Investors,

Keeping it light this week after a weekend of travel.

Enjoy!

Indices

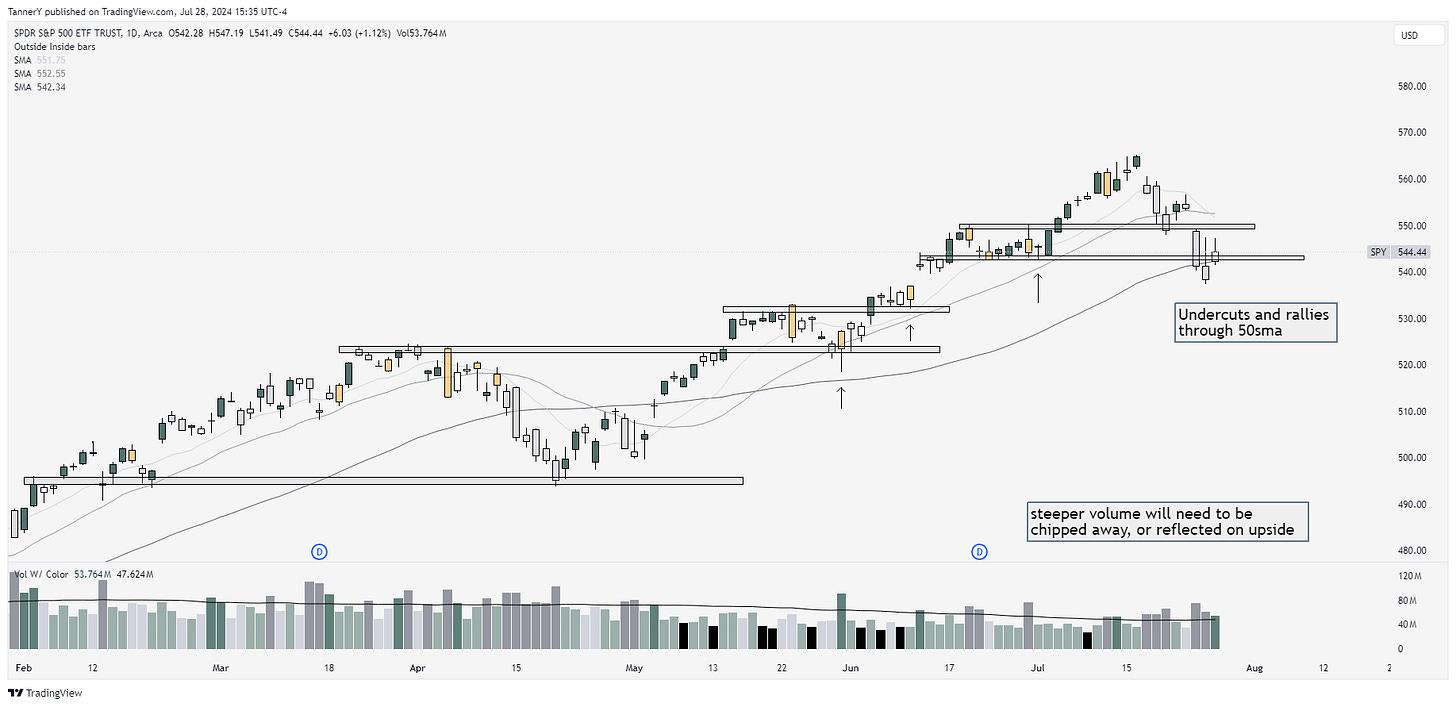

We saw yet another pullback in broad (weighted) indices last week. This likely comes in lieu of further rotation out of mega cap tech and into some lesser loved sector, specifically those impacted by rate cuts and other small/midcap groups.

All in, I think this type of rotation is healthy, and not only brings new opportunities for the portfolio, but also the watchlist. It is sometimes easy to settle into a watchlist of stocks that have been performing for months, but when they all go red for a few days on end, it helps open my eyes to some others within the same groups as my watchlist that are outperforming. Keep this in mind as you traverse the landscape. Sometimes its Goldman Sachs year, sometimes JPM.

SPY 0.00%↑ look, notes annotated.

