Investors,

Welcome back to another iteration of ‘The Weekly Selection’, where I cover my thoughts on the market, what’s upcoming and some other little nuggets for your enjoyment.

Before we begin, get active on the rest of my socials:

SOCIALS

Subscribe to the newsletter!

Indices

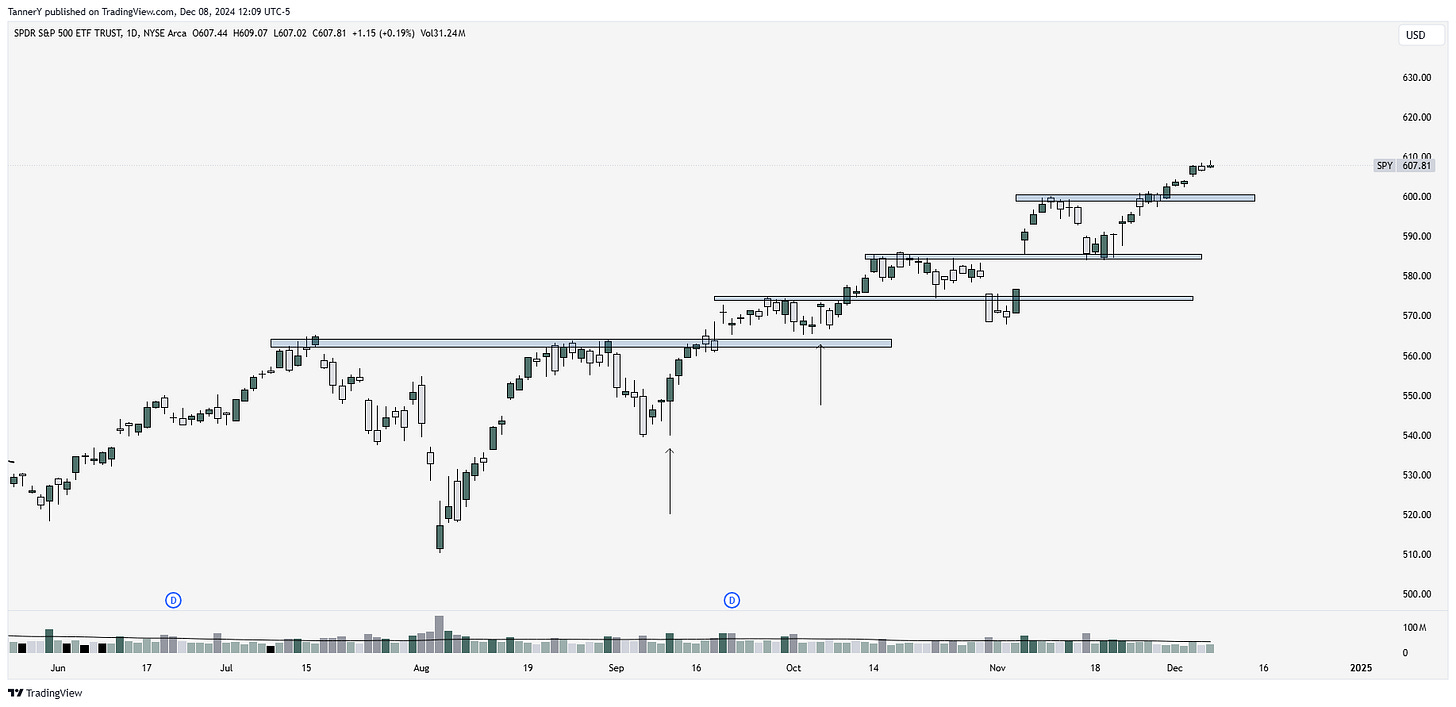

Markets grinded higher last week. As I have stated previously, the end of the year is historically the best time for the market, as selling lessens before tax year end. We are seeing this in full effect, with the market adding 6% since November.

SPY 0.00%↑ looking fresh, just grinding higher. healthy action, and a great trading environment.

FNGU 0.00%↑ is a 3x levered tech and consumer discretionary ETF. The breakaway performance here vs RSP and SPY notes the strength in mega caps, despite underperformance 2 weeks ago. Again, this is healthy rotational action that has not been difficult to manage or spot.

GLD 0.00%↑ getting caught in the mix here below all SMAs. A few weeks ago we saw a thrust back to the upper pivot, but the trade was not able to validate higher. Now we see the curl downward, which I expect to continue. The election was the peak of uncertainty for global markets in my opinion, and with that out of the way the change in character is notable.

