Introduction

Investors, Traders, Enthusiasts,

Welcome back to another volume of “The Weekly Selection”, where I go over the broad market indexes, some helpful tips regarding trading and investing, as well as trade ideas that I am looking forward to in the weeks ahead.

Last week was a monster. The script I wrote for positive reaction to economic data played out, with primary indexes boosting into ATH territory. What’s interesting is that I actually believe there is still a considerable amount of cash on the sidelines. Lows put in towards late October and the subsequent run occurred so swiftly that many were caught of guard, leaving them out of position. This, combined with the volume of dollars in Money Market accounts, leads me to believe that this may not be the end of this seemingly unsuspecting run.

YouTube

Again, I would like to give a quick plug to my YouTube channel. If you enjoy listening/hearing a rundown in addition to the newsletter, I suggest subscribing to my YouTube below, where I provide commentary and hopefully more helpful information soon!

Index Breakdown

SPY 0.00%↑ up first of course. With economic data out of the way, the market has surpassed the previous all time high from 2021. After an extremely lackluster 2022, 2023 has been a great rebound, and closing strong. Going into the end of the year, I do not know what to expect. What I do know is I will be mostly cash going into the end of the year. Smaller trading positions as Ive realized a fair amount of gains, and there’s no reason to push it.

The Nasdaq 100 gives us a slightly different look. There is the classic cup and handle with breakout look, but the point we closed last week is most peculiar. Right at the high. Does it need rest? or can the market rally through for this index.

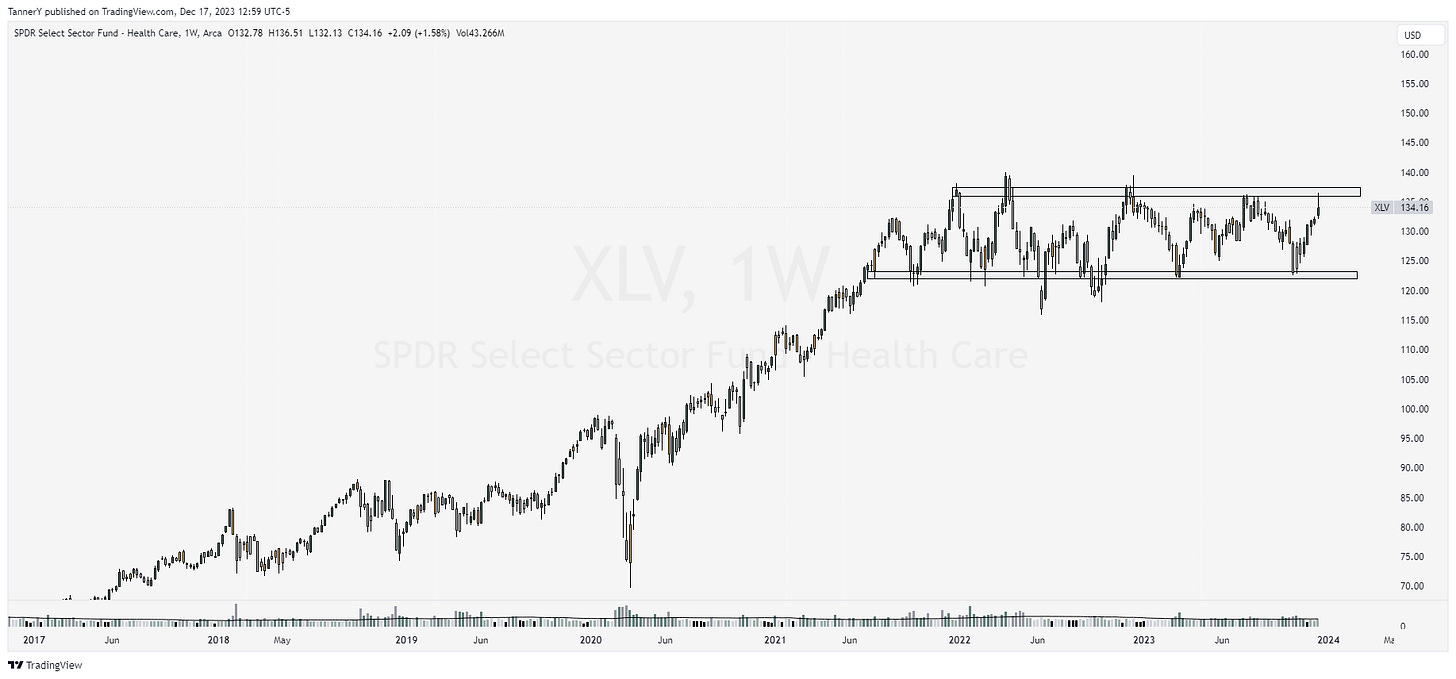

XLV 0.00%↑ healthcare shaping up. Is this an index that is exhausted from Covid? or is it ready to go?

Tip of the week

Protect gains! Pretty simple and straight forward tip that I write when the market is on a tear. There’s no reason to exhaust your account while the market exhausts. The market will be here tomorrow, the day after, and the one after that. opportunity missed is nothing to fomo about. I don’t plan on giving back what the market has given.

Past Performance

Holy bananas the performance:

Great week for the newsletter portfolio. CVNA 0.00%↑ printing a monster move, with notable moves from TSLA 0.00%↑ and AEHR 0.00%↑ as well. There’s more in the tank for them I believe.

Charts

Coming off a week like last, I don’t see the need to be sizing into positions nearly as much, however I will still go through my weekly motions, looking to see what may be setting up for the future.

NVDA 0.00%↑ still one of the strongest in the market. Follow through at the 500 pivot could be one more to add to the list of nice moves by the beast.

MNDY 0.00%↑ clears the pivot, and now pulling back on light volume. Follow through here seems probable.

META 0.00%↑ tight under a long term pivot. Meta has not traded all time highs this year, which is surprising.

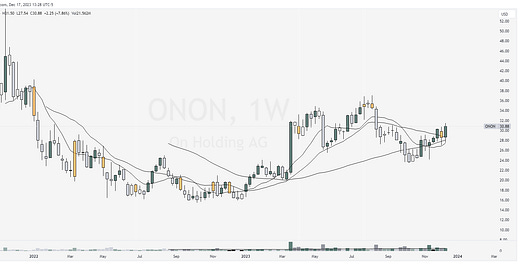

ONON 0.00%↑ not a super pretty chart, but the congregation of moving averages on top of price has a nice look to it here. Explosive?

MDB 0.00%↑ tightening above the pivot, may need time but a nice AI play for those interested.

That’s all for this week!

IF YOU ENJOYED:

Like this post