Investors,

Welcome back to another iteration of ‘The Weekly Selection’, where I cover my thoughts on the market, what’s upcoming and some other little nuggets for your enjoyment.

Before we begin, get active on the rest of my socials:

SOCIALS

Subscribe to the newsletter!

Indices:

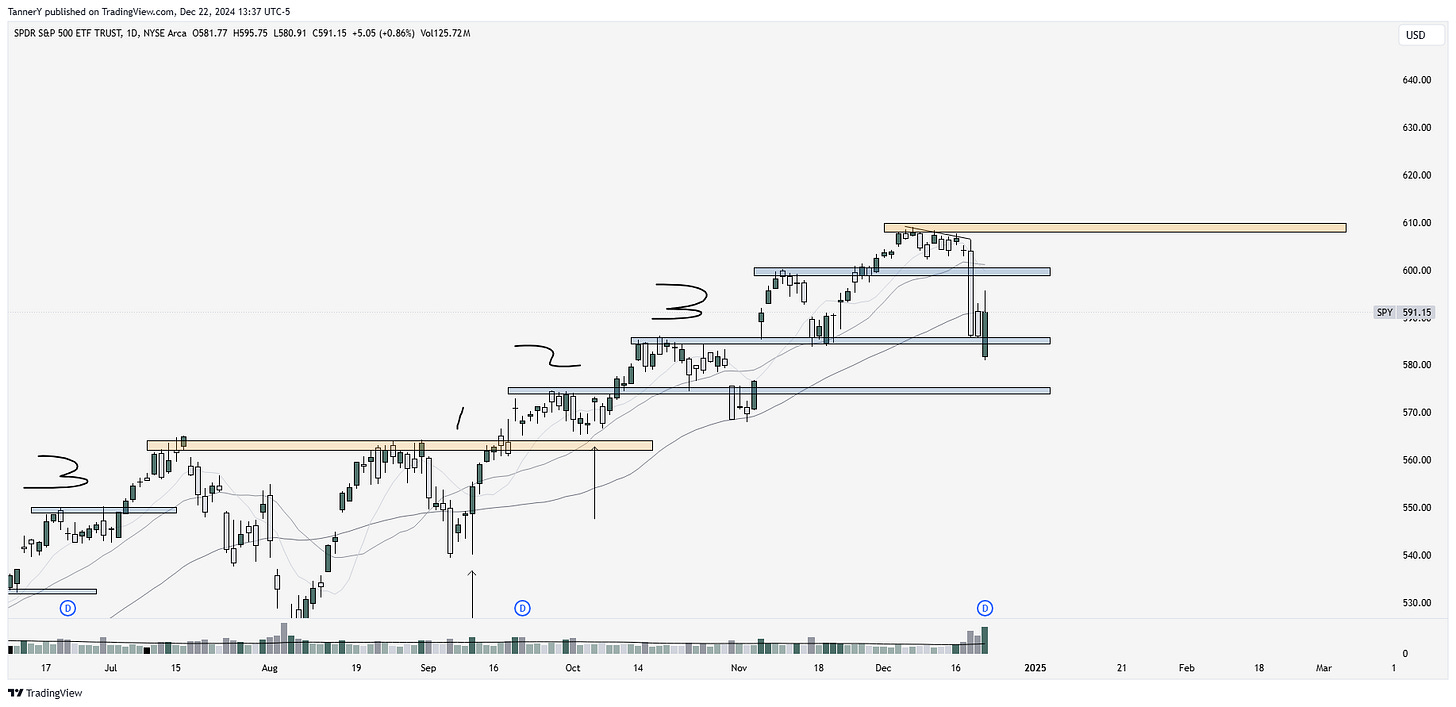

Last week saw notable volatility across the market. Hawkish comments from the federal reserve instilled fear in the markets, and I think the strength of this run was truly tested for the first time in a number of months.

Furthermore, I think this weeks low marks a spot that we need to keep an eye on moving forward as a "higher low”. In past newsletters I have been adamant about the 3 pivots away from primary break, and how important it is to pullback into the previous, which we did.

anyway, lets get into the work for this week:

Reiterating SPY 0.00%↑, putting in this high volume higher low. Exhaustion is displayed with huge volume, which we see here.

