Investors,

Welcome back to another iteration of ‘The Weekly Selection’, where I cover my thoughts on the market, what’s upcoming and some other little nuggets for your enjoyment.

Before we begin, get active on the rest of my socials:

SOCIALS

Subscribe to the newsletter!

Election

The election is over, Donald Trump is the winner. As we discussed last week, to me the election was something to get out of the way, more that something to be weary about. Historically, the trend of before the election is the trend after, so this event, while important for the world, doesn’t have as much of an impact on the market in the near team as many think.

Below is the data to back up presidents having attempts on their life being a positive for their campaign:

As you can see, the data was suggestive of Donald Trump winning after someone made an attempt on his life.

Indices

As it can be observed, SPY 0.00%↑ takes out the highs and continues its monstrous run, starting a little more than a year ago now. Not really much to comment on here, Historically, as states last week, the market continues the trend prior to the election.

IWM 0.00%↑ notable for the first time in a while. I think this index is impacted heavily by candidate. Trump supporting domestic businesses bodes well for small/midcap names that are not globalized like most of the large players.

GLD 0.00%↑ the gold trade is starting to fade. Naturally, with the election over there is less uncertainty in the market. Gold being the uncertainty asset means it tapers off when a political catalyst comes to pass.

Again, as I discussed last week, the S5FI tracks stocks above their 50day moving average. Its important to track this, but also note that the data can change in a hurry, as we saw this week.

Parabolic Trend Analysis

NIO 0.00%↑ saw a huge run in 2020-2021. In fact, this was one of the first runs I really capitalized on and was able to hold for a huge equity gain. This was mostly due to the fact that It barely ever crossed below SMAs, and the options were underpriced well into the run.

Another large reason for the run was favorable government policy changes. NIO was supported by the Chinese government, which basically means they’re going up, as we all know how risky Chinese Investment can be prior to regulatory certainties being established.

*This portion of the newsletter takes considerable time in researching the stocks and why they ran. If you enjoyed, consider liking this post and sharing with a friend.*

Charts

IN THEMES:

CRYPTOCURRENCIES AND RELATED -

MSTR 0.00%↑ SMLR 0.00%↑ IBIT 0.00%↑ BITX 0.00%↑ COIN 0.00%↑ CORZ 0.00%↑ IREN 0.00%↑ WULF 0.00%↑ CLSK 0.00%↑

With the presidential election out of the way, crypto now begins its breakout. I will have a full crypto article sometime this week, but for now, these are some names I am watching in the stock world of crypto/crypto related names.

SMLR 0.00%↑. This is a BTC proxy just like MSTR 0.00%↑, however they are cashflow positive and operating at the same premium as MSTR. I believe that this smaller market cap version of MSTR has the ability to garner a larger premium to their BTC holdings because of their standing as a business, outside of their BTC treasury. Additionally, because of their small size, institutional participation would be extremely potent.

ELECTRICY/POWER GRID (LARGE)

POWL 0.00%↑ VST 0.00%↑ CEG 0.00%↑ TLN 0.00%↑

VST 0.00%↑ Reports a blowout quarter, I think this is a great name over $145.

SPECULATIVE NUCLEAR (MINI)

SMR 0.00%↑ OKLO 0.00%↑ LEU 0.00%↑ ASPI 0.00%↑ NNE 0.00%↑

ASPI 0.00%↑, not the most perfect tight look, however it has that low sweep and rally look that I like quite a bit. ASPI is also a core piece of the nuclear value chain, as they are providing the isotopes for everyone’s nuclear operations. In additional to this, they are working on quantum enrichment, which I think shows their diverse capability in providing value to a plethora of important and futuristic industries.

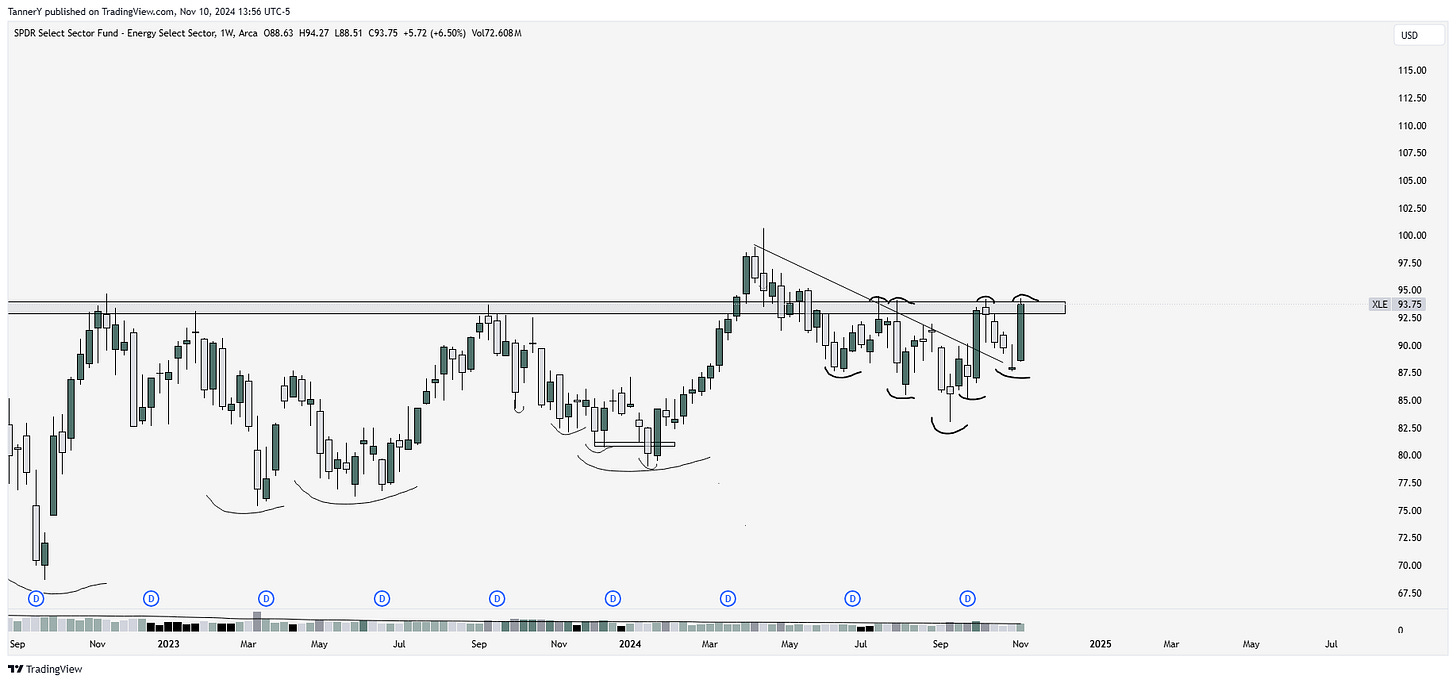

ENERGY

Energy makes a swift return to the ring, as Donald Trump takes office and speculators assume he will benefit the fossil fuels markets.

XLE 0.00%↑ COP 0.00%↑ XOM 0.00%↑ MPC 0.00%↑ PSX 0.00%↑

OUT THEMES

Not a single red sector this week. See you next time, right here.