Investors,

Welcome back to another iteration of ‘The Weekly Selection’, where I cover my thoughts on the market, what’s upcoming and some other little nuggets for your enjoyment.

Before we begin, get active on the rest of my socials:

SOCIALS

Subscribe to the newsletter!

Indices

Last week, we discussed the idea of a flat-up week in broad markets. This week delivered. See below:

“This pattern of weak open to the week and strong close is seldom punished with downside the next week.”

Broad markets during holiday weeks tend to be slower, however since we are in the hottest quarter of the year for performance (historically), the idea of actionable opportunities is not so farfetched.

SPY 0.00%↑ up first of course. We are pushing out to the $600 mark for the first time, and now 3 pivots away from the base. As Ive mentioned previously, the last part of these sectoral runs is usually the most difficult to trade, as money tends to sneak away from the obvious parts of the market, and into the value. We will see if that holds true this time around.

RSP 0.00%↑ was written as the strongest index of the bunch, noted on 11/17. This holds true as it continues to grind higher well above previous ATH. I think this shows the broadening of the market and its true strength.

The S5FI (stocks above their 50D SMA) is still quite healthy. In an earlier post Ive discussed how a healthy market does not mean this reading is pushing the upper echelon, it means it is healthily hanging between 40-60%. Personally, this is when I have made the most headway in the portfolio.

Parabolic Trend Analysis

$ACLS Parabolic Trend analysis. $ACLS operating in the Semiconductor manufacturing space and saw a huge 1500% Run post Covid-19. Primary drivers of this run were: Macro tailwinds, buybacks (driving EPS triple digit), being a crucial part of the value chain, shortages, theme with strong staying power. Enjoy!

*This portion of the newsletter takes considerable time in researching the stocks and why they ran. If you enjoyed, consider liking this post and sharing with a friend.*

TOP THEMES FOR THE WEEK AHEAD

QUANTUM COMPUTING: IONQ 0.00%↑ QUBT 0.00%↑ IBM 0.00%↑ MRVL 0.00%↑ COHR 0.00%↑ RDNT 0.00%↑ QTUM 0.00%↑

This is the week for quantum to determine whether or not the group has staying power or was a quick flash theme. Many of these names went short term parabolic off long downtrends, so I would like to see constructive basing and news to aid the run further.

URANIUM: UEC 0.00%↑ URA 0.00%↑ CCJ 0.00%↑ NXE 0.00%↑ LEU 0.00%↑ ASPI 0.00%↑

The Uranium/nuclear play still seems quite intact. After huge runs in the primary nuclear names, we now see some of that money rotating into the rest of the value chain.

ELECTRICITY VALUE CHAIN: VST 0.00%↑ POWL 0.00%↑ TLN 0.00%↑

VST 0.00%↑ has been a hell of a stock for the last year or so. Again, the focus is HIGH STAYING POWER THEMES. The electricity value chain is stuffed with these.

HOMEBUILDERS: BLDR 0.00%↑ LEN 0.00%↑ PHM 0.00%↑ HD 0.00%↑ LOW 0.00%↑

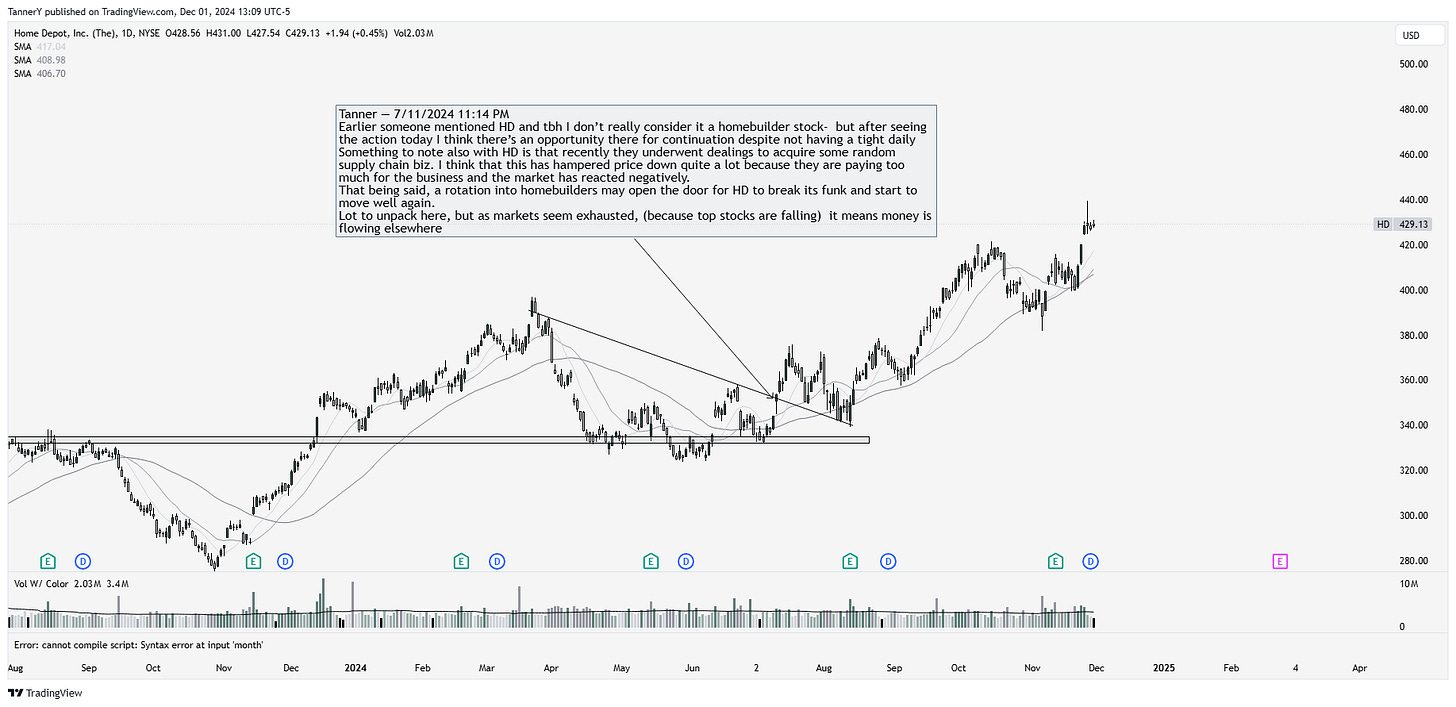

Earlier this summer, I discussed how HD 0.00%↑ was a value buy after the acquisition of a supply chain business that they paid too much for. We now see that thesis come to pass with HD 0.00%↑ pushing new highs. I am bullish on homebuilders in the long term through holiday season as well as into the new year with new home build applications up 30% y/y from 2023. We have a lot more people in our country now (for better or worse) and the market has seen a huge pinch in supply. This bodes well as a long term theme with staying power.

Thats all for this week. Thank you for reading, and if you got any value from this, please share this with a friend or subscribe.

🐐