Introduction

Hello Investors,

Keeping it fairly light this week, with an analysis of the broad market, and a quick lesson on trend analysis. With some of the major earnings out of the way, we are starting to get a clearer picture of the market, where its heading and how we can analyze it for directional trading success.

Below are the key indexes as well as some of the biggest market players:

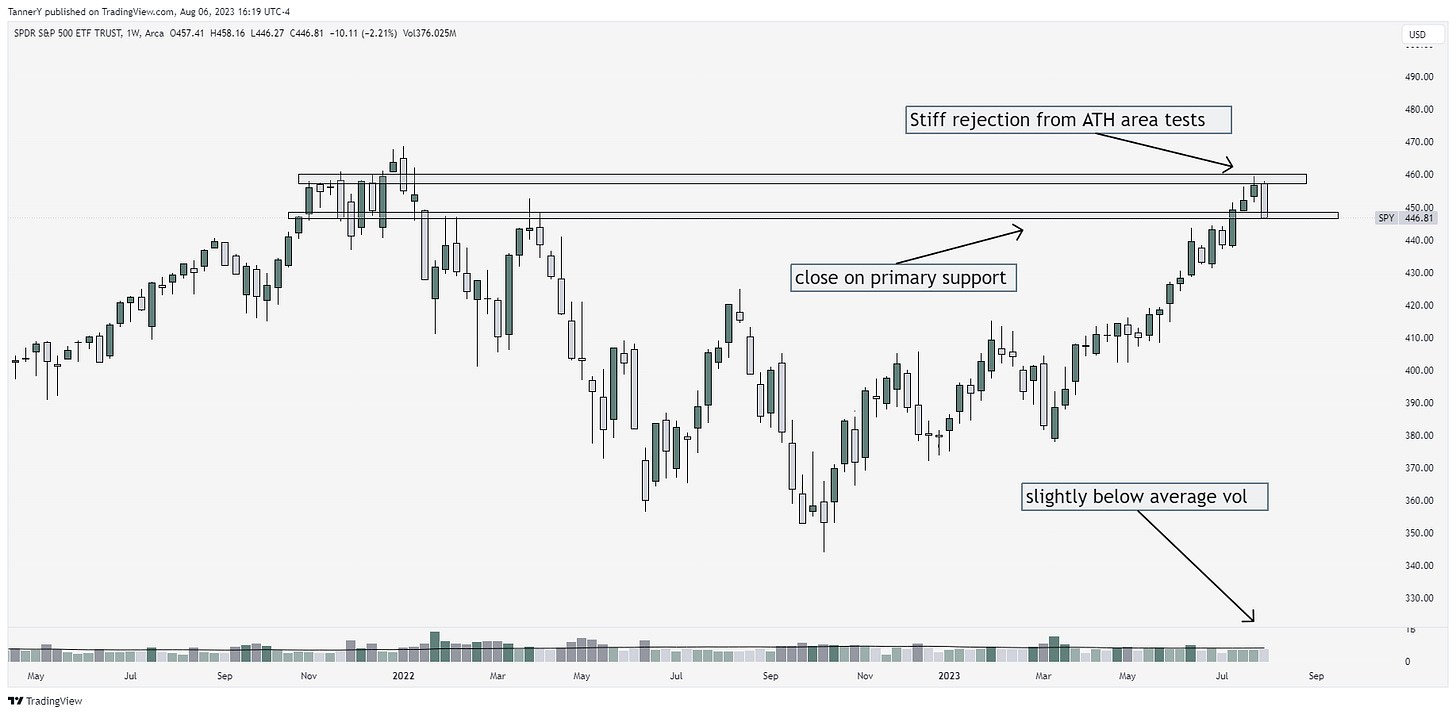

SPY 0.00%↑ first, pretty clean rejection from what I presumed to be the final support before ATH.

