Investors,

Welcome back to another iteration of ‘The Weekly Selection’, where I cover my thoughts on the market, what’s upcoming and some other little nuggets for your enjoyment.

Before we begin, get active on the rest of my socials:

SOCIALS

Subscribe to the newsletter!

Indices

After a blast off week in indexes post election, the market saw a notable, but healthy pullback this week. Earnings season is still in full swing, with some key groups showing relative strength, however breadth and main themes deteriorated. Lets get into it below:

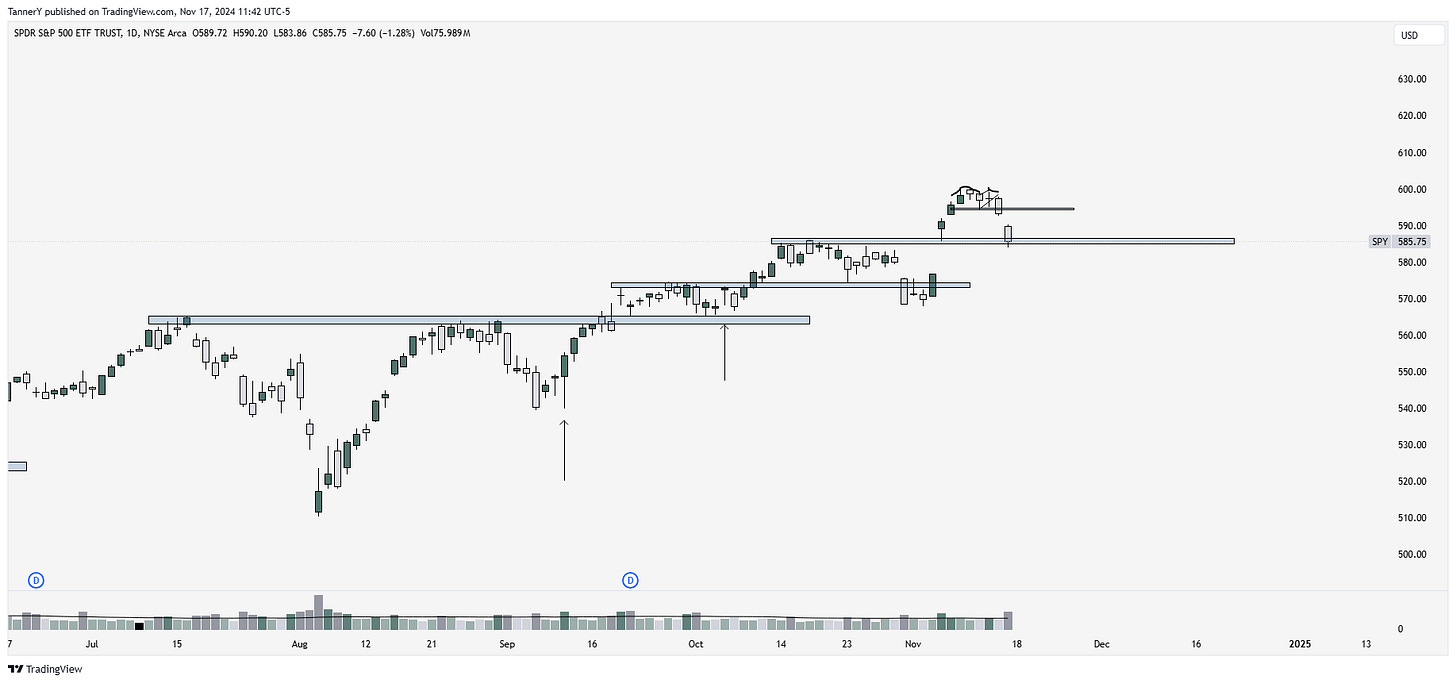

As we have discussed in past articles, SPY 0.00%↑ usually gets 3 good pivotal moves away from a base (of 2 months or more) before it cools off. With the recent price action post election, we are now seeing this in play. SPY pulls back to the previous pivot highs, which I still believe to be constructive, however the velocity and volume that took place isn’t all that reassuring. What I would like to see now is a flush out down to the second pivot ($574) and then constructive ranging while breadth improves.