RSP 0.00%↑ exhausts and puts in an undercut and rally below a historical support. Ideally we see this make a considerable relief bounce followed by an additional higher low to set the motion moving forward.

XLK 0.00%↑ tech ETF holding up better than expected. Shows strength in the bigger marketcap names.

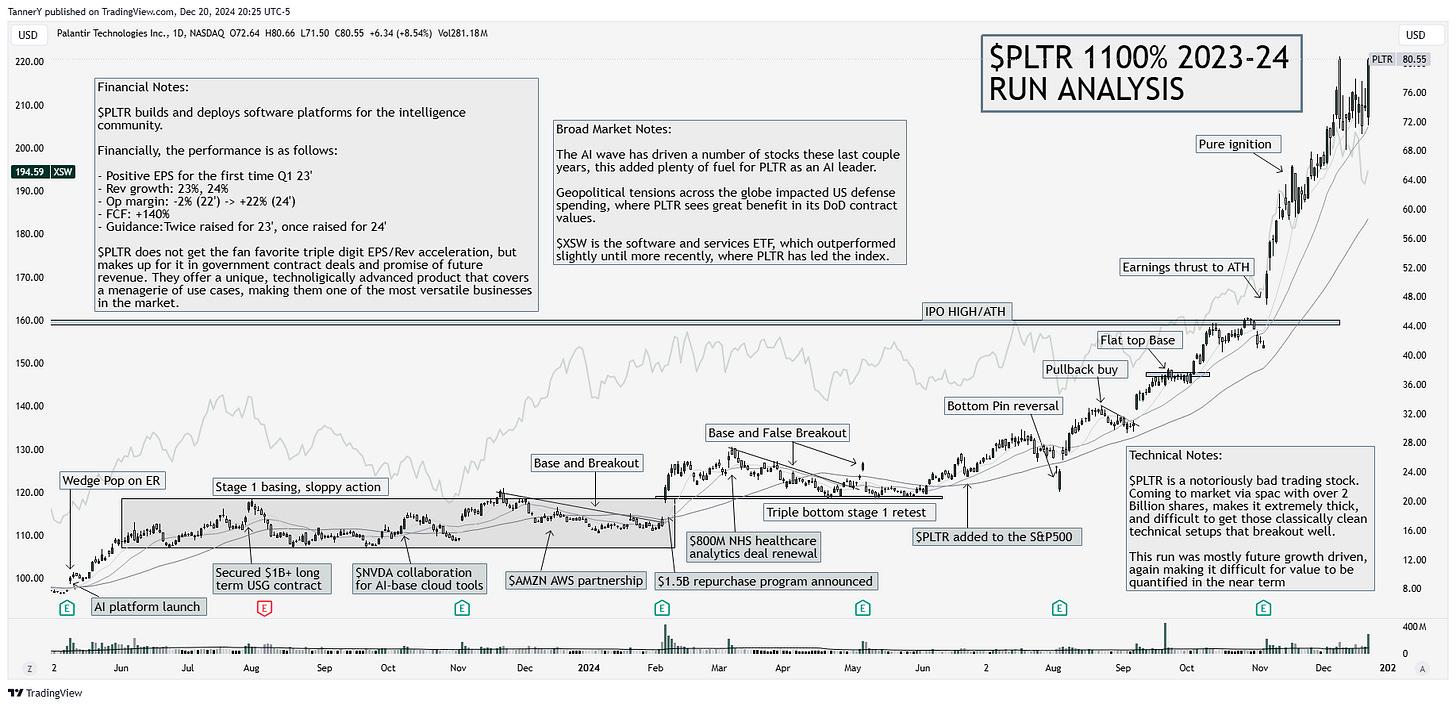

Parabolic Trend Analysis

Palantir has opened its sails to the the many tailwinds of the market over the last few years. While its not quite a financial monster, Palantir enjoys a strong technological moat, proximity to funding through the government, and multifaceted applications of its software.

