Investors,

Welcome to another iteration of The Weekly Selection. The purpose of this write up is to bring an all inclusive look at both the broad and individual stock market, how I view it, and what I expect for the next week.

In addition to this, provided within are a few goodies for your enjoyment, like the portfolio tracker for the stocks selected, and a parabolic trend analysis from a stock in the past.

If you enjoy this article, don’t forget to drop a like and a subscription to support the continuation of my FREE content.

Indices

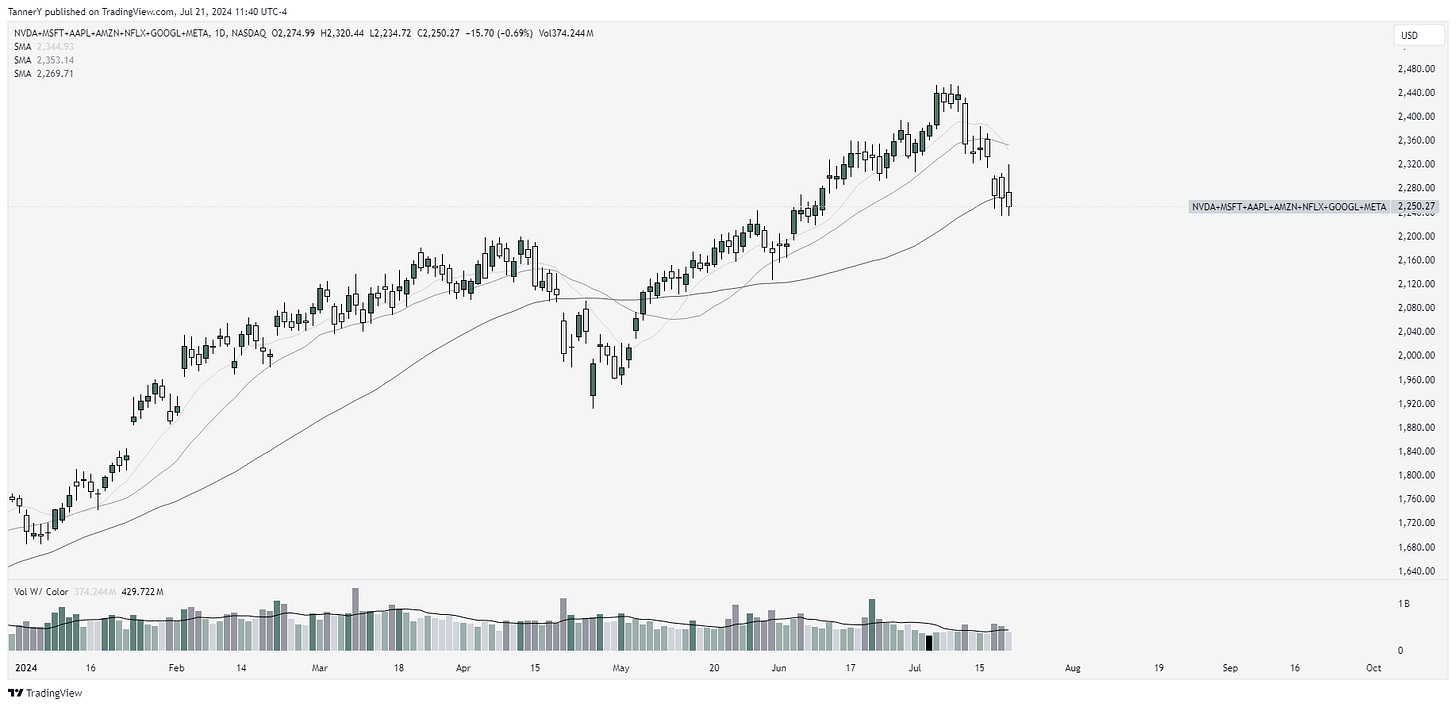

Last week we saw some of the biggest disconnected price action between indexes. SPY 0.00%↑ traded down with the magnificent 7 falling, but small/mid cap indexes saw huge upside. This disconnect comes in lieu of rate cut speculations taking the market by storm, as well as the Trump assassination attempt last weekend.

