Investors,

Welcome back to another iteration of ‘The Weekly Selection’, where I cover my thoughts on the market, what’s upcoming and some other little nuggets for your enjoyment.

Before we get into it, I’m going to switch my socials from the bottom to the top, for better exposure.

SOCIALS

Subscribe to the newsletter!

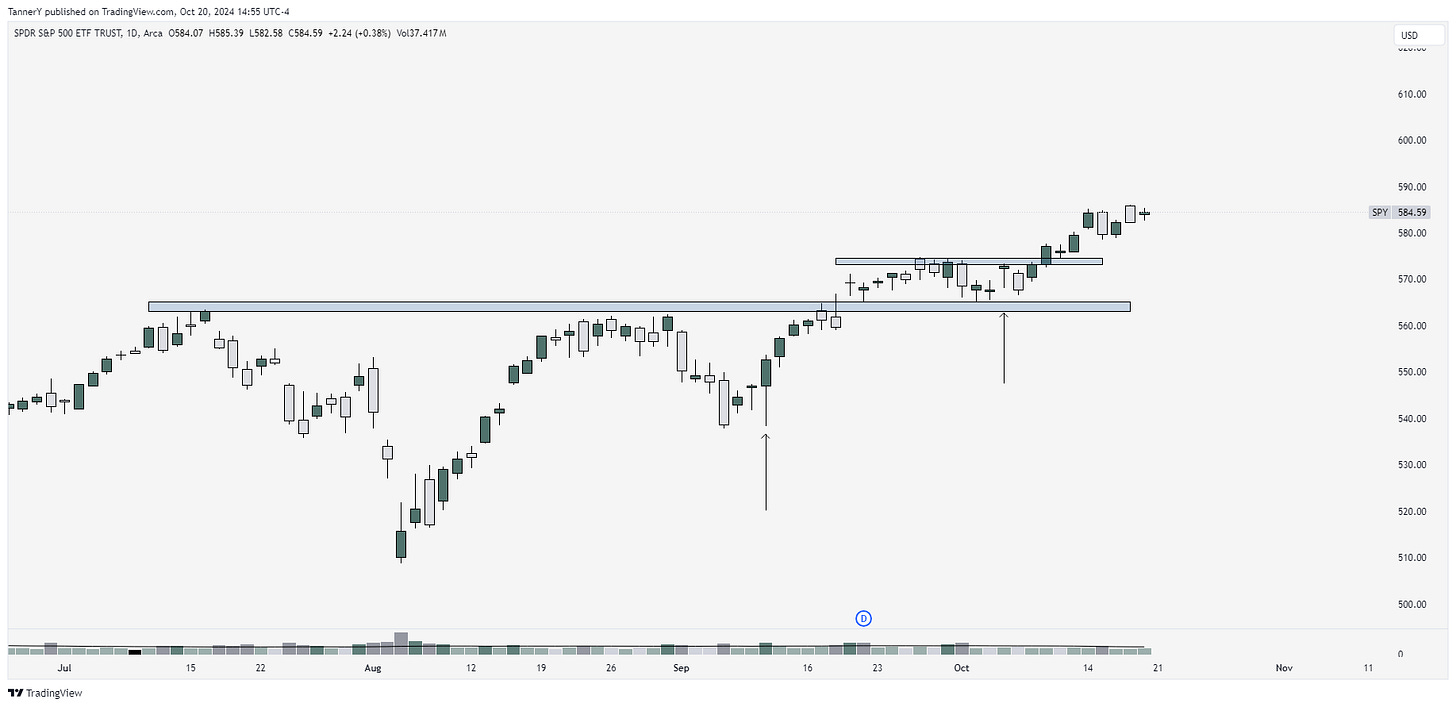

Indices

SPY 0.00%↑ moves away from second pivot point. As we’ve discussed in times of recent, this is healthy action, and I will only start to get concerned once we are 3 pivots away from the initial break from the August base.

