Investors,

Welcome back to another iteration of the weekly selection. Last week we saw some turbulence around FOMC and Jerome Powell’s comments. Many are now expecting rate cuts in September, and the market is selling on this news.

Personally I’m not really in the prediction business. What I see right now is a pullback in a long run of spectacular months. If I tried to get ahead of every downturn, Id have stopped trading years ago. Its our responsibility as technical traders to keep our directional biases hampered until we are proven otherwise. Does this mean there are times when not to trade, even when maintaining the thesis? Absolutely. Personally however, I see no reason until structural violations are in play.

Indices

SPY 0.00%↑ up first. As we can see, some of those lower pivots are being used as support on this pullback. Let me reiterate that so far all of this PA is healthy until proven otherwise. We have slipped all SMAs on high volume, but retesting some respectable areas.

GLD 0.00%↑ the gold trade is still very much in tact. For those who follow closely, you know that this has been one of my better ideas this year, and it continues to perform and look great. I have a core position for sept 225c.

IWM 0.00%↑ turned around heavily at the end of the week. Brutal price action after FOMC, either this recovers in a V shape fashion or people are really not confidence in sept cuts. (IWM heavily impacted by rates as most of the businesses within are debt heavy).

Parabolic Trend Analysis

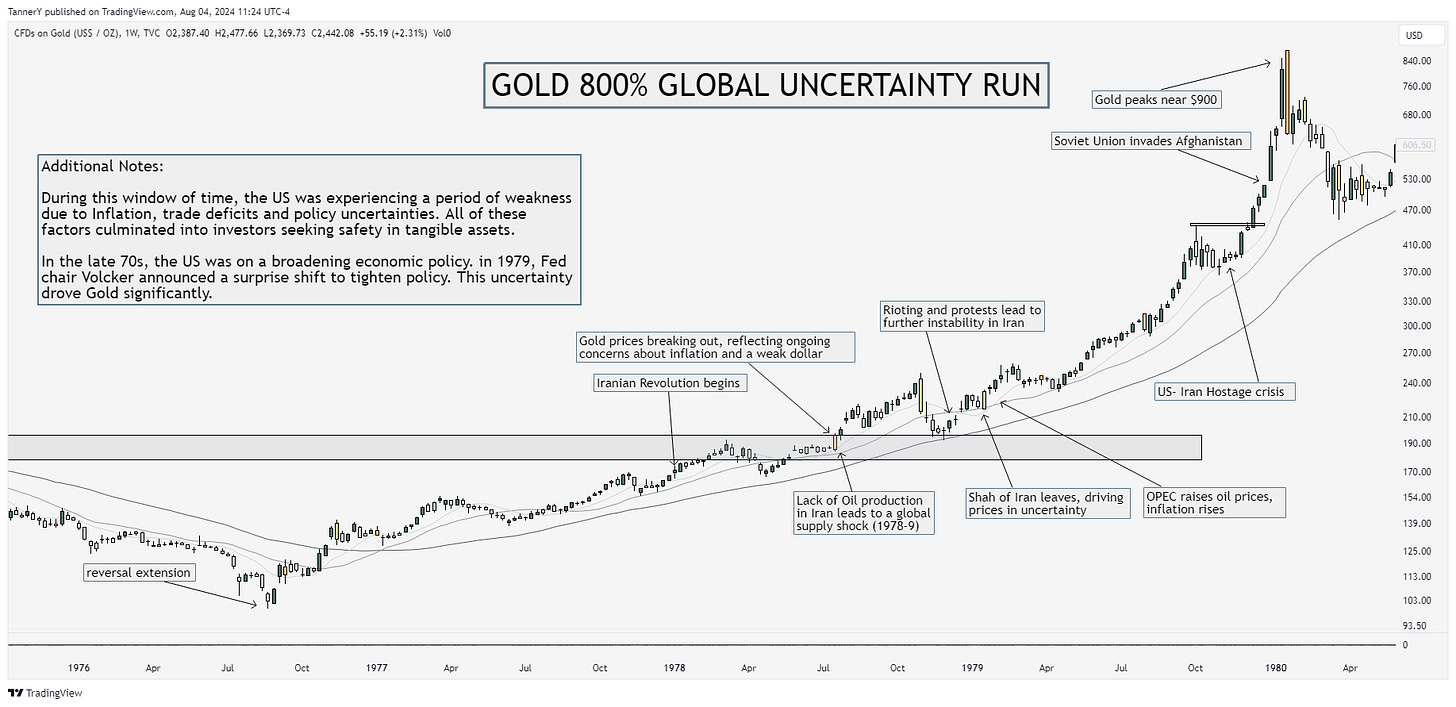

This week were talking about GOLD. Back in the late 70s and early 80s, we saw a number of geopolitical tensions, economic uncertainties and foreign threats cause a massive move in GOLD in a short period of time. This graphic outlines this data.

