Hello Investors,

As we continue to trek into the winter, its becoming apparent that the market has begun to build a bit of foundation beneath its feet. Broad markets ($QQQ and $SPY) performed well, ending up roughly 1.5%. This is coming off of FOMC, OPEX, and a menagerie of fed committee speakers, all of which have historically moved markets. The upcoming week is rather dry on economic events, so I would have to assume we see more stagnant action than anything.

Something Ive been continually participating in are the few sectors that have been showing relative strength. These include consumers, materials, healthcare and energy. I will continue this until we start to see more bases and proper setups in tech and others most affected by this high inflation period.

Below is the chart for SPY 0.00%↑:

Some notes:

Did not close an inside week

Approaching the top of the trend from the last 11 months

overhead resistance in the event of a breakout at $414

Holidays around the corner, historically has been the markets best performing months

Below is the chart for IWM 0.00%↑, a less leading tech stock heavy picture of the market:

Some notes:

Inside week

Approaching its own trend

has seen a significantly larger drawdown than SPY 0.00%↑, despite a less aggressive run during 2020/21

stronger base price action in this area, dating back to 2018 (multiple tops)

Quote of the week:

“I think the most important step towards making money is trading your own ideas… that doesn’t mean you have to come up with the idea, but if you write it down and make it your own then its your idea. Writing my thoughts is vital for me”

- Oliver Kell, US investing champion 2020 (900%+, equity only)

This quote speaks volumes to me and I hope it gives some insight for my followers that take a lot of my trades. To truly have conviction in setups, its crucial to see something in the setup that is unique to your own style/ rulebook. In addition, if something goes wrong in a setup you’ve truly understood and taken on your own accord, it gives the opportunity to learn and adjust your own aforementioned style/rules.

Past Performance:

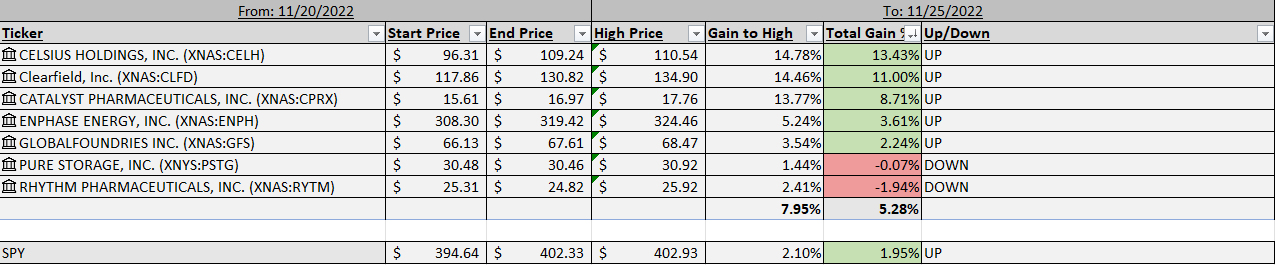

What a week for the selection stocks. The average return for the week was 5.28%, beating the broad market by over 200%. CELH 0.00%↑ has been good to me in the past, and I will continue to hold into this week. CLFD 0.00%↑ didn't quite give me an entry, but I will keep an eye on this one moving forward.

Charts:

Here is everything Im looking at for this upcoming week. If its anything like last week, I will be a happy camper. If you’d like to follow my day/options trades, feel free to follow my twitter, HERE.

WOLF 0.00%↑ is first up. Loving the look of this gap fill play, especially with Semis looking strong. My good friend david sent me $SMH, which is exceptionally positioned.

MBLY 0.00%↑: Strong hourly look, but will definitely need to get out of these long wicked rejections before I decide to take a stab at it.

$IBRK was on the watchlist a couple weeks ago. I would like to see this make a move into this top range where it has been finding resistance for a few years. It is also notable that brokerages have been performing well lately as a whole.

LULU 0.00%↑ has a respectable rounded bottom look to it, shaping its weekly quite attractively. I will look to take this position for a swing through the holiday season.

TOST 0.00%↑ has a less structured setup than most, but Im watching it regardless. I used one of their readers at a restaurant recently, and it was quite fast. The market for them seems to be saturated, but their financials don't lie.

YOU 0.00%↑ id like to see this get through its supply zone, and ill be watching it this week.

That’s all for this weeks selection!

I hope you enjoyed. If you did, you can subscribe at the button below.

-Tanner