Introduction

Hello Investors,

Welcome back to another volume of “The Weekly Selection”, where I go over my thoughts on the market for the upcoming week, share some helpful tips, as well as trade ideas I am looking into for my own portfolio.

Lets first take a look at the indexes. Below are the charts with some annotations

SPY 0.00%↑ trades below all moving averages this week. On Friday a nice close catches the 10sma, which is rather important on these larger timeframes.

IWM 0.00%↑ small/mid caps barely felt the summer run, and now showing weakness heading into the fall. SMCI 0.00%↑, a top holding of the index traded down significantly on strong earnings, marking the potential end of its epic run.

XLE 0.00%↑ energy continues to outperform and hold up. Sitting right below the breakout of a multi year base, my eyes are still on this sector to catch laggards still breaking out. XOM 0.00%↑ CVX 0.00%↑ have been underperforming, interested in seeing them start to participate to push the entire index up and out.

SLV 0.00%↑ Silver beginning a breakout, lots of bullish flows to support this move as well.

Tip of the Week

There will always be another day. Another day, another month, another week. With so much social media pressure its easy to feel the desire to trade all the time and continue to make an effort in the market. These last few weeks I have done less trading than I have all year, and despite pressures from the discord and other outlets to do so, I just don’t see the quality of opportunity in either direction that really jumps out at me, and for that reason I leave this tip. Don’t trade just to trade, do it because you see opportunity that respects your rules and is productive for your strategy.

Past Performance

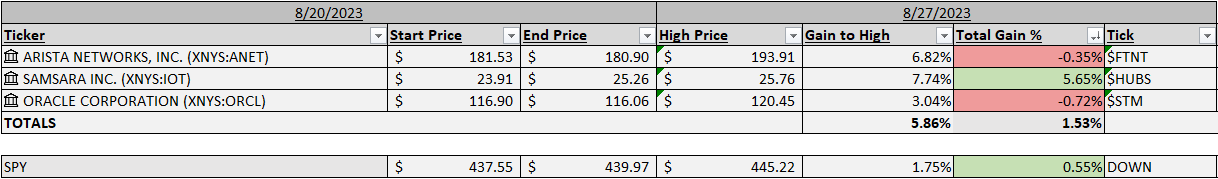

Overall pretty strong performance from the individual stocks last week. ANET 0.00%↑ made a strong run early in the week, only to be beaten down later. IOT 0.00%↑ was a standout in the market, making a nice run off lows. ORCL 0.00%↑ still consolidating.

Charts

Seeing as the opportunity is few and far between lately, lets take a look at everyone’s favorites this week.

TSLA 0.00%↑ trading in a nice 4 day range, definitely one to watch for a break in either direction. Draw zones on the hourly for confirmation.

AMZN 0.00%↑ putting in a double bottom after drawing down to the earnings gap. Could turn into a bull flag and continue.

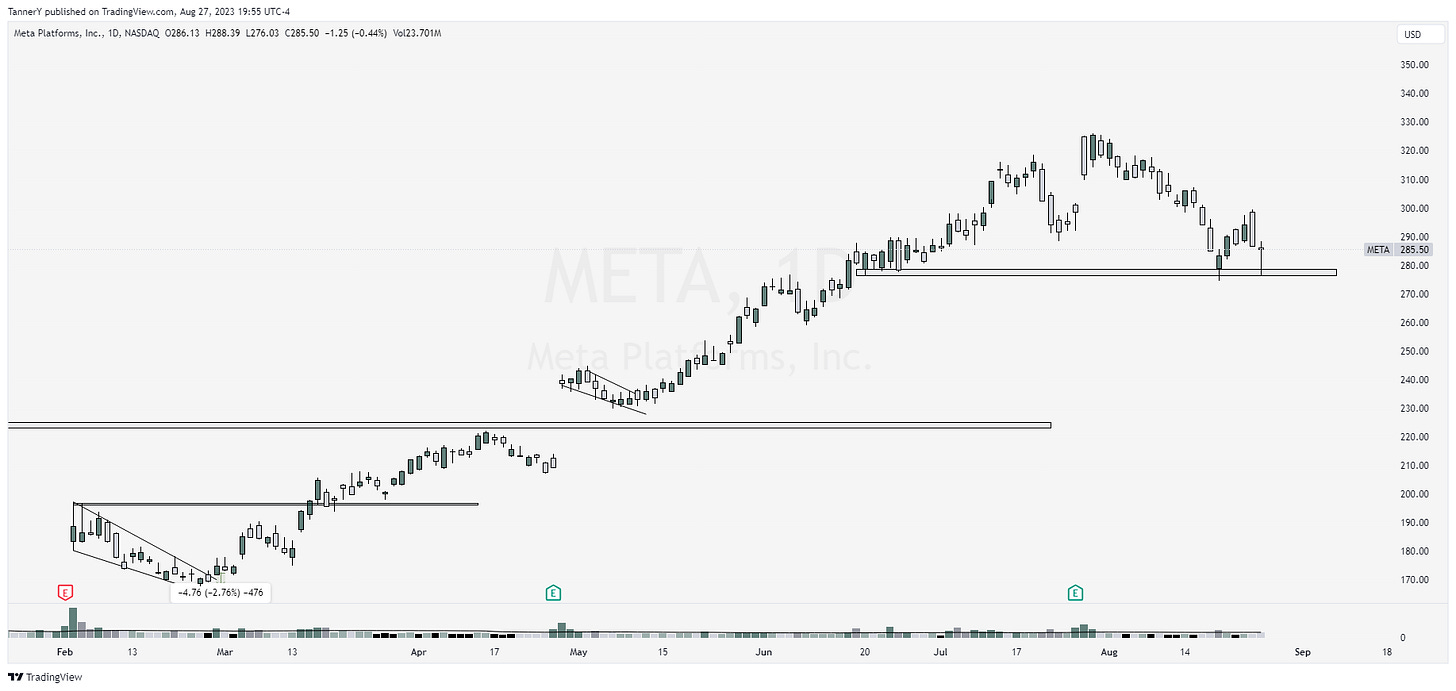

META 0.00%↑ putting in a nice double bottom as well, utilizing an old support for the test. Watch for a slip or continuation out.

ADBE 0.00%↑ putting in a flag above an old resistance. Watching closely for a break.

That’s all for this week!

If you enjoyed-

Follow my twitter: HERE

Join my free discord: HERE

Also, be sure to leave a like on this post to support me.