Investors,

Welcome back to another volume of The Weekly Selection. In this writeup, I cover my thoughts on the markets, some events to anticipate, and my analysis of stock movements from past and present. Were just under 3000 free subscribers, and Id appreciate any shares to friends or family who may be interested in my work.

With that said, lets get into the markets for the week. As far as primary indexes go, the action was straightforward. We pushed to new ATH into rate cuts, and fell slightly post event. We have to assume the market has been pricing in cuts for a while, as the first supposed cut was scheduled for March of this year. The economic crunch from heightened monetary policy has seemingly ran its course, although I worry about the future of the housing market given the current state of outstanding supply. As it stands, its one of the only necessities of the average consumer that has remained elevated heavily, as the post covid market gave many investment firms and liquid investors the ability to expand their portfolios. This is something I will be monitoring closely, with some research to come in the future.

Indices

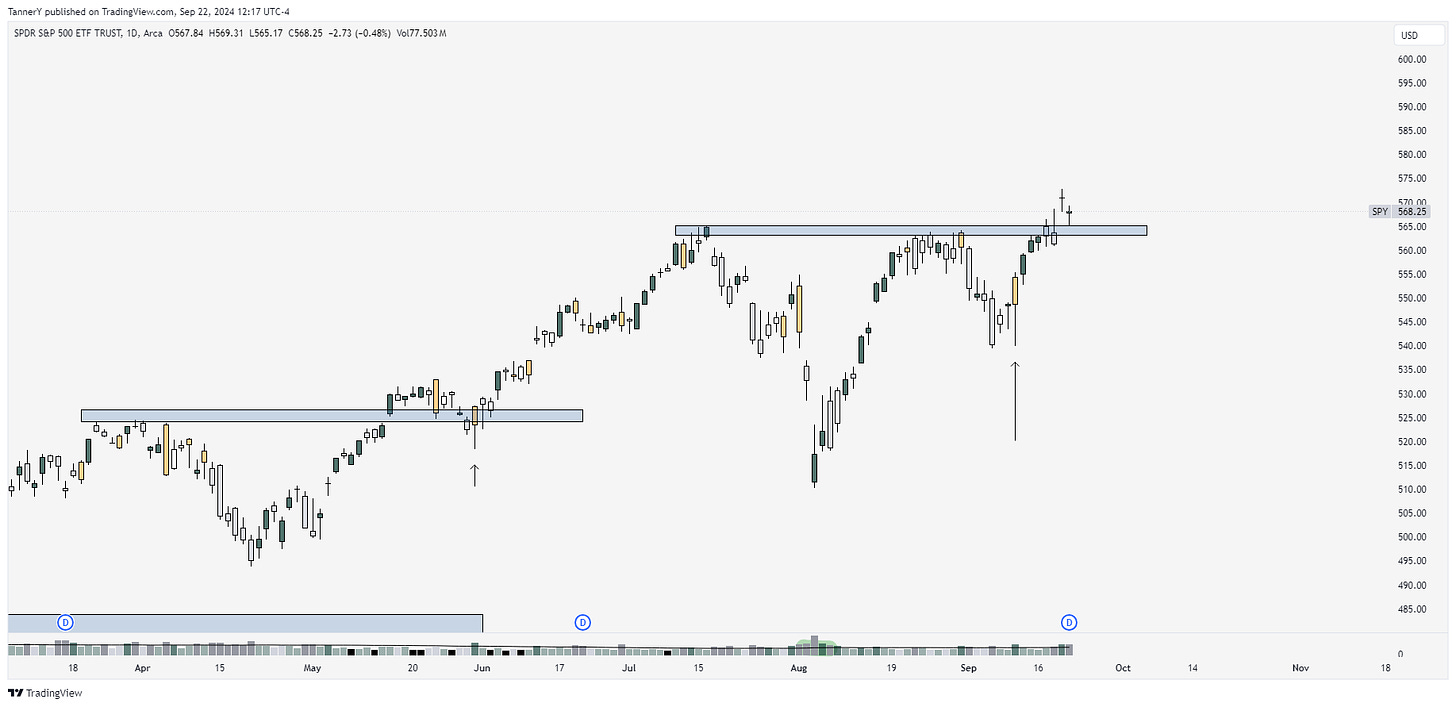

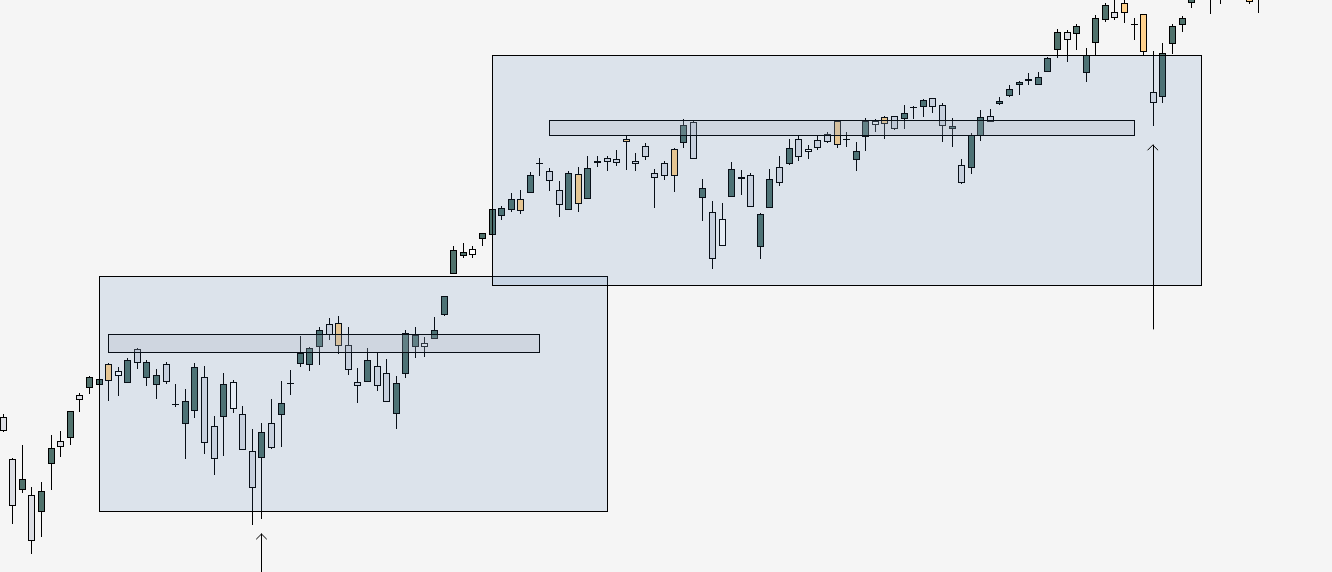

In the short term, price action looks quite volatile, as a pivot in policy causes a bit of uncertainty in markets. As far as strictly price action is concerned, the current look is very similar to that of 2021, shown below:

Note the similarities between then and now. Although day to day may offer less opportunity in this slow drift up market, that can change in a hurry and the trend is still in place. In 2021, I missed more opportunities trying to pin the top of the market than just trading until the market turned and positions lost. I keep this in mind now as we approach 1 year into this bull run.

The gold chart needs no introduction on this newsletter. Honestly, it doesn’t need much annotation on the chart either. Perfect up the right side, starting to breakaway, and in any case cant really get much better. Love it.

