Investors,

Welcome back to another iteration of “The Weekly Selection”, where I cover my thoughts on the market at large, as well as share some additional insights on stocks of the past.

Last week I was unable to get my Parabolic Trend Analysis out in time, so mid-week I went in and edited the article to include it. If you missed it: FIND IT HERE.

Alright, now that the formalities are out of the way, lets get into the work for this week. Oh, and be sure to share this post with your friends.

Indices

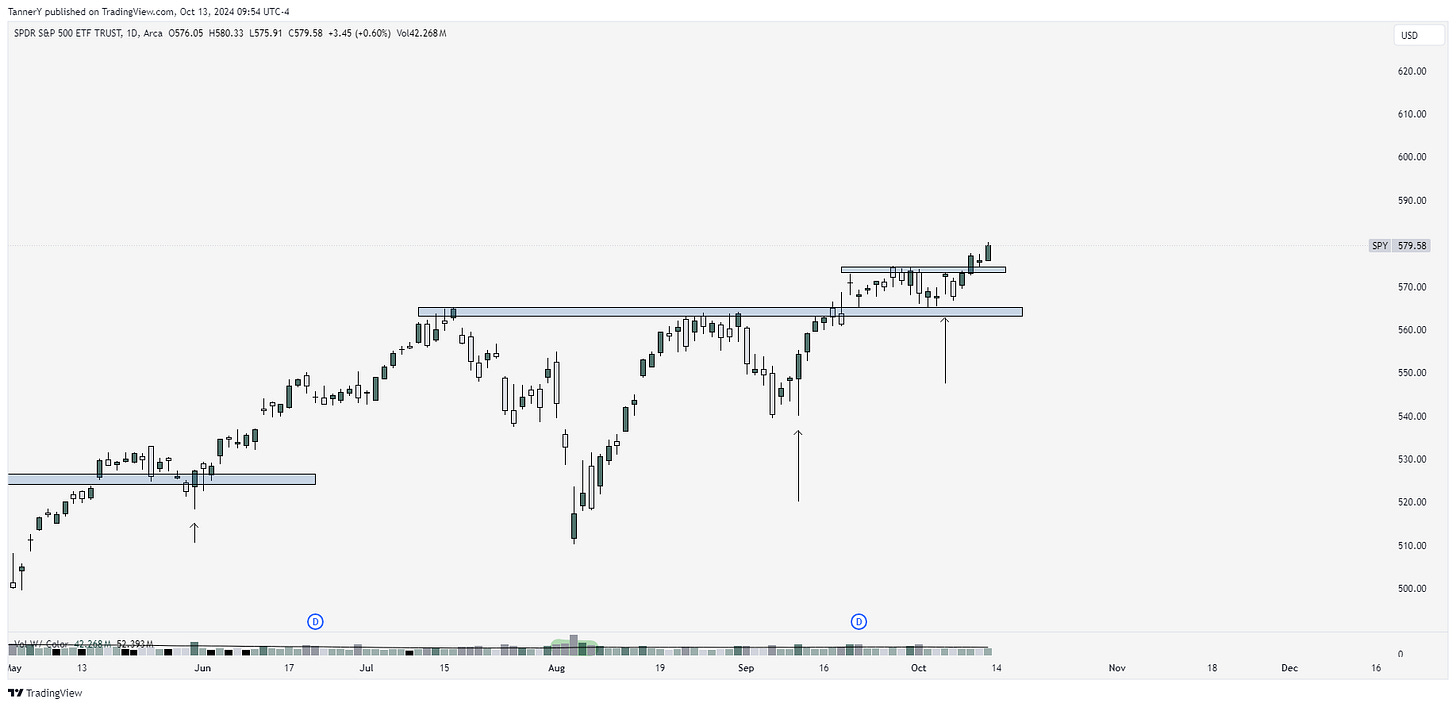

Last week, we discussed the “weak open, strong close” theme within the index, and how that was a sign of strength. This week, we see this come to fruition yet again, not only closing higher than last week, but doing so after a weak open on Monday.

