Introduction

Hello Investors,

Welcome back to another Iteration of my weekly newsletter, Where I take a deep dive into financial markets, education, stock ideas and more.

This newsletter is free, and all I ask in return is for those who enjoy it to like and share with a friend to help me grow. Additionally, I do have a free Discord group, which can be joined HERE

To start off, lets take a look at the indexes, and see if we can identify any changes from previous weeks.

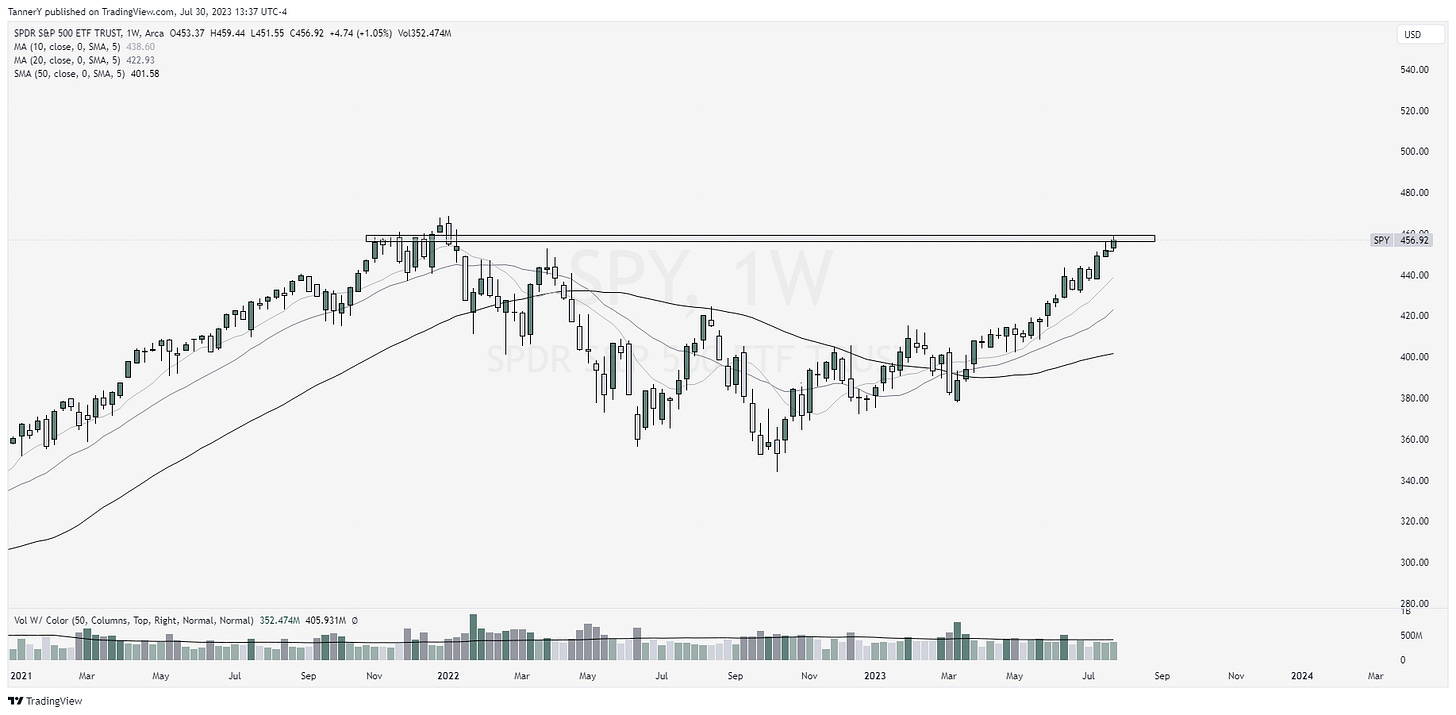

SPY 0.00%↑ is up first. The SPY represents a balanced look at the market. While still having weight, it is more evenly spread out between tech, financials, energy and the rest of the sectors. This is the most popular index to track the performance of the market. As we can see, the broad market is nearing all time highs. Just a mere 2% off the mark, I think its fair assume the options are limited here. We either double top and reject, or blast through with some consolidation or none. Over the last few weeks I have been talking about the participation of other sectors adding to the fuel on this run. Last week was no exception, with this thesis still proving correct.

XLI 0.00%↑, while not volatile, is an obvious leader right now as well. This index is made up of industrials such as John Deere, Boeing, Lockheed Martin, ADP, and Caterpillar machines. Something to note as we trudge forward

IWM 0.00%↑ is the small/mid cap tracker. As we can see, follow through is apparent from the mention a few weeks ago. SMCI 0.00%↑ is the top holding, which is far and ahead one of the strongest stocks in the market right now.

Tip of the week

This ones for the beginners, and runs in tandem with my article “How to invest your first $1000”. I’ve noticed lots of new followers and subscribers lately, so I’d like to offer a bit of advice that I took when I was first starting out. “Invest in what you know”. Whether the market is up, down, or sideways, if you are a consistent user of a product or service, its fair to assume there are others in the same boat as you. As we know, the most used products, such as Apple, WD-40, Lululemon, John Deere and salesforce perform the best, and making investment decisions based on this simple idea gave me a strong starting point of stocks to watch and buy.

Past Performance

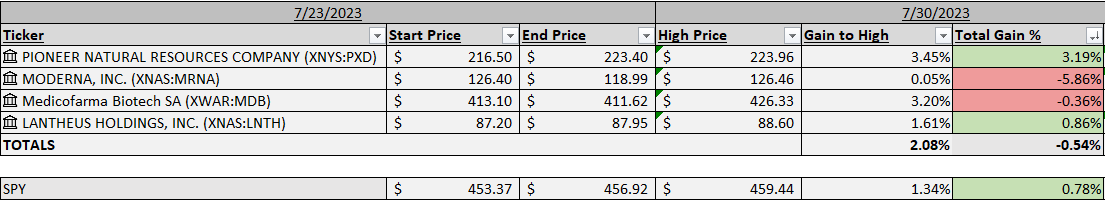

Individual stock selection was mixed this week. I was hoping to see some continuation in XLV/healthcare, which we did not get. MRNA really screwed the pooch, trading immediately down from its pivot position off lows.

Charts

Some ideas I am watching this week

MNDY 0.00%↑ has been trading sideways for a number of months now. With earnings still a ways out, I think MNDY could make a nice push out of this stage 1 base and begin its uptrend. If it does not provide a cushion by earnings, I will cut the position as the R/R goes out the window.

STNE 0.00%↑ is beginning to move out of a 2 year long stage 1 base. Rotation into foreign stocks has been apparent last week, with China names moving upwards. STNE is Brazilian tech, and is extremely well valued.

MRVL 0.00%↑ basing into earnings. Strong stock, divi date out of the way as well.

DOCN 0.00%↑ offers a nice opportunity on a SaaS company. good for some diversity in the port.

PANW 0.00%↑ is a top stock in a top group. Despite upcoming competition with Microsoft, the technical and fundamentals remain aligned, offering an inside day post breakout, above the moving averages.

That’s all for this week!

If you enjoyed-

Follow my twitter: HERE

Join my free discord HERE

Also, be sure to leave a like on this post to support me.