QQQ 0.00%↑ saw an obvious false breakout last week. Some niche tech groups are performing well, which we will get to later, however the big names retraced, pulling the index down.

RSP 0.00%↑ equal weight SP500 ETF sees health pullback into the MA stack. I think this is the best look between the aforementioned indexes. It has grinded higher without too much volatility for a while, and that is strong until proven otherwise.

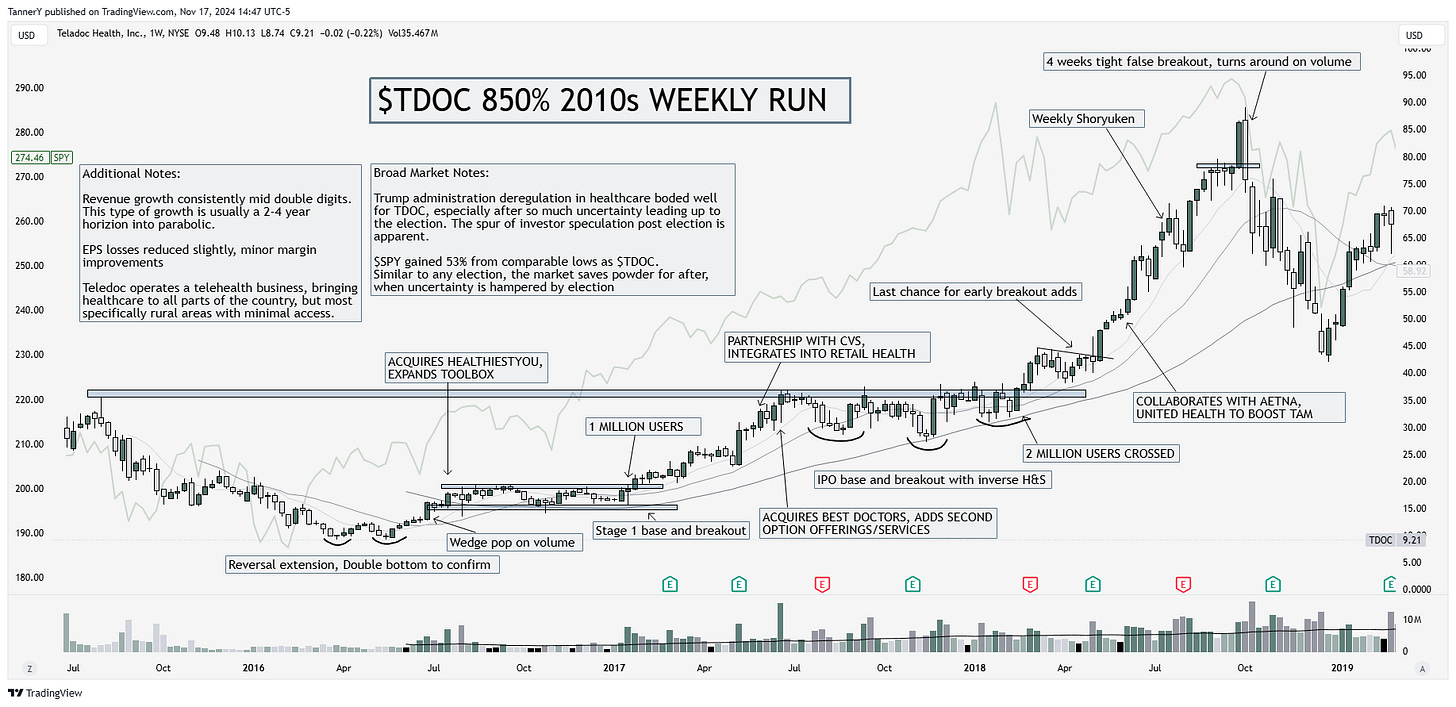

Parabolic Trend Analysis

TDOC 0.00%↑ saw a huge rise in the mid 2010s. The expansion of the internet is well underway, and healthcare was an obvious choice to expand to for rural communities with lower access to brick and mortar healthcare. Strategic acquisitions and partnerships aided Teladoc in their rise, putting them in positions to not only grow users, but also bring additional services to the existing base. This run took a few years to really take off, which I think is a product of being unprofitable and *only* growing revenues in the mid double digits. To see a true parabolic stock in less than one year, it is apparent from past examples that triple digit growth, extenuating market conditions or turn to profitability are required.