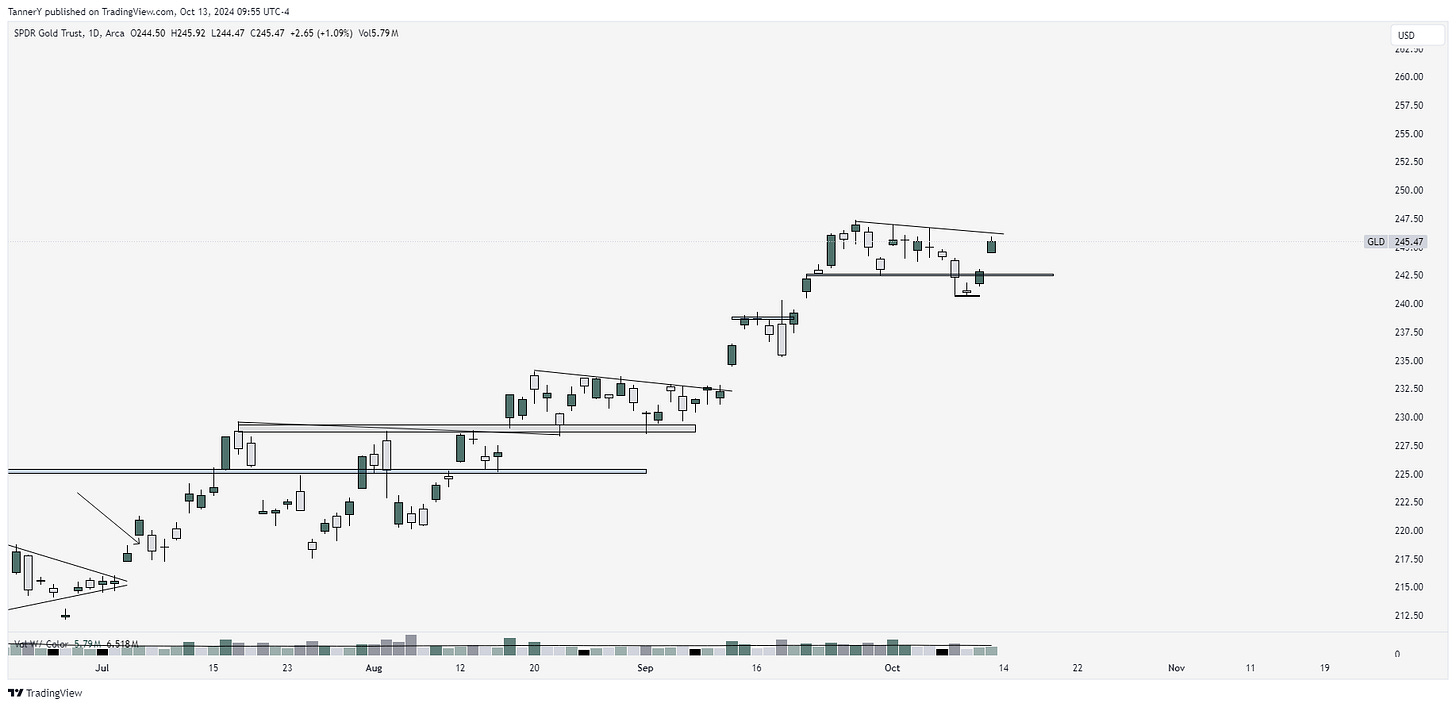

GLD 0.00%↑ Gold expresses a slight bobble in the middle of the weekly session this week. Again, last week it was discussed that GLD 0.00%↑ has a similar analog to that of the late 1970s, which plays out with a move up to roughly 249 before selling off. I think this is still in play, and the weakness shown this week is a testament to that.

