Introduction

Welcome back to another Iteration of my weekly newsletter, Where I take a deep dive into financial markets, education, stock ideas and more.

To start off, lets take a look at the indexes, and see if we can identify any changes from previous weeks.

Additionally, something to note is earnings season is upon us. Check your earnings dates to avoid getting caught ‘swinging’ into reports.

Starting out with the SPY 0.00%↑, we can see the stretch from the moving averages is apparent, however irrationality has not set in. Price respected the $444 key area, based below and has now broken higher.

Slightly different idea over at QQQ 0.00%↑, a primarily tech based index. Down last week, shows that the continuation is SPY 0.00%↑ is due to the lagging participation in other sectors, notably XLF (financials), XLV (healthcare), and XLE (energy).

Of the 3 aforementioned indexes, XLE offers my favorite setup. Inside week on ascending volume, Which could be in part bad news for the broad market if there is a material uptick in inflation.

Tip of the week

Watch for sector rotation. Money is always flowing somewhere, regardless of market conditions. This was easily seen through 2022, where everyone’s favorite stocks to trade became untradeable, while less popular value, healthcare, and consumer stocks became paramount to the success of ones portfolio.

Past performance

Slightly below average performance in individual stock ideas last week. MRVL 0.00%↑ offered a nice trade earlier in the week, only to walk it back down in the later sessions. AVDX 0.00%↑ was the standout, continuing its breakout from the cup and handle, in which it extends its gains from the breakout to 13%.

Charts

PXD 0.00%↑ is my primary watch for oil/gas stocks this week. A friend of mine is questionably sized in this position, and I will look to pin an entry soon.

MRNA 0.00%↑ healthcare name is next up. Assuming some further rotation into the sector, I will be using $120 as my stop on MRNA, looking for continuation to the to the top of the range as my final price target.

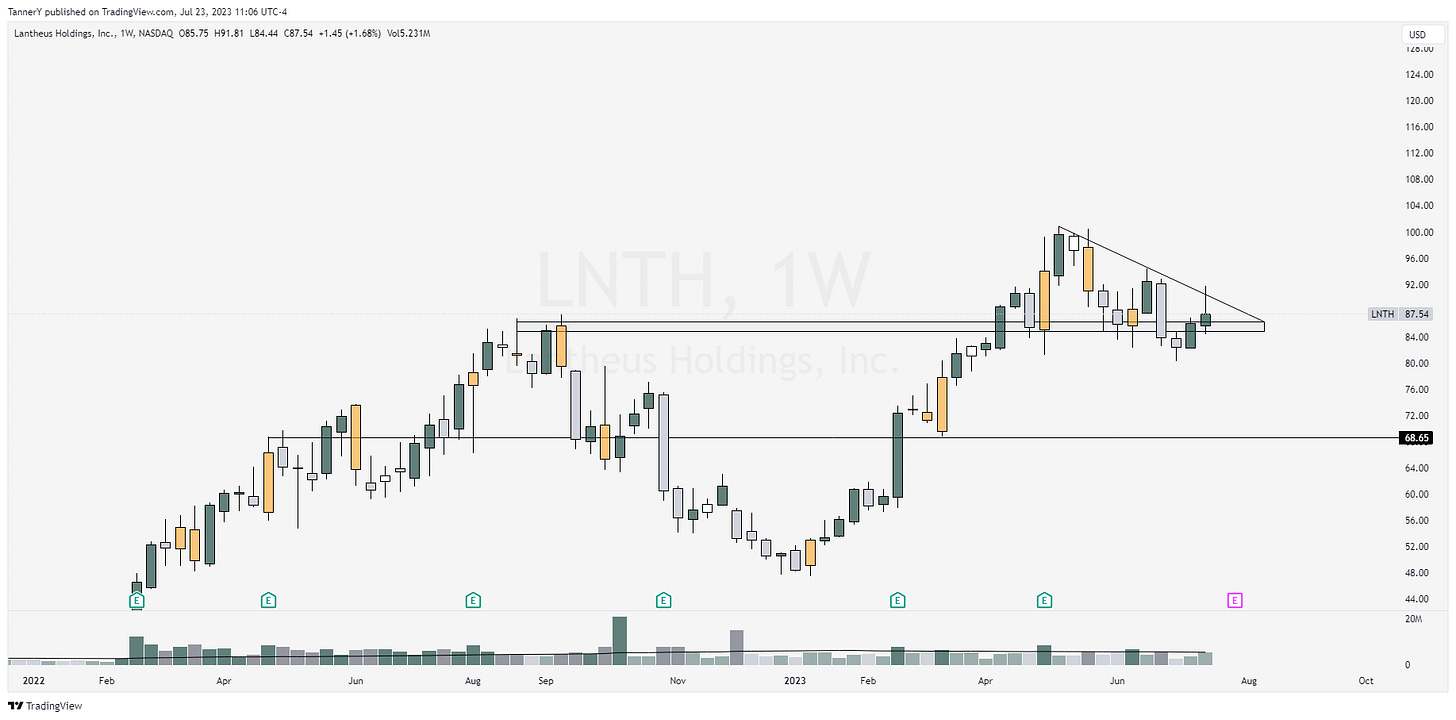

LNTH 0.00%↑ offering a nice exposure to healthcare technology, setting up on the weekly for a breakout into earnings in early August.

MDB 0.00%↑ sees a pullback last week, offering good exposure to SaaS and AI.

That’s all for this week,

If you enjoyed-

Follow my twitter: HERE

Join my free discord HERE

Also, be sure to leave a like on this post to support me.