Investors,

Welcome back to another iteration of The Weekly Selection, where I take you through my lens of the market, and provide commentary on what we are seeing in various markets. In addition to this, I provide some additional nuggets of information, like the Parabolic Trend Analysis and Developing Charts sections. Enjoy!

Last week we saw the follow through many were looking for to ensure the bull market continued. It was great to see gold continue to outperform, and many of the magnificent 7 stocks make strong reclaims through their moving averages. In addition to this, some standout growth/ep names like ASPN 0.00%↑ and ASTS 0.00%↑ saw phenomenal feedback that ensured leadership small/midcaps are remaining strong.

Indices

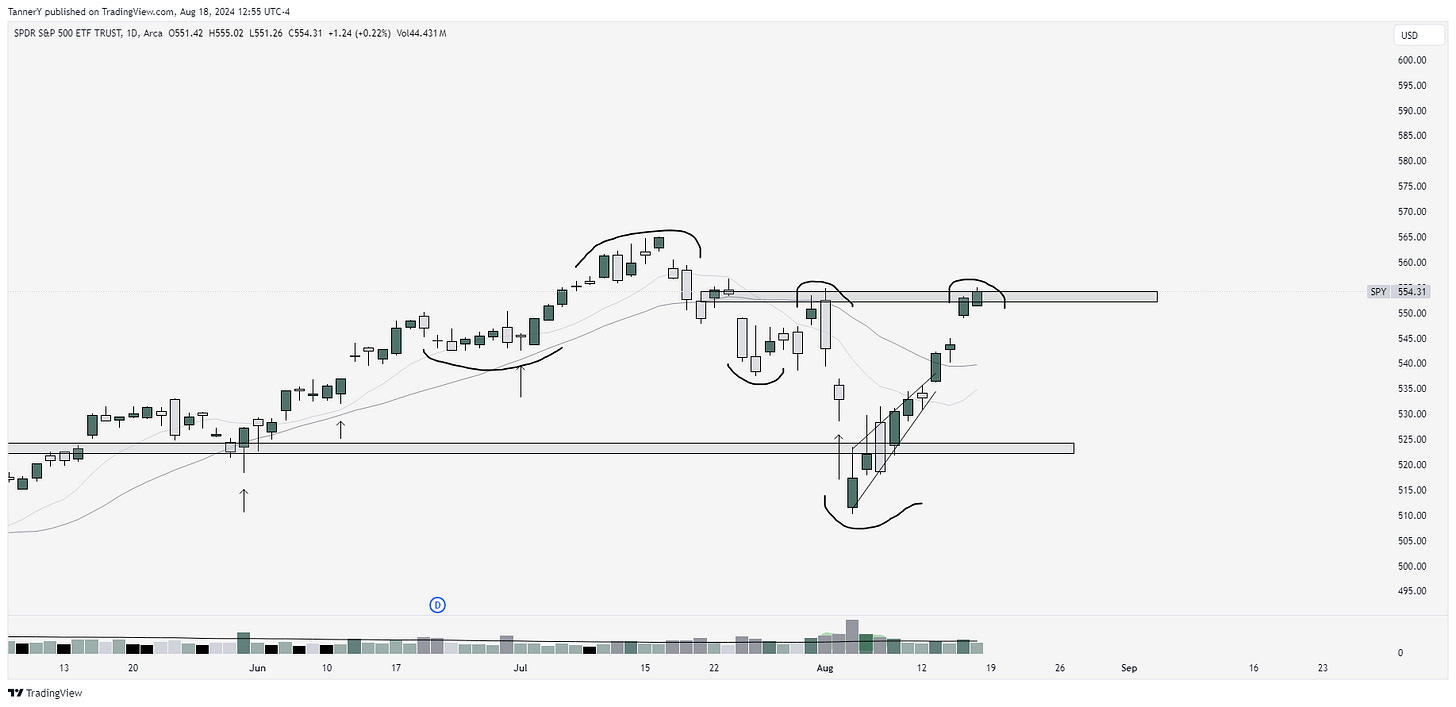

SPY 0.00%↑ trading back through 10/20 SMA with ease and volume to match that of the downside. Impressive reclaim here and I think this opens up a lot of opportunity on leading names. The key here is to look for something like we saw in October of last year, where the swift reclaim on volume was followed by a week of sideways consolidation at a higher high to lock in the direction. See below:

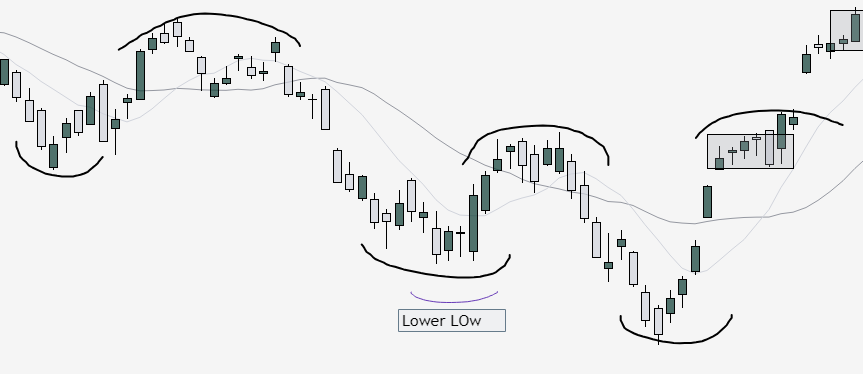

Note the turnaround with a higher high and pure consolidation before continuation higher. This was one of the cleanest most obvious trend direction changes of recent years.

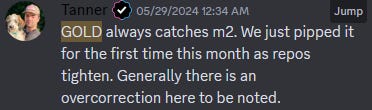

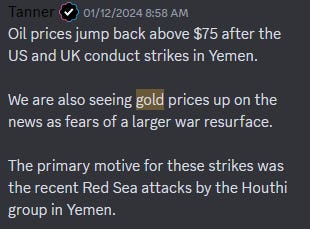

It wouldn’t be a weekly selection with a look at gold. I mean check this out. Strength through broad market pullback and thrust up to highs when market turns around. That is relative strength, and if you’re curious here were some of my thesis’ earlier this year.

Generally, as global conflict rises, lame duck election year comes into play (non re election) and uncertainty builds, gold performs well. As of late we have seen all of this come to fruition, even seeing the prime minister of Bangladesh abandon her country after a lack of control deemed it unsafe. In my opinion, and ive been adamant about this in my newsletters, this trade is very reflective of the 1980 gold run which saw a 2x in a very short time.

Parabolic Trend Analysis

DOCN 0.00%↑ was a hell of a trader in 2021. I tried it a few times during this push, amounting to some gains. Ultimately, I didn’t trade this as well as I should have, with most of my mistakes coming from trying to compartmentalize the move instead of zooming out and seeing all the pieces falling into place. Entries aside, this was a hell of a run for the stock, and shows how powerful the guide raises+ beats can be for a growth name.

If you enjoyed this portion of the newsletter, drop a like as it takes the longest and requires the most preparation.

Past Performance

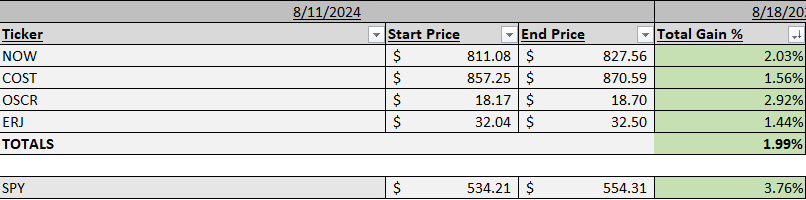

I played it safe this week. With indexes looming over the edge tucked below SMAs, I didn’t feel confident in full one week moves. That led to the selection containing a lot of high probability but low reward setups, thus the underperformance to the market when it surged.

Charts

NVDA 0.00%↑ chart looks like a warzone but I like this DTL look as well as consistent highs opportunity that we’ve seen twice before since 2023 on this name.