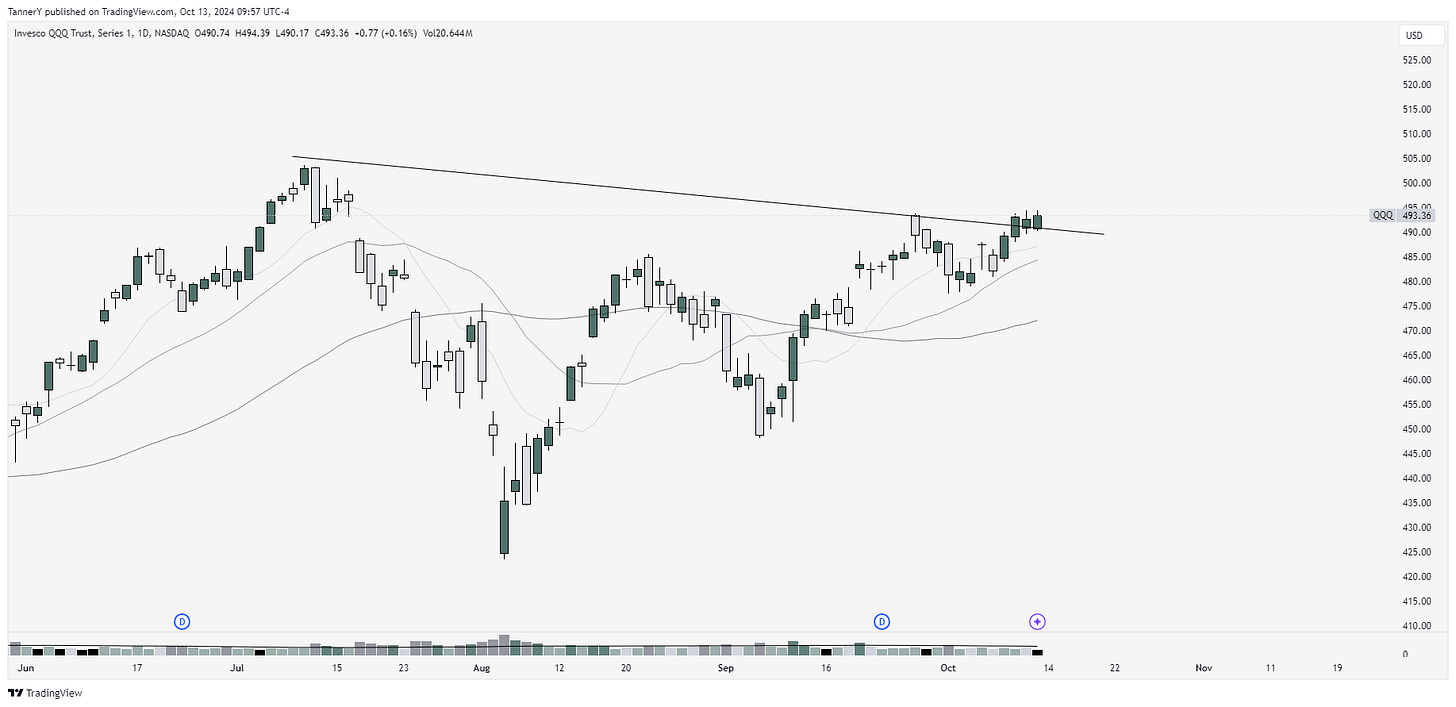

QQQ 0.00%↑, I don’t usually post Qs on here, but I will today as I had a question in the middle of the week wondering if QQQ divergence from SPY was a bearish indicator. It is not. QQQ represents a more tech heavy weighted market index. If we are seeing QQQ weakness, with SPY strength, it most likely means the non-tech sectors are performing well to tech weakness. This was true this week, as we saw Industrials and financials outperform heavily, two large components of SPY.

