The Weekly Selection: 10/27/2024

Hallo-war

Investors,

Welcome back to another iteration of ‘The Weekly Selection’, where I cover my thoughts on the market, what’s upcoming and some other little nuggets for your enjoyment.

Before we begin, get active on the rest of my socials:

SOCIALS

Subscribe to the newsletter!

Indices

SPY 0.00%↑ up first. Similarly to last week, we are still in the second pivot range above the main breakout from August. As I’ve discussed before, we usually get three good pivot moves of one month or less outside of a main, larger pivot. This action we’re seeing now is healthy.

Where the cracks start to show is in the S5FI, where this week alone we saw a large decline in sp500 stocks above the 50sma. While this isn’t an end all be all, its worth taking note of as it gives a good frame of reference for where the market is outside of the buzz stocks.

GLD 0.00%↑ continuing to act well! Seeing a large move over the weekend as well with Israel starting to roll out offensive operations in the Middle Eastern theatre.

Parabolic Trend Analysis

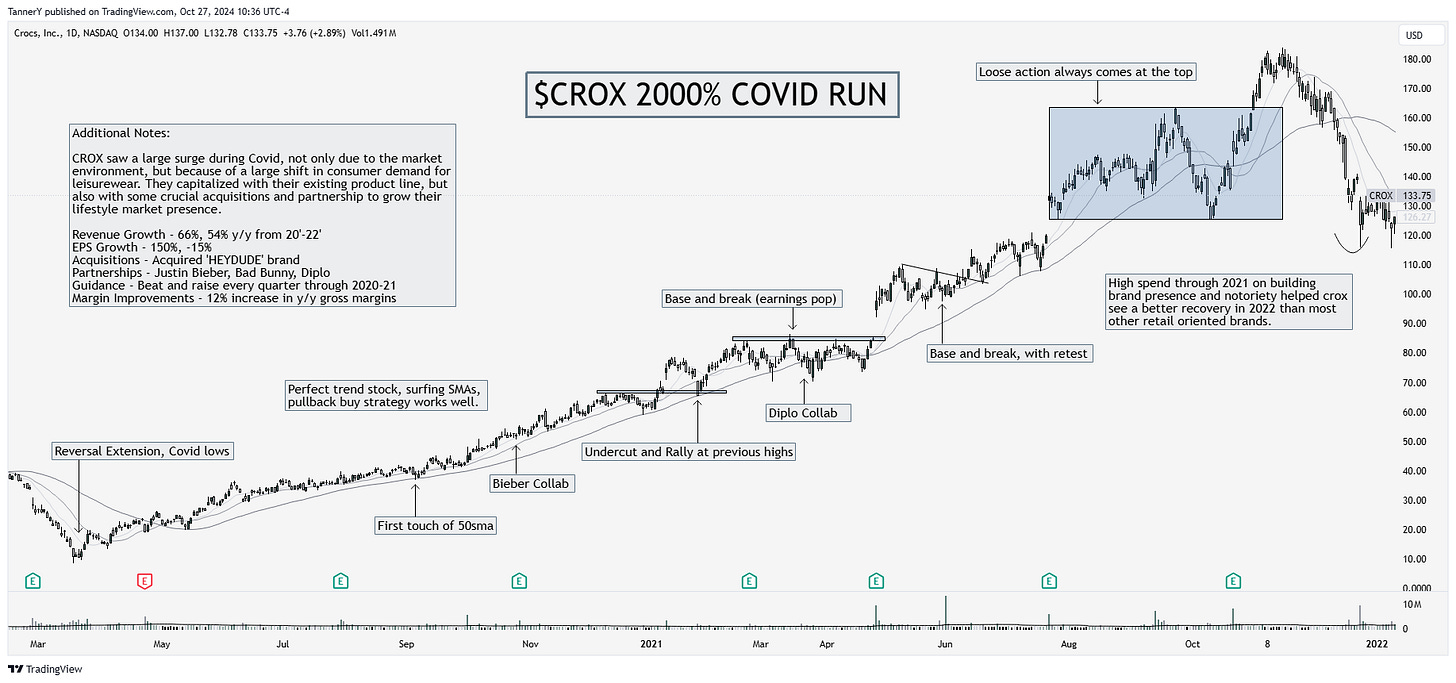

CROX 0.00%↑ saw a huge Covid move, not only due to the market environment but also their execution of a strategic brand push to get to the forefront of athleisure in a rapidly changing clothing landscape.

*This portion of the newsletter takes considerable time in researching the stocks and why they ran. If you enjoyed, consider liking this post and sharing with a friend.*

Charts

Lets get into the charts for the week. Again, if you missed it last week, I have changed the structure of this portion to include more stocks and have less pressure on the Monday-Friday positions. That type of trend analysis for a full weeks move has not been working well this year, so I think this change is warranted.

IN GROUPS:

Nuclear: SMR 0.00%↑ OKLO 0.00%↑ NNE 0.00%↑ TLN 0.00%↑ CEG 0.00%↑ VST 0.00%↑ %

SMR 0.00%↑ best in class look for the nuclear theme. High tight flag above all time highs. This is a 5 star setup that meets all the criteria of a monster stock in the making.

Magnificent 7 stocks: NVDA 0.00%↑ AAPL 0.00%↑ AMZN 0.00%↑ NFLX 0.00%↑ MSFT 0.00%↑ GOOGL 0.00%↑ META 0.00%↑

GOOGL 0.00%↑ Is the top look for this group in my opinion. They report earnings this week, along with much of the market. NVDA 0.00%↑ is also notable pushing up to ATH yet again.

Crypto/miners: MSTR 0.00%↑ WULF 0.00%↑ IREN 0.00%↑ CORZ 0.00%↑ IBIT 0.00%↑ APLD 0.00%↑

WULF 0.00%↑ tightening near a local high. If crypto is going to make a run, theres a menagerie of good names in this group to focus on.

OUT GROUPS:

Homebuilders: XHB 0.00%↑ BLDR 0.00%↑ LEN 0.00%↑

BLDR 0.00%↑ is the worst looking of the group. After such a long run, the breakdown near the highs here is notable. This group can shape up fast, but for now it looks like more downside than up.

That’s all for this week! don’t forget to like and share.

SOCIALS

Nice. Menagerie indeed!