Investors,

Welcome to another iteration of The Weekly Selection. The purpose of this write up is to bring an all inclusive look at both the broad and individual stock market, how I view it, and what I expect for the next week.

In addition to this, provided within are a few goodies for your enjoyment, like the portfolio tracker for the stocks selected, and a parabolic trend analysis from a stock in the past.

If you enjoy this article, don’t forget to drop a like and a subscription to support the continuation of my FREE content.

Opening Notes

This week is the beginning of earnings for non financial related businesses. Expect some turmoil on stocks that are reporting, and also their competitors/related businesses. People seldom remember that if a business reports and is doing exceptionally well, its usually true that its peers are also doing well if their businesses are closely related in structure, but differ in clientele.

Additionally, this weekend saw an attempt on the former president, Donald Trumps life. I’m sure you have all seen the videos/media, so I will spare the story, but here is the most popular photo from the event:

After performing some historical research to see how this situation has effected presidential candidates of the past, this is what I found. In the history of this country, there have been four attempts on presidential candidates during their runs. Of the four, two of those presidents went on to become president: Theodore Roosevelt and Ronald Reagan.

I was not alive for either, but in my research I have found that these presidents were touted as some of the greatest of all time. The other two attempts were on Robert F. Kennedy in 1968 and George Wallace in 1972. Robert succumbed to his injuries, so his data is null, but George Wallace did not and did not become president.

Point is, I believe that based on historical data, attempts on a presidential candidates life only raises them up, which lends this event to play an interesting role in the presidency for this year. This will also have an impact on markets, so expect that this week.

Indices

Lets get into how the indexes look going into this tumultuous week.

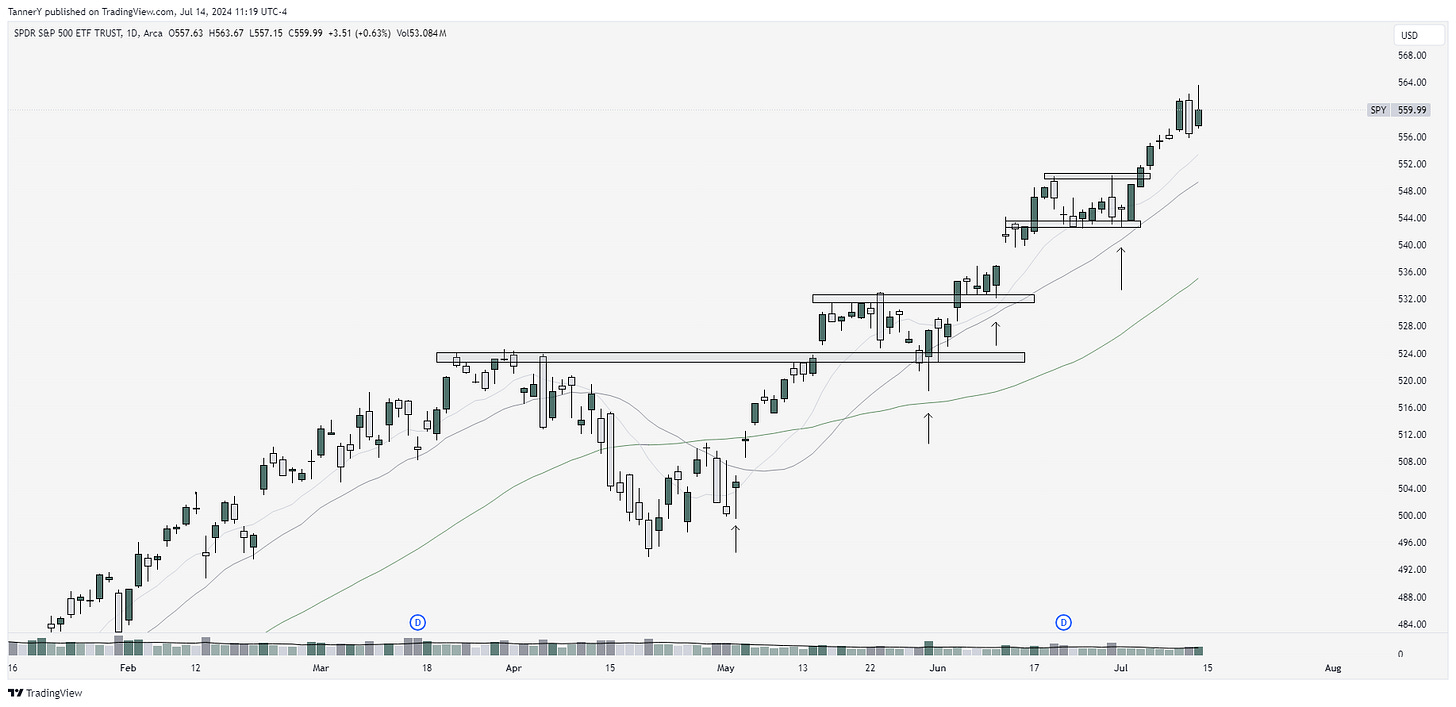

SPY 0.00%↑: We remain a few small pivots away from the May breakout. Moves upward have been healthy with respect of primary moving averages.

RSP 0.00%↑ breaking out. Remember, RSP is the equal weight ETF for the market. So if it is breaking out, it means stocks besides the top 10 are strong. Bullish for sure.

GLD 0.00%↑ turns upward after putting in a long base. I am long GLD for this move, and will be rolling out as we continue higher.

Parabolic Trend Analysis

Axon enterprises, formerly Taser International is the company that came to market with the modern day taser device. This product revolutionized non lethal criminal deterrents, and in this writeup I share my thoughts on its 12000% stock increase in 2003 when it came to market with its primary model.

*if you enjoyed this portion of the newsletter, considering sharing and subscribing, as this free research takes about 4 hours to complete every week*

Past Performance

Past performance was okay for last week. We saw $PANW fade away, which many were excited about. ENVX 0.00%↑ was the standout, which was great.

I decided not to take NNE 0.00%↑ in the main port given its volatility. I instead day traded it a few times.

Charts

SMCI 0.00%↑ has been on this newsletter more than any other name. I this the news of it being added to the Nasdaq will be bullish, and likely breaks it out of this base.

META 0.00%↑ makes a pullback into a historic support. very nice without earnings coming up.

GEV 0.00%↑ makes its return to the newsletter. Nice base here under a historic support.

UBER 0.00%↑ reclaims its moving averages, bases, now looking to move higher. That’s all for today!

IF YOU ENJOYED:

Subscribe to the newsletter!