ONON 0.00%↑ decent look here. Might need more sideways but a punch through that $44 level explodes.

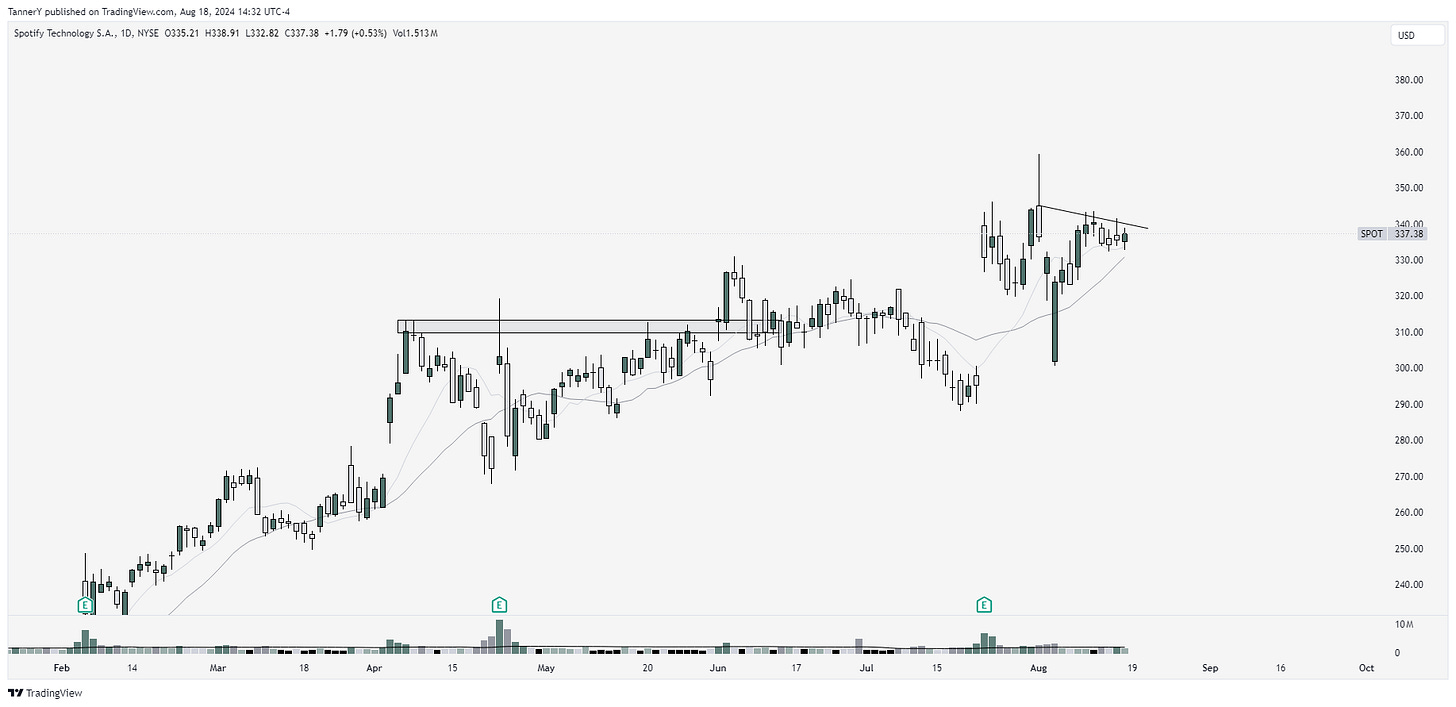

SPOT 0.00%↑ a bit of slop up here with wonky sell off days. I think that volume has been digested well, even recovering fully after gapping down. I like this for a 10/20sma pinch upward.

CORZ 0.00%↑ crypto name. I like this reclaim but with a solid technical setup to support continuation.

Lots of big tech has thrusted higher, but I don’t feel confident in another full week of straight uppies so Ive left those off the watchlist.

IF YOU ENJOYED:

Subscribe to the newsletter!

waiting for next post please