Investors,

Welcome back to another volume of “The Weekly Selection” This article is especially important to me, as it marks my 100th weekly writeup in this format. What a journey it has been, from august of 2022-present. Back then, I fired this up as a means to convey what was previously a PDF that I would individually email to subscribers.

Some stats from then to now:

Subscribers gained - 2700

Total views - 60000

States - 41

Countries - 90

Thank you all for the continued support on this writeup. It is truly mind blowing to me to see such an audience spread across the globe and I am thankful everyday for the weekly readers who continue to tune in, share, and enjoy my content.

That said, lets get into it.

Indices

SPY 0.00%↑ trading around its lower pivots from the April pullback. I believe this action to be healthy, but healthy does not mean actionable. To return to a tradeable market, in my opinion we will need to fully reclaim moving averages, see support from various sectors and see low risk entries on high quality businesses. Right now we are in a limbo state, where indecision is present. This is not tradeable yet.

The GLD 0.00%↑ trade is still in tact. Price is tightening up at the top of the range, and I think with continued uncertainty around the world this trade remains top tier. Relative to the market, GLD is holding up exceptionally, barely giving up any gains in this pullback. There are many speculators in the commodities markets, but I think no matter what way I cut it, we go higher here similar to what we saw in the late 70s during incredibly similar geopolitical, economic and uncertain times.

IWM 0.00%↑ pulling back into its range, talk about a short lived run. Honestly was expecting this to perform better given fed rate decisions and outlook, but ive said that before the results have continued to speak for themselves.

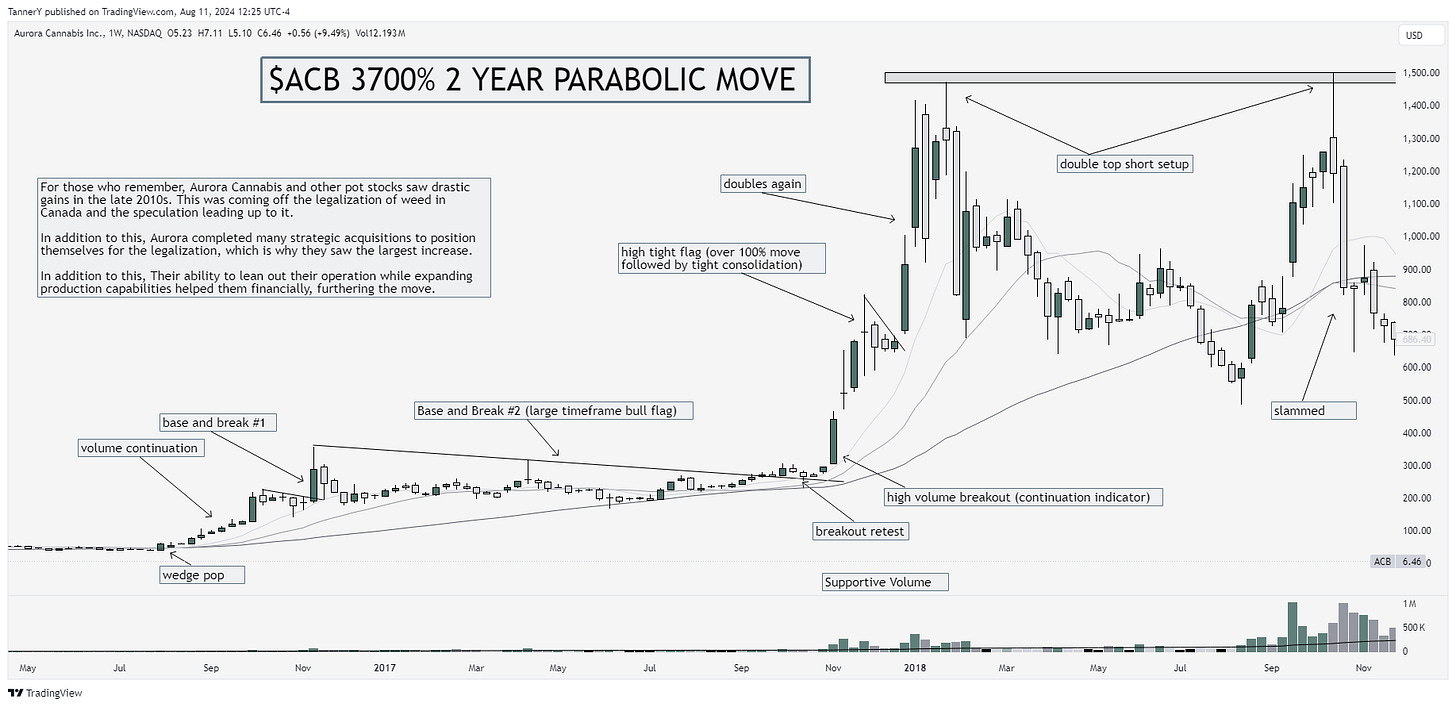

Parabolic Trend Analysis

ACB 0.00%↑ saw a 3700% rise from 2016-2018. This was mostly all hype, as shortly after they began their slide into oblivion. A classic example of buy the rumor sell the news, as now ACB trades around $6 per share, versus a high of $1,476.