DoD Awarded Contracts:

2021 - $398.9M

2022 - $556.2M +39%

2023 - $516.7M (7.10%)

2024 - $678.3M 31.28%

As we can observe, a serious turn around in DoD awarded contracts from 23-24 has alleviated investor concerns, and driven confidence in their position in the military industrial complex.

*This portion of the newsletter takes considerable time in researching the stocks and why they ran. If you enjoyed, consider liking this post and sharing with a friend.*

Upcoming Themes

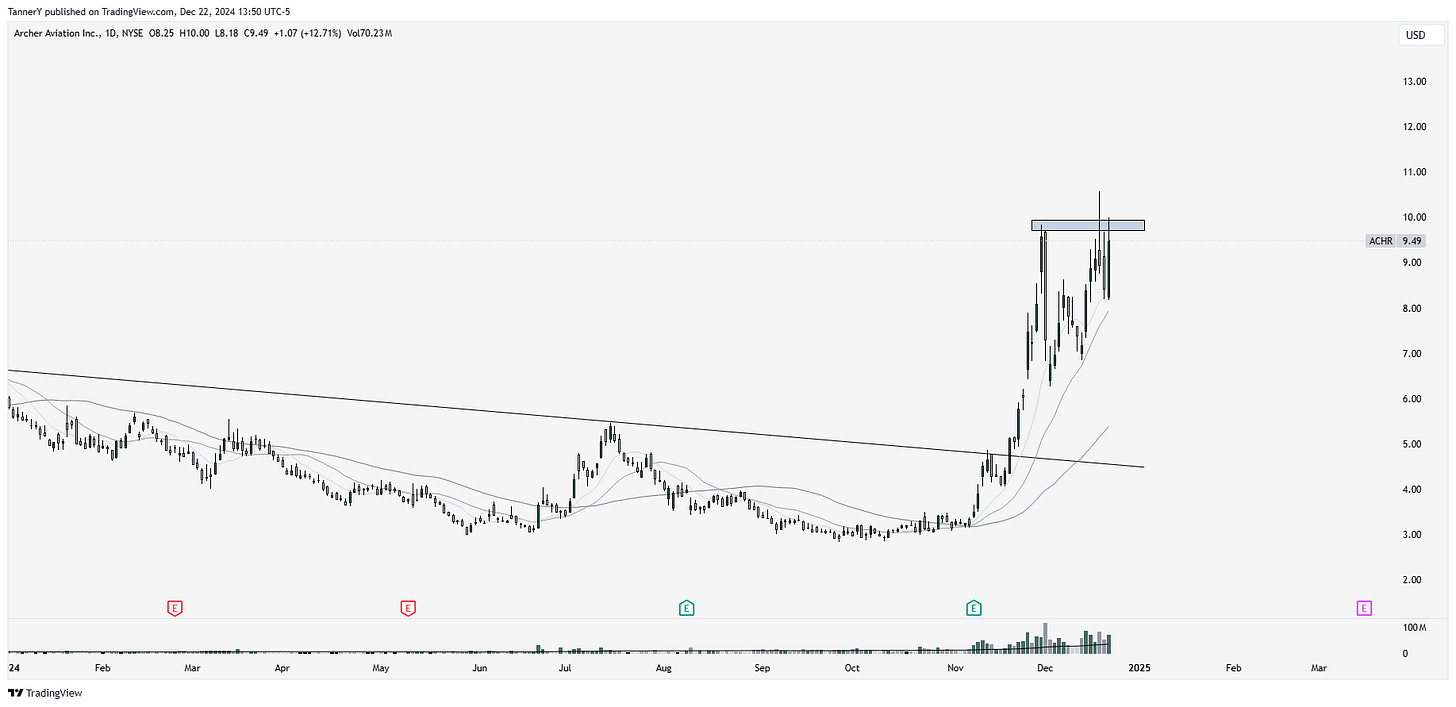

AIR TAXIS: JOBY 0.00%↑ ACHR 0.00%↑

ACHR 0.00%↑ holding up better in this small, but strong group. Nice high to trade against as we push higher.