Parabolic Trend Analysis

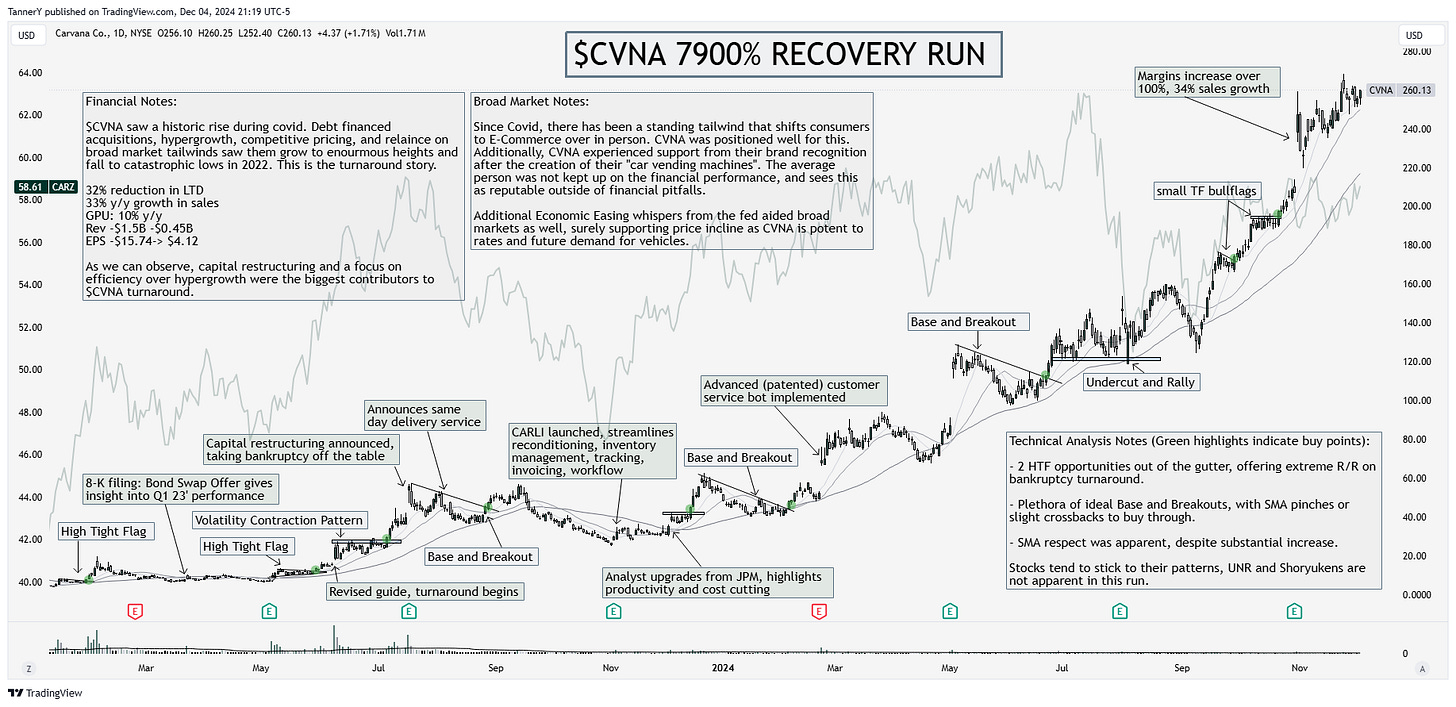

This week we are studying CVNA 0.00%↑, which has been one of the greatest comebacks Ive ever seen. Enjoy.

CVNA 0.00%↑ is a fan favorite trading stock, but few understand the innerworkings of the turnaround. $CVNA first and foremost is at the mercy of the seas when it comes to: Consumer spending, trends and funding. The easing environment of 2020-2022 saw monster growth, at the expense of sloppy financial management.

In 2022, after a bout with bankruptcy $CVNA strategically shifted focus from disruptive to managerial, emphasizing efficiency and streamlining internal services and workflow. Debt was restructured down, new internal products were launched, and the pace was set. A key piece of this restructuring was the bond swap announced in 2023. This allowed current bond holders to exchange unsecured bonds with collateral, an easy decision. New bonds are due late 2020s-early 30s between 9-11% interest. This took billions off their sheet, and got rid of a $500M 2025 bond expiry.

CVNA benefitted from broad market tailwinds, such as fed easing and drastic increases in consumer spending, as many consumers were unaware of the bankruptcy dealings, preserving brand identity and interest.

*This portion of the newsletter takes considerable time in researching the stocks and why they ran. If you enjoyed, consider liking this post and sharing with a friend.*

TOP THEMES FOR THE WEEK AHEAD

This week, and the last few have been the era of “Sci-Fi” Stocks. Space, quantum computing, AI, crypto, air taxis, Robotics, cyber security and more. Lets dive in:

QUANTUM: IONQ 0.00%↑ RGTI 0.00%↑ QBTS 0.00%↑ QUBT 0.00%↑

RGTI 0.00%↑ here, note the breakout of the range on supreme volume. The group first popped on speculation last year, and this year the volume and interest has heightened tremendously.

