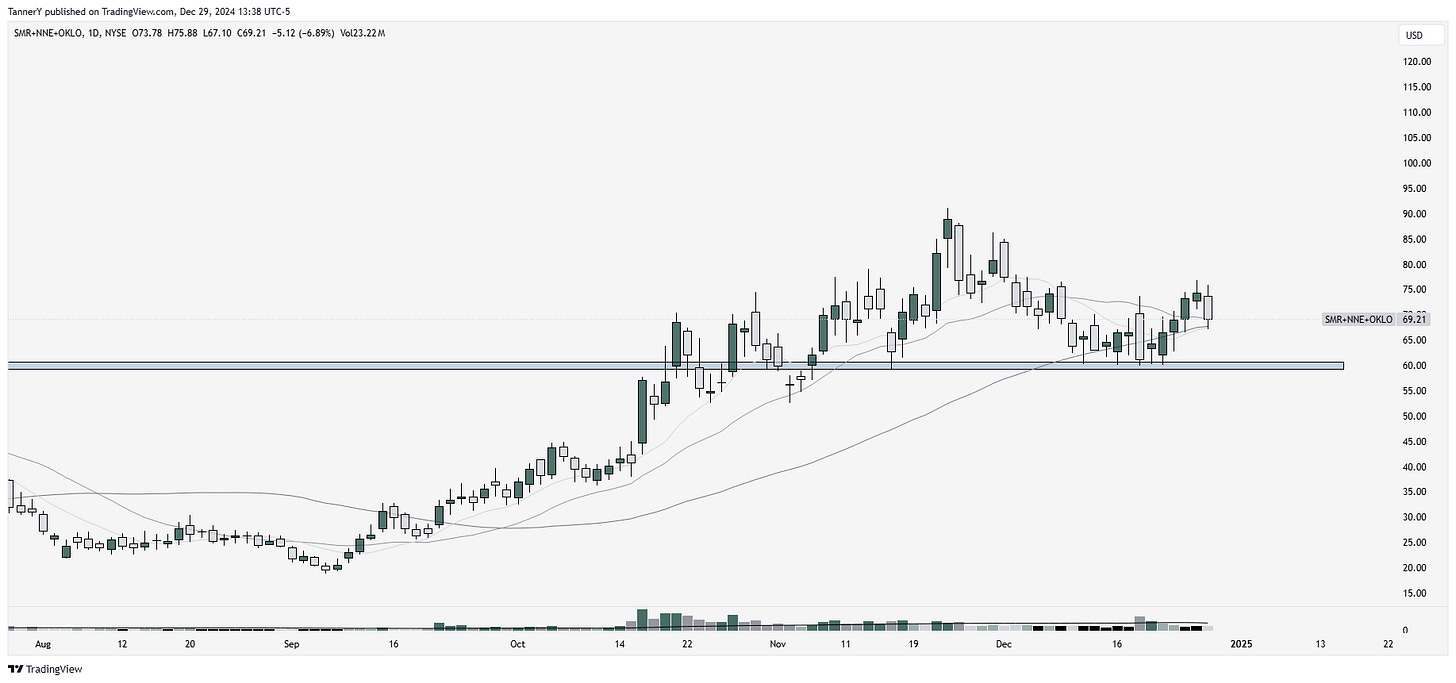

NUCLEAR AND POWER: SMR 0.00%↑ OKLO 0.00%↑ LEU 0.00%↑ VST 0.00%↑ POWL 0.00%↑ NNE 0.00%↑

Composite look at some of these names. The structure is solid, but in my opinion needs news or stimulus to make another leg.

PERSONAL DEFENSE/DEPORTATION: BYRN 0.00%↑ AXON 0.00%↑ OSIS 0.00%↑ GEO 0.00%↑

BYRN 0.00%↑ has been on quite a run recently as a leader in the group. I would like to see this set up while peers catch up. This trade is based around body cams, surveillance devices, non lethal personal defense and jails.