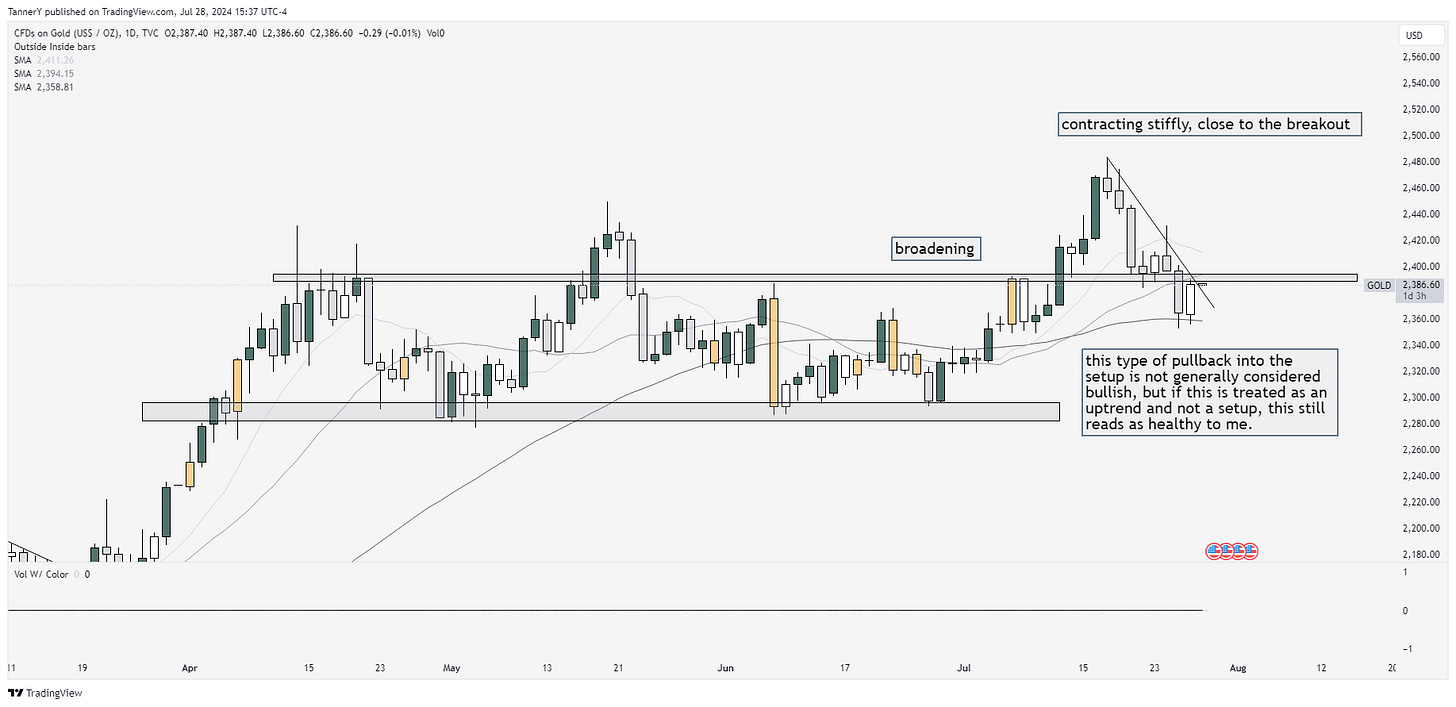

GLD 0.00%↑ note annotated as well.

IWM 0.00%↑ this looks incredibly explosive. Small/midcap index, first bull-flag out of two year consolidation. I like TNA 0.00%↑ for some levered exposure on equity.

Parabolic Trend Analysis

Just not enough time for this one this week. Will be back next week for the analysis.

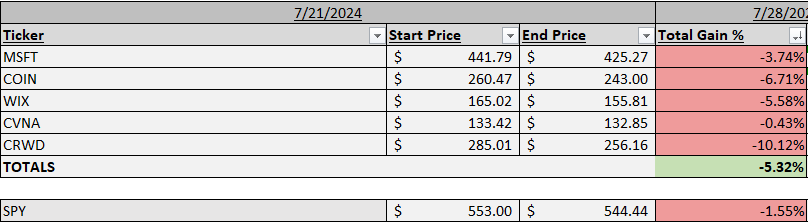

Past Performance

Tough week again for the selection. On the uptrend the picks have been difficult, as many Mondays weve seen gap ups, killing the momentum, but the downturns have been coming later in the week making it difficult to make headway for the market.

Charts

TNA 0.00%↑ nice bull flag here. Doesnt quite meet high and tight criteria, which would have been a much bigger move out of the base before consolidation, but I am a fan.

MSTR 0.00%↑ breakout retest and now continuing higher. Looks good. Earnings this week but those are generally a non event for this BTC proxy.

GOOGL 0.00%↑ fan of this. nice retest of old support, earnings out of the way also.

HD 0.00%↑ nice look, value has been solid.

ONON 0.00%↑ growth name. Spreading out the love on this newsletter as far as picks go, lots of different groups and sizes.

That’s all for this week!

IF YOU ENJOYED:

Subscribe to the newsletter!