The Weekly Selection: 11/24/2024

Vol. 115: Gobble On

Investors,

Welcome back to another iteration of ‘The Weekly Selection’, where I cover my thoughts on the market, what’s upcoming and some other little nuggets for your enjoyment.

Before we begin, get active on the rest of my socials:

SOCIALS

Subscribe to the newsletter!

Many were under the impression that the market was ready for a greater pullback last week. We seemed to need it with many strength indicators showing cracks. The outlined path was a move down to $574 and then continue higher. Instead what we saw was a very constructive base at the second pivot out of the larger base, and then continuation higher. This pattern of weak open to the week and strong close is seldom punished with downside the next week.

Additionally, Its worth noting the relative strength in RSP over SPY. Mega cap equities may hurt in a trump election due to his strict policy on large global powers. The more agile and smaller mid and large cap names likely outperform here, so that’s not too much of a surprise.

SPY 0.00%↑ above, still very constructive.

The S5FI indicator, showing us that markets still have a lot of room before they become overbought. If we focus on the May - July Period earlier this year, its observable that markets ran hard while this indicator stayed fairly neutral, indicating that we can have great action without high readings in health gauges.

Parabolic Trend Analysis

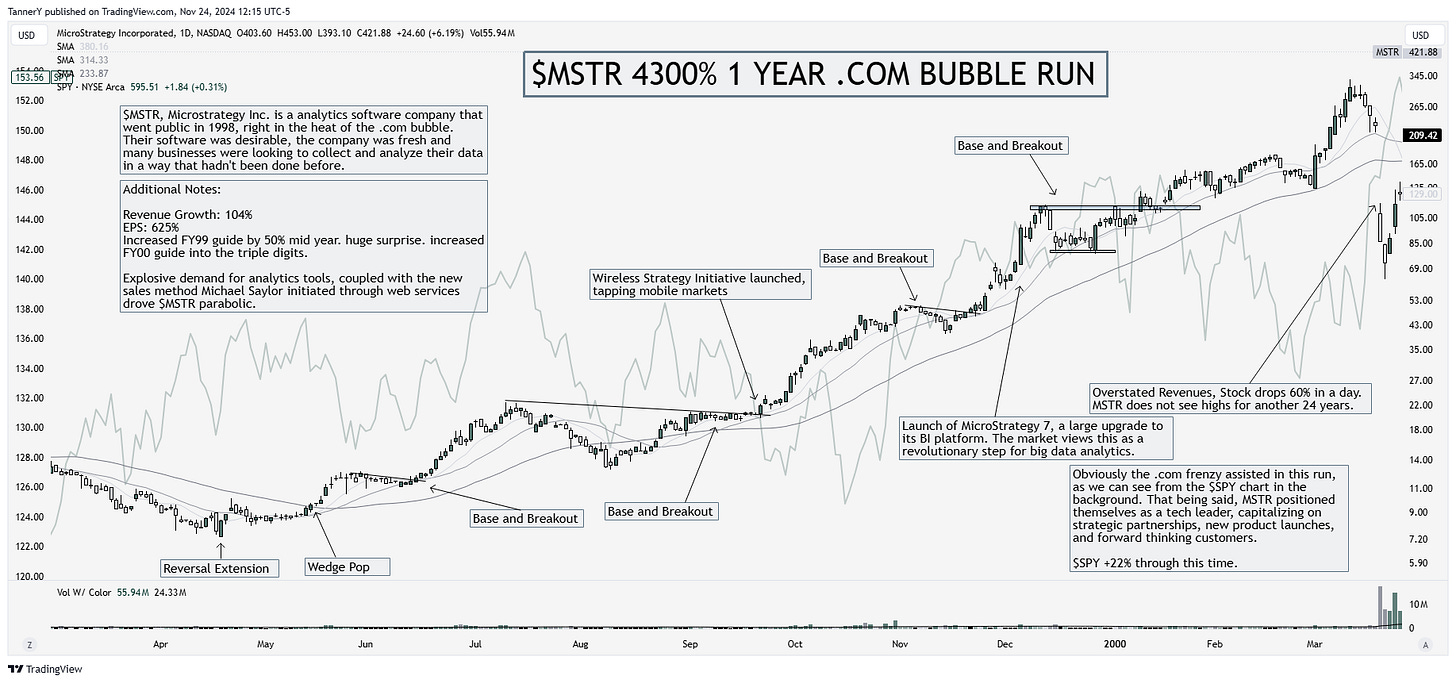

MSTR 0.00%↑ is the talk of the town these days. But few remember that it was a massive runner back in 1999, at the peak of the .com bubble. Study of this price action can help us get a glimpse into what to expect in the current day. If we have seen specific action once in the past, its more likely than seeing something we’ve never experienced before.

*This portion of the newsletter takes considerable time in researching the stocks and why they ran. If you enjoyed, consider liking this post and sharing with a friend.*

Charts

Alright, lets get into the IN/OUT THEMES for the week ahead. Lots to look at this week!

IN THEMES:

INDEPENDANT POWER PRODUCERS: VST 0.00%↑ CEG 0.00%↑ TLN 0.00%↑ POWL 0.00%↑

POWL 0.00%↑ looking pretty constructive through earnings. The IPP names are continuously strong through plenty of nuclear headlines, unsurprisingly.

NUCLEAR REACTORS AND EQUIPMENT: NNE 0.00%↑ SMR 0.00%↑ OKLO 0.00%↑ ASPI 0.00%↑ LEU 0.00%↑

ASPI 0.00%↑ is in the business of selling isotopes. This niche, paired with the current desire for nuclear bodes well for upside.

IPO STOCKS: RBRK 0.00%↑ ALAB 0.00%↑ RDDT 0.00%↑ LB 0.00%↑

IPOs have been hot this year, with stocks like RBRK 0.00%↑ breaking out of their IPO based with conviction.

CRYPTO MINERS: CORZ 0.00%↑ HUT 0.00%↑ BTBT 0.00%↑ BTDR 0.00%↑ WGMI 0.00%↑ CIFR 0.00%↑ WULF 0.00%↑ IREN 0.00%↑ HIVE 0.00%↑ RIOT 0.00%↑ MARA 0.00%↑ CLSK 0.00%↑

HUT 0.00%↑ far and away the best looking of this group. Maybe some rotation into the miners?

SOFTWARE/SaaS: DDOG 0.00%↑ NET 0.00%↑ SNOW 0.00%↑ NOW 0.00%↑

DDOG 0.00%↑ makes a huge move out on volume, looking to see this coil up again.

OUT THEMES:

HEALTHCARE: XLV 0.00%↑ UNH 0.00%↑ LLY 0.00%↑ NVO 0.00%↑ HIMS 0.00%↑

These healthcare/GLP stocks are getting slammed. I think the exhaustion is in there.