SPY trading down, so far -2.87%. The deepest pullback of this run has been in April saw a -5.8% pullback. I think this time around I will be much more keen on watching how price reacts to some of these mini pivots that have been getting put in.

This is a composite of the mag 7 stocks (NVDA AMZN AAPL MSFT GOOGL NFLX META). As you can see, the composite has been pulling back longer than the broad market. back in April, broad bottomed before the mag 7. I think with mag 7 so elevated, the RSP/broad market is a better indicator of health than the SPY given its heavy weight towards mega tech.

For what its worth, healthcare, Industrials, and consumer discretionary all look very constructive. I will be watching these groups this week.

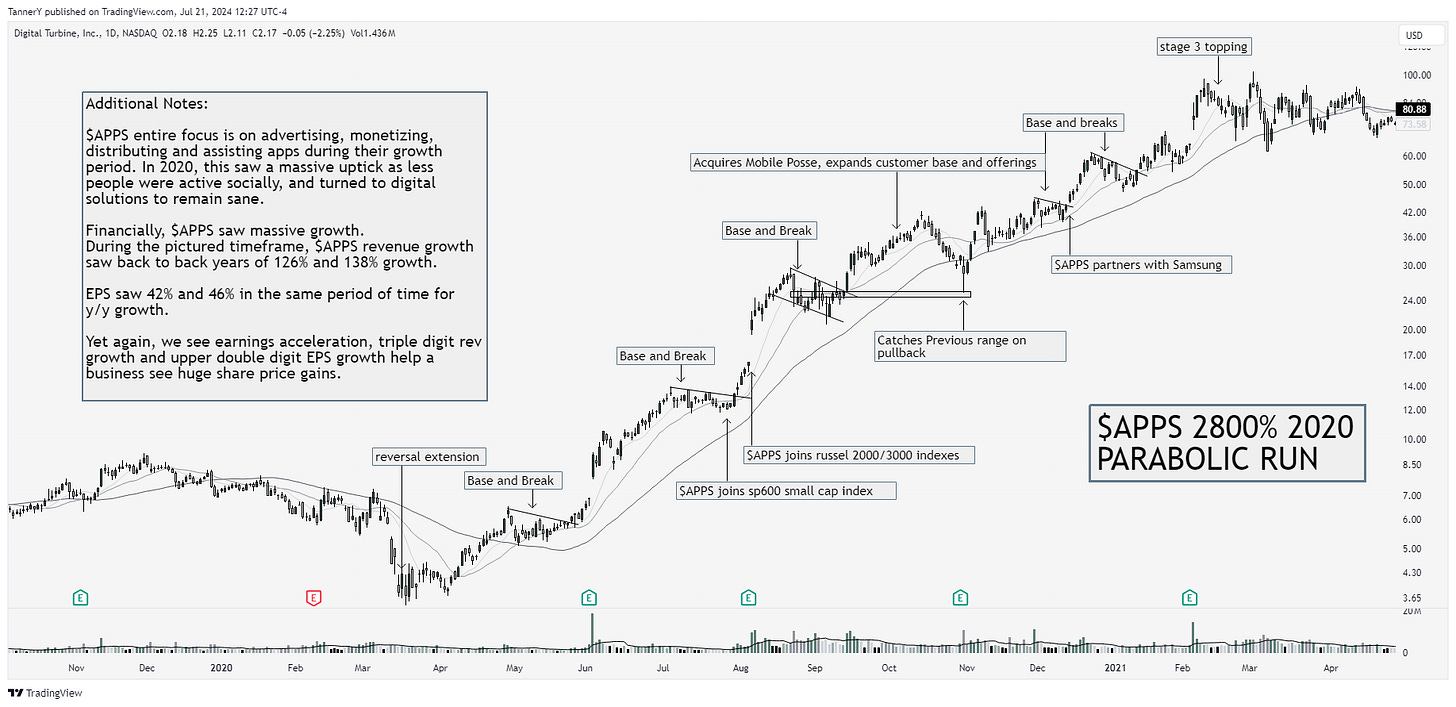

Parabolic Trend Analysis

APPS 0.00%↑ saw a monstrous 2800% gain back in 2020, but what led to its growth? Check out the above image to see!

If you enjoyed this segment, consider subscribing, as it requires the most work and research of this Free newsletter.