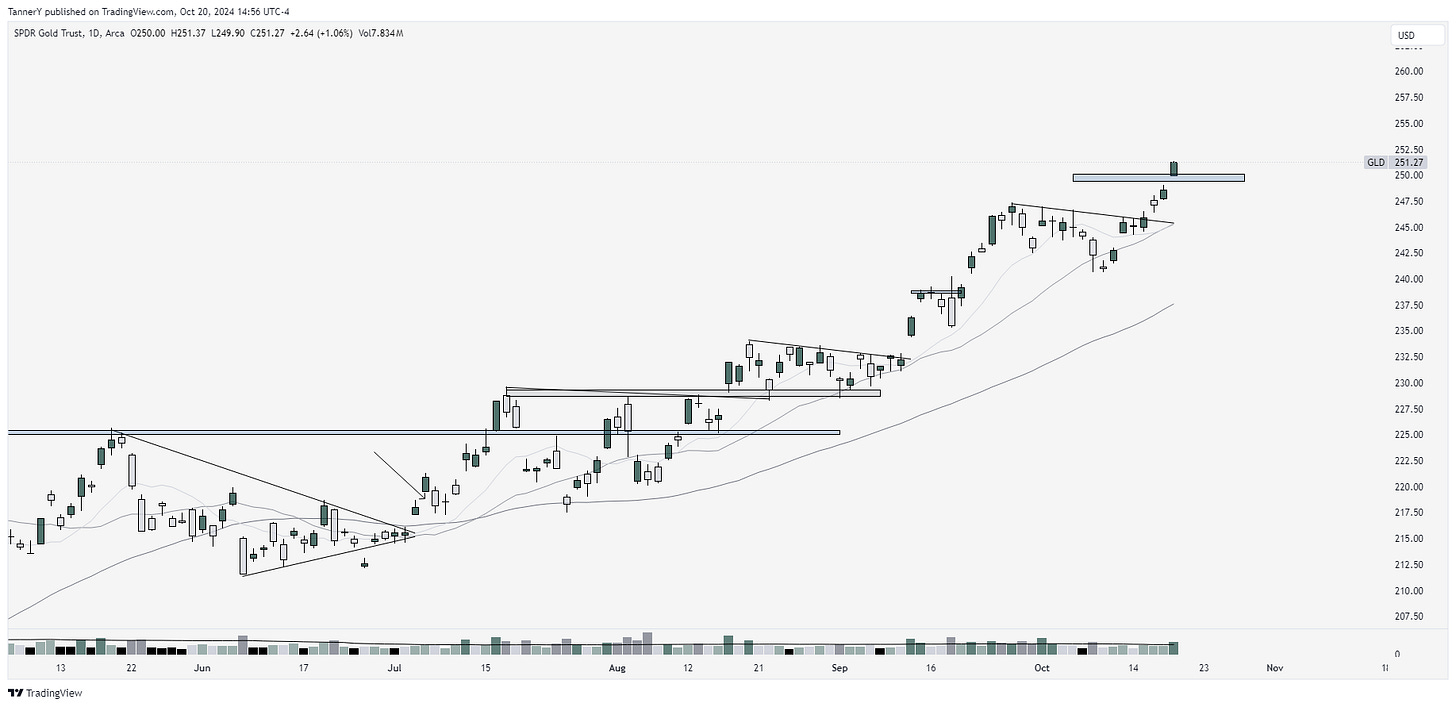

GLD 0.00%↑ extends gains into all time highs. This is going to be my trade of the year as it quickly approaches SMCI 0.00%↑ levels of success. We have been all over this move in this newsletter since last October.

QQQ 0.00%↑ still void of participation at the all time high. To me this signifies the possibility of a thrust upward from megacap tech.