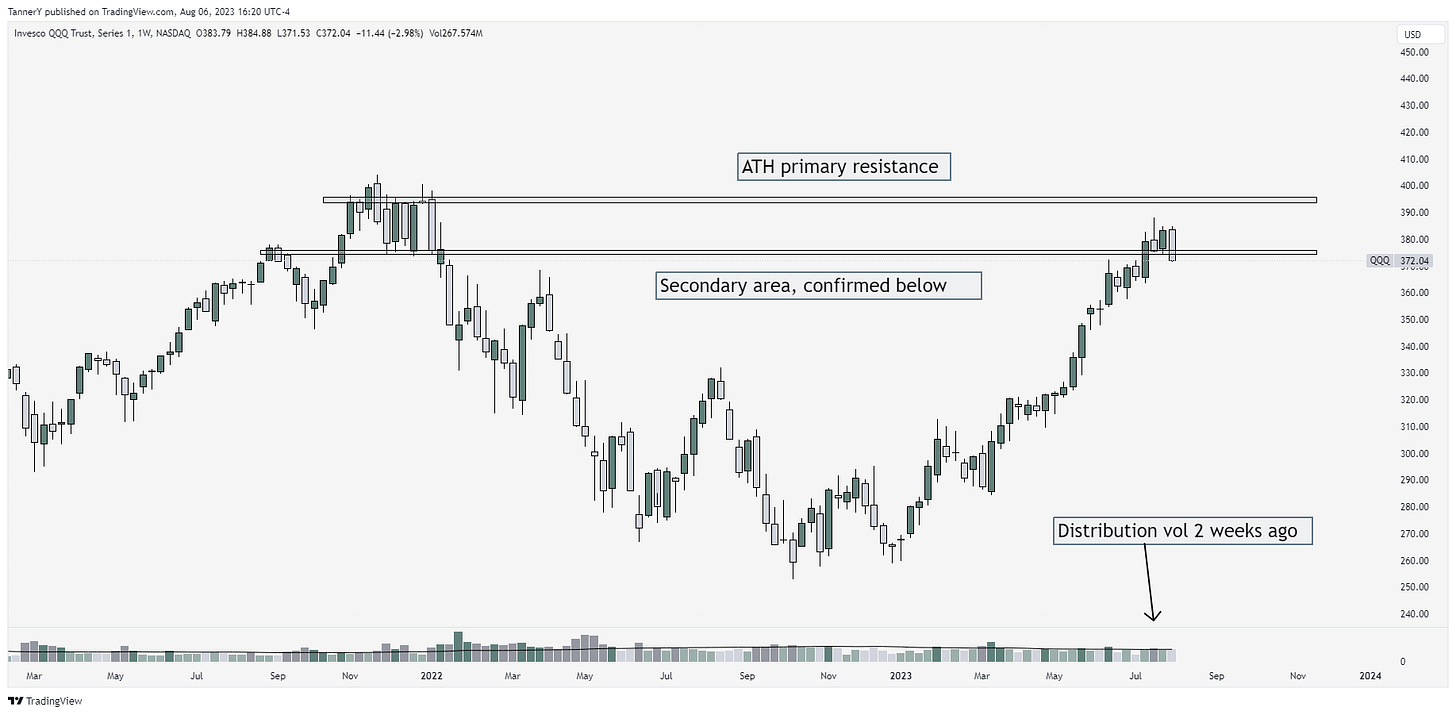

QQQ 0.00%↑ up next, didn’t make it to ATH, rejected below. Distribution volume 2 weeks ago was a nice hint, with confirmation coming this week on confirmation below secondary zone.

AAPL 0.00%↑, one of the strongest stocks in the market in recent years, closes below the 50 on above average volume after lackluster earnings. As a market leader, this is a key failure in the technical and fundamental landscape.

IWM 0.00%↑ small/mid caps. Rejected, but nowhere near as far to fall. Focus for me is shifting here.

Helpful Tips

Always pay attention to your larger timeframes

When positioning for swings or the week ahead, its crucial to see the broad scope from many perspectives to get the greatest idea of what different aspects of the market are doing. When I look ahead, I always check all my indexes, which can be found below:

Beneath this, there are industry groups. These include but are not limited to, computer hardware, homebuilders, insurance, and many other lumped together stocks that all compete/perform in the same niche. Looking into the performances of these specific groups can help you find the significant stocks in each group to keep yourself in the top performing stocks.

Take breaks

For those who follow me closely, know that over the last week I have placed the fewest trades of any week this year. When the trend is not in our favor, and development is still playing out in upcoming sectors, I tend to get more relaxed with my trading, and instead look to watch how price is playing out, instead of hype focusing on my positions and their PNL.

Charts

As I mentioned above, I don’t have much I am watching this week. I thinks bonds are a respectable long around here, as well as energy with many reporting well already.

If you enjoyed-

Follow my twitter: HERE

Join my free discord HERE

Also, be sure to leave a like on this post to support me.