The Weekly Selection: 11/06/2022

Volume 12

Introduction:

Welcome back investors,

What a week! We saw volatile index movement, mostly due to the feds decision to raise rates by 75 basis points (.75%). This upcoming week should be a bit more mellow, although there are quite a few large companies that have yet to report earnings, giving the potential for further market volatility. Expect my stock ideas to be a bit more conservative this week, as the indexes are positioning in an area of uncertainty.

SPY 0.00%↑ seen below:

The last couple weeks have reminded me of other less interesting mini runs in this downtrend. From what I’m seeing, and what Powell is saying, this trend will continue, and my stock ideas will reflect that.

Quote of the week:

“He who lives by the crystal ball will eat shattered glass”

- Ray Dalio

Ray Dalio, one of my all time favorite investors said this quite some time ago, but I think it applies well to current market conditions. I constantly see people contradicting themselves, making wild baseless claims about market direction, and then just being terribly wrong in the end. I try and keep this in mind as I make these newsletters, since there’s too much uncertainty to be totally confident in anything.

Past Performance:

Individual stocks didn’t perform as well as I had hoped, with oil not really doing much outside of the big names. SRPT 0.00%↑ reported earnings which I didn't catch, silly mistake on my part. UDMY 0.00%↑ has a stronger look than it did last week.

Charts:

What everyone is here for, lets get to it.

AEHR 0.00%↑ with strong action yet again. This pullback to the previous local resistance (top green box) and strong bounce off of it, indicates continuation potential.

IBKR 0.00%↑ with a longggg setup. May take this for a swing on a breakout

CPRX 0.00%↑ with a flag falling into the moving averages. I will look to enter a position.

ENPH 0.00%↑ Depending on how this acts around the long term demand zone (green) I may look to long. Continually strong earnings and relative strength to the market.

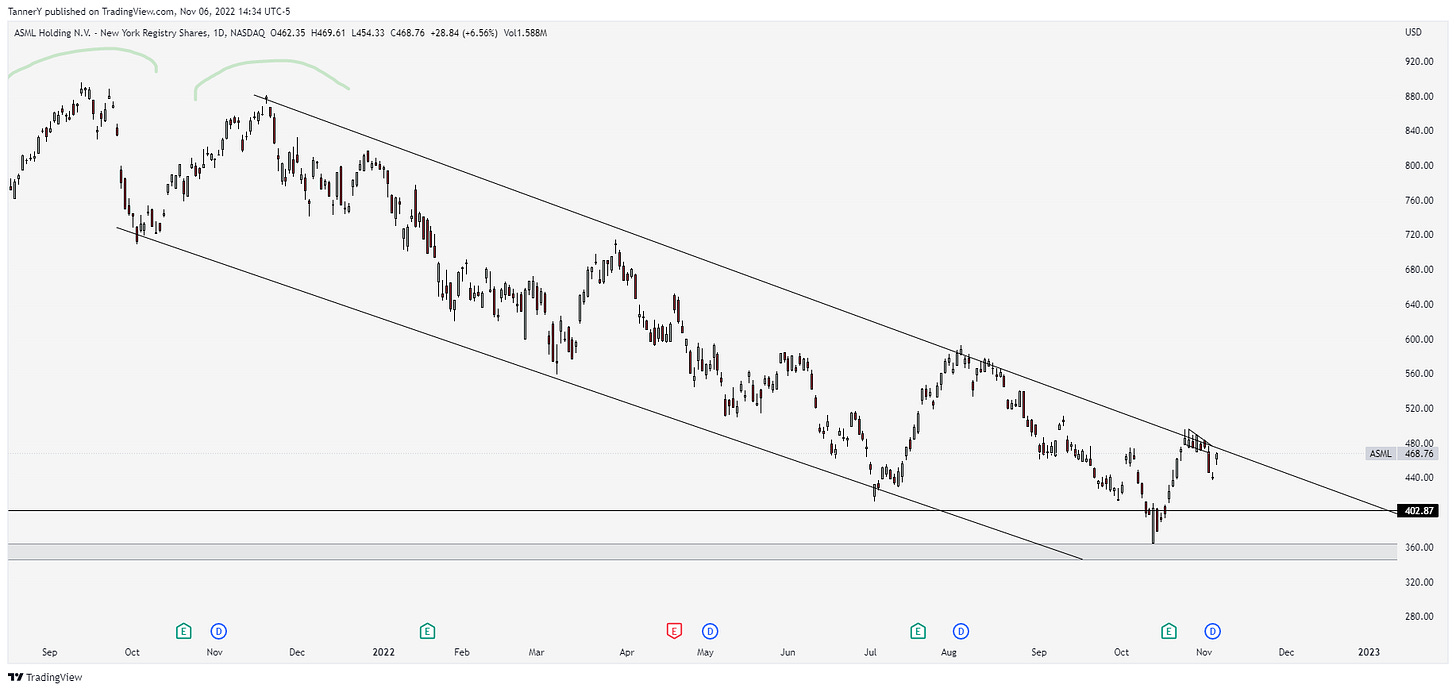

ASML 0.00%↑ love this channel setup.

Thats all for this week. Like I said, staying nimble in these uncertain times is best. Take profits, protect gains and learn as much as you can.

Follow me on twitter HERE

- Tanner