If you enjoyed this portion of the newsletter, consider liking and sharing this post. The research requirements are heavy for this, and Id appreciate it!Past Performance

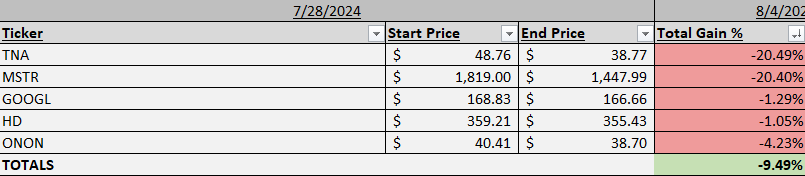

Another brutal week for the selection ideas. Even in an effort to diversify the portfolio, still names are getting slammed from Mon-Fri. Many of the names have great intraweek performance, offering plenty of tradeable opportunities, but from a full week perspective it is very difficult to string together 5 days of solid PA for many of these stocks. Breakouts are also struggling.

Charts

I am not sure what this upcoming week brings, SPY is below all SMAs, but most of the big earnings are out of the way. It will be an interesting watch.

MELI 0.00%↑ great report and solid y/y metrics. Looking forward to this one this week to see if it can maintain its relative strength.

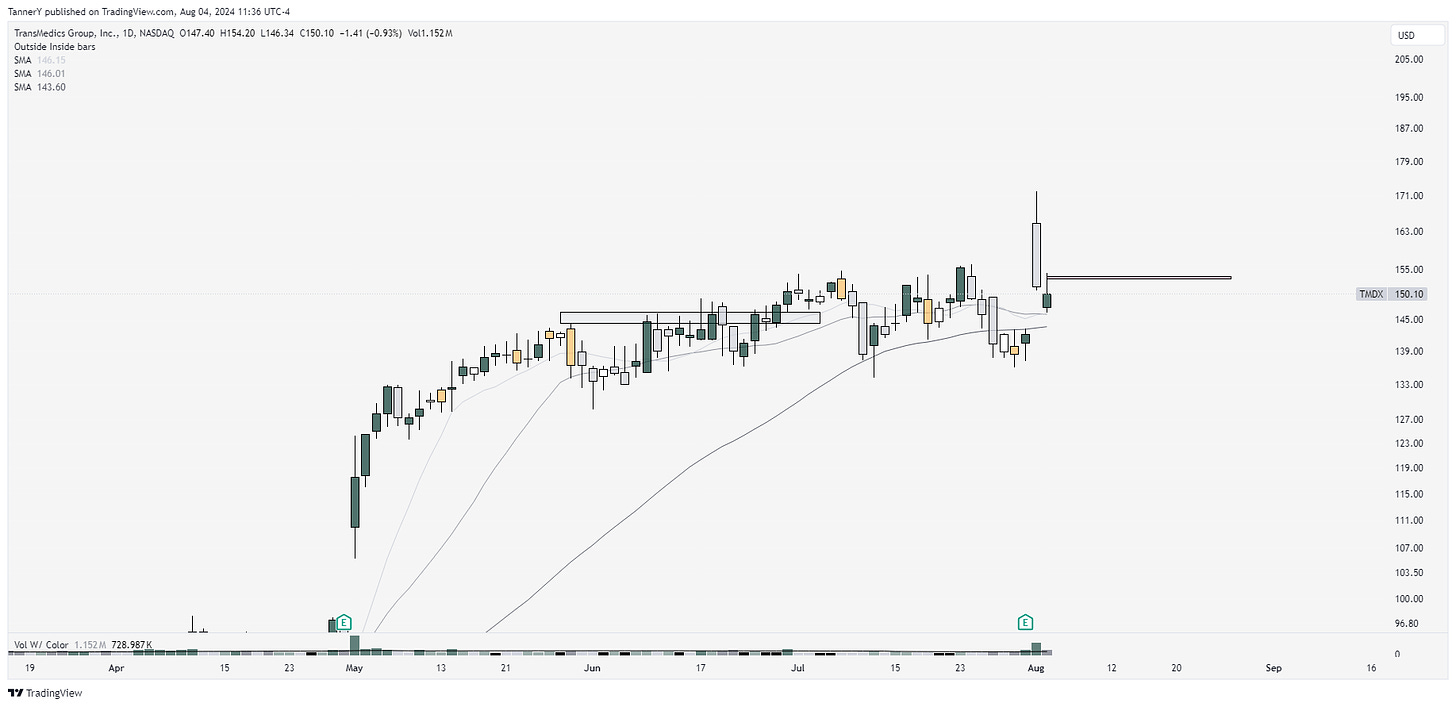

TMDX 0.00%↑ has been a great trader in the past, another solid report out of the way.

GLD 0.00%↑ as uncertainty rises around the world the safety in gold may start to unfold to the upside.

That’s really all ive got for you this week. I will be active on my twitter posted below:

IF YOU ENJOYED:

Subscribe to the newsletter!