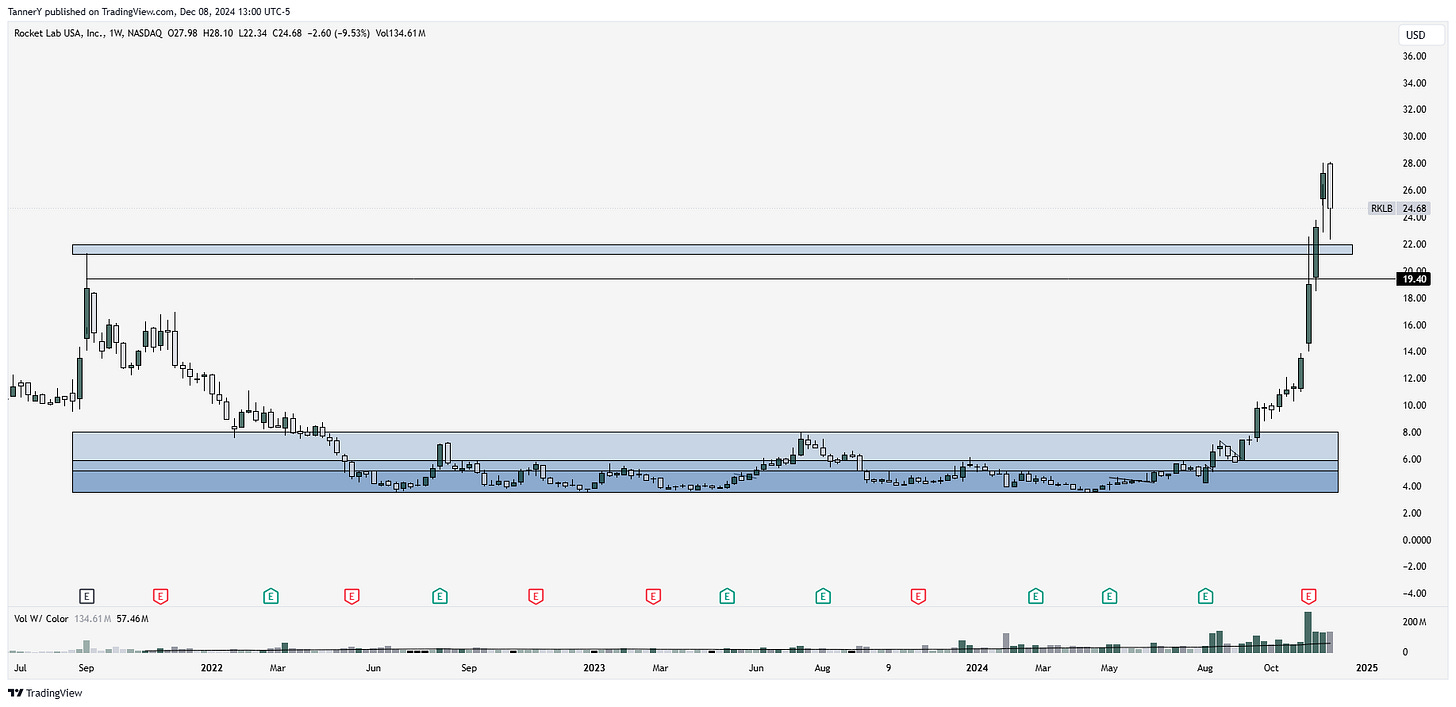

SPACE EXPLORATION: DXYZ 0.00%↑ RKLB 0.00%↑ RDW 0.00%↑ GSAT 0.00%↑

RKLB 0.00%↑ has been a top performer in my portfolio this year. I think a vast majority of this is due to their undervaluation vs SpaceX, as well as interest in space with Elon Musk close to the white house.

NUCLEAR: VST 0.00%↑ POWL 0.00%↑ CEG 0.00%↑ GEV 0.00%↑

VST 0.00%↑ extremely clean look here. Might need a bit more structure to make an impactful move upward. GEV 0.00%↑ also extremely notable.

CYBERSECURITY: CYBR 0.00%↑ CRWD 0.00%↑ FTNT 0.00%↑ PANW 0.00%↑

FTNT 0.00%↑ one of the top cyber stocks this cycle. Pushing ATH after consecutive quarters of beating and reiterating guidance. Great look and one to watch.

AIR TAXIS: JOBY 0.00%↑ ACHR 0.00%↑

ACHR, note the acceleration of volume out of the DTL. This is absolutely one to watch for continuation as that type of accumulation is often rewarded for months, not weeks.

CRYPTO AND RELATED: MSTR 0.00%↑ COIN 0.00%↑ HUT 0.00%↑ BTBT 0.00%↑ BTDR 0.00%↑ IREN 0.00%↑ MARA 0.00%↑ SMLR 0.00%↑

COIN 0.00%↑ tricky to add lately. That said, phenomenal look on the daily and breaking out towards the ATH range. Stocks that get within 15% of their ATH are more likely to try for it than not.

ROBOTICS: ISRG 0.00%↑ TSLA 0.00%↑ SERV 0.00%↑

TSLA 0.00%↑ might be more than just robotics, as it is also a trump trade, however the action is undeniable. Approaching all time highs, I’d imagine it tests.

That’s all for this week! If you enjoyed, drop a like on this post or a comment. See you next time.