Parabolic Trend Analysis

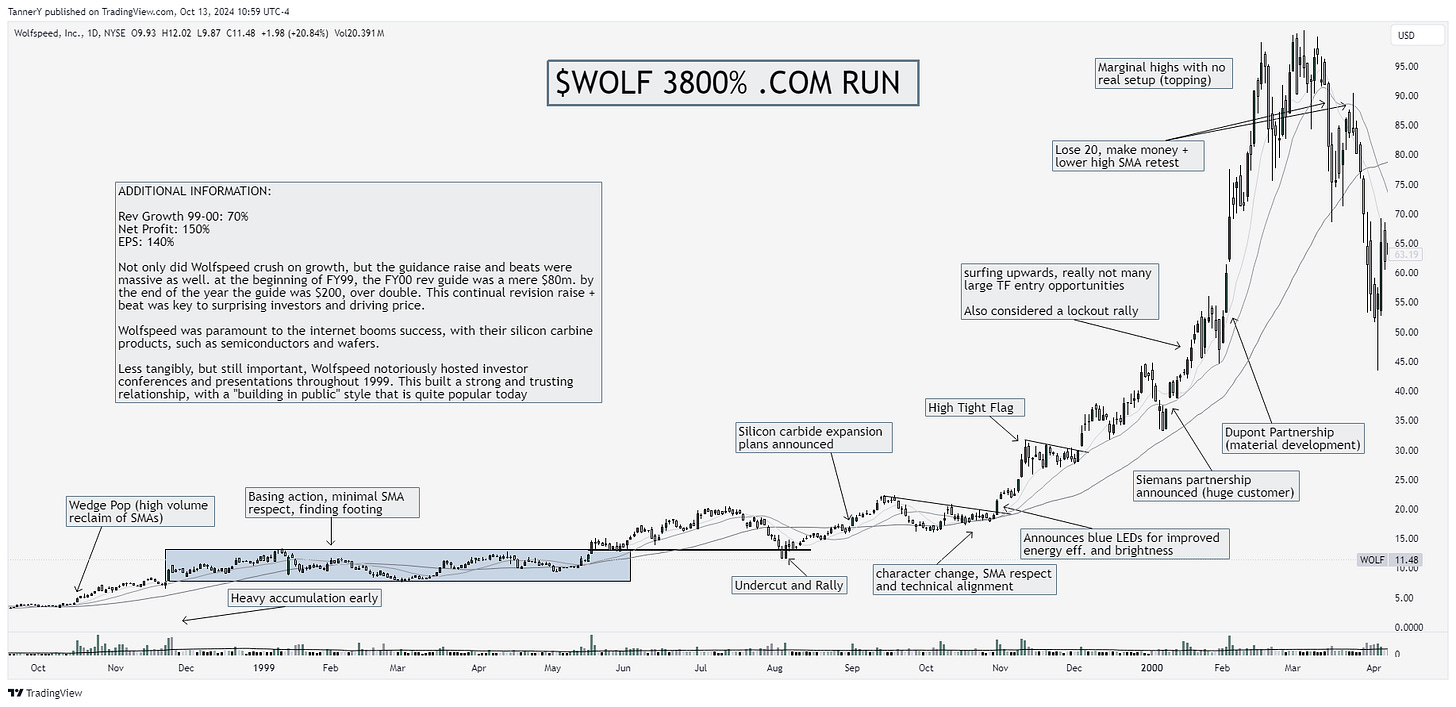

WOLF 0.00%↑ 1999 stock run was legendary, just like many other .com bubble stock runs. Their LED display technology drove E-commerce and digital marketing. Additionally, their silicon carbide technology pushed the development of high frequency and power devices. This was impactful in both telecom as well as broadband services.

*If you enjoyed this portion of the newsletter, consider subscribing or pledging. This portion of this free publication takes the most time, and your support would be greatly appreciated.

Past Performance

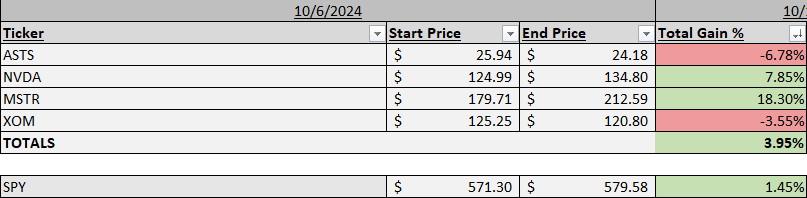

Performance was solid this week. NVDA 0.00%↑ and MSTR 0.00%↑ have been my primary focus list stocks for a few weeks now, and everyone is now seeing why. Fwiw, these have been on the last 3 newsletters. No reason to not see the opportunity there.