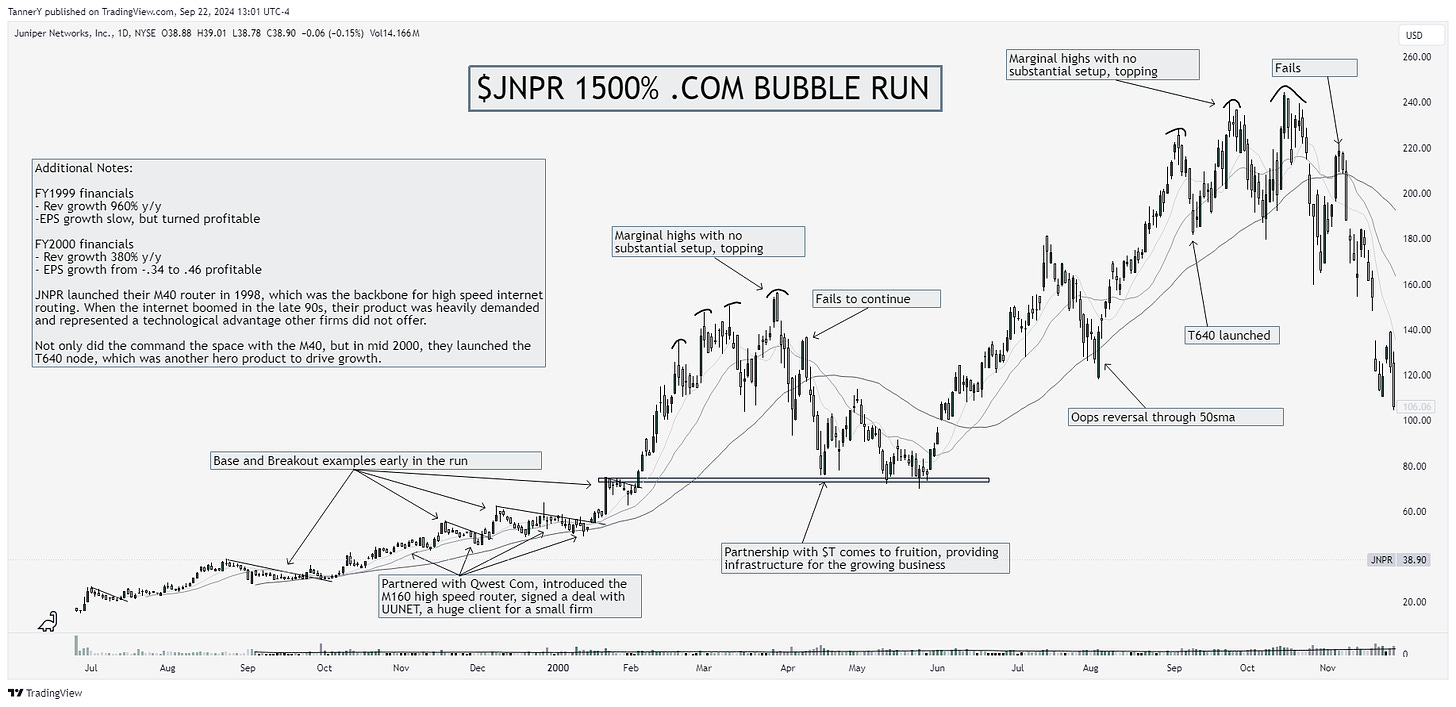

Parabolic Trend Analysis

JNPR 0.00%↑ Juniper Networks saw explosive growth in 1999 thanks to their innovative products, high quality partnerships, and ability to get control of their margins to turn from an unprofitable growth IPO into a monster in the internet boom. Their products laid the foundation for high speed network traffic management.

If you enjoyed this portion of the newsletter, consider liking this post. This portion takes the longest of any, and requires quite a bit of research on the backend.

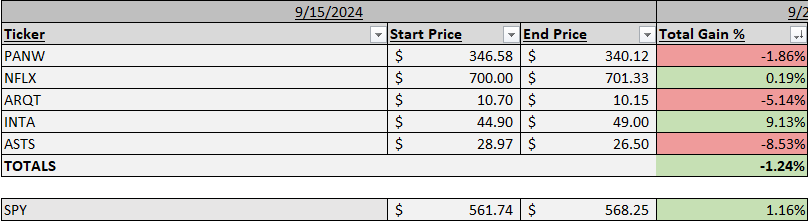

Past Performance

Not the best performance this week. I was contemplating swapping META 0.00%↑ for NFLX 0.00%↑, but decided against it. NFLX ended up getting stuffed at the highs, which was unfortunate to see.

