Introduction:

Hey Everyone!

Before we get into the content of this weeks newsletter, I’d like to take a brief moment to revisit its structure, purpose and intended outcomes. Over the last week or so, we’ve seen about a 20% increase in following, which I believe warrants a reintroduction.

At its core, this newsletter serves as a consistent place people of all education levels can see a one week snapshot of the stock market. During my first couple years of learning financial markets, I found a pretty big void in this area, especially in an easily digestible layout for beginners.

Additionally, the newsletter serves as a channel for me to post my personal watchlist, or stocks that I’m looking at going into the next week. Until I’m a certified financial advisor, these stock and investment ideas are just that, ideas.

A final goal of this open access publication is to bring light to some specific topics within financial markets such as investment strategies, basics of fundamental and technical analysis, as well as a plethora of topics related to the creation of wealth on many timeframes.

Market outlook:

Without further adieu, lets get into it.

SPY 0.00%↑, the 'benchmark' of the market saw a 1.14% rise last week, continuing what many call "the santa rally" which is a historic period around the holidays where markets tend to perform well.

The chart can be seen below:

As it can be observed, we are at the top of the downtrading channel, which has been an indicator of market pullbacks in times past. For this reason, my stock ideas will mostly be relative strength stocks in outperforming sectors, and less tech which is subject to broad market volatility.

Quote of the week:

“The stock market is a device to transfer money from the impatient to the patient.”

- Warren Buffett, Berkshire Hathaway

The quote this week speaks volumes to the market action we’ve been experiencing for the last year. As time goes on, more and more feel discouraged, lost or hopeless to the situation. 401ks, retirement accounts and trading accounts feel the pain, but its those that stick through the tough economics that come out significantly better on the other side. Patience pays.

Past performance:

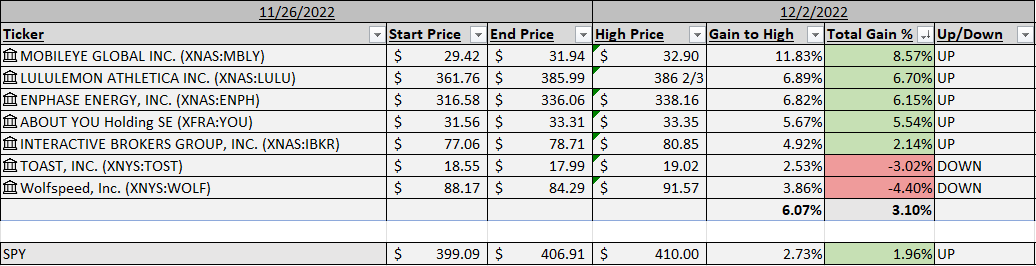

The individual stock ideas and their performance can be seen below:

Compared to the market (bottom most row), individual stock ideas far outperformed. The average gain was 3.10% with an open to high average of 6.07%. This type of performance is expected with SPY 0.00%↑ in an uptrend.

MBLY 0.00%↑ LULU 0.00%↑ ENPH 0.00%↑ YOU 0.00%↑ IBKR 0.00%↑ TOST 0.00%↑ WOLF 0.00%↑

Charts:

Looking forward to this week, I’m watching the following. Notes are posted below each chart.

AMGN 0.00%↑ is up first. High and tight flag pattern well above the previous resistance zone indicated by the green box.

RYTM 0.00%↑ has been a monster this year. After about 4 months of consolidation, It looks ready to make a run to the 31/32 area indicated by the green box. I have a position in this one that was posted on my twitter which can be found HERE.

ASML 0.00%↑ has been another one of my better performers lately. With a $38b backlog in orders for their EUV machines and strong fundamentals to go with it, I think this one has more to run given flat/upwards market action.

CLFD 0.00%↑ is following a theme I like lately. Higher lows above June/July base. If the market does breakout of its downtrend, this is where I'm headed.

Not a whole lot of fancy TA on this one, but SGML 0.00%↑ has recently reclaimed all major MAs and is looking like a top member of its group.

DXCM 0.00%↑ coming off of a long term zone as well as getting some moving averages prepped for crosses. Looking good for the next couple weeks.

CPNG 0.00%↑ has some thick overhead, but the chart sure does look nice.

Thats all for this week!

If you enjoyed, Feel free to share with friends or subscribe by clicking the button below!

Tanner