The Weekly Selection: 08/25/2024

Vol. 102: Galactic Opportunities, Propelled Profits

Investors,

Welcome back to another iteration of The Weekly Selection, where I take you through my lens of the market, and provide commentary on what we are seeing in various markets. In addition to this, I provide some additional nuggets of information, like the Parabolic Trend Analysis and Developing Charts sections. Enjoy!

Indices

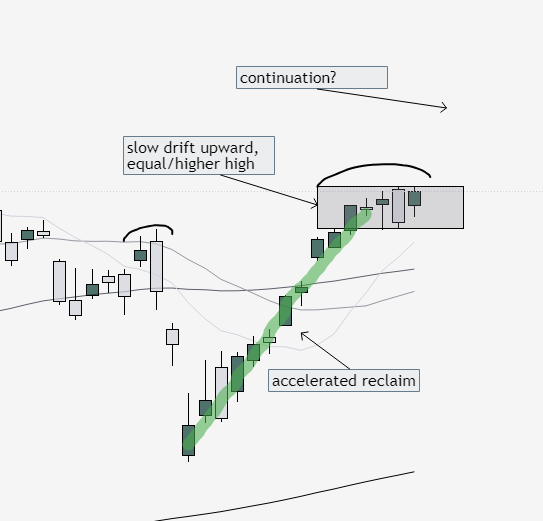

last week we saw a fairly common theme, with a daily chart pocket development. This happened last November, and looks like this:

This time around we saw something similar, although after a much shorter time than this (3 months vs 1 month). That’s seen below:

Very similar looking, except in this case we are pushing into ATH. Curious to see how it plays out.

The cleanliness on this GLD 0.00%↑ chart is really special. Not only are we breaking out of a 3 year base from $2,000 per oz, but now making a first large base above that initial breakout that dates back to April. Huge fan here.

IWM 0.00%↑ sees full reclaim from the long term support. Nice to see such participation in small/midcaps. This is where a lot of the opportunity has come from recently in trading.

Parabolic Trend Analysis

MNST 0.00%↑ was the original CELH 0.00%↑. Fun branding, Aggressive marketing, high octane (energy) drinks. This run from the early 2000s is wild to look back and see. They were so dominant and the price action reflected that as it just cruised upward.

If you enjoyed this portion of the newsletter, drop a like as it takes the longest and requires the most preparation.

Past Performance

Solid performance last week on newsletter names. CORZ 0.00%↑ and ONON 0.00%↑ standouts that not many were talking about. Big fan of how crypto acted last week.

Charts

Before we get into this weeks charts, I want to take a minute to talk about the space theme that is developing. ASTS 0.00%↑ is leading the charge, putting satellites into orbit for Verizon, Google Vodaphone and AT&T. They have a launch coming up in September, and it will be worth watching. I have been trading this name a lot, but not on the newsletter as it poses too much event risk. In this group is also RKLB 0.00%↑, which seems to be a bit of a gem as far as opportunity goes. They recycle and launch rockets for other companies as well.

Ok, back to it:

MSTR 0.00%↑ crypto name. MSTR is the second largest BTC wallet in the world, so it basically follows bitcoin. I like this stock and bought it Friday on the Range breakout.

PANW 0.00%↑ pulling back to previous range highs. Great look with ER out of the way.

WIX 0.00%↑ nice look consolidating above the DTL breakout.

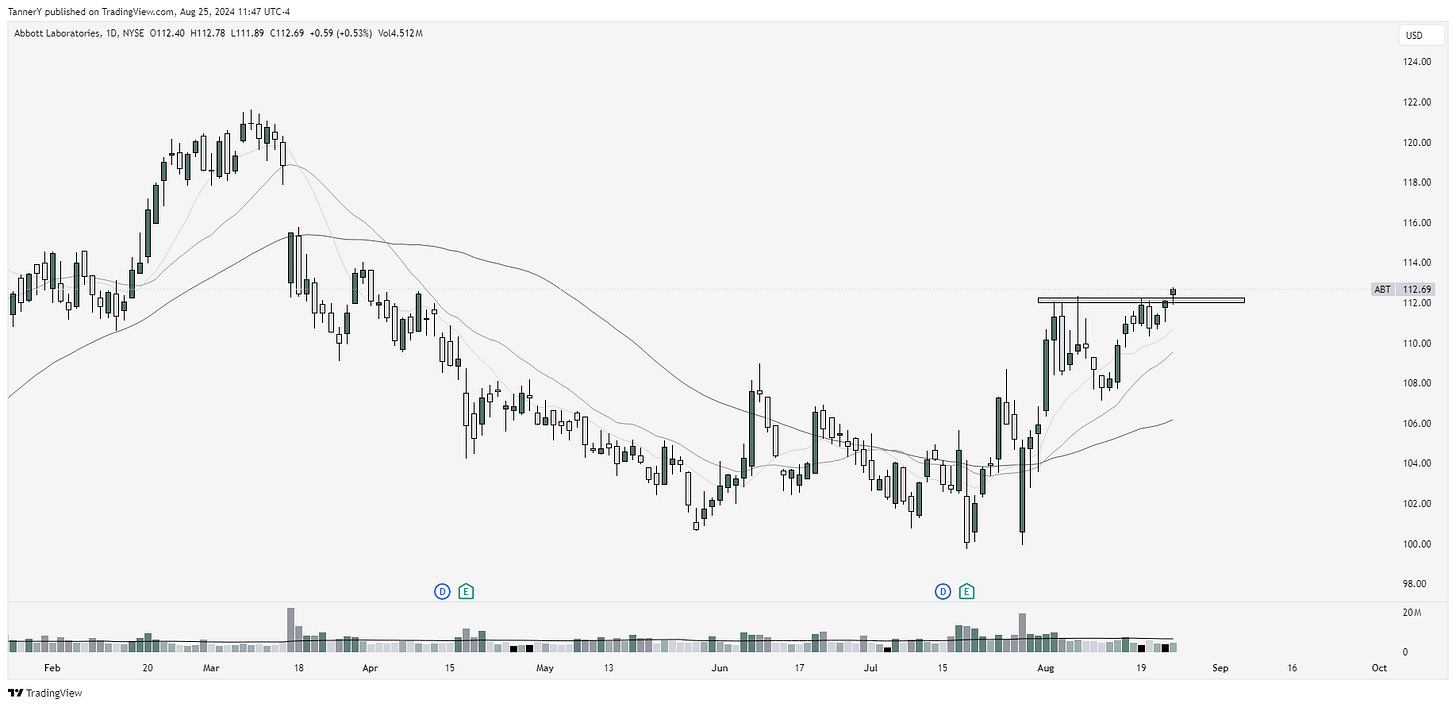

ABT 0.00%↑ strong technical look + Monkeypox news surely drives this name as they were a key player back in 2022.

IF YOU ENJOYED:

Subscribe to the newsletter!