Introduction

Hello Investors,

Welcome back to another volume of The Weekly Selection. It seems as though we read last week like a book. Going into a tremendous amount of economic events and data, it was in my opinion to stay hands off and far away from the action. This course of action saved me quite a bit of headache.

Lets take a look at the carnage in the charts below:

SPY 0.00%↑ now beginning to build out a flag type look on the daily. With moving averages turned on, it is below all 3 primary. Not a good look. QQQ 0.00%↑ very similar chart, will refrain from posting.

IWM 0.00%↑ small/mids getting hammered again, about on par with SPY 0.00%↑

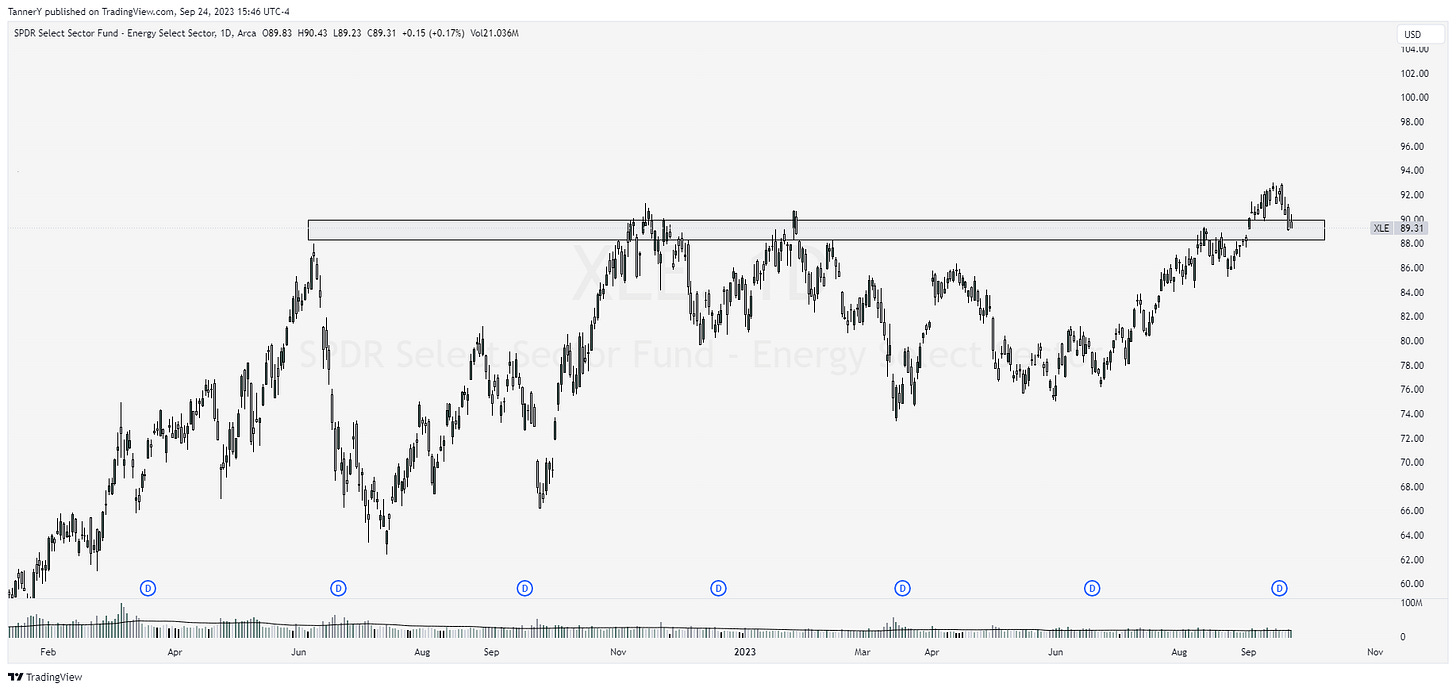

XLE 0.00%↑ energy pulling back into its ATH range, still an index to watch.

Quote of the week

“Markets can stay irrational longer than you can stay solvent”

- John Maynard Keynes

In a time like now where there is plenty of information to make a wild assumption about the market and the direction it is headed in, always remember this quote, as some of the best market runs have come in times where everyone thought it couldn’t happen, and vice versa.