If you enjoyed this portion of the newsletter, drop a like!

Past Performance

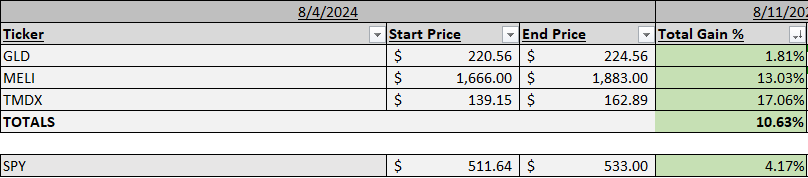

Solid week for the portfolio, MELI 0.00%↑ and TMDX 0.00%↑ were great post ER picks, GLD 0.00%↑ is just class lately.

Charts

NOW 0.00%↑ good R/S through the right side of the chart.

COST 0.00%↑ nice look to it. Last pullback we saw this name sneak away with no consolidation, perhaps it goes again.

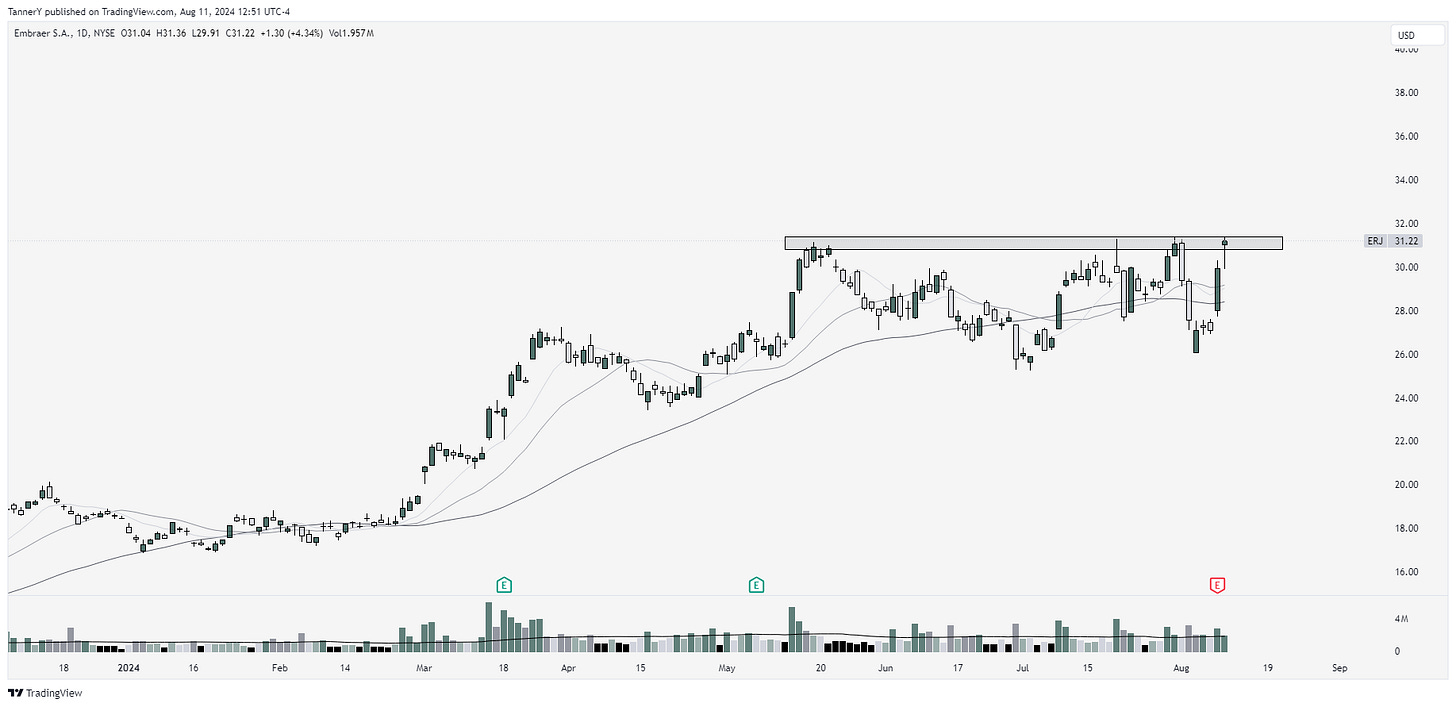

ERJ 0.00%↑ good group RS and nice consolidation, looks to be punching through on volume.

OSCR 0.00%↑ looking to breakout on volume after a standout quarter. We shall see.

GLD 0.00%↑ needs no chart, on the list as well.

IF YOU ENJOYED:

Subscribe to the newsletter!