Introduction

Hello Investors,

Welcome back to another edition of: The Weekly Selection, where I go over the broad market, my thoughts on direction for the week, some helpful tips, as well as stocks and charts I am watching.

As many of you know, there was no newsletter two weeks ago. From that week to now, a major move has taken place, putting loads of stocks on once empty watchlists. When people come to me and say things like “we missed it” or “the market will never be the same” I’m always sure to remind them of the unpredictability of the market, and how no matter how bad or good things look, a turn is just ahead.

Lets get into the indexes for the week. For my newer readers, the indexes track large portions of the market all together, acting as an average performance of a bucket of stocks. These generally give a good insight on the health of the market.

SPY 0.00%↑ is up first, and as it can be observed, it has traded into its downtrend. I will be watching this for either a rejection or breakout.

QQQ 0.00%↑ represents a more tech focused outlook, and it has already broken out of its trend. QQQ being one step ahead of spy on the breakout is good news for spy, but its important to watch both and see what’s going where as it may give a clue to the other.

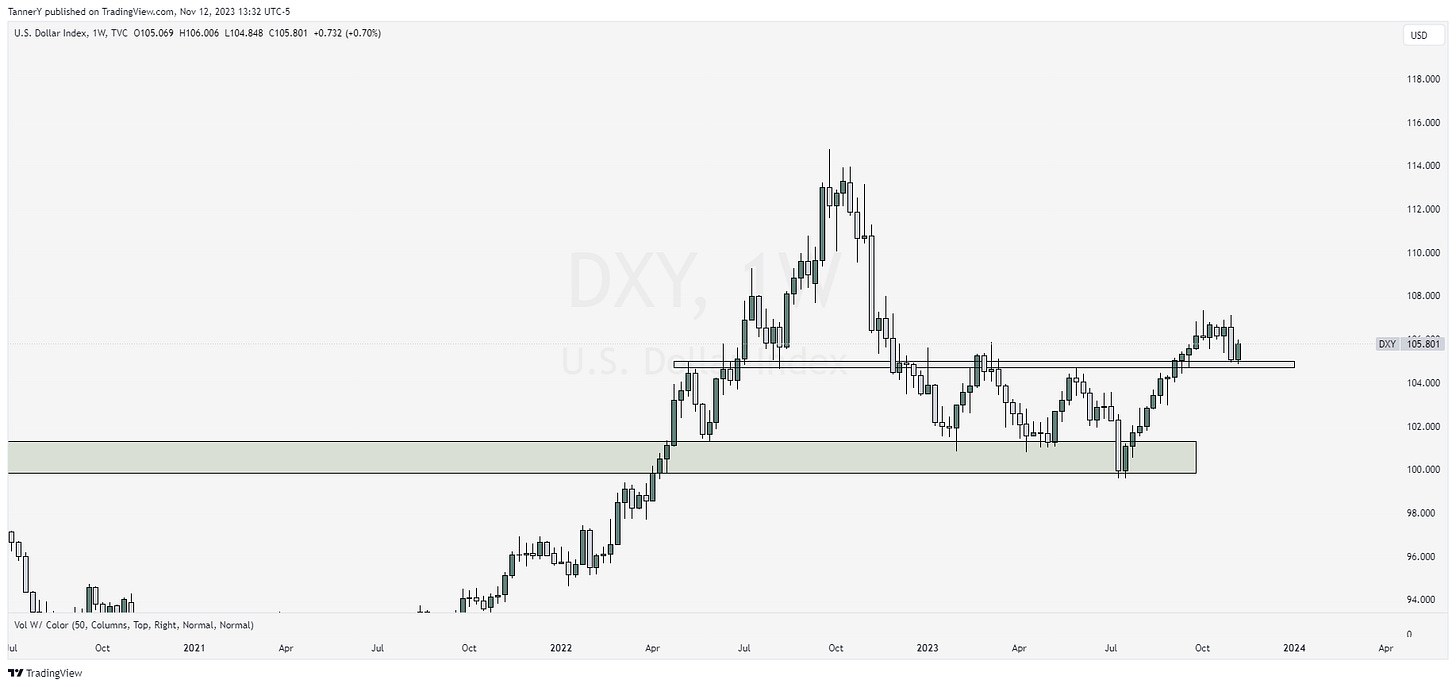

$DXY represents the USD. While difficult to chart, its still important to pay attention to as traditionally if the USD is up, stocks/equities are down and vice versa.

Crypto

I don’t usually talk about crypto, but with the launch of crypto ETFs coming to market soon, I will chart the two primary cryptocurrencies, Ethereum and Bitcoin.

Bitcoin first. With the announcement of the BTC ETF which will effectively allow people to easily buy Bitcoin, The price has risen significantly out of its base. Now it approaches an area of resistance, where either a consolidation or rejection will occur. Id like to see it consolidate here until the launch of the ETFs push price above to keep the run going.

Ethereum hasn’t had as much of a run as BTC, however it is in a similar technical spot. I’m personally more a fan of Ethereum than BTC.

