Introduction

Welcome Investors,

Looking forward to an action packed week in the market! With loads of economic data events coming down the pipeline, directional positioning is made nearly impossible. With this in mind, I will be sharing more about general structure of the indexes as opposed to individual stocks. Personally, I will be remaining mostly cash through the week, with positioning coming after the slew of events have taken place.

Below is a look at indexes, with commentary underneath.

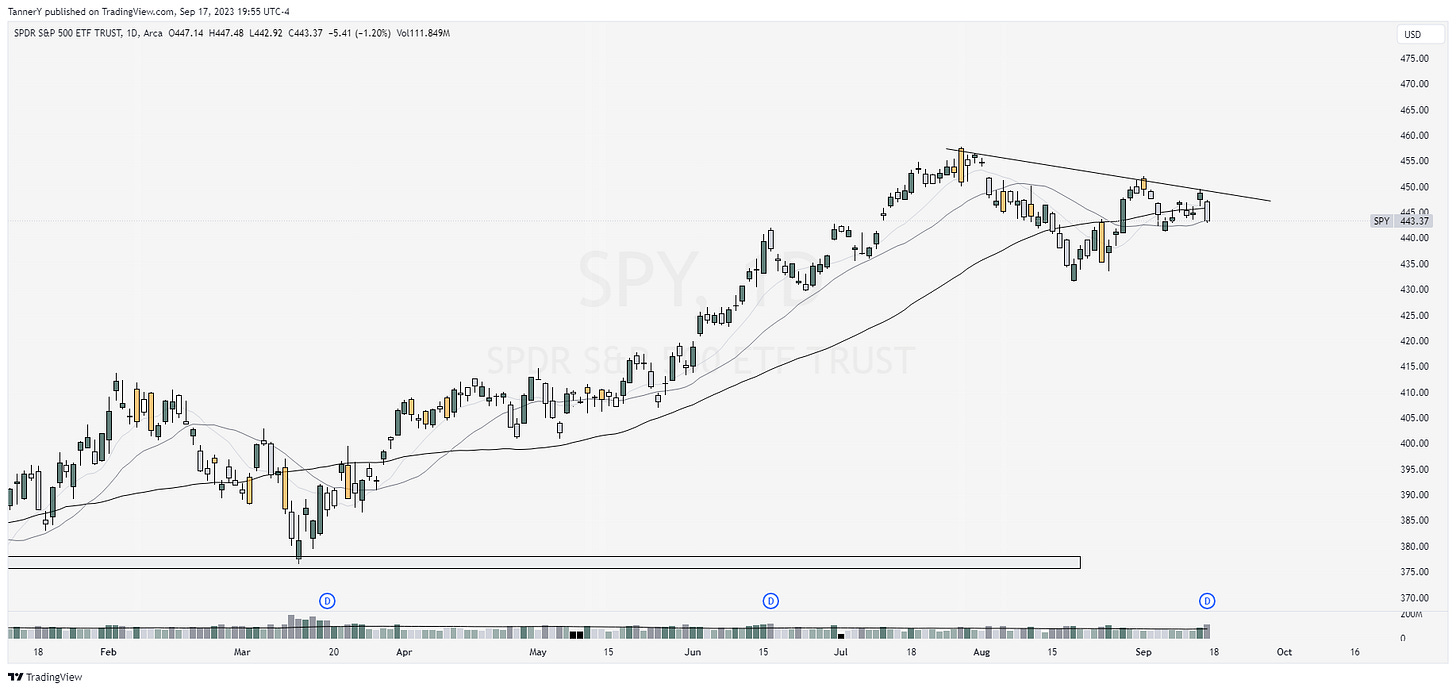

SPY 0.00%↑ continuing to work this consolidation after a monster first half of the year. In last weeks article, I mentioned that to see a push to ATH it would take an economic catalyst or a large consolidation period before the move. It seems we may get a combination of both dependent on the economic events this week.