BATTERY/EV: QS 0.00%↑ ENVX 0.00%↑ MVST 0.00%↑ FREY 0.00%↑ EOSE 0.00%↑ SLDP 0.00%↑ TSLA 0.00%↑

The battery/EV theme is emerging quickly, with drones and supportive industries to drones starting to pick up steam. If the future of warfare is unmanned, its important to note the supplementary groups. An additional group I could see picking up with this as well is Lithium, although commodities markets are not always as easy to pin as the application groups.

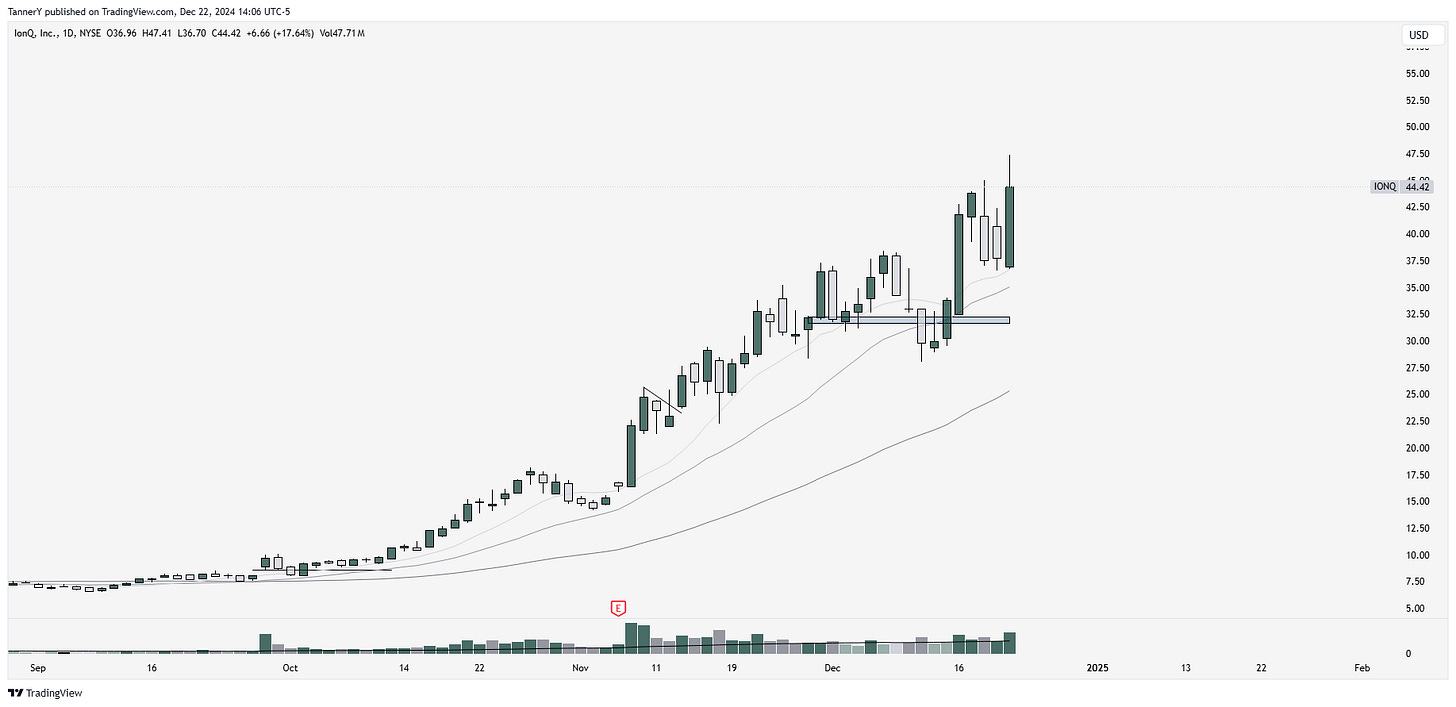

QUANTUM COMPUTING: RGTI 1.68%↑ QUBT 0.93%↑ QBTS 1.89%↑ IONQ 0.00%

IONQ 0.00%↑ has been the clear leader in quantum, with many of its peers, speculative or not also getting a significant amount of short term love. IMO this is the least fundamental theme I discuss, as it has the most speculation and fluff from the market and loose news (GOOG chip)

AI/DATA: PLTR 0.00%↑, RDDT 0.00%↑ ALAB 0.00%↑

PLTR 0.00%↑ is the talk of the town as a true AI leader, with a menagerie of applications in the private and public sector. I wouldn’t be surprised to see this get to $100 in 2025.

