Hello Everyone,

With markets continuing to be driven by data events, fed speakers, and numerous global socioeconomic factors, it certainly puts us in an interesting position as investors. Last weeks market action was tough, but expected per the last issue of The Weekly Selection. A long standing downtrend in price action continues, not looking like it will breakout for the foreseeable future. My outlook is that there is still considerable pain to be had in the long term, and I will continue to add to my positions as I see fit.

The chart for the broad market index ($SPY) can be seen below:

SPY 0.00%↑ as it can be observed, the downtrend is in full effect for the market. While its widely understood that stocks usually bottom before the economy does, there has been little evidence of that bottom taking place any time soon per fed chair Jerome Powell. To the far left of the chart the Covid dip can be seen, and we are still considerably higher.

Quote of the week:

“Though tempting, trying to time the market is a loser’s game. $10,000 continuously invested in the market over the past 20 years grew to more than $48,000. If you missed just the best 30 days, your investment was reduced to $9,900”

- Christopher Davis, Davis Advisors ($70b AUM)

My quotes as of late have been geared primary towards the long haul investing psychology. We don’t know when the market will bottom, or at what price. The big picture outlook has historically been the most profitable.

Past Performance:

Individual stock performance last week was quite poor. Between everything the loss on equity was nearly double that of the market return. There were some standout moves, notably in DXCM 0.00%↑ and SGML 0.00%↑, however, there's really no way to sugarcoat it. There was minimal strength in any sector.

Looking forward:

Be on the looking for a new volume of my education series. Sometime this upcoming week I will be going over the importance of the IRA for young people and how continually contributing to one can drastic improve the financial health of an individual. If you’d like to be notified of this release, subscribe at the button on the top or bottom of this volume.

Charts:

Lets see if we can find some stocks ready for breakout this week. Some Im watching are as follows:

CPRX 0.00%↑ is up first. Strong daily flag forming and near ATH.

CELH 0.00%↑ with a weekly cup and handle pattern. This is a great looking stock into the coming weeks in my opinion.

ASML 0.00%↑ with a tight daily setup. Great fundamentals as well.

AMAT 0.00%↑ is a position I entered on Friday. Strong daily flag setup.

MRNA 0.00%↑ is another I entered last week. Looking ready to breakout into its frothier zone above 200.

DE 0.00%↑ with a large consolidation at all time high. Sitting over a large gap from earnings. could play long or short here.

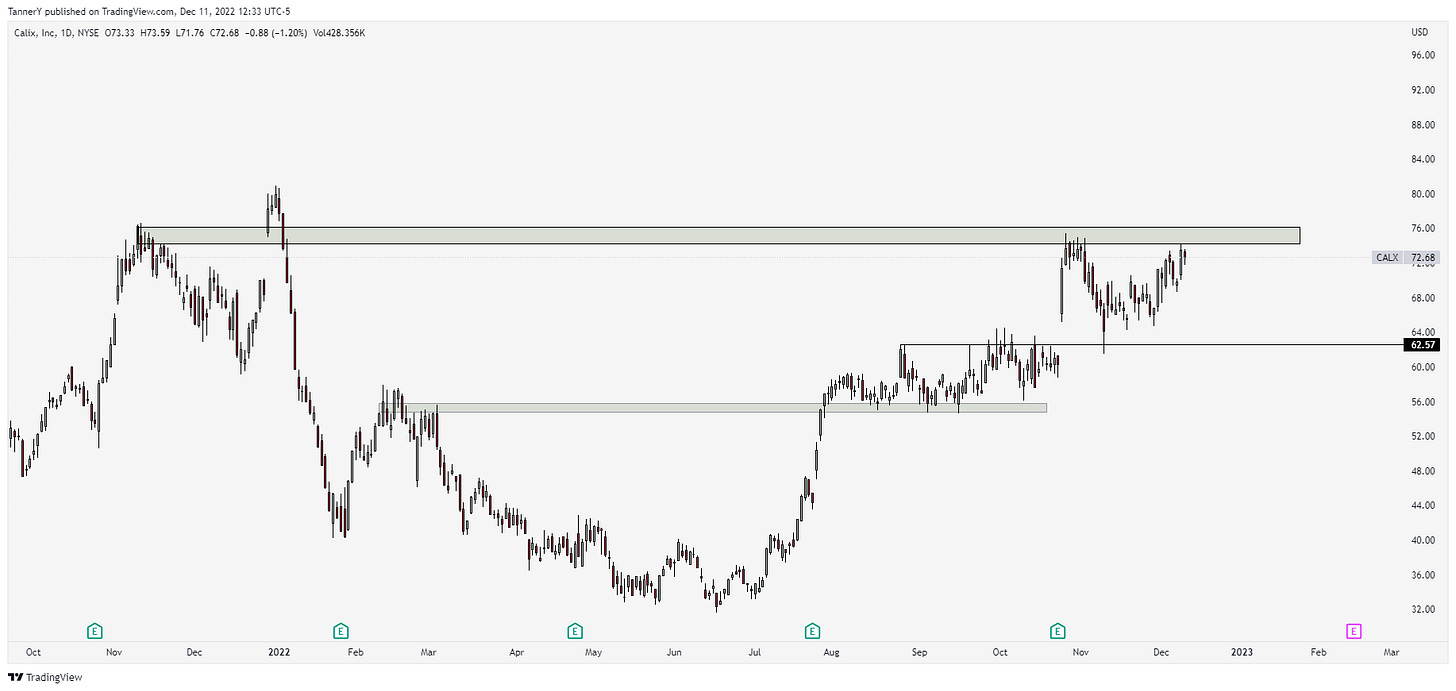

CALX 0.00%↑ with a nice curl after earnings pullback.

That’s all for this week everyone!

For my fellow students, good luck on finals.

-Tanner