Introduction

Hello Investors,

Welcome back to another edition of: The Weekly selection, where I go through our current position in the market, my thoughts, helpful tips as well as some charts and ideas I am looking at for the week ahead.

Coming off of a shorter market week, with thanksgiving and black Friday, the markets are left at a bit of a metaphorical crossroads. After such a tumultuous run this fall season, It appears as though a pullback is in order. That being said, this strength comes at a welcome time, leading into the end of the year which is traditionally bullish, as well as off of a key support level for most ETFs. The culmination of these factors could lead to a number of outcomes.

Lets jump right into some of them below:

As per usual, SPY 0.00%↑ is up first. At first glance, the duration and speed of this move has been impressive. Moving from a key support to a key resistance without much dawdling in-between. The show of strength is impressive.

QQQ 0.00%↑breaking out of the wedge. Now approaching a similar resistance to SPY 0.00%↑, but didn’t get the bounce off lower resistance, signifying the strength in tech as of late.

Past Performance

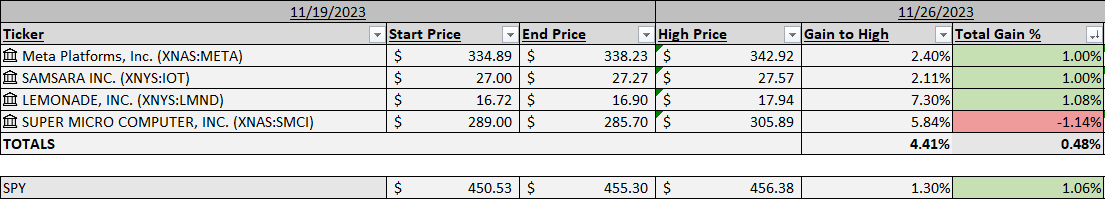

went 3/4 on ideas last week. LMND 0.00%↑ was a standout with a few trade opportunities, and SMCI 0.00%↑ offered a clean breakout early in the week.

Charts

$ETHUSD up first. After last weeks inside week, I was expecting this type of move to come. A slightly up week, closing high. $ETH definitely has the legs to make a run.

IOT 0.00%↑ is one to be careful with. Earnings this week, but with a strong fundamental base, I think this one can get to stepping.

ONON 0.00%↑ shoe manufacturer, Has an interesting pivot around $29, could see 35 on a break upward.

AFRM 0.00%↑ pointing upwards with a double inside candle on the weekly. 22 was the pivot, still looks great.

LMND 0.00%↑ again, 17.5 is a pivotal spot. I like this.

That’s all for this week!

If you enjoyed, don’t forget to leave a like and subscription to support my content.

Good luck!