Introduction:

Hey Everyone,

What a week! Indexes finally closing higher with conviction, monster individual stock breakouts and the start to earnings season. So far so good with banks leading the charge, most of which had ‘ok’ things to say. In this market, we will take it.

The upcoming calendar for this week is looking daunting, with some heavy hitters up to bat. As far as price action is concerned, markets appear strong, closing up 2.82%, the largest gain since June. Friday also marked another ‘OPEX’, or the day in the month where the most contracts expire. This usually stokes a directional move in underlying equities, like we saw.

SPY 0.00%↑:

As we can observe, SPY 0.00%↑ is holding this area which contains June lows and some post Covid breakouts. Both of which have been crucial for the market. Id like to see this continue to serve as a base if we’re expected to get any kind of run into the holidays.

Economics Calendar:

Nothing overly spectacular to see here until Thursday, which packs in GDP and Fed balance sheet updates.

Past Performance:

Individual stock picks from last week performed well, with all stocks trading up, and an average gain of 6.84% from open to close. ASML 0.00%↑ had a hell of a week, reporting astonishing earnings and getting some follow through action afterward. Of last weeks picks, I took ASML 0.00%↑ and ADBE 0.00%↑, holding them into this week.

Weekly quote:

“To be an investor you need to be a believer in a better tomorrow”

-Benjamin Graham, Father of Fundamental analysis

This quote has always stood out to me, as it strips away the financial aspect of investing, and cuts to the core of why companies exist in the first place, to innovate and create.

Charts:

Before getting into this weeks tradeable setups, Id also like to spotlight AEHR 0.00%↑, a wafer level semiconductor testing company which has been on a tear recently. I first mentioned it a few newsletters ago, and its been performing exceptionally every since. On my twitter, I alerted a leveraged position to go with my equity, which ran over 1000%. My page can be found HERE. The AEHR 0.00%↑ chart is as follows:

Doing exactly as we’d hoped, AEHR broke out a few days after strong earnings, and trended up with broad market afterwards. Something to remember, stocks that trade flat while the broad market trades down are typically the stocks that will trade higher, faster when markets recover.

Below are a few more setups I like this week, and remember, these are price action related, having nothing to do with the health of the company like last weeks newsletter.

$CLFD: Pretty self explanatory with the notes right on the chart. Loving this daily inverse head and shoulders look.

FOUR 0.00%↑ : Solid daily flag, well above June/July lows. Looking to see a break to the upside and maybe some good earnings in early November.

GUSH 0.00%↑ with a solid inverse head and shoulders pattern forming, as well as a large gap to fill above. Energy is also the leading sector right now.

CROX 0.00%↑ : Inverse head and shoulders on the weekly, looking like a strong candidate for solid earnings as well. Id like to long this above that 50sma pictured above.

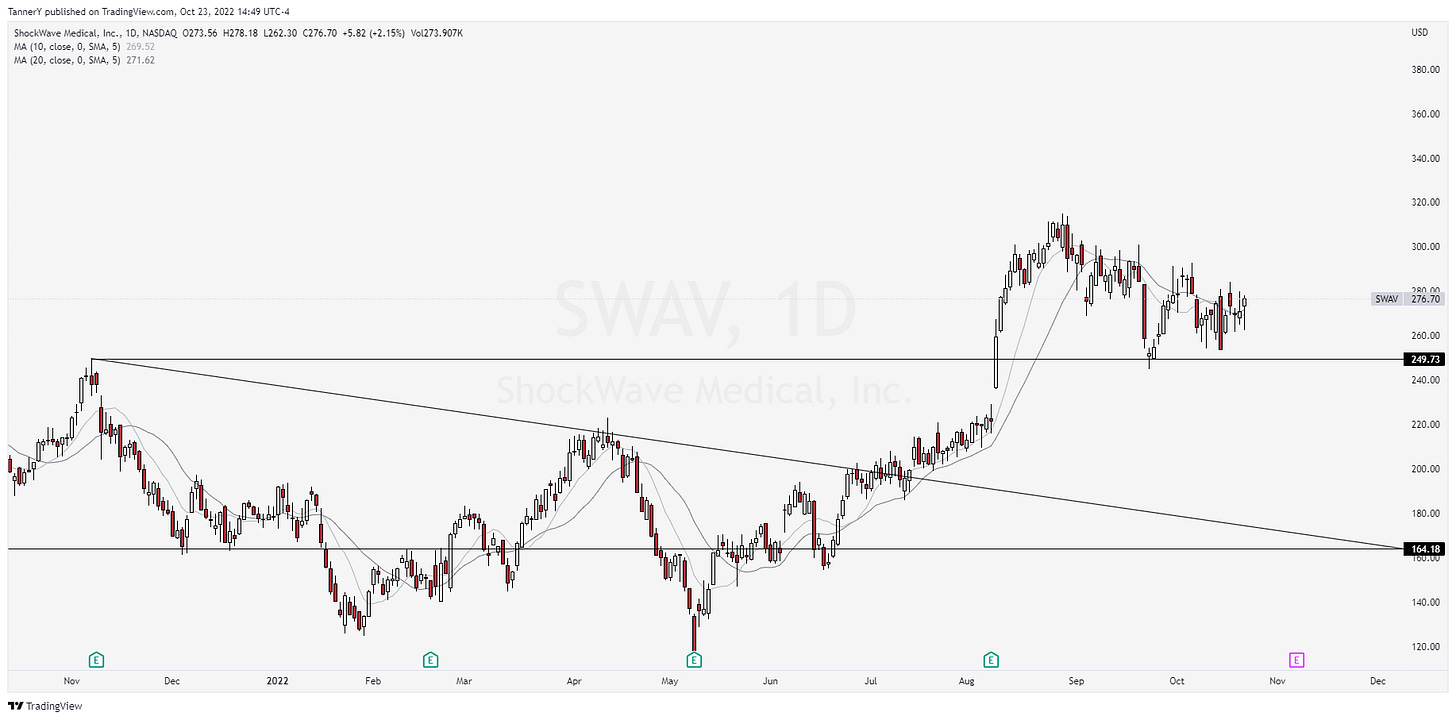

SWAV 0.00%↑ : On the off chance healthcare wants to make another run, SWAV is looking good.

That’s all for this week guys!

If you enjoyed, Feel free to subscribe at the top or bottom of the page for free.

-Tanner