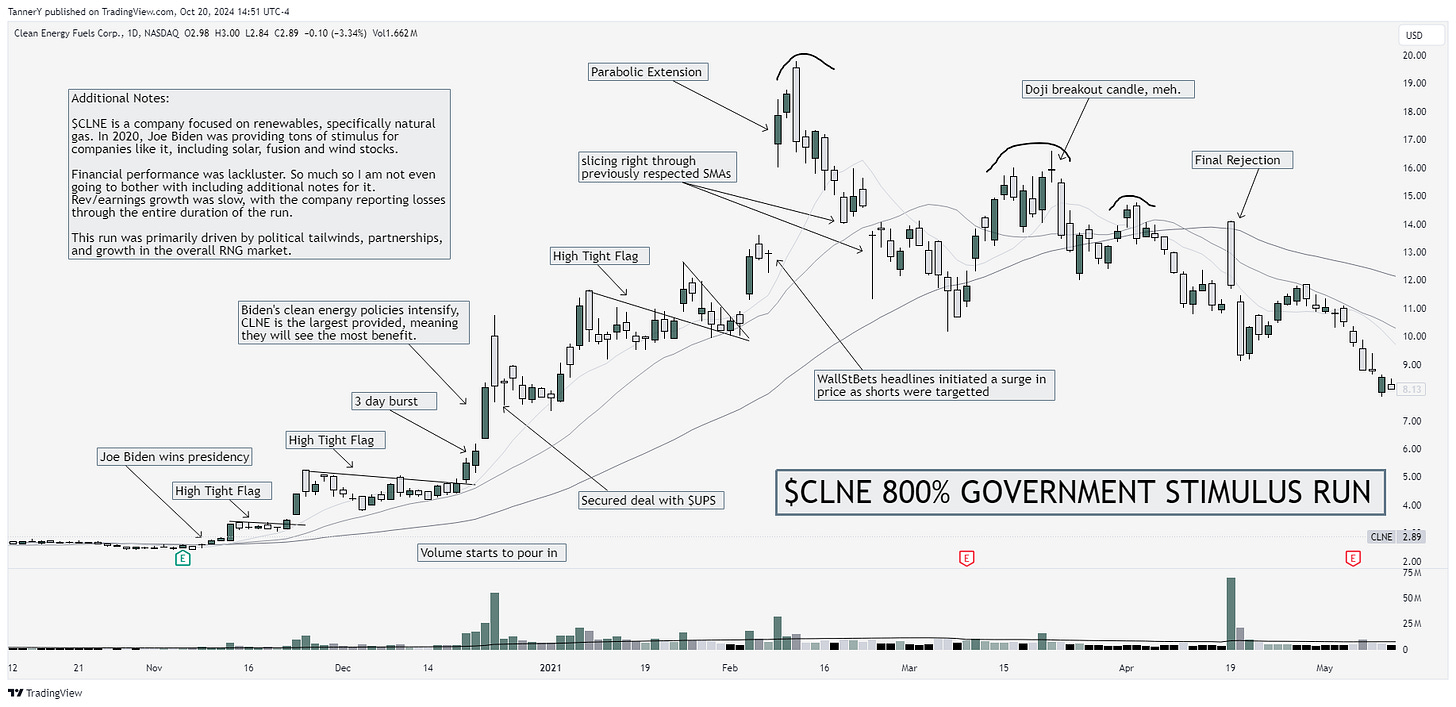

Parabolic Trend Analysis

CLNE 0.00%↑ is a renewable natural gas company. In 2020, when Joe Biden came into office, the catalysts for this company began to pile in as people realized the power some government stimulus could have. This came to fruition, as the stock saw an 800% run in just a few short months. With the election coming up, think about what industries or sectors may benefit from one side or another getting elected. Regardless of who you want to win, there will be opportunity.

*If you enjoyed this portion of the newsletter, consider subscribing or pledging. This portion of this free publication takes the most time, and your support would be greatly appreciated.*

Past Performance

I don’t have my excel sheet in front of me currently, but the performance last week is as follows: UBER 0.00%↑ & AMD 0.00%↑ traded down, rejecting pivots. MOD 0.00%↑ traded flat, and MRVL 0.00%↑ and STX 0.00%↑ both traded up. It was an OK week, I think the performance vs the market is close, maybe slightly underperforming as UBER just totally crapped the bed.

Charts

Ive been thinking about ways to optimize the newsletter even further, and I think I may have found a way without sacrificing the quality. I want to incorporate a theme (IN/OUT) analysis where I can quickly supply stocks that are in rotation or out. I think this will allow people to see more names from this newsletter, as well as maintain the thematic quality that keeps my stocks at an edge. This will however give more total stocks to look at, and not all will have charts. If you like, or don’t like this change, let me know in the comments below.