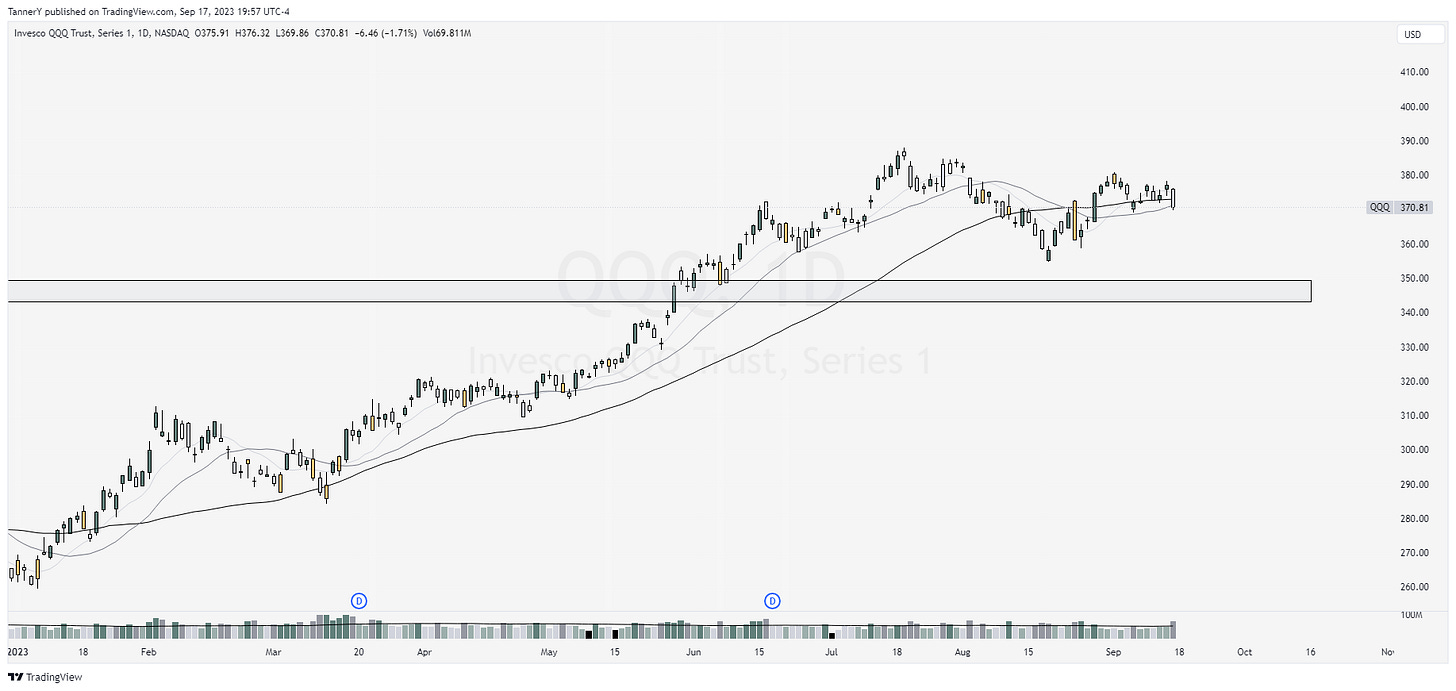

QQQ 0.00%↑ marginally different from $SPY. Slightly more upright consolidation.

IWM 0.00%↑ small/mid caps tilting down. Definitely showing weakness here, with its largest holding SMCI 0.00%↑ having trouble at its key moving averages.

XLE 0.00%↑ makes the move to ATH this week, tremendous breakout with power.