Charts

UBER 0.00%↑ with a nice EP over prev ATH resistance band.

AMD 0.00%↑ has been a laggard of the group for a while. This current spot gives good R/R for a potential run.

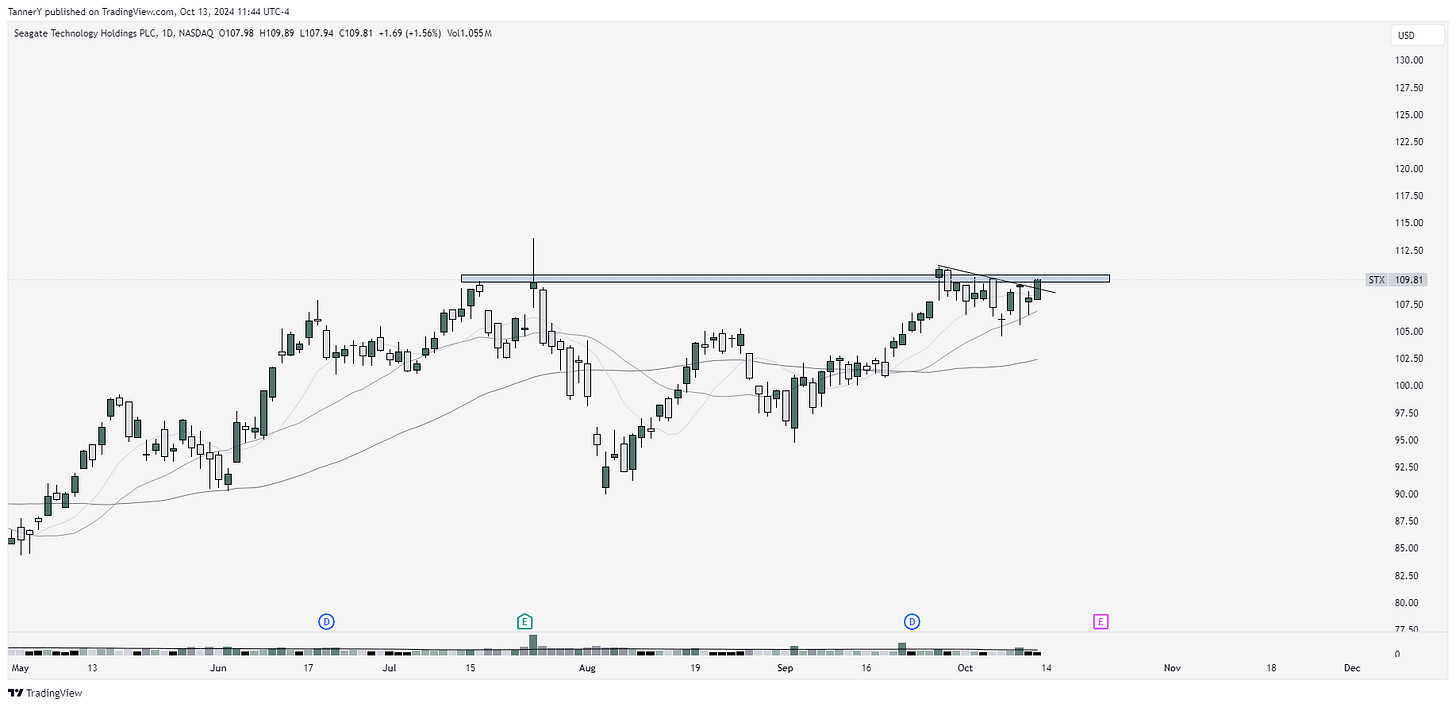

STX 0.00%↑ hell of a look here. Very tight right at pivot.

MRVL 0.00%↑ also extremely clean here.

MOD 0.00%↑ great look with manufacturing names shaping up well.

IF YOU ENJOYED:

Subscribe to the newsletter!

great job mentioning NVDA for a few weeks now. wild move as of late! near ATHs!