*This portion of the newsletter takes considerable time in researching the stocks and why they ran. If you enjoyed, consider liking this post and sharing with a friend.*

Charts

IN THEMES:

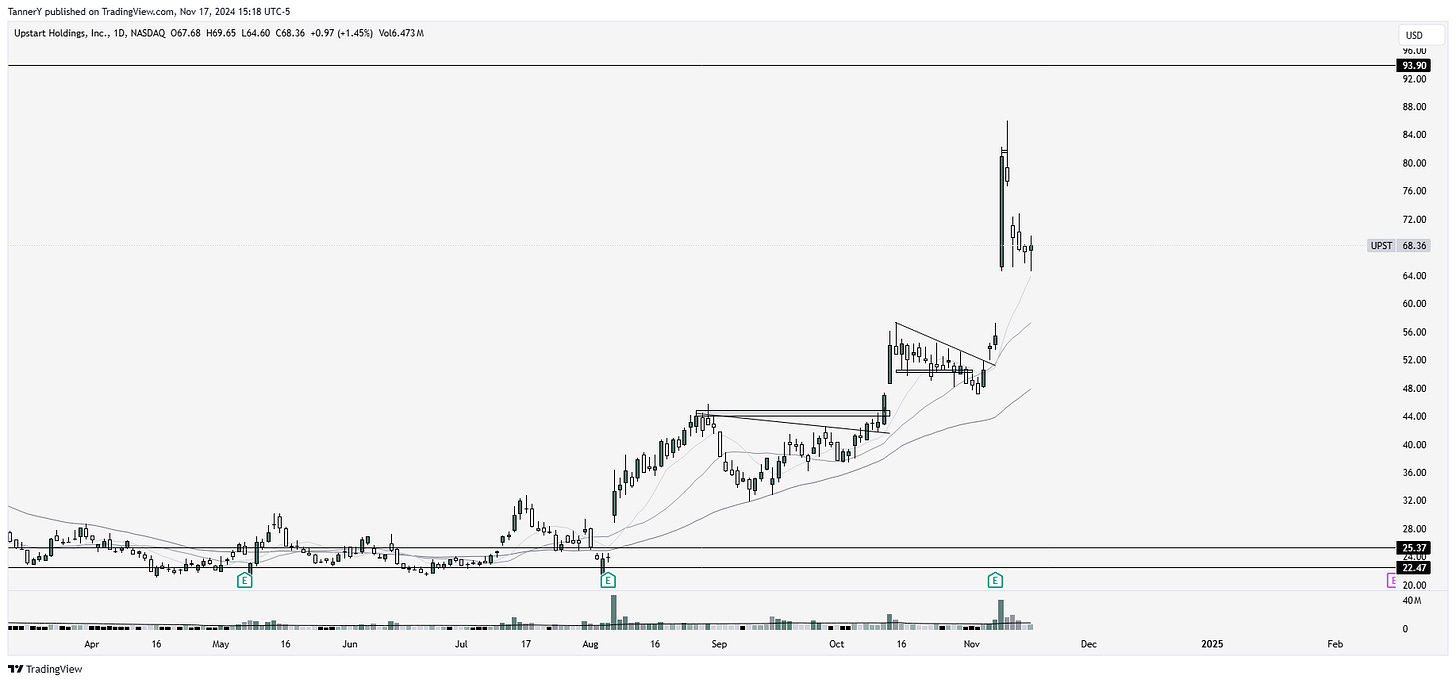

PAYMENT PROCESSORS/FINTECH

SQ 0.00%↑ AFRM 0.00%↑ UPST 0.00%↑ PYPL 0.00%↑

UPST 0.00%↑ my favorite look in the group (I own it, $64.8). The group performance has been good lately, and UPST soaking this offering well has me enticed.

CRYPTOCURRENCY:

MSTR 0.00%↑ IBIT 0.00%↑ BITCOIN ETH SOL WULF 0.00%↑ CIFR 0.00%↑ IREN 0.00%↑ APLD 0.00%↑

Bitcoin, a thing of beauty. No further explanations needed than huge institutional inflows and a monster breakout.

