Investors and Enthusiasts,

Welcome back to another volume of “The Weekly Selection”, where I go over the broad market indexes, some helpful tips regarding trading and investing, as well as some ideas that I am looking forward to in the weeks ahead.

Last week saw a bit of chop early on, then a rather abrupt show of strength to close it out. To be more precise, we actually broke out above a rather important Covid range, that has been hampering broad market indexes for a few weeks now. Seeing this type of strength after such a run from the October 27th low is impressive, and leads me to believe that we could be looking at a fruitful end of the year (from a technical standpoint).

On the fundamental side of the market, this upcoming week has some hurdles. Tuesdays CPI, Wednesdays PPI and final fed decision will likely cause turmoil, and its important to be aware of your positioning with this in mind.

YouTube

Before we get any further, Id like to take a quick moment to plug my YouTube channel. I launched it last week, and will be uploading videos regarding the market there on Sunday evenings. I highly recommend checking it out!

Indexes

Moving along into the index charts, they can be seen below:

SPY 0.00%↑ up first, as we can see, the 458 range was respected for 2 weeks, and now breaks upwards. Will it need time to settle before making the move to highs? or will this weeks economic data send it?

QQQ 0.00%↑ somehow with a more reasonable look. In months past its usually been SPY 0.00%↑ with a more obviously structure to it, but this QQQ 0.00%↑ tells a nice story of consolidation above the moving averages, tucked below its all time high range. Very nice if big tech continues.

IWM 0.00%↑ in the middle of the range. not a ton to go off of here, besides less exhaustive look than QQQ 0.00%↑ and SPY 0.00%↑

Tip of the week

“Be greedy when others are fearful, and fearful when others are greedy”

- Warren Buffett

I know this is a well known quote, and a cliché one at that. Regardless, it is important not to try and take it so literally, but to assess the situation around you and make a guestimate on if you notice more fear than greed, or vice versa. I personally am beginning to see greed, and as that mental gauge continues to climb, I position accordingly by sizing smaller and smaller until the gig is up.

Past Performance

Less than Ideal performance on individual stocks last week. I think everyone on here is still within its setup, just needed a bit more time than I gave it buy putting it on the watchlist so soon.

Charts

With the economic data coming out this week, It is important to manage your risk accordingly. There is no reason to be going all in overnight with data at 8:30am. Now lets get into it.

NVDA 0.00%↑ up first this week. As you can see, this is the first time NVDA has traded sideways for multiple months in a row in a long time. With ER and dividend out of the day, continuation seems possible after a higher low was put in last week.

Sensational long opportunity on CVNA 0.00%↑ as it provides an explosive past as well as a clean R/R setup.

CELH 0.00%↑ offering a clean setup on a previous resistance turned support. I like this long term, but A swing could be in order.

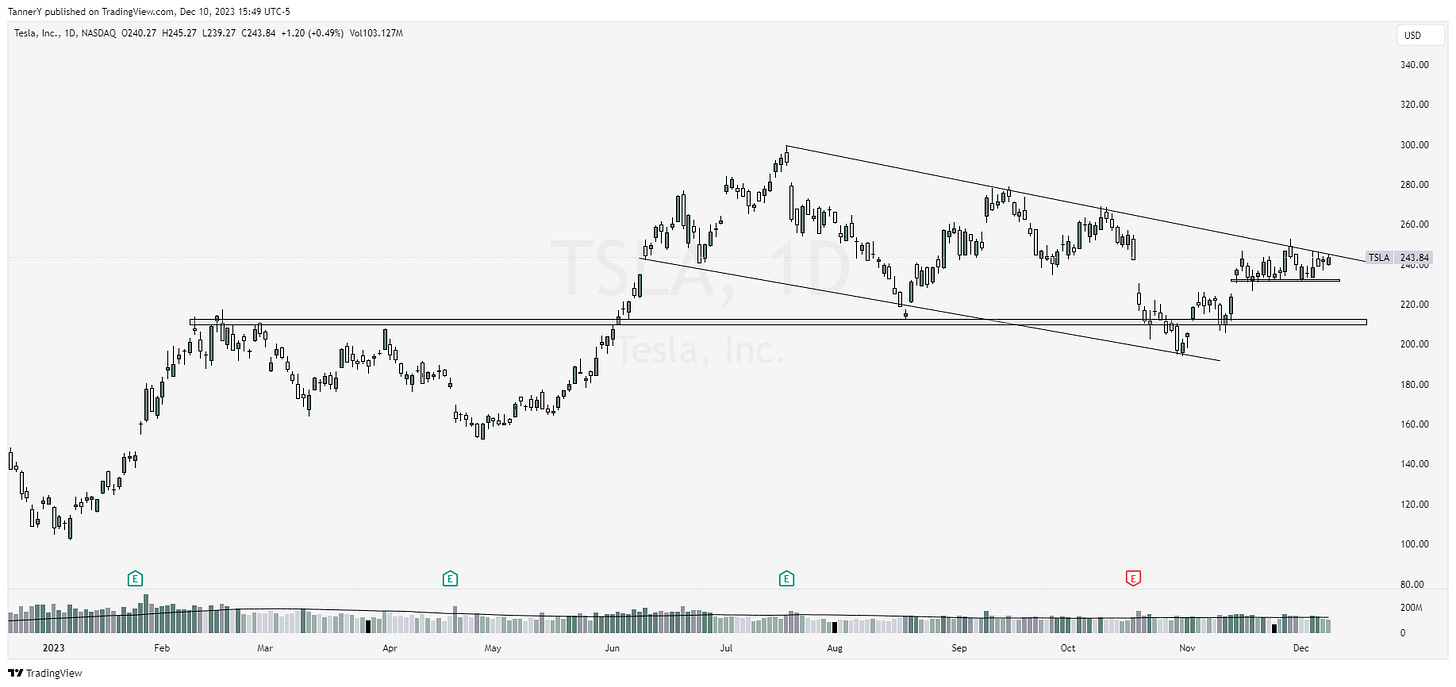

TSLA 0.00%↑ tight along the right side. Exceptional looking chart on a powerful mover.

AEHR 0.00%↑ more of a speculative opportunity. Resting along long term support/resistance, offering a clean opportunity heading into earnings in a few weeks.

That’s all for this week!

IF YOU ENJOYED:

Like this post

See you guys next Sunday!