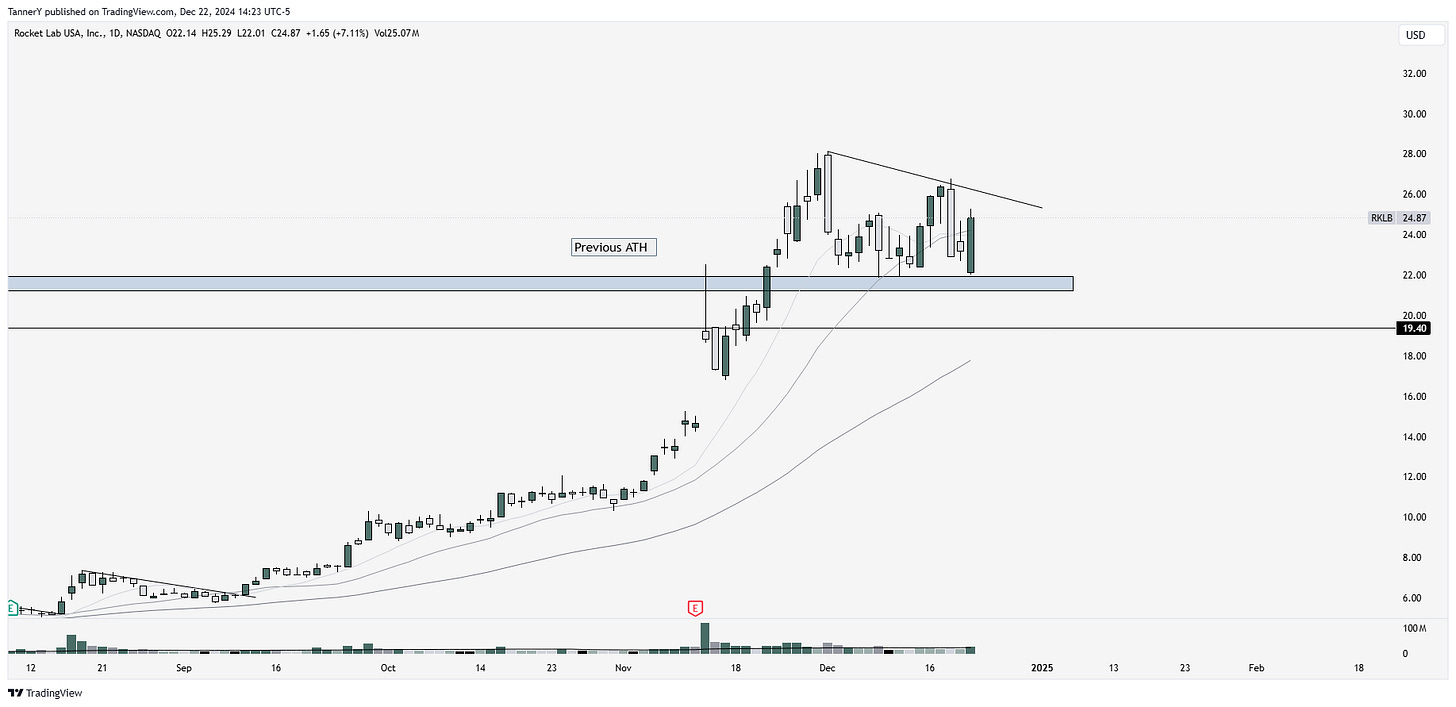

TRUMP TRADES: DJT 0.00%↑ GEO 0.00%↑ AXON 0.00%↑ BYRN 0.00%↑ TSLA -0.70%↓ PLTR -0.42%↓ DXYZ 0.00%↑ RKLB 0.64%↑

Proximity to trump trades are still acting extremely well. Even the lesser know trades like jails via GEO are holding up in market weakness. This type of PA through pullback is often rewarded.

That’s all for this week. If you enjoyed, consider reading another article HERE

Don’t forget to like this post, and share with a friend!

See you next week.