Past Performance

I had nothing on my watchlist last week

Charts

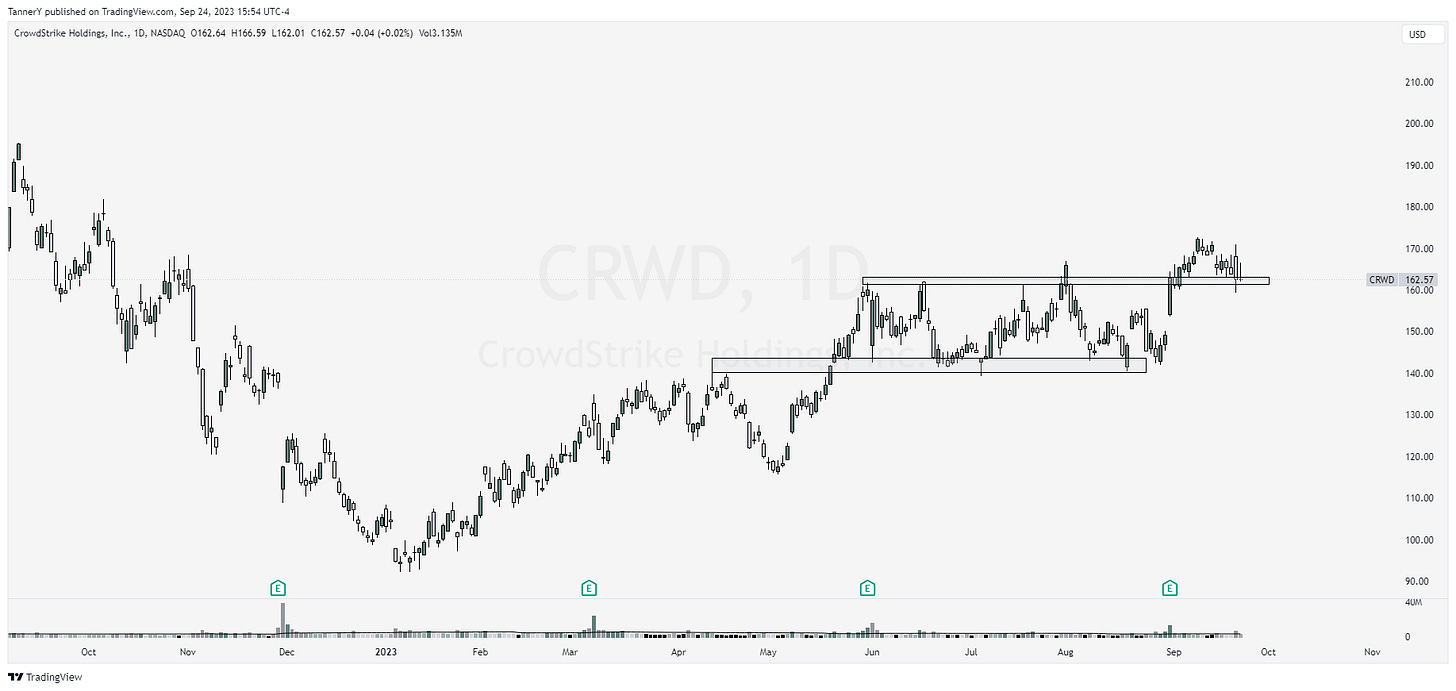

Charts this week may be a combination of breakout trades and bottom areas for some stocks. I am still playing quite reserved going into this week.

After changing their membership policy, COST 0.00%↑ Costco has experienced a nice run in share price and earnings. Technically speaking, price looks double topped and ready to draw back a little bit.

ADBE 0.00%↑ at $500 is a solid R/R long from a technical stand point.

CRWD 0.00%↑ likely sees a bounce off $160.

NVDA 0.00%↑ super whacky PA in this upper range. Some might even call it broken and overvalued. I would agree, but an argument can be made for this Point of contention ive drawn on there.

Alright, that is going to do it for this week!

If you enjoyed-

Follow my twitter: HERE

Join my free discord: HERE

Also, be sure to leave a like on this post to support me.