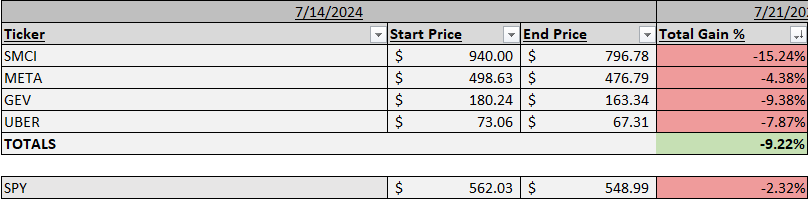

Past Performance

What a stock pickers market we are in. By Tuesday, I knew the selection was in bad shape, but the entire purpose of this is to track from Monday open- Friday close, so had to let it play out. Definitely a tough beat this week.

Charts

MSFT 0.00%↑ off its 50sma and another previous support. Of the mag 7 I like this name.

COIN 0.00%↑ and other crypto related names ($MSTR) looking great with BTC making a nice comeback from 55k. If anyone remembers, my July low target for bitcoin was 55k, ill post that to another newsletter later this week.

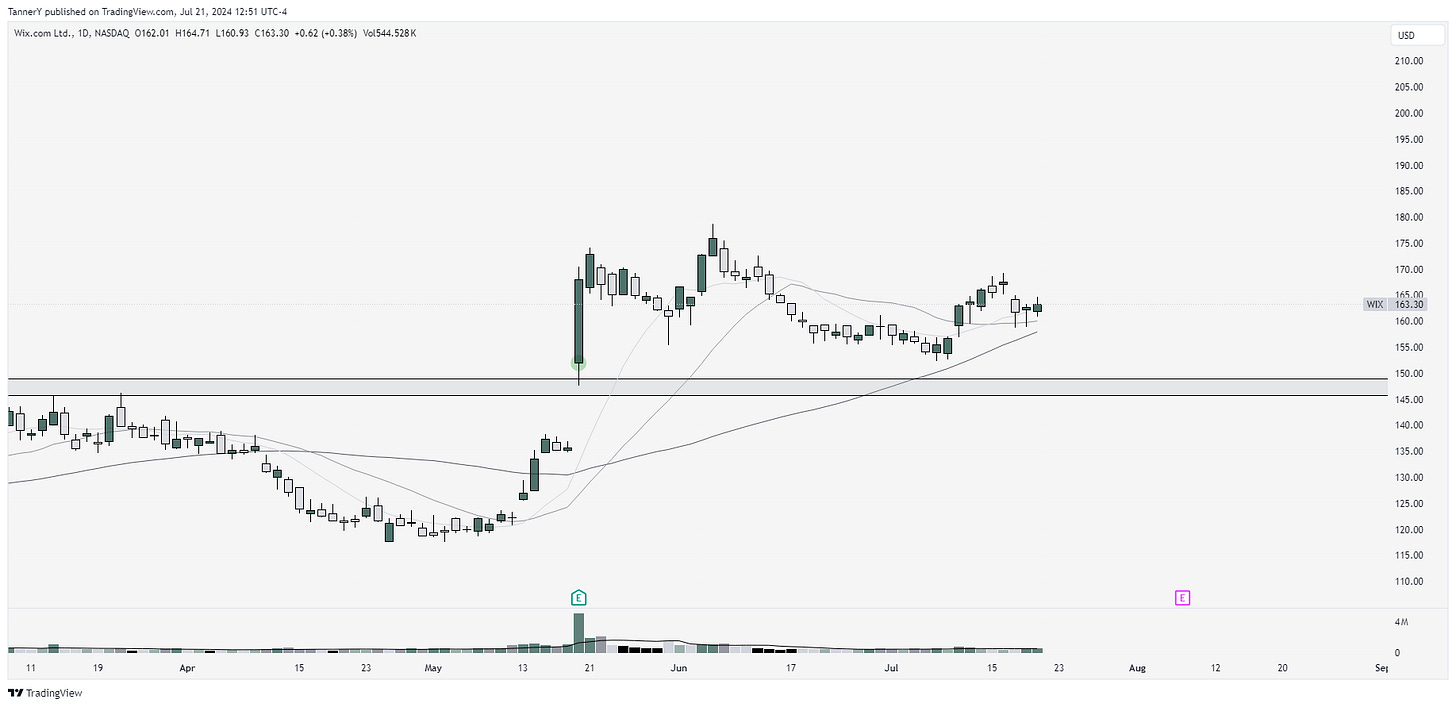

WIX 0.00%↑ an EP name from the watchlist a while ago, I like this look above long term resistance + tight action near all 3 moving averages.

This could be a bottom sniff, but I like CRWD 0.00%↑. These hacks/events are usually short term fodder, and resolve relatively quickly.

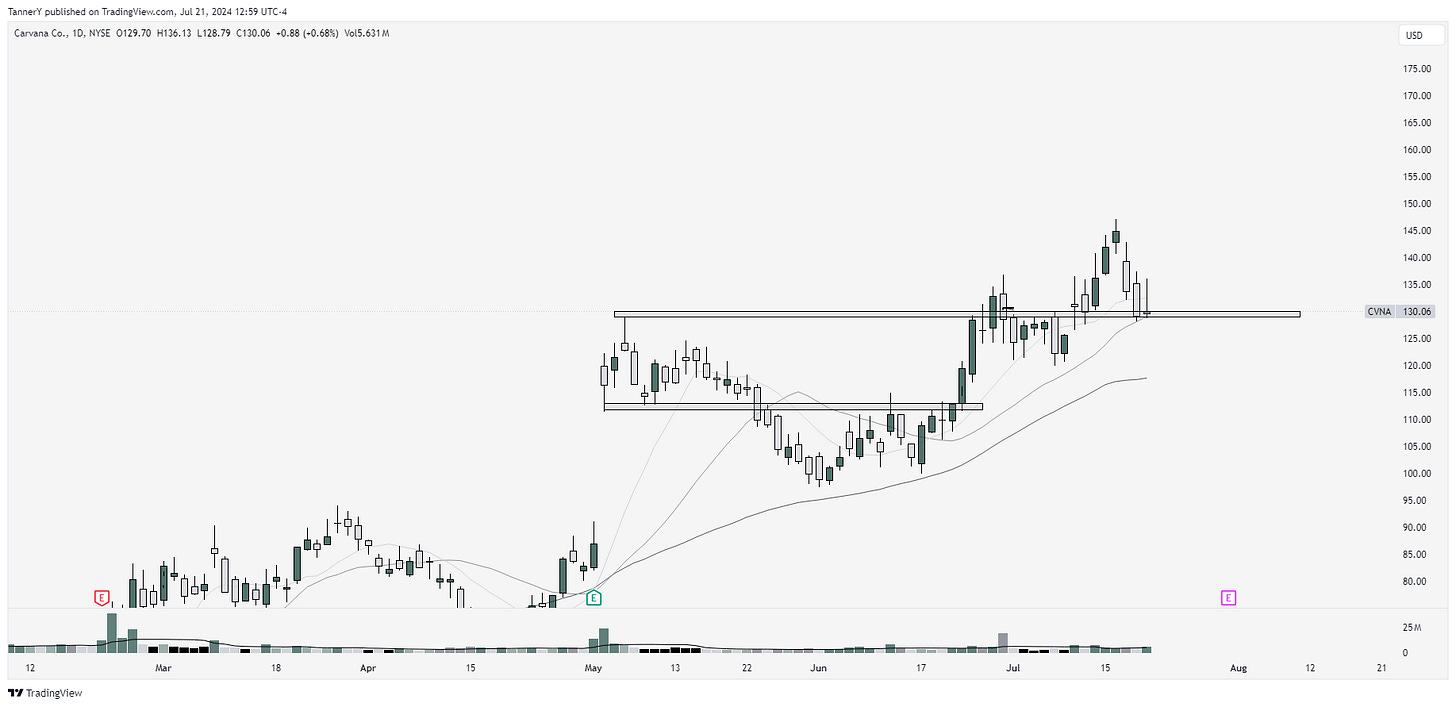

CVNA 0.00%↑ working around a nice pivot. Also top holding of IWM 0.00%↑ which has been running hot. Nice look.

IF YOU ENJOYED:

Subscribe to the newsletter!