Introduction

Hello Investors,

Welcome back to another issue of “The Weekly Selection”, where I cover a plethora of market related topics and provide my commentary on where I think we are, where we may be going and how best to navigate these potential outcomes.

Last week the market saw a drastic rise after CPI (inflation) data came out on Wednesday. Being a binary event, I stayed fairly risk off as getting caught before the market opens on data is never a good feeling and doesn’t allow for any kind of stops to be put in place.

Below are the charts for SPY 0.00%↑ and QQQ 0.00%↑, as well as IWM 0.00%↑ which has been showing a lot of promise lately.

Quote of the week

“Money is made by sitting, not trading”

- Jesse Livermore, Investor

This quote holds true for me the last couple months. While I was scalping equities and trading a considerable amount, I missed out on buying the breakout and holding the market leaders. NVDA 0.00%↑ at 260, META 0.00%↑ at 231 and SMCI 0.00%↑ at 136 were all notable trades where I should have sat on my position but instead was taking far too much off the table early, now leaving me with non leadership positions.

Past Performance

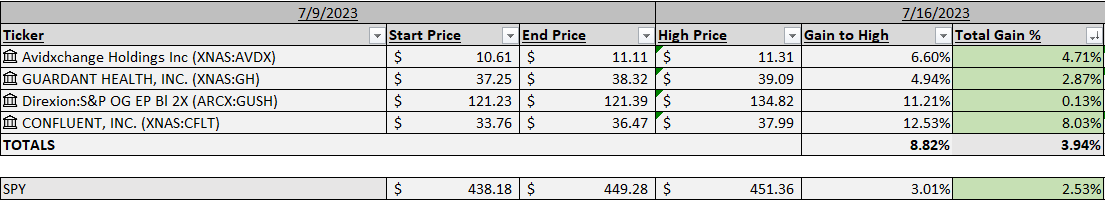

Strong performance across the board. AVDX 0.00%↑ CFLT 0.00%↑ GH 0.00%↑ all still look good, with GUSH 0.00%↑ making a large retracement to end the week barely green. For those who are new to the newsletter, The past performance section tracks the stocks I mention on here from Mondays open to Fridays close. In addition to this newsletter I also go over charts on Sunday nights at 8pm, which can be found HERE.

Charts

AVDX 0.00%↑ making a return for the second week in a row. Strong close last week, and a nice cup/handle setup.

QCOM 0.00%↑ is a slower mover, but still looking good, printing an inside day at the breakout area of its few month long downtrend.

MRVL 0.00%↑ weekly chart. Breakout after divi day, one of the stronger stage one breakouts im seeing in the market right now.

CELH 0.00%↑ might need another few days to consolidate, but the strength on Friday is telling.

That’s all for this week!

If you enjoyed, drop me a like on this post.

If you’d like to follow me on twitter for more of my investment research and trades throughout the week, follow me HERE.

Tanner