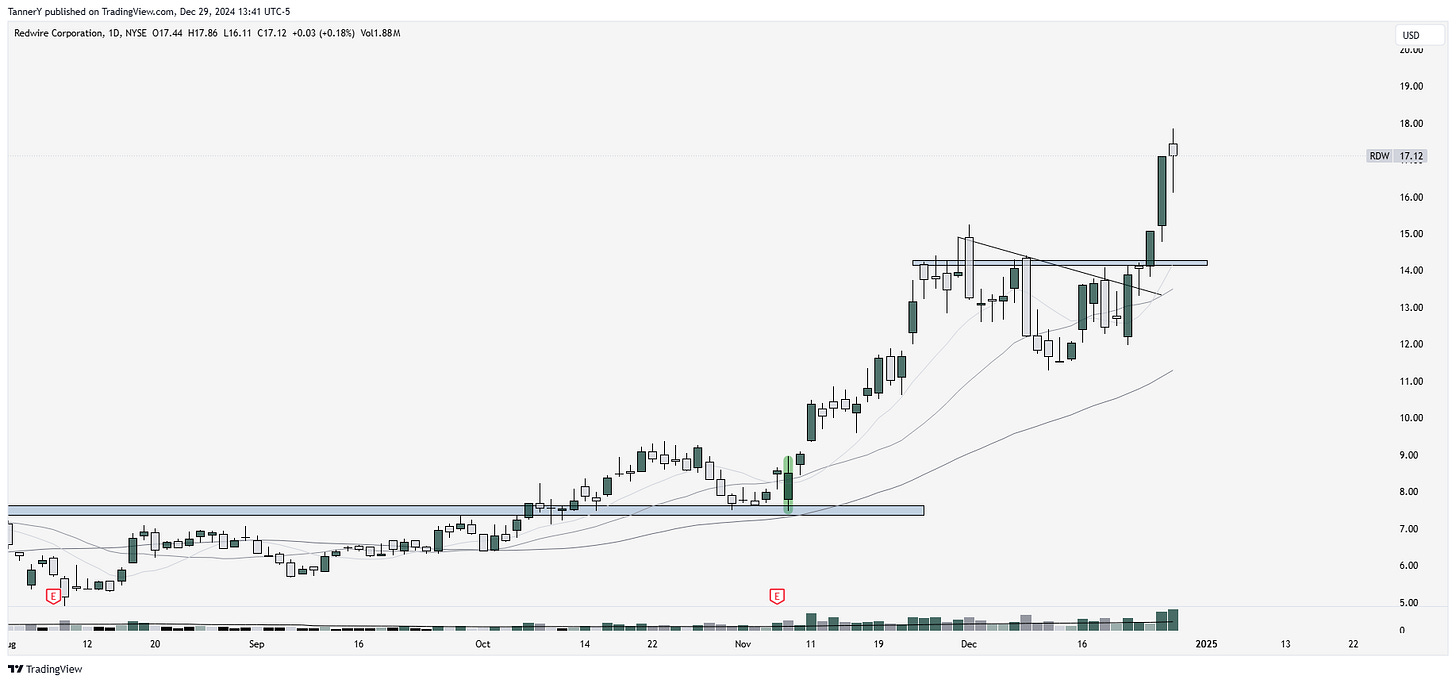

SPACE: RDW 0.00%↑ ASTS 0.00%↑ RKLB 0.00%↑

RDW 0.00%↑ was discussed last week as a top watch, and I was able to pin an entry on it this week. The theme looks great and in tact, with RKLB 0.00%↑ really shaping up nicely.

SEMIS: NVDA 0.00%↑ TSM 0.00%↑ AMD 0.00%↑ ASML 0.00%↑

Quite a pivotal spot for $NVDA. Personally I think this is displaying many of the topping signals that past parabolic trends have displayed towards the end of their runs. We will see how this unfolds.

That’s all for this week. If you enjoyed, consider reading another article HERE

Don’t forget to like this post, and share with a friend!

See you next week.