Charts

Crypto is starting to shape up, and MSTR offers exposure to bitcoin via their 244,000 coins held. I am a fan of this tight inside day above the pivot.

NVDA 0.00%↑ hits the undercut and rally post earnings. Many concerned that stock split stuffed momentum, I don’t concern myself with such theories.

GD 0.00%↑ defense co, still a hot group with a big stick of volume on Friday. Big fan here.

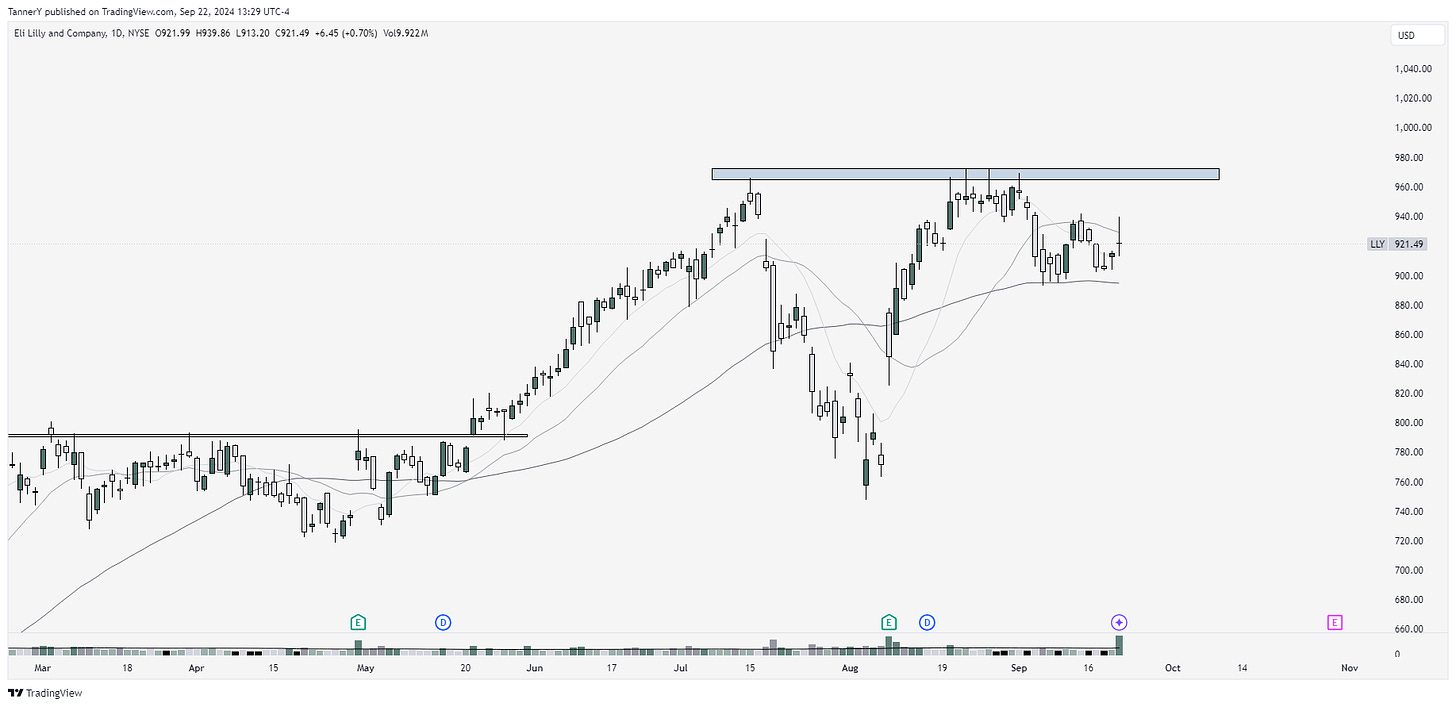

LLY 0.00%↑ great look, under DTL, needs a nice push back into those highs or this may fall apart.

IF YOU ENJOYED:

Subscribe to the newsletter!

3000 🥳