Notable group as well is space, although fragmented. DXYZ 0.00%↑ is 37% SpaceX via their private equity fund, and RKLB 0.00%↑ is a juicer. ASTS 0.00%↑ nothing burger for now.

Also SMR 0.00%↑ NNE 0.00%↑ TLN 0.00%↑ VST 0.00%↑ Nuclear is in, but starting to fade as the honeymoon phase of inflows is coming to a close.

So much more for IN THEMES, however these are my focuses.

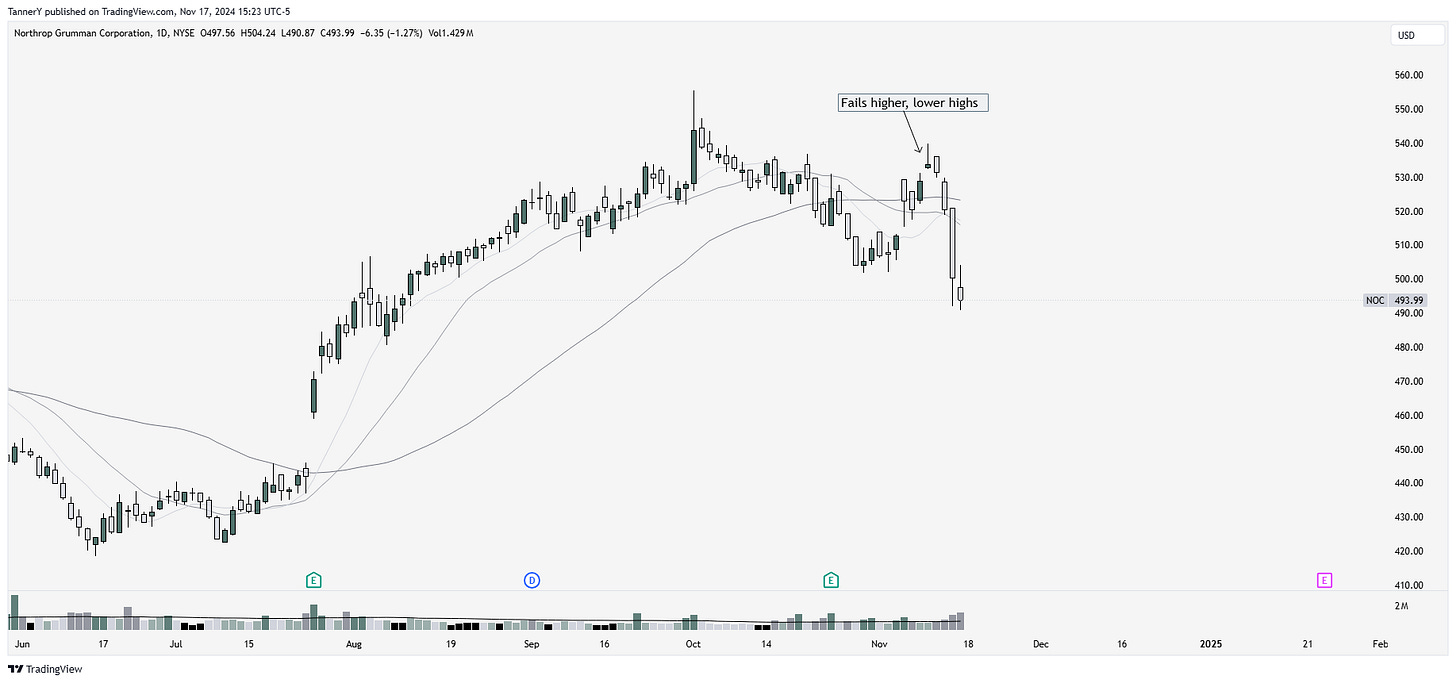

OUT THEMES

AEROSPACE AND DEFENSE

Traditional aerospace is out with Trump coming into office. GD 0.00%↑ LMT 0.00%↑ NOC 0.00%↑ HON 0.00%↑

NOC 0.00%↑ like many of these names rolling over on lower highs. Trump trade is short aerospace imo with conflict likely to deescalate when he takes office.

See you next time, right here.