THEMES IN:

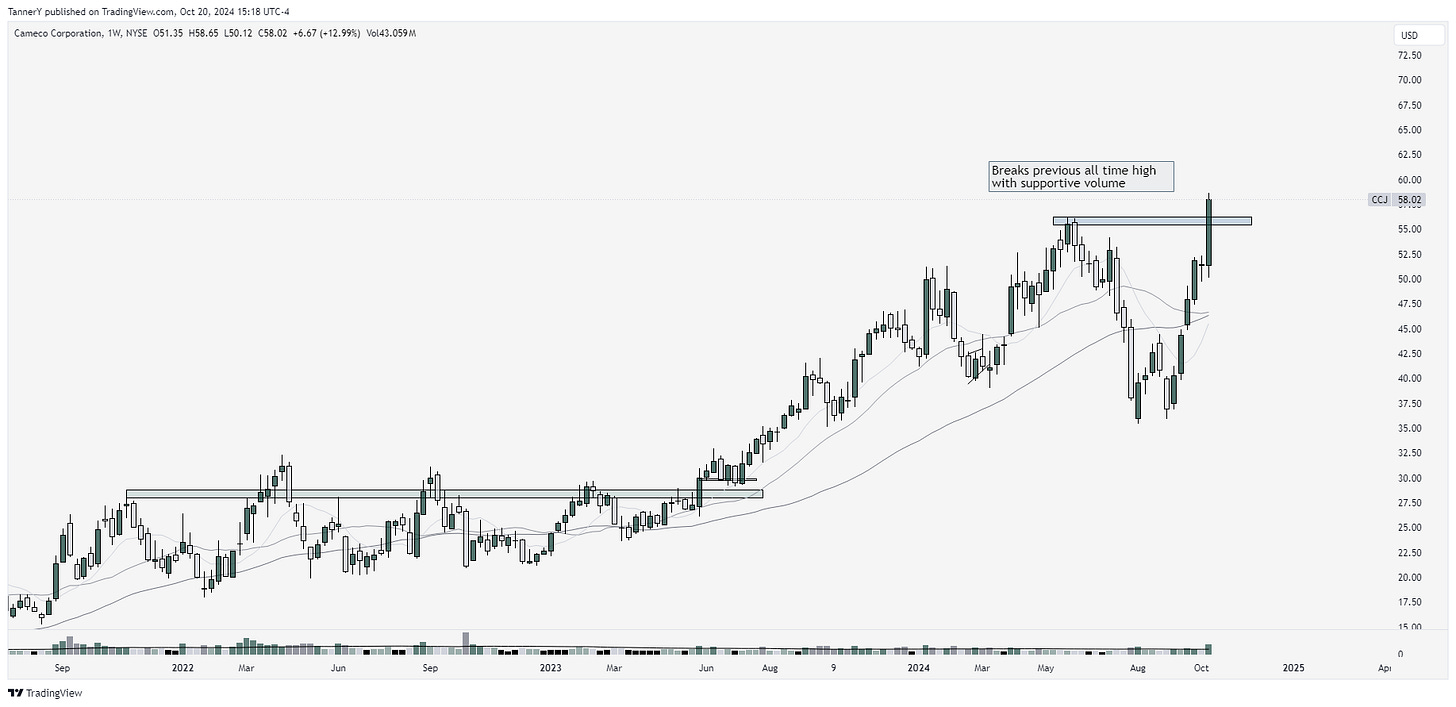

URANIUM: URA 0.00%↑ CCJ 0.00%↑ UEC 0.00%↑ NXE 0.00%↑

Uranium names are heating up as an adjacent to nuclear theme. CCJ 0.00%↑ is the market leader here.

NUCLEAR: NNE 0.00%↑ CEG 0.00%↑ VST 0.00%↑ OKLO 0.00%↑ SMR 0.00%↑ LEU 0.00%↑

Nuclear names have been running hot as deregulation comes into play and propaganda from big energy works to change the stigma for Americans with nuclear. See my TWITTER POST ABOUT THIS THEME HERE.

$OKLO is owned by Sam Altman, founder of OpenAI.

HOMEBUILDERS: LEN 0.00%↑ XHB 0.00%↑ BLDR 0.00%↑ DHI 0.00%↑ PHM 0.00%↑

DHI 0.00%↑ here representing the group well. consistently pushing all time highs and imo is in rotation going into 2025.

SPACE/SATELITTE: LUNR 0.00%↑ ASTS 0.00%↑ RKLB 0.00%↑ IRDM 0.00%↑

RKLB 0.00%↑ notable price action here. Definitely started to get extended but a great look.

THATS ALL FOR THIS WEEK. IF YOU ENJOYED:

Subscribe to the newsletter!

Might have to buy some Nuclear 🤔