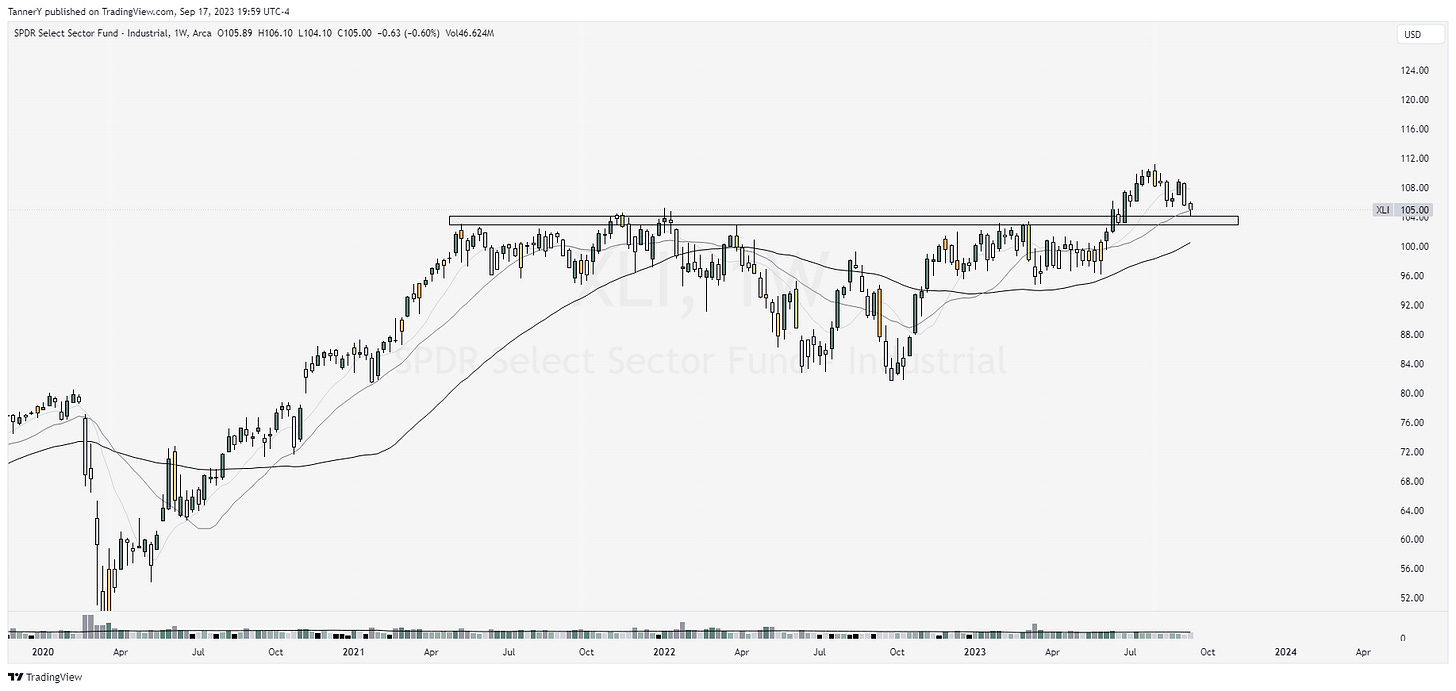

XLI 0.00%↑ industrials taking a breather to retest the 20sma and a rather important weekly point of contention. Would like to see this turn up off this level to continue the strong moves in CAT 0.00%↑ DE 0.00%↑.

Tip of the week

Personally, I like to wait until economic data is out of the way to position heavily in my swing account. Unless I have booked a large gain I see no reason to take risks on binary events. With such a large week ahead, I will be deploying this strategy and mostly staying on the sidelines until direction has been made clear. Its possible indexes come down and test the lower trend, and that is not something I want to be caught offsides on.

Past Performance

Brutal week for the selection. Many of my top ideas completely rolled over, most notably $NFLX, which was positioned perfectly below a gap to the upside, but instead decided to die. MOD 0.00%↑ and SMCI 0.00%↑ were also promising, both finding no footing.

Charts

Enjoy this week. Watch, be mindful of economic data, and most importantly take notes. I will be scalping and trading intraday, but likely will hold no swings through this economic data chop that I’m sure is to come.

If you enjoyed-

Follow my twitter: HERE

Join my free discord: HERE

Also, be sure to leave a like on this post to support me.