**If you want to see more Crypto content, leave a comment on this post so I know to include it again**

Tip of the Week

Run the scans. Even if markets are bad, or there’s nothing on them, run it. I run my scans multiple times a day everyday, regardless of conditions because I want to be the first to see the turn in sentiment. This pays dividends long term. No pun intended.

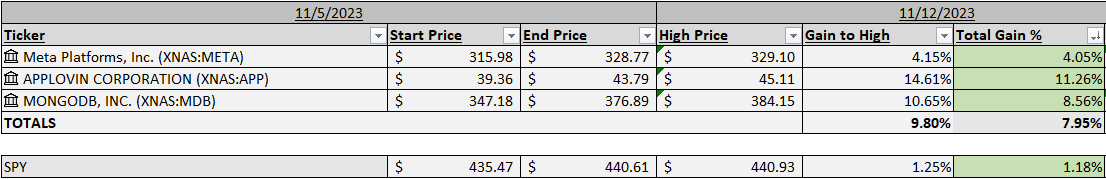

Past Performance

Top gainers from the weekly selection last week. TDW 0.00%↑ reported earnings, which I was unaware of and got hit pretty bad on for -15% bringing the all in total to 2% positive on the week. APP 0.00%↑ was a clear standout, breakout out of a long base.

Charts

PANW 0.00%↑ is on watch for earnings this week. Traditionally a high earner, a breakout to fresh highs could be electric for a trade.

VRT 0.00%↑ with earnings out of the way, I like the pivotal look here for continuation

MDB 0.00%↑ weekly breakout. big old candle to confirm. Love this long.

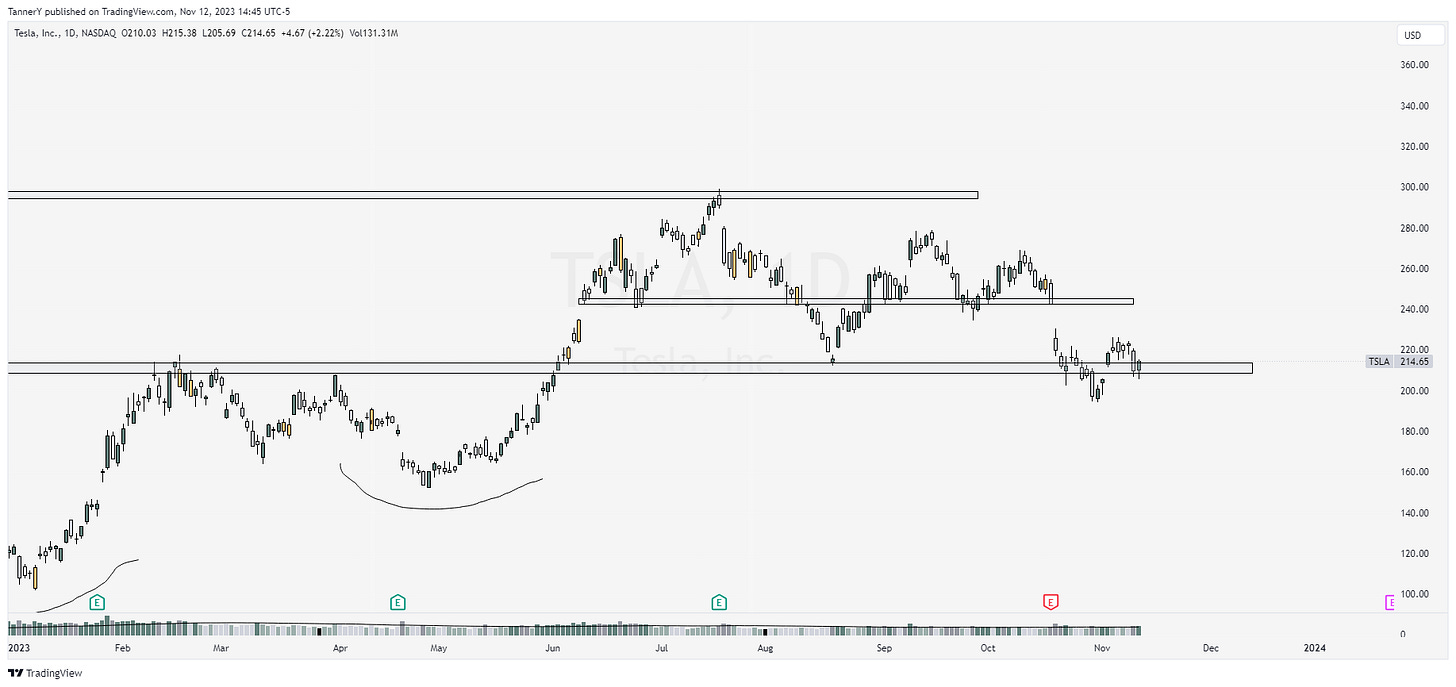

TSLA 0.00%↑ sitting on a key support. Are the glory days over? Or does the once titan have a run in the tank.

That’s all for this week!

If you enjoyed:

Like this post

Subscribe to see more content

Share with a friend

See you all next week